How to Calculate Brokerage in HDFC Securities?

Check All Frequently Asked Questions

Most of the traders remain concerned about the brokerage fees charged by the stockbroker. Although many are aware of the same but often remain confused when the trading charges are being imposed on them. In this article, clear your confusion by knowing how to calculate brokerage in HDFC Securities.

Wondering why it is important to know?

To prevent yourself from paying any kind of extra fees and to know the hidden charges charged by the stockbroker.

HDFC Securities Brokerage Charges

Before knowing the process how to calculate brokerage in HDFC Securities, let’s have a quick glance at the brokerage fees charged by HDFC Securities. Now being the bank-based stockbroker, HDFC Securities generally charges higher in comparison to other stockbrokers.

Here is the standard brokerage charged by HDFC securities to trade in different segments

The number of brokerage charges payable to HDFC securities will depend on the brokerage plan. HDFC Securities offers a wide range of Value Plans, each consisting of an upfront amount and the consequent brokerage charges for every trading segment.

As you can see from the above image, the value plans, namely Lite, Alpha, and Alpha+, differ in brokerage charges for a given trading segment. So the higher the upfront fee or, the more expensive your plan is, the lesser the brokerage rate.

Here we will take a look at the basic “Lite Zero” plan, which is free of cost.

If the calculation of the brokerage charges confuses you, don’t panic. Instead, we will take an elementary example to understand how to calculate brokerage in HDFC Securities.

EXAMPLE:

Price= 2000

Quantity= 100 Segment- Delivery Order- BUY

Turnover= ₹ 200000/-

Delivery Brokerage Rate : 0.50% or min ₹ 25/-

Calculation: 0.50% of 200000 = ₹ 1000

Since 1000 is greater than 25, therefore;

Brokerage Charges for this Buy Order is ₹ 1000.

These are only the trading charges charged on the total turnover value. Apart from this, there are STT charges, GST, transactions, etc.

To understand this, considering the same example, the STT charges in HDFC Securities is 0.1% of the turnover value, stamp duty is 0.01% of the transaction, SEBI charges 0.00015% of turnover and 18% GST charged on brokerage and transaction.

The total turnover value in the above example is ₹2,00,000/-

STT Charges= 0.1%*2,00,000

= ₹200

Stamp Duty= 0.01%*2,00,000

= ₹20

SEBI Charges= 0.00015%

= ₹0.3

All these taxes make it more difficult for traders to calculate the total brokerage and further to the profit they can earn.

So brokerage and other taxes are calculated on the total turnover value. Did you get it? Or do calculations make you dizzy, or do you find mathematics too boring? So tell you what, we’ll do the calculation for you using our mathematical brokerage calculator.

HDFC Securities Brokerage Calculator

Our website features not just a brokerage calculator but an overall tax calculator for HDFC Securities. These calculators are efficient and reliable because they are devoid of any human intervention. So you don’t have to worry about any errors and can easily calculate the brokerage in HDFC Securities.

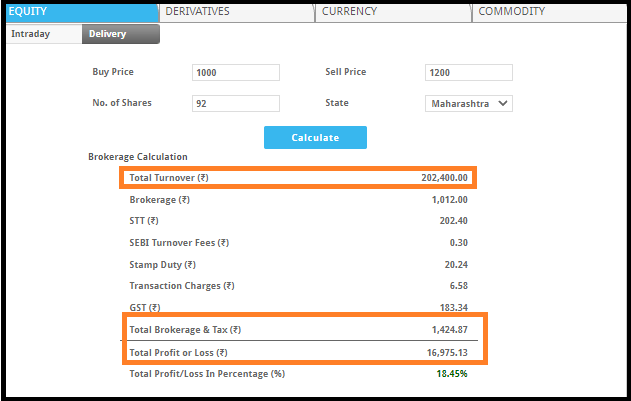

You just have to input values like buy and sell price, the number of shares, and the state. Then, the calculator will return results such as STT, Brokerage, Transaction charges, stamp duty. It also calculates net profit/loss or turnovers.

If you haven’t used these calculators we have for every top broker in India, you are missing a lot of timely information.

Conclusion

Calculating a brokerage in HDFC Securities gives you a better idea of how much the trading cost to you and further makes it easier for you to evaluate the total profit or loss percentage.

Other than this, this brokerage may vary according to the plan you opt for.

So, apart from the stock selection, it is good to do research and proper evaluation of the trading cost before investing or trading with HDFC Securities.

Now open a Demat account for FREE. Get in touch with us and we will assist you in choosing the right stockbroker.

More on HDFC Securities