Celebrus

List of Stock Brokers Reviews:

Celebrus is a Kochi-based full-service stockbroker and is a subsidiary company of Commodity Online Group. Where the parent firm is known primarily for commodity-based trading since its establishment in 2007 while Celebrus provides investment services across segments.

Celebrus Review

The stockbroker has a limited offline presence with branches in 12 different cities of the country. If you are looking to become a Celebrus franchise, you can definitely look for a long-term business partnership with the broker.

As per the latest records, Celebrus had an active client base of 5,822 and is ranked pretty low at 100+ rating (lower the better) in India in terms of the overall number of clients.

With this full-service stockbroker, you can trade and invest in the following segments:

In the rest of the review, we will talk about the specific aspects that can assist you in making a decision on whether to go ahead with Celebrus or not.

Celebrus Trading Platforms

Celebrus provides you with different options when it comes to trading softwares, across the web, mobile and desktop version of applications. Let’s talk about these platforms one by one:

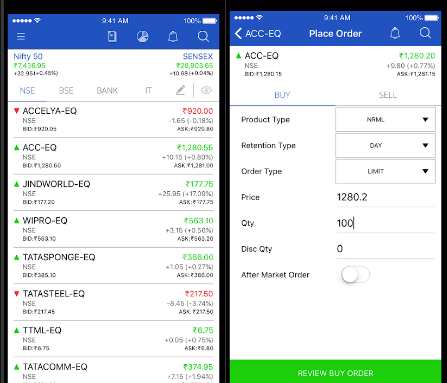

Commodity Online Leap Mobile App

With this mobile trading application, you can trade in equity, commodity and currency trading segments. Some of the features offered in this app are:

- Reports such as Order Book, Net Position, Funds View, Trade Book available.

- Limited charts available for fundamental level analysis

- Decent user experience and interface design

At the same time, the application has faced some criticism as well from its existing user base. Some concerns are listed below:

- Regular time-outs without any alert or notification.

- A limited number of features offered.

- Performance or speed can certainly be improved.

Here is how the app is rated at the Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 8.4 MB |

| Negative Ratings Percentage | 15.3% |

| Overall Review |  |

| Update Frequency | 4 Months |

Celebrus Leap

Celebrus Leap is a web-based trading application that does not require any download or installation. This can be accessed from any device since the software is responsive in nature. Thus, be it mobile, desktop, computer or laptop – you can use this application from any device.

Like Celebrus Leap Mobile, this application also offers a limited number of features. Thus, if you are a beginner to an intermediate level trader, then you may check out this application. However, there are good chances that you will hit a wall very soon as far as accessing different trading features are concerned.

This is how this application from Celebrus looks like:

Nest Trader

Celebrus also offers a terminal based software for users looking for high performance/speed with an exhaustive number of features. Nest Trader is a third party software and is not maintained by this full-service stockbroker. You can access the following features in Nest trader as shown:

- Multiple watchlists for monitoring specific stocks and indices

- Personalization with dashboard, alerts and notifications

- An inbuilt mechanism for research, recommendations and tips at both fundamental and technical level trading.

- Different types of orders allowed to be processed

- Charts, technical indicators provided for detailed intraday level analysis.

There are a couple of concerns in this application as well, including:

- Application relatively bulky that thus, requires relatively heavier configuration

- User experience is relatively okayish in nature, can be tough for beginner level traders especially to understand the way this application works.

Celebrus Customer Care

If you are looking to get in touch with the customer support of Celebrus, these are communication channels available for you:

- Phone

- Offline Branches

The broker has a presence at the following locations:

- Kochi

- Ahmedabad

- Chennai

- Coimbatore

- Bangalore

- Pala

- Kasaragod

- Calicut

- Erode

- Thrissur

- Chengannur

- Trivandrum

In case, you are someone who prefers a local connect (especially if you are living in any of the cities mentioned above) and want to operate your account primarily in an offline manner (call and trade for instance), then this customer support works aptly for you.

However, from an online perspective, communication channels are very limited. Furthermore, the skill-set of the executives can be improved as well, especially in terms of their understanding of trading related terms and the kind of services this full-service stockbroker has to offer.

Overall, they do not really leave a good impression, especially if they are talking to an expert level trader.

Celebrus Research

The full-service stockbroker claims to provide tips and recommendations at an accuracy rate of 75% to 80%. However, these are claimed numbers and therefore, you are advised to test the waters yourselves before trusting these tips with your hard-earned capital.

Celebrus is primarily known for commodity-level research as the broker focuses on this specific trading segment more closely. From a peer comparison perspective, Celebrus falls in line with what is proposed by Goodwill Commodities.

Celebrus Charges

Let’s move ahead and talk about the costs associated with your trading and demat account through Celebrus.

A piece of advice – don’t look at pricing and charges in isolation. Always see whether the broker is value for money at the end of the day or not. Thus, make sure you look at the overall set of services and then evaluate the broker accordingly.

Celebrus Account Opening Charges

| Trading Account Opening Charges (One Time) | ₹0 |

| Demat account Opening Charges (One Time) | ₹0 |

| Trading Annual maintenance charges (AMC) | ₹200, ₹599 Lifelong Free |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

As mentioned above, account opening with Celebrus is free while there are maintenance charges (AMC) involved. They also provide you with a lifetime free AMC plan where you need to pay an upfront charge of ₹599 and that will cover your AMC with Celebrus for as long as your account is active with the broker.

Celebrus Brokerage

Since Celebrus is a full-service stockbroker, it charges you a specific percentage of your trade value as the brokerage charge across trading segments. That implies, higher the transaction value, higher will be the brokerage charge you will end up paying to this broker.

As far as the specific charges are concerned, here are the details:

| Equity Delivery | 0.3% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.02% |

| Equity Options | ₹75 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹75 per lot |

| Commodity | 0.02% |

To understand further, let’s take an example.

If you trade for an overall value of ₹1 Lakh in Equity Delivery segment, then you will end up paying 0.3% of that amount, that is ₹300 for that particular trade. The broker maintains a minimum brokerage of ₹25 per trade as well, in case the trade value is relatively smaller.

You can also use this Celebrus Brokerage Calculator for a detailed understanding of different charges and the final profit/loss you make out of your trade.

Celebrus Transaction Charges

Here are the details on the transaction charges levied by this full-service stockbroker:

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00190% |

| Equity Options | 0.05000% |

| Currency Futures | 0.00115% |

| Currency Options | 0.0400% |

| Commodity | 0.00260% |

Remember one thing, there are few stockbrokers that charge relatively high transaction charges as compared to industry standards. Thus, make sure that apart from negotiating on the brokerage you pay, keep some negotiation room for the transaction charges as well.

Celebrus Margin

Some traders prefer to use margin or exposure in their trades in order to amplify their profits. Now, beginner level traders are advised to make sure that they understand the intricacies involved with this concept as using exposure can be hazardous to your trading capital as well.

Also Read: Margin Call

In the case of Celebrus, these are the leverage values you can use in different trading segments:

| Equity | Upto 20 times for Intraday Upto 4 times for Delivery |

| Equity Futures | Upto 4X for Intraday |

| Equity Options | Upto 2X for Intraday |

| Currency Futures | Upto 4X for Intraday |

| Currency Options | Upto 2X for Intraday |

| Commodity | Upto 8 times for Intraday |

Celebrus Advantages

Here are some of the top benefits you will get in case you opt for this full-service stockbroker for your trading in the stock market:

- Research and tips provided are of reasonable quality and accuracy.

- Apt for south-India based traders looking for an offline friendly broker

- Free Demat and Trading Account Opening

- Decent Intraday Level Exposure for Equity segment.

Celebrus Disadvantages

At the same time, you will be facing these concerns while you use the services of Celebrus in your investments:

- Limited innovation in the trading platforms offered by this broker.

- Investments in segments such as Mutual funds, bonds not possible.

- Customer support at an online level is quite mediocre and can be improved.

- Limited Offline presence through its branches, sub-brokers and franchises.

Celebrus Membership Information

Here is the detailed information on different memberships Celebrus has with different exchanges and regulatory bodies of Indian Stock Market:

| Entity | Membership ID |

| BSE | INB011468239 |

| NSE | INB231468233 |

| NMCE | NMCE/TCM/CORP/0346 |

| FMC | MCX/TCM/CORP/1868 |

| MCX | INB261468230 |

| NCDEX | NCDEX/TCM/CORP/0992 |

| Registered Address | Celebrus Commodities Limited, 27/540, 3rd Floor, EAK Towers, Main Avenue, Panampilly Nagar Kochi, Kerala, India - 682036 |

Conclusion

Celebrus is definitely one of the prominent stockbrokers in India. It offers good value to its clients. However, it is not one of the top-notch stockbrokers by any means. They look to provide you with some kind of value in each and every aspect possible, but unfortunately, fail to shine in any one specific area that can be a highlight for this broker.

Well, in case you are looking to test the waters with a broker as far as trading is concerned, you can give it a try through Celebrus but certainly, it is not a recommended broker if you are looking to trade on a serious basis.

Interested to open an account?

Enter Your details here and we will arrange a FREE Call back.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Celebrus Branches

As mentioned above, Celebrus has a presence in a few selected cities of India:

| Kochi | Kasaragod |

| Ahmedabad | Calicut |

| Chennai | Erode |

| Coimbatore | Thrissur |

| Bangalore | Chengannur |

| Pala | Trivandrum |

As you can see that apart from Ahmedabad, this full-service stockbroker is majorly present in cities that are located in the southern part of India. This gives you a hint of the kind of geographical focus this broker has, at least for now.

More on Celebrus

If you wish to learn more about this full-service stockbroker, here are a few references for you:

Celebrus is a part of Commodityonline Group ,

1) Lack of communication language if your ON trade then you will definitely lost as phone calls are transferred P2P and you need to explain all again

2) You are charged heavily for brokerage unless you complain and no correction is made there after , even you are damn confirmed by there CRM Dhivya Pillai

3) There trading App is still under development by some college students so orders are placed but cant sq, off

4) If you work as franchisee Then offer rms limit without your concern but if client goes negative then you will be hold responsible and your funds will be blocked even you refer any friend to them

5) Your RMS limits can be lowered even your trade is ON

6) Dont care about your emergency for any situations in Trade

7)Most important is they provide your data to other companies which in return will call you for nonsense offers of tips.

8) Only they can apologize for your loss due to their own mistake by confirming this will not repeat again , you will receive multiple calls from many employees and sooner or later you will suffer loss for same mistake and again history is repeated

ALL ABOVE POINTS ARE 100% CORRECT WITH PROOF IF THEY WANT TO CHALLENGE I HAD SCREENSHOTS TO SHARE .