CanMoney

List of Stock Brokers Reviews:

CanMoney or Canara Bank Securities Limited is a subsidiary of Canara Bank. It was incorporated in 1996 and is mainly into equity broking and distribution of financial products.

It started as “Gilt Securities Trading Corporation Limited” or GSTCL in the year 1996 and after the acquisition by the bank, it was renamed as “Canara Bank Securities Ltd” or CBSL in 2009.

CanMoney Review

CanMoney, as a bank-based full-service stockbroker, provides convenient trading options through efficient and online trading service, prompt settlement and transparency in operations. It facilitates seamless trading in the stock market for the investor clients of Canara Bank.

The company provides trading facilities in equity, futures & options and currency trading. It also gives special services to the NRIs and non-individuals. The company also deals in portfolio management services for its clients and other financial products.

CanMoney Active Clients

As of 2020-21, CanMoney reported 9,124 active clients. The clients of CanMoney include individuals, institutions and non-individuals.

The individuals include high net-worth individuals and non-resident Indians, and the non-individuals include HUFs, partnership firms, trusts, proprietary concerns and corporate bodies.

CanMoney Products & Services

CanMoney offers multiple products in the cash and derivative segment. In the cash segment, the company offers three products.

The first is the simple cash and carry product (CNC), which allows the traders to buy the stock only against available cash, and sell the stock only when they have marked a hold from their Demat account.

The second product is the intraday trading (IDT), wherein the traders can buy or sell against the available margin. All the positions are squared off at the end of each trading day.

The third one is buy-in today sell out tomorrow (BITSOT). It allows the traders to sell the shares even before they receive the delivery of these shares from the exchange.

The company also provides futures & options (FNO) trading against the deposit of funds and online trading in currency futures & options.

Other services of CanMoney comprise of an online subscription to mutual funds schemes and online subscription to IPOs.

If you are a non-resident Indian, CanMoney provides you with an NRI Demat Account as well.

CanMoney Trading Platforms

Like any other mainstream stockbroker, CanMoney also provides trading platforms across different devices be it mobile, laptop or desktop. Let’s quickly look at the different trading applications offered by the broker to its clients:

Web Platforms – CANLOYAL and CANROYAL

The web trading platform CANLOYAL is for all the clients. It gives the clients access to live streaming quotes to help them keep a track of the price movements in real-time.

The platform offers multiple market watch, message window and trading window, all-in-one screen, for the clients to keep a track of the stocks and trade.

The platform is accessible from anywhere and provides access to all back-end reports and data, along with trading on BSE and NSE, and payments and DP gateway from Canara Bank.

The CANROYAL platform is exclusive to HNIs and active traders.

This platform has advanced charting capabilities, technical analysis and gives the clients access to every bid and offer for every participant in the market. It is highly advanced and customizable, with state-of-the-art technology.

The platform gives the active traders dynamic buying power, real-time position updates and constant alerts.

System Configuration

Before you start using this application, make sure that your system has the requisite configuration:

- Browser compatibility with IE6.0, Firefox, Chrome, Opera, Safari

- Internet speed of a minimum of 128 kbps/more

- OS (Windows 98 / 2000 / XP or Windows Vista Basic, Windows 7, Windows 8.1

- The processor must be Pentium 3 or above.

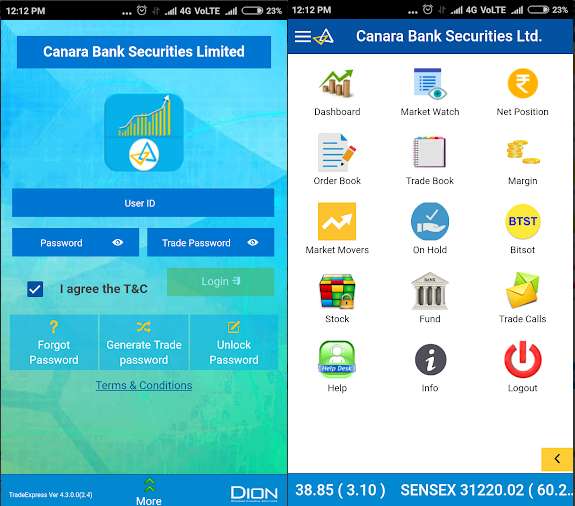

CanMoney Mobile App

The mobile trading app of CanMoney allows the traders to track the markets anywhere on the go. The traders can track live markets, monitor the stocks, and place, modify or cancel trades.

The application also provides access to the order book, trade book, margins and other data of the clients.

Here is a quick look at some of the features provided in this mobile app from CanMoney:

- Market watch

- Charts and real-time market quotes for analysis

- Multiple types of order placement

- Check Order Book, Trade Book, etc.

- Live Market Calls

At the same time, some of the concerns raised by the clients of this bank-based stockbroker around its mobile app are listed below:

- App hangs at times, especially if your phone RAM is not that high.

- Limited number of features

- Login related issues

Here are some stats from different play stores after 400+ reviews and ratings:

CanMoney Research

CanMoney has excellent research and advisory team. The research time provides comprehensive reports on Indian markets, Asian markets, European markets and US markets.

The reports include mornings reports, evening reports, FNO guides, midday reviews, sector reports, currency guides, equity guides, IPOs/FPOs, bulk & block deals reports, corporate actions, technical fundamental reports, upcoming results and weekly monitor.

The research team also publishes reports in the form of market breadth, FII activity, F&O scrips, market commentary, corporate announcements, economic events calendar, last one year charts and new issue monitor.

CanMoney Customer Care

CanMoney provides excellent customer service facilities to its clients through:

- Email,

- Toll-free phone numbers, and

- Offline branches

- Fax

There are dedicated phone numbers for trading queries, new account opening related queries, operational queries, accounts and settlement related queries and technical assistance.

As far as the timelines are concerned, the broker’s customer support is open between 9 am and 6 pm on weekdays. There is no customer support provided on the weekends and exchange holidays.

When it comes to quality though, this full-service stockbroker definitely needs to work upon the executive training and the overall turnaround time taken for issue resolution. In other words, Customer Service can be seen at an average quality at CanMoney.

CanMoney Pricing

As far as charges are concerned, CanMoney charges high account opening charges with reasonable annual maintenance charges (AMC) levied on a yearly basis:

- The account opening charges for online trading are ₹600, which includes charges towards BSE agreement, NSE agreement, DP agreement, and other expenses.

- The annual maintenance fee is ₹200 per year.

CanMoney Brokerage

Then comes brokerage which is one of the most important aspects before you choose any stockbroker. This charge is levied continually on every trade you place on the stock market through this broker:

Brokerage charges vary with the brokerage plan chosen by the client.

The first plan is the Normal Brokerage Option (NBO). The brokerage is 0.05% for cash segment, 0.35% for delivery and 0.10% for futures & options.

The second option is the Upfront Brokerage Options (UBO). It has four plans under it.

Standard Plan requires an upfront payment of ₹299 and the brokerage will be reduced to 0.035% for cash, 0.30% for delivery and 0.07% for FNO.

Silver Plan, with an upfront payment of ₹499, offers brokerage at 0.03% for cash, 0.25% for delivery and 0.06% for FNO.

Gold Plan charges ₹999 as an upfront payment and the brokerage is 0.025% for cash, 0.20% for delivery and 0.05% for FNO.

While the Platinum Plan charges ₹3999 as upfront fee and brokerage is 0.02% for cash, 0.16% for delivery and 0.04% for futures & options.

The third option is the Turnover Based Brokerage Option (TBO). Here, if the daily turnover is below ₹5 lacs, the brokerage is 0.25% and for daily turnover between ₹5 lacs and ₹20 lacs, the brokerage gets reduced to 0.15%.

For daily turnover between ₹20 lacs and ₹50 lacs, the brokerage is 0.10% and for daily turnover above ₹50 lacs, the brokerage gets further reduced to 0.07%.

The brokerage for derivative options is ₹50 per lot on the single side, and for currency derivatives, the brokerage is ₹15 per lot for futures and ₹5 per lot for options, levied on each trade leg.

Here is a quick look at the different plans for brokerage charges:

Option 1

Option 2

Option 3

Here are some other charges related aspects that you must be aware of before opening the account with CanMoney:

- By default, Option 1 will be exercised as the brokerage plan.

- If you choose to go for Option B, the corresponding subscription amount will be auto-deducted from your trading account balance.

- A minimum brokerage of ₹50 will be applied to your options trading through this stockbroker.

- If you are into currency futures trading, a transaction charge of ₹15 per lot will be levied on your trades.

- If you are looking to change the brokerage option (discussed above), a charge of ₹100 per change will be levied.

- There is no condition of minimum balance to be kept in the CanMoney Demat Account.

CanMoney Margin

As far as exposure is concerned, you don’t get much of it as long as you are a client of this broker (across segments):

- The exposure provided is up to 5 times for intraday and up to 5 times for delivery trading.

- The exposure for equity futures is up to 2 times for intraday.

From the industry perspective, these margin values are some of the lowest ones offered by any broker, especially for intraday trading. Thus, make your choice of stockbroker accordingly.

CanMoney Advantages

Here is a quick look at some of the benefits of using the service of this bank-based stockbroker:

- The company has a nationwide presence.

- Implicit trust factor since the stockbroker comes from a banking background

- The brokerage structure is very flexible and can be chosen based on the needs and the trading pattern of the clients.

CanMoney Disadvantages

Furthermore, here is a glimpse of some of the negative aspects that you must be aware of as well:

- The software of CanMoney does not provide Algo trading and misses some features like brokerage and margin calculator.

- Still limited brand equity.

CanMoney Membership Information

From a regulation perspective, here are the details about the memberships the stockbroker has with different regulatory bodies of the Indian stock market:

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking your next steps forward:

CanMoney Branches

The main offices of CanMoney are in Bangalore and Mumbai, with branches in Agra, Ahmedabad, Bhopal, Calicut, Chandigarh, Chennai, Coimbatore, Delhi, Ernakulam, Gurgaon, Goa, Hubli, Hyderabad, Jaipur and Jalandhar.

The other branches are located in Kolkata, Madurai, Mangalore, Meerut, Noida, Udupi, Mysore, Hassan, Nagpur, Patna, Pune, Ranchi, Salem, Shivamogga, Trichy, Trivandrum, Kottayam, Visakhapatnam and Varanasi.

You can read this review in Hindi as well.

wish to open dmat