Bonanza Portfolio

List of Stock Brokers Reviews:

Bonanza Portfolio is one of the prominent full-service stockbroking houses in India with a presence in 560 cities of India in around 1800 outlets (franchises and sub-broker partners). Bonanza Portfolio provides a 3-in-1 account to its clients in partnership with a few national banks.

In this detailed review, we will have a look at the various aspects of this broker including its trading platforms, brokerage, margin, service, research and a lot more. Hopefully, by the end of this review, you will be able to decide whether to go ahead with this stockbroker or not.

Bonanza Portfolio Review

Established in the year 1994, Bonanza Portfolio has a membership with different segment indices such as NSE, BSE, MCX, MCX – SX, ICEX, USE along with the affiliation from NDSL and CDSL. With all these memberships, Bonanza Portfolio allows its clients to trade across:

“Bonanza Portfolio has an active client base of 32,546 for this year 2020-21.”

Along with trading in these financial segments, Bonanza Portfolio can also help you in:

- Portfolio Management Services

- Investment Banking

- Depository Services

- Institutional Broking

- Advisory Services

Shiv Kumar Goel – Founder, Bonanza Portfolio

Bonanza Portfolio Trading Platforms

Trading platforms come in different forms and designs with various kinds of user experiences. If you do not like the trading platform provided by a broker, then it does not make sense to continue trading through it. Thus, be very sure of the kind of trading software provided by the broker.

Bonanza Portfolio provides different trading platforms such as:

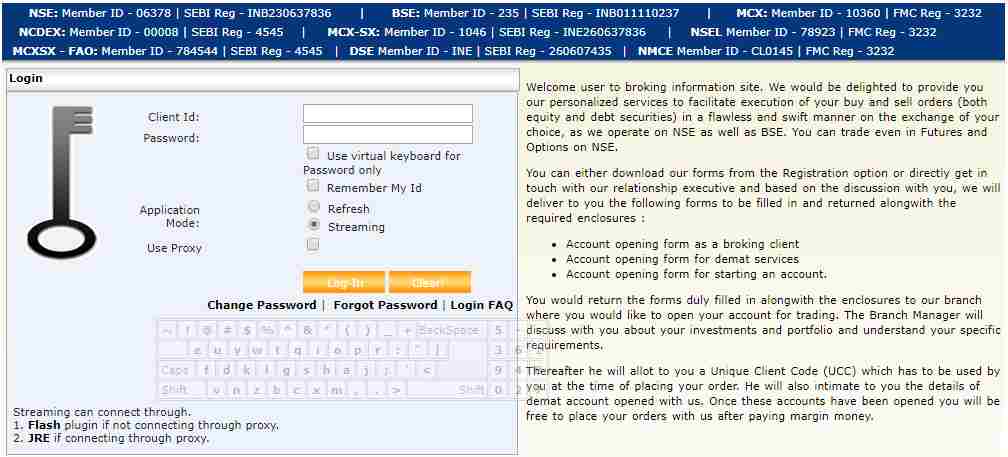

Bonanza Portfolio My E-Trade

This is a web-based trading platform where clients can just log in with registered credentials and start trading. It is a responsive and adaptive trading platform which can be accessed through any browser or any device such as web, laptop, desktop or mobile.

Some of the features of E-Trade are:

- Highly interactive charting flows with market trends and indicators

- The layout can be customized as per user preferences. So you can put out the kind of sectors or stocks you prefer right in front of you and keep an eye on them all the time.

The platform is powered by Omnesys and has the complete backup and support.

This is how the login screen for the application looks like:

Bonanza Portfolio Nest Trader

Nest Trader is the conventional trading terminal employed by multiple stock brokers and powered by Omnesys. It comes with the following features:

- Trading screens with risk management, heat maps, market depth

- Charting functionality with historical, intra-day and comparative trends and analysis

- Alerts management and notifications

This terminal application is relatively bulky in size and thus, requires a decent configuration of your laptop or computer for consistent trading experience. Furthermore, the user experience provided by the application is relatively sub-optimal in nature. This is how the application looks like:

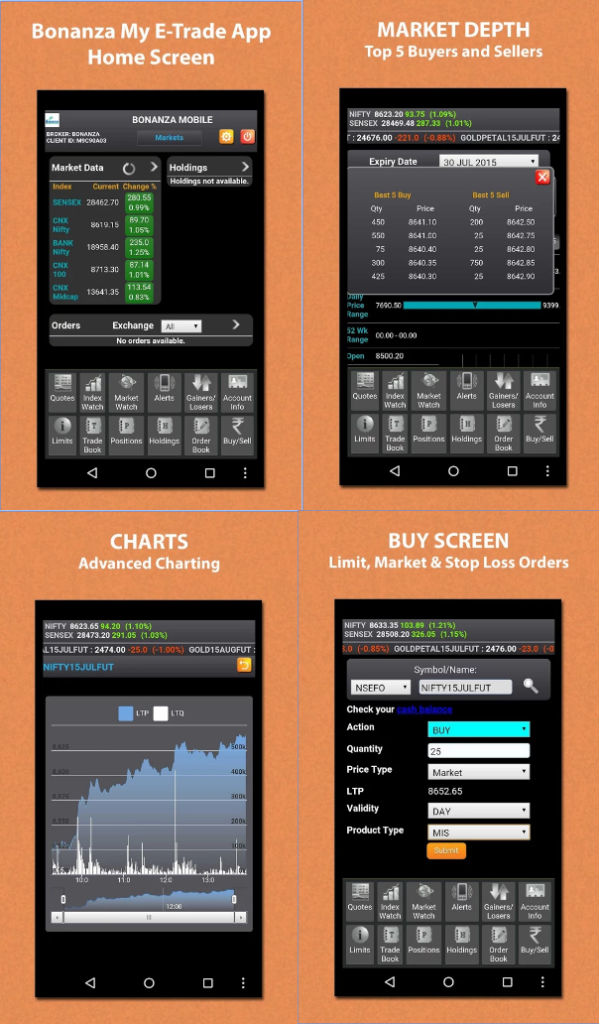

Bonanza My E-Trade Mobile App

Bonanza allows its clients to trade through their mobile app My E-Trade across BSE, NSE, MCX and other registered indices.

Features:

- Charting

- Live market streaming, Quotes

- Ordering Reports, Trading Reports

There have been few concerns raised regarding the mobile app speed and order placement.

This is how the application is rated at Google Play Store:

| Number of Installs | 1000 - 5000 |

| Mobile App Size | 25 MB |

| Negative Ratings Percentage | 16% |

| Overall Review |  |

| Update Frequency | > 2 Years |

Bonanza Portfolio Customer Service

These are the communication channels provided by the full-service stockbroker, Bonanza Portfolio, to its clients:

- Toll-Free Number

- Webform

- Offline branches

Not only the number of communication channels are limited, but the full-service stockbroker also provides pretty low-quality customer service. For instance, their google play store page does not see any response to the customer issues whatsoever.

Yes, during your account opening process the broker team will seem like one of the most caring ones for you. But once you are done with the account opening, you will be left more or less on your own when you have any queries, concerns, doubts or issues.

Bonanza Portfolio Research

This full-service stockbroker provides research to its clients across different segments at fundamental as well as technical levels. This is how the broker has segregated its research:

- Equity

- Trading Ideas

- Daily market strategy

- Monthly updates

- Investment ideas

- Daily derivatives strategy

- Event updates

- Positional technical calls

- Mutual Funds

- Daily Reports

- Weekly Reports

- Monthly Reports

- Special Reports

- Commodity

- Agri commodity views

- Non-Agri commodity views

- Monthly updates

- Positional Calls

- Trading Ideas

- Currency

- Daily forex insight

- Trading Ideas

- Weekly forex insight

- Positional calls

With clean segregation, the full-service stockbroker provides around average research, recommendations and tips to its clients as far as accuracy and performance are concerned. Users are advised to perform their own analysis as well before executing any orders on the stock market.

Bonanza Portfolio Pricing

Bonanza Portfolio is a reasonable stockbroker when it comes to pricing. Be it account opening, maintenance, brokerage charges etc, Bonanza seems to be relatively easy on your pockets, even though it is a discount stock broker.

Here are the details:

Bonanza Portfolio Account Opening Charges:

Here are the account opening charges of Bonanza Portfolio:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹250 |

Bonanza is one of the very few full-service stockbrokers that provide few Demat and trading account opening. Furthermore, the annual maintenance charges for your Demat account is ₹250, which is a pretty nominal price for AMC.

Bonanza Portfolio Brokerage

In terms of Brokerage, there are multiple plans provided by Bonanza Portfolio depending upon the margin money employed by the client before initiating trading. Here are the details:

Default Plan

| Segment | Default Plan |

| Intraday | 0.01% |

| Futures | 0.01% |

| Delivery | 0.1% |

| Equity Options | 20 per lot |

| Currency | 0.005% |

| Currency Options | 7 per lot |

| Commodities | 0.006% |

| Commodities Delivery | 0.04% |

Use this Bonanza Portfolio Brokerage Calculator for complete charges and your profit.

Without any upfront subscription, you get the above brokerage charges.

Plan 1000

Then there are subscription based plans where you pay a specific upfront cost and accordingly, the brokerage is applied against your trading. It starts with a minimal of ₹1000 and goes until ₹27,000 depending upon your trading preferences, capital and expectations from the stockbroker.

| Segment | Plan 1000 |

| Intraday | 0.005% |

| Futures | 0.005% |

| Delivery | 0.1% |

| Equity Options | 15 per lot |

| Currency | 0.0025% |

| Currency Options | 5 per lot |

| Commodities | 0.004% |

| Commodities Delivery | 0.025% |

Plan 3000

The subscription cost of this plan is ₹3000 and provides you with the following brokerage rates across segments:

| Segment | Plan 3000 |

| Intraday | 0.00375% |

| Futures | 0.00375% |

| Delivery | 0.03% |

| Equity Options | 12 per lot |

| Currency | 0.0020% |

| Currency Options | 5 per lot |

| Commodities | 0.0025% |

| Commodities Delivery | 0.020% |

Plan 7500

The subscription cost of this plan is ₹7500 and provides you with the following brokerage rates across segments:

| Segment | Plan 7500 |

| Intraday | 0.00312% |

| Futures | 0.00312% |

| Delivery | 0.025% |

| Equity Options | 10 per lot |

| Currency | 0.0015% |

| Currency Options | 4 per lot |

| Commodities | 0.00208% |

| Commodities Delivery | 0.0166% |

Plan 27000

The subscription cost of this plan is ₹27000 and provides you with the following brokerage rates across segments:

| Segment | Plan 27000 |

| Intraday | 0.00281% |

| Futures | 0.00281% |

| Delivery | 0.0225% |

| Equity Options | 9 per lot |

| Currency | 0.00135% |

| Currency Options | 3.6 per lot |

| Commodities | 0.00187% |

| Commodities Delivery | 0.015% |

Bonanza Portfolio Transaction Charges

Apart from the account opening fees and brokerage charges, here are the transaction charges levied by BSE or NSE (depending on the traded index):

| Segment | Transaction Charges |

| Intraday | 0.00325% |

| Futures | 0.0019% |

| Delivery | 0.00325% |

| Equity Options | 0.05% |

| Currency Futures | 0.0011% |

| Currency Options | 0.040% |

| Commodities | 0.0021% |

The full-service stockbroker charges pretty reasonable transaction charges. Although, there are a few stockbrokers in India that compensate their low brokerage charges by charging high transaction charges. Bonanza Portfolio is not one of those and stays clean and transparent with its pricing.

Bonanza Portfolio Margin

Bonanza Portfolio provides the following margins to its clients depending on the traded segment:

| Segment | Margins or Exposure |

| Equity | Upto 10 times for intraday, Delivery@interest |

| Equity Futures | Upto 3 times for intraday |

| Equity Options | No leverage for buying, upto 2 times for shorting |

| Currency Futures | Upto 2 times for intraday |

| Currency Options | No leverage for buying, upto 2 times for shorting |

| Commodities | Upto 3 times for intraday |

The full-service stockbroker stays pretty average when it comes to providing exposure or leverage to its clients.

Bonanza Portfolio Disadvantages

These are some of the concerns if you use the services of this stockbroker for your trading:

- Relatively high call and trade pricing at ₹25 per trade

- No support for NRI clients

- No toll-free number for clients to reach out to Bonanza Portfolio

- No support for iOs based devices

- No automated trading.

“Bonanza Portfolio has received a total 3 complaints this year 2019-20 at 0.03% complaint percentage, slightly better than the industry average (which is 0.06%).”

Bonanza Portfolio Advantages

The stockbroker comes with the following merits:

- Multiple brokerage plans providing clients with better brokerage rates depending on the margin money.

- An array of trading segments allowed to clients

- Huge offline coverage and support.

Conclusion

“Bonanza Portfolio is certainly a value for money full-service stockbroker. However, most of the aspects provided by the broker are pretty average in performance. Nonetheless, there are concerns with the broker as far as its research, customer service and platforms are concerned.

Users are advised to understand what they are looking for and only go for this full-service stockbroker if it is able to fulfil those needs and preferences. Opening the account just on the basis of free demat and trading accounts is a novice decision.”

Looking to open an account?

Enter Your details here to get a FREE callback:

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Bonanza Portfolio Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB011110237 |

| NSE | INB230637836 |

| NSDL | IN-DP-62-2015 |

| PMS | INP000000985 |

| MCX | INB260637831 |

| NCDEX | INZ000030530 |

| Registered Address | 4353/4C, Madan Mohan Street, Ansari Road, Daryaganj, New Delhi-110002 |

The details can be verified from corresponding websites of the exchanges.

Bonanza Portfolio FAQs:

Here are some of the most frequently asked questions about Bonanza Portfolio you must be aware of:

Is Bonanza Portfolio a trustable stockbroker? Is it reliable?

This full-service stockbroker was established in the year 1994 and has been able to survive for more than 2 decades in this ever-changing stock market industry. However, it still is a work-in-progress broker and has not been able to clearly define its positioning among the user base.

The broker provides reasonable value through its services such as support, trading platforms, exposure, research at a nominal cost but still it is yet not counted as one of the prominent names in the industry.

But as far as reliability or trust factor is concerned, the broker certainly makes the cut and can be trusted for stock trading and investment.

How is the performance of the trading platforms of Bonanza Portfolio?

Bonanza provides a mix of outsourced and in-house developed trading platforms. The Nest trading terminal software is one of the most mature applications and is outsourced for the clients of the full-service broker.

NEST is certainly a recommendable trading software but the in-house trading applications developed by the broker are not recommendable solutions. There are quite a few concerns with these applications in terms of limited features, speed, usability, the accuracy of feed etc.

At least for the mobile app, the worst part is that customer support does not seem to provide any heed to user issues and concerns.

For more details, please refer to the ‘Trading Platforms’ section above.

What are the account opening charges at Bonanza Portfolio?

Bonanza Portfolio does not charge anything for opening a Demat or trading account. This is one of the very few stockbrokers that provides accounts for free. Having said that, our advice is not to just open your trading or Demat account based on the fact that the account opening is free.

There are way too many other factors involved in stockbroker selection such as trading platforms, exposure, service, products range, brokerage, research and so on. Make sure you understand different aspects of the stockbroker and only then take a call.

How is the brokerage calculated at Bonanza Portfolio?

There are multiple brokerage plans provided by Bonanza Portfolio starting with a default plan without subscription with 0.1% delivery brokerage. Then there are other plans with a specific subscription price, paying which the brokerage rates get even smaller.

You can check out the comparisons of Bonanza Portfolio Vs Other Stock Brokers here:

Bonanza Portfolio Branches

The full-service stockbroker has a presence across the following locations across different parts of India:

| States/City | |||

| Andhra Pradesh | Chittoor | Hyderabad | Kakinada |

| Rajahmundhry | Vijaywada | Vizag | |

| Anantpur | Tirupathi | Kurnool | |

| Cuddapah | Kothagudem | Secunderabad | |

| Guntur | Karimnagar | Srikakulam | |

| Wrangal | Tanuku | ||

| Assam | Guwahati | ||

| Bihar | Patna | Arah | |

| Chhatisgarh | Bhillai | ||

| Delhi/NCR | New Delhi | ||

| Gujarat | Ahmedabad | Surat | Nadiad |

| Anand | Jamnagar | Baroda | |

| Vadodara | Gandhinagar | Maninagar | |

| Haryana | Gurgaon | Panchkula | Rajkot |

| Himachal Pradesh | Sirmour | Mandi | |

| Jharkhand | Jamshedpur | ||

| Jammu & Srinagar | Jammu | ||

| Jharkhand | Ranchi | ||

| Karnataka | Bangalore | Dehradun | Mangalore |

| Tiptur | Hubli | ||

| Kerala | Kochi | Kottayam | Ernakulam |

| Tellicherry | Vadakara | Moovattupuzha | |

| Thodupuzha | Pala | Truchur | |

| Calicut | Kattapanna | Muttom | |

| Trivandrum | NedumKandam | Kumily | |

| Madhya Pradesh | Bhopal | Jabalpur | Indore |

| Gwalior | |||

| Maharashtra | Ahmednagar | Thane | Jalgaon |

| Nashik | Pune | Nagpur | |

| Mumbai | Jalna | Kolhapur | |

| Orissa | Bhubaneswar | ||

| Rajasthan | Ajmer | Sujangarh | Bikaner |

| Udaipur | Jodhpur | Alwar | |

| Kota | Jaipur | ||

| Tamil Nadu | Chennai | Coimbatore | Pondicherry |

| Erode | Tuticorin | Thirunelveli | |

| Madurai | Tirupur | ||

| Uttar Pradesh | Hrishikesh | Haridwar |

More on Bonanza Portfolio:

If you wish to learn more about this full-service stockbroker, here are a few references for you:

Bonanza Online Review  |

Bonanza Online Comparisons  |

| Bonanza Online Transaction Charges |

Bonanza Online Hindi Review  |

Bonanza Online Brokerage Calculator  |

| Bonanza Franchise |