Edelweiss Trading

More on Online Share Trading

Being an investor in Edelweiss is not the only option available in the firm as being a trader, you can earn huge profits too. Apart from the investment, let’s concentrate on Edelweiss Trading.

Wait, however!

Do you know the firm’s background? If not really, then we will learn about the firm by having a sneak-peek at the same.

Edelweiss Capital is a full-service stockbroker that is registered with the SEBI, which means all the activities and functions are controlled and monitored by it.

Choosing the right stockbroker for a Share market account opening will help you to reap the benefits of their convenient services.

Apart from being registered with SEBI, the firm is also enrolled as a Depository Participant with NSDL.

Edelweiss provides the best trading platforms in India, and the firm is enlisted in the various stock exchanges, including:

Surprisingly, Edelweiss is available at 200 locations with over 475 offices and more than 12,00,000 active clients. The firm allows the trading in different segments, including:

As you get the brief knowledge of the background of the firm, now it is essential to mention that they provide delivery and Intraday trading to its clients.

To delve into the topic of Edelweiss Trading, you will have to hold your attentiveness and take heed on the following sections-

Come on, now let’s get started!

Edelweiss Trading Review

Edelweiss is a full-service stockbroker that offers an opportunity to plan a long-term investment through delivery trading by busing the best Delivery Trading Strategy or to earn profit by opting for short-term trading options like intraday or swing trading.

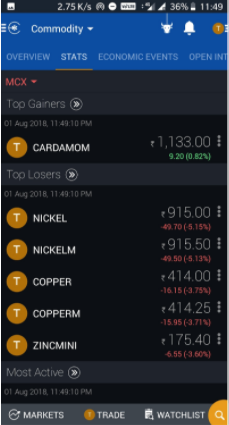

Other than this, the firm is registered with MCX and thus allows you to trade in the Commodity Futures and Commodity Options.

Apart from this, you will be allowed to differentiate the trading segments and the charges so that the trading can become reliable.

Before you start the trading journey with Edelweiss it is important to learn the steps of how to start investing and know all the details including charges and other trading benefits like software and platforms that the broker provides.

Edelweiss Trading Account

To start trading, you need to have an account where you can keep the money that will be used for purchasing or selling financial securities such as equity, derivatives, currency, IPO, etc., and that account will be your trading account.

If you want to particularly invest in Equity then it is best to know about the Equity Investment Types and Equity Investment before you actually get to reap the benefits of trading and investing.

Just like the demat account, the trading account is also necessary to grab the seamless experience of trading and investment.

To open the trading account, few firms charge fees that will allow you to trade with some trading applications having flawless features.

The account opening charges of the Edelweiss are free, which means a trader does not need to pay any fees to open a demat or trading account with the firm.

| Edelweiss Trading Account Opening Charges | |

| Trading account opening | FREE |

| Demat account opening | FREE |

If you haven’t opened the demat account, you can fill the following registration form to connect with the Edelweiss team.

Now you might be thinking “Why should you be connected with the Edelweiss for the trading account?” Here are the reasons mentioned below to answer the query:

- It provides seamless transactions.

- You can smoothly go with reliable research.

- You will get the guided portfolios.

- Research recommendations are provided by the firm.

- You can check the leverage products.

- A trader can enjoy the SEBI margin trading facility (SMTF).

- The automated limits on collateral are provided by the firm to the traders.

- A trader can enjoy the funding options with Edelweiss.

Edelweiss Trading Charges

After opening the trading account, a trader will get curious to know about the trading charges. So let’s take some time to delve into the Edelweiss Trading Charges.

Let’s get started!

In the below table, you will get the detailed data about the trading brokerage charges in the two plans, i.e., the Lite plan and the Elite plan.

| Edelweiss Trading Charges | ||

| Segments | Lite Plan | Elite Plan |

| Equity Delivery Trading | Rs. 10/ trade | 0.30% |

| Equity Intraday Trading | Rs. 10/ trade | 0.03% |

| Commodity Options Trading | NA | NA |

| Equity Futures Trading | Rs. 10/ trade | 0.03% |

| Equity Options Trading | Rs. 10/ trade | Rs. 75 per lot |

| Currency Futures Trading | Rs. 10/ trade | 0.02% |

| Currency Options Trading | Rs. 10/ trade | Rs. 20 per lot |

| Minimum Brokerage | Rs. 10/ trade | Percentage of transaction |

Thus, Edelweiss offers two different plans that give access to traders to trade in the minimum amount of ₹10 under Lite plan, whereas the Elite plan charges the fees in a percentage basis which is as low as 0.02% to 0.03%.

Other than this the equity options trading charges ₹75 per lot under the Elite plan.

Thus, gaining the knowledge of the Edelweiss charges can actually helps you to make a wise decision of whether or not to open an account with the broker.

Edelweiss Trading Platform

Being a full-service stockbroker, Edelweiss offers research tips and ideas that help traders and investors to make smart investment decisions. You can easily come across these tips through the Edelweiss trading platform.

These trading platforms are easily accessible on desktop and mobile phones.

With multiple features in it the Edelweiss Trader (a mobile trading platform) helps you in doing stock analysis and in picking the right stock.

Further, it makes it easy for traders to buy or sell a particular share with a single click.

To get the detailed information, let’s move ahead with more information around the Edelweiss mobile trading app and Edelweiss Trading Software.

Let’s get started and get satiated with Edelweiss Trading by covering its trading platforms.

Edelweiss Mobile Trading App

To enjoy trading, Edelweiss has created a mobile app that will help you to trade efficiently with various tips and researches.

The Edelweiss Mobile App helps traders to enjoy the different services and features offered by the app.

Through the Edelweiss Mobile Trading App, you can trade effectively from anywhere and anytime. The app is available for both Android and iOS users with its magnificent features.

But why Edelweiss Mobile Trading App? Below the reasons are stated:

- The app is a user-friendly portal for trading.

- The trading speed is commendable.

- The trading features make the trading experience better for the traders or investors.

- Android and iOS users can use the services that are available in the app.

The mobile app can be referred to as the applicable, satisfactory way of trading in the Edelweiss for all the users.

Edelweiss Trading Software

Here comes the Edelweiss Trading Software by the name ‘Terminal X3’, and it is a desktop trading software. It is a trading terminal that is available with an analytical solution for the traders.

TX3 is available with 3X factors, including:

- Remarkable speed

- Wise data analytics

- Advanced charting

This Edelweiss Trading Software is mostly considered as the appropriate trading platform for the investors and traders and swiftly performs the trading functionalities.

The platform can easily get installed and is accessible to trade in various segments. Now the question that must be arising in the mind is ‘Why Edelweiss Trading Software?’

The answer can be checked below as the features are listed below:

- The platform can be accessed with Windows, Mac, and other browser types.

- The real-time updates are given to the traders, and portfolio details can be tracked by the trader.

- The stock tips, along with the advice, are provided in the software by the firm.

Edelweiss Trading Login

After connecting the firm on different platforms, now the process of Edelweiss Login comes to the forefront. For that, let’s discuss the ways to enter Edelweiss Trading Platforms.

To access the Edelweiss Trading Platform, you need to follow the underneath steps:

- You should have the trading, and Edelweiss demat account opened to login into the app.

- At the time of account opening, you will be given the ‘Welcome Kit’ containing the unique User Id and Password.

- By using these credentials, you can enter the app instantly and can start trading.

Note: If the trader ever wanted to change the password, it can be possible by generating a 2FA password.

The Edelweiss Broking Customer Care came to the fore to answer any kind of question or to quickly solve your query.

Conclusion

Edelweiss is a full-service stockbroker licensed, regulated, and supervised by the SEBI. In addition to being registered with SEBI, the company is also registered with NSDL as a Depository Participant.

In India, Edelweiss offers the best trading platforms, and the broker is listed on numerous stock exchanges, including BSE, NSE, and MSE.

Edelweiss assists you with either trade-in delivery, intraday delivery, or both. In addition, you will be required to distinguish the trading segments and the fees so that the trading can become accurate.

You need to have an account to start trading where you can store the money that is to be used to purchase or sell financial instruments such as shares, futures, currency, IPO, etc., and your trading account will be that account.

For investors and traders, this Edelweiss Trading Program is often regarded as the acceptable trading platform and efficiently performs the trading functions. The platform is easy to install and usable for trading in different segments.

You need to have a demat and trading account opened to login into any trading platform of the business that will enable you to obtain credentials through which you can join Edelweiss platforms.

The business is capable of starting trading with different trading terminals and is responsible for performing various services for traders or investors.

Enjoy your trading with Edelweiss!

Wish to open a Demat Account? Please refer to the form below

Know more about Edelweiss Broking