Delivery Charges in 5paisa

More on Online Share Trading

Every broker levies multiple charges on an account holder. In the case of the discount broker, 5paisa, one such charge is delivery charges in 5paisa. Today, we will talk about it in detail.

So, let’s go!

But before we dive into the conversation about delivery charges in 5paisa, we need to know a little about the stockbroker.

5paisa is a discount broker and was initially a subsidiary of the well-established full-service broker – IIFL Securities. It is headquartered in Thane, Maharashtra, and became an independent corporate identity in 2017.

The broker is SEBI registered and is a depository participant with CDSL. It aids share market trading as it is allows trading on various stock exchanges like NSE, BSE, and MCX.

With this information, let’s move ahead to discuss the 5paisa delivery charges in detail.

5paisa Delivery Brokerage Charges

A long-term trader looks for the answer to an important question, i.e., how much is the 5paisa brokerage for delivery?

So, the answer to this question will be provided in this detailed article.

Generally, the delivery charges are divided into two categories – Brokerage charges and Margin charges. These charges don’t fluctuate much in the case of different trading segments.

The 5paisa delivery brokerage charges are fixed at flat ₹20 for all orders executed by a trader or investor, irrespective of the traded segment.

However, you are given the option to choose a value addition 5paisa brokerage plans that reduce the brokerage charges to ₹10 per order. These packs offer you many essential add-ons like portfolio analyzer, free trades, etc.

These packs also cut down your expenses on AMC and DP charges as they are nil. In general, DP charges in 5paisa are levied during selling trades in delivery format.

The 5paisa charges in the equity segment are the most talked about among the traders and investors. Thus, below the equity delivery charges in 5paisa are discussed in the following section.

Equity Delivery Charges in 5paisa

Under the basic plan, which is subscribed by default when you open a demat account with 5paisa, the equity delivery brokerage charge is ₹20 per order. This amount can be reduced by subscribing to a value addition pack.

They offer two value addition packs, namely 5Paisa Power Investor Pack, UltraTrader Pack of 5Paisa. In either of these packs, the 5paisa equity delivery charges are slashed by ₹10. It means you pay just ₹10 per order.

For an easy comparison of demat account charges, they have been tabulated below:

| Equity Delivery Charges in 5paisa | |||

| Packs | Basic Plan | Power Investor Pack | UltraTrader Pack |

| Brokerage Charges | ₹20 per order | ₹10 per order | ₹10 per order |

If you wish to calculate the charge, you will pay for every order in the case of delivery trading; you can use the 5paisa delivery charges calculator available on their website.

The section talks about 5paisa delivery margin charges.

5Paisa Brokerage Calculator

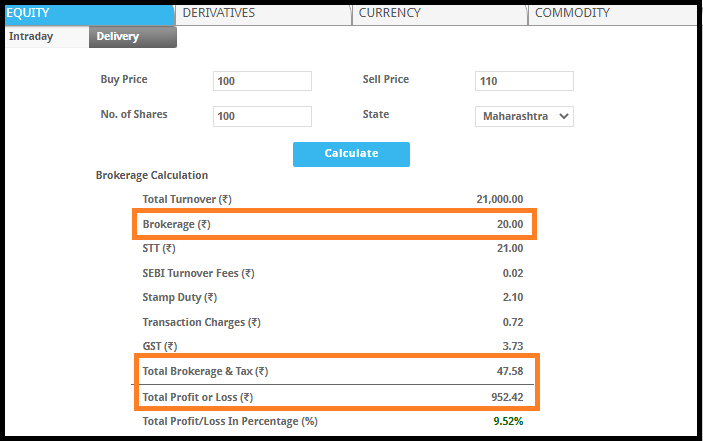

Although the broker imposes the flat brokerage charges, but there are some taxes that often makes it difficult for traders to evaluate the brokerage and total profit that one can make.

To simplify it, here is the brokerage calculator that evaluates all charges imposed by the broker.

Just enter the information required and get the detailed information of fees to be paid.

5paisa Delivery Margin Charges

A trader and investor always make sure to be aware of the 5paisa delivery margin charges before engaging with the discount broker.

Generally, brokers offer a fixed percentage range for every trading segment, and 5paisa is no exception.

5paisa offers the same percentage of delivery margin, irrespective of the value addition pack you choose.

In the basic plan and the two value addition packs, the 5paisa margin for delivery charges is up to 4x or as per the guidelines of the stock exchange. These have been tabulated below:

| 5paisa Delivery Margin Charges | |||

| Packs | Basic Plan | Power Investor Pack | UltraTrader Pack |

| Margin Percentage | Up to 4x or as per stock exchange guidelines | Up to 4x or as per stock exchange guidelines | Up to 4x or as per stock exchange guidelines |

The minimum amount to be maintained in the margin account to avoid a margin call is updated by the stockbroker from time to time. Therefore, you will have to keep an eye on this aspect regularly.

Now, let’s talk about the 5paisa delivery leverage charges calculator.

5paisa Delivery Leverage Charges Calculator

Suppose you want to calculate the amount you will pay for availing of the 5paisa margin facility for a particular financial asset. In that case, you can use the 5paisa Margin Calculator available on the official website and our website too.

This calculator helps you to select the stock you want to buy using the margin provided by the stockbroker and find out the margin percentage for it. Since the margin value is dependent on various factors related to the stock, it varies for every stock.

Now let’s talk about the charges for converting intraday to delivery in 5paisa.

Charges For Converting Intraday To Delivery In 5paisa

There are multiple instances where the trader commences the trade with the plan of exiting it by the end of the day, i.e., doing intraday trading. But, as the session nears the closing time, they change their mind and convert it to delivery trade.

Are you getting confused?

Let’s understand this with a simple example.

Suppose Rahul starts his trading session by placing an order for buying XYZ stock at ₹100, and the validity of this order execution is for this trading session only. He plans to wait till 2:15 P.M. to take a call on his trading decision.

At 2:15 P.M., he realizes that the profit margin in this trade is minimal but has chances to grow if he holds the security overnight or for a more extended period.

Therefore, he logs into his trading application to convert the trade from intraday to delivery.

But he is worried if he will have to pay any charges for the same.

Now, as he has a 5paisa demat account, he doesn’t have to pay a single penny for this trade conversion. The broker offers this service free of cost, either way.

So, trade with never-ending confidence with this discount broker.

Conclusion

The delivery charges in 5paisa are majorly divided into two categories – Brokerage and Margin.

The margin percentage is decided based on various factors of a particular stock, and the brokerage is levied irrespective of the segment and style you choose.

According to the trading segment, varying charges are levied on trader and investor, and delivery trading charges are discussed in detail above.

A specific service by the broker is to provide its clients with free of cost trade conversion option.

You can convert the trade from delivery to intraday or vice versa without paying any charges.

We hope that your query regarding the same has been resolved.

Happy trading!

Wish to start trading in the Share Market? Refer to the form below

Know more about 5paisa