Choice Broking

List of Stock Brokers Reviews:

Choice Broking is a Mumbai based full-service stockbroker of India, established in the year 2010. This stockbroker is a member of NSE, BSE, MCX-SX, MCX, NCDEX along with registration of CDSL. They got their corporate office in 2011 and currently have an employee range of around 500 in total.

Choice Broking Review

Being a full-service stockbroker, Choice Broking provides regular research and tips to its clients for intraday as well as fundamental research.

The research quality, although, is just average and it is advised that clients perform their own analysis as well to validate the learnings from the research team of the full-service stockbroker (especially when it comes to fundamental research – more on this later).

As far as the offline presence is concerned, Choice Broking has more than 1100 franchises across different parts of the country. If you are interested in partnering the broker, here is a quick review on Choice Broking Sub broker for your reference.

Recently, the broker has acquired other stockbrokers such as Inditrade and NG Rathi Group to enlargen its presence and business scale inorganically.

The broker has an active client base of 29, 280 for the financial year 2020 which is not that high from the industry perspective. For more information, check this detailed review on Top Stockbrokers with Active Clients.

Using its services, you can trade or invest in the following segments:

CA Kamal Poddar, Managing Director – Choice Broking

Choice Broking Demat Account

To gain trading experience with the full-service stockbroker one needs to open a demat account. Choice Broking offers a 2-in-1 account where you can reap the benefit of trading and demat accounts together.

Opening a demat account with the stockbroker gives you many more benefits like free access to the trading platforms, research tips, etc.

But what about the account opening fees. Does the stockbroker charges any fees for account opening?

Let’s check the detail of the demat account charges of the broker in the segment below. But before let’s have a quick glance on Choice Broking demat account opening process

Choice Broking Demat Account Opening

Being a full-service stockbroker it offers the benefit of its client right from the beginning. So, when it comes to account opening process, you can fill the application form online and start trade within few minutes.

To open an account you need to follow few important steps:

- Visit the website and click on the link ‘Open a demat account’.

- Enter the Name and mobile number.

- Verify the details by entering the OTP.

- Now enter other details like PAN card and Aadhar card number.

- Further submit the bank details by entering the bank account number, IFSC code etc.

- The verification is done by sending ₹1 to your account.

- Now enter other basic details and proceed to the last step of e-sign.

- To complete this step, enter the Aadhar number and the OTP send to the mobile number registered with Aadhar.

- On verification, the account opening confirmation will be sent to your mobile and email.

You can simplify the complete process with us. Get in touch with us and open a Free demat account online now.

Choice Broking Demat Account Opening Charges

Now let’s see that how much the broker charges to activate the account.

So here, even though the broker is full-service still offers the benefit of free account opening to its clients.

| Choice Broking Account Opening Charges | |

| Account Opening Charges | Nil |

Choice Broking AMC Charges

Along with the demat account opening charges, one need to pay the maintenance charges as well. In case of Choice Broking account, this maintenance cost is applicable from the second year onwards and further you can waive off this fees by choosing the specific plan of the broker.

The details of AMC charges and different plans is provided in the table below:

| Choice Broking AMC Charges | |

| First year | Free |

| Second Year Onwards | ₹200+GST (yearly plan) |

| ₹1500+GST (Lifetime) | |

| ₹3000+GST (Refundable,this AMC is refunded to the trader once he/she decides to close their account) |

Choice Broking Trading Platforms

Choice Broking offers in-house developed browser-based application Investica and a mobile application Choice Index for its clients. In terms of the terminal based software, the full-service stockbroker does not have an in-house solution and rather offers ODIN terminal software.

Let’s discuss these trading platforms one by one in length:

Choice Broking App

Choice Broking offers a decent performing mobile application to its clients across Android and iOS operating systems.

The app. launched in 2015, comes with the following features as mentioned below:

- A real-time feed from the indices available across multiple data points of scrips

- Charting with technical indicators for analysis

- Payment integration with 27 banks

- Provision to create multiple watchlists

- Tips, research reports and recommendations available

- After Market Orders (AMO) allowed.

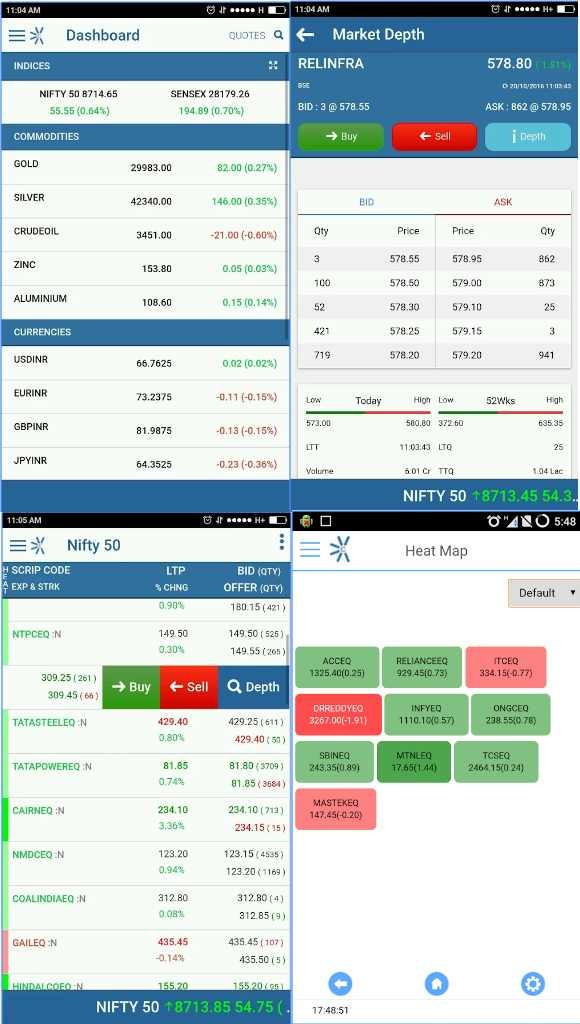

Here are some of the screenshots of Choice Index for reference:

At the same time, there are few concerns raised by the clients about this mobile application, as listed below:

- Overall user experience, especially for beginner level traders can be optimized

- The app hangs and freezes at times, especially for users who perform multiple operations at once

- No interface available for live market news, a basic feature a mobile app MUST have

Here are the stats from the Google Play store around the performance of Choice Index Mobile app:

| Number of Installs | 1000-5000 |

| Mobile App Size | 10 MB |

| Negative Ratings Percentage | 16% |

| Overall Review |  |

| Update Frequency | 8-10 weeks |

Choice Investica

Choice Investica is another in-house developed trading application from Choice Broking which is basically a browser-based trading platform.

This application can be used from any browser (be it Internet Explorer, Google Chrome, Mozilla Firefox or Safari) and any particular device (be it Laptop, Computer, Phone, Tab).

Choice Investica, launched in 2017, is a lightweight application which is responsive in nature. That means it gives flexibility to clients that they can access it from anywhere and any device, for that matter.

Users need to browse a specific link, provide username and password and start trading. Some of the features of this application include:

- Optimal user experience and decent design

- Trade or invest across multiple segments using a single application

- News and real-time charting available for analysis

- Multiple types of orders allowed include After Market Orders (AMO) that can be placed after the market closes for the day.

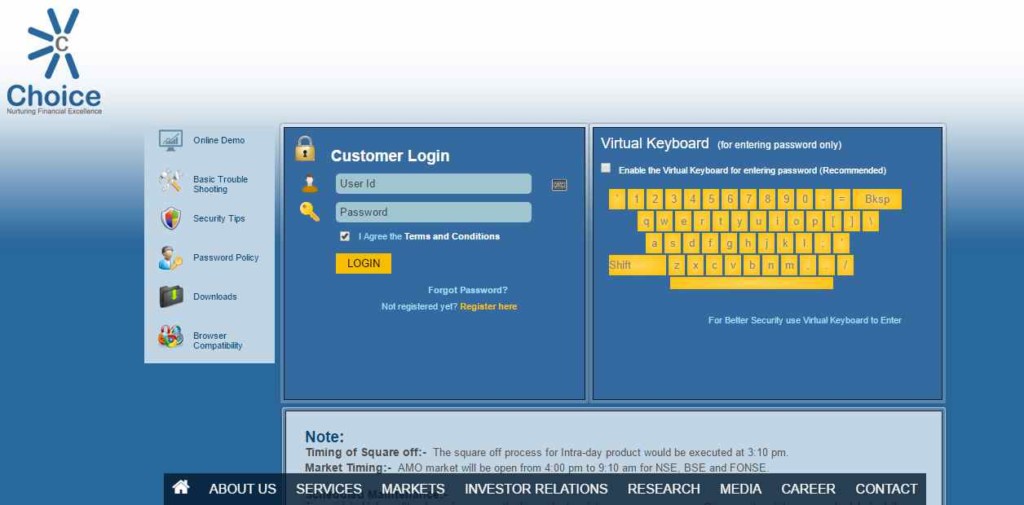

This is how the application looks like:

From the outset, the application looks to be cleanly designed with optimal usage of colour coding, and thus, offering a decent look and feel to the overall layout.

ODIN Diet

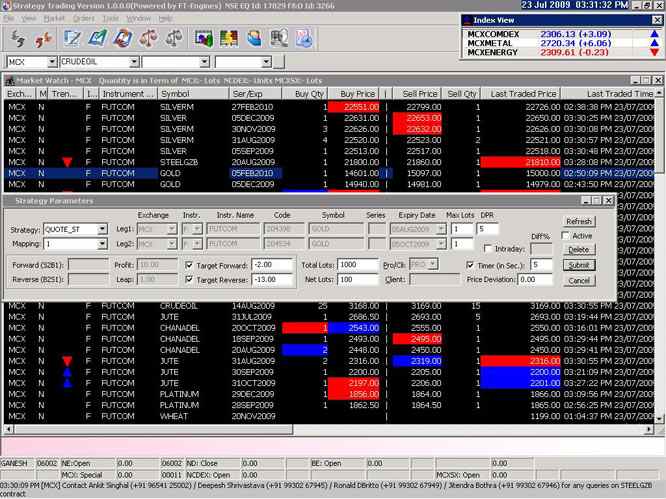

Then comes the terminal based trading platform, ODIN (developed and maintained by Fintech or Financial Technologies) which has been there for a while and is used by multiple stockbrokers for their clients.

ODIN Diet allows you to trade across multiple commodities such as Equity, Commodity, Currency, Derivatives etc. Here are some of the features of this terminal-based application:

- Allows users to develop and run multiple strategies for their technical and fundamental level trades.

- This trading application is pretty exhaustive in terms of the number of features, especially for analysis.

- Built-in features and intelligence that allows clients to look for market opportunities.

The only concern with the usage of out-sourced trading applications such as ODIN Diet is that the control of the addition of new features or facilitating of fixing bugs or issues raised by clients through comments and feedback do not get incorporated quickly.

The whole process is a tad complicated and involves multiple parties before it finally happens if it happens.

This is how the ODIN Diet dashboard looks like:

Jiffy App

This full-service stockbroker has recently introduced its new mobile trading app called Jiffy. The primary claim by the broker is that this mobile trading app is really fast in processing and execution.

Some of the generic features this mobile app provides are:

- Allows you to trade across Equity, Commodity, Currency and Derivatives

- 14 types of charts for stock market analysis with intuitive user experience

- Key information and data points (such as ratios, peer comparison, financials, bids, shareholding pattern, company details etc) around different scrips.

- Watchlist that can be personalized as per user preferences

- Alerts and notifications

At the same time, some of the concerns raised by the clients of this broker are:

- As of now, there are no screeners available

- Mutual funds investment not possible

Here are some of the stats about this mobile app from the Google Play Store:

| Number of Installs | 5,000+ |

| Mobile App Size | 9.4MB |

| Negative Ratings Percentage | 2.04% |

| Overall Review |  |

Choice Broking Customer Care

The full-service stockbroker provides the following ways to get in touch, as listed below:

- Offline branches

- Phone

- Web-form

The broker provides assistance at both offline as well as online levels, however, the overall customer support quality is not in line with what is expected from a full-service stockbroker generally.

If you are looking to be the client of this broker, keep your expectations low in terms of the turnaround time and personalized level communication. Furthermore, it seems the support executives are not really aware of stock market terminology in general either.

This points to that fact that maybe they are not provided with any proper training before moving on to the position.

Choice Broking Research

The stockbroker provides a wide range of research reports and recommendations through the following offerings as listed below:

Fundamental Research

- Stock Research Note

- IPO Update

- Result Update

Technical Research

- Pick of the Week

- Morning Tea

- Equity Techno Call

- Currency Techno Call

- Derivatives Strategy

- Commodities Techno Call

- Traders’ Choice

- Commodity One Page

- Commodity Insight

- Derivative Direction

- Choice Sparks

- Special Report

- Weekly Report

Call Tracker

- Pick of the Week

- Morning Tea

- Equity

- Derivative Strategy

- Commodities Techno Call

- Trader’s Choice

- Commodity Insight

As can be seen above, the broker provides an exhaustive range of reports when it comes to technical and intraday trading, however, the research is limited for fundamental or long-term investment.

Some of the reports mentioned above are daily, weekly, monthly or yearly in nature depending on the nature of the report and return expectations.

The only major feedback, as mentioned above, is that the broker needs to open up its research methodologies towards long-term investments.

Choice Broking Pricing

As far as pricing is concerned, Choice Broking charges a reasonable brokerage across segments. As far as Choice Broking Demat Account opening is concerned, there are multiple plans in placed and users, depending on their commitment level, can pick a plan. Here are the complete details:

Choice Broking Account Opening Charges

Here are the details of the multiple account opening plans offered by the full-service stockbroker. There are 3 plans in total and these plans differ in terms of the number of years commitment a client can make with the broker.

| Plan | Pricing | Duration |

| Plan 1 | ₹200+GST | Yearly |

| Plan 2 | ₹1500+GST | Life Time Free AMC |

| Plan 3 | ₹3000 | Full Refundable While Closing the Account |

| For Corporate Account | ₹1000+GST | AMC Applicable from the 1st year |

In case, if you have not selected any Plan, then a default Plan of Rs. 200 will be considered automatically.

Choice Broking Brokerage Charges

As far as a brokerage is concerned, here are the charges based on the trade value. The percentage shown in the plans below is used to calculate the brokerage.

For instance, the delivery brokerage is 0.20% – that implies that if a client trades for ₹1,00,000 on the stock market then he/she is required to pay a brokerage of 0.20% of ₹1,00,000 i.e. ₹200.

There are few transaction charges and taxes as well in addition to the brokerage rate but that is applicable to all the stockbrokers in India.

Here are the complete details of multiple segments of trading offered by Choice:

| Equity Delivery | 0.2% |

| Equity Intraday | 0.02% |

| Equity Futures | 0.02% |

| Equity Options | ₹25 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹20 per lot |

| Commodity Futures | 0.02% |

| Commodity Options | ₹50 per lot |

Use this Choice Broking Brokerage Calculator for complete calculation of the charges and your profit.

Choice Broking Transaction Charges

These are the details on the transaction charges levied by Choice to its clients. The values are pretty standard in terms of the overall industry benchmarks:

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.0019% |

| Equity Options | 0.05% |

| Currency Futures | 0.0009% |

| Currency Options | 0.04% |

| Commodity Futures - Non Agri | 0.05% |

| Commodity Futures - Agri | 0.00175% |

| Commodity Options | 0 |

Choice Broking Margin

Users looking for Exposure or Leverage from Choice Broking can expect an average range of values. The exposure values will be minimal at the same but by time, as the user gains some momentum and brings consistent growth in his/her portfolio, then these exposure values can be negotiated.

Here is what Choice Broking offers:

| Equity | Upto 10 times for Intraday, & 2 times for Delivery |

| Equity Futures | Upto 3 times Intraday |

| Equity Options | Upto 2 times Intraday |

| Currency Futures | Upto 2 times Intraday |

| Currency Options | Upto 2 times Intraday |

| Commodity | Upto 3 times Intraday |

Choice Broking Disadvantages

There are few concerns as well when it comes to opening an account with the full-service stockbroker. Here are a few listed below:

- No in-house desktop-based terminal application

- Average Customer service

- Not so high exposure values offered

- Below average brand recall.

- Okayish accuracy of research reports and recommendations

Choice Broking Advantages

At the same time, here is what clients of Choice Broking enjoy using the services of this full services stockbroker:

- Decent range of trading and investment products

- Good Trading platforms

- Multiple account opening and maintenance charge plans

Looking to Open an account?

Provide your details in the form below and we will set up a callback for you, right away.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

You can check out the detailed comparison of Choice Broking Vs Other Stock Brokers here:

Choice Broking Branches

The full-service stockbroker has limited offline coverage with a presence in the following locations of India, including:

| States/City | ||

| Andhra Pradesh | Hyderabad | |

| Assam | Guwahati | |

| Bihar | Patna | |

| Chhattishgarh | Raipur | |

| Delhi/NCR | New Delhi | |

| Gujarat | Surat | Ahmedabad |

| Baroda | ||

| Jharkhand | Ranchi | |

| Karnataka | Bangalore | |

| Kerala | Kochi | |

| Madhya Pradesh | Indore | Bhopal |

| Maharashtra | Nagpur | Mumbai |

| Rajasthan | Jaipur | Jhunjhunu |

| Sikar | ||

| Tamil Nadu | Chennai | Karur |

| Coimbatore | ||

| West Bengal | Kolkata |

More on Choice Broking:

If you are looking to know more about Choice Broking, here are a few reference links for you:

I am a trader with Inditrade KHN054 migrated to Choice Broking.After the migration it is seen that Mtm is not reflecting in the net position expiry summary in Online Diet workstation at clientlevel instead valuation is shown.Mtm ought to be on the settlement price or closing price and not on the valuatuon.This change is causing difficulties for position monitoring especially while doing lambda trading.My escalations regarding this to the management in Kochi not properly redressed and hence this noting here. Regards ,Najeeb T P

Very bad experience i had with choice broking, no proper information will be provided to the client, there is a cheat in tax deductions