How to Calculate Stop Loss?

Most of the traders make use of the stop loss but how many among you actually know the right price point to minimize the loss? Well! it is challenging but learning the way of how to calculate stop loss helps you in minimizing the losses and in booking your profit in the trade.

So, if you are active traders who are looking ahead to make profit and high returns in the stock market by keeping your losses in check, then here is the way that helps you meet your targets.

How to Set Stop Loss in Intraday Trading?

Although stop-loss is beneficial for all kinds of trades, generally it plays a vital role in intraday trading.

This is due to the fact of the intention behind the trade where the traders tend to make huge intraday trading profits in the shortest time span.

To understand this, let’s take an example.

Rishi is an intraday trader. He is a beginner and hence has not much idea of where to set the stop loss.

He traded in the stocks of Happiest Minds Technology and bought 100 shares at ₹1500 each. Since he was a beginner, he set the stop loss at ₹1498 assuming that the stock would move only in the upward direction.

Since the intraday stocks are the most volatile and soon the price dropped to ₹1494, thus hitting its stop loss value i.e. ₹1498 and later closed at ₹1515.

What understanding did you gain from the above example?

Rishi could have set the stop loss somewhere around ₹1490-₹1492, but setting too low might increase his losses.

On the other hand, setting at ₹1498, kept him away from making a potential profit from his trade.

So, what is the right way to determine and calculate the stop loss value for intraday trading?

Here, there are three types of strategies that can be used by the traders like Rishi for calculating the stop loss of a particular stock. They are:

- Percentage Method

- Support Method

- Moving Average Method

For better understanding check out the video below:

To know more about the strategies mentioned above in detail, then it is the right time to discuss them in brief.

How to Calculate Stop Loss Percentage?

The percentage method is the most common way to determine and calculate stop loss.

Although it is similar to the one discussed in the example above, here instead of setting stop loss on the basis of the value you might lose if the trend reverses, it helps you in calculating the stop loss in percentage.

So let’s suppose the stock is trading at an uptrend with the CMP at ₹1550. Rishi bought 100 shares with the belief that the stock will remain bullish and will close at around 8% growth i.e. at ₹1674.

At the same time, he wants to limit his losses and therefore determines the historical trend of the share of the last 5 days. He noticed that the share price is highly volatile and has seen a dip of a maximum of 6% in the last few days.

Hence, he placed the stop loss at 3% below the CMP i.e. around ₹1504.

Since the stock was bullish but highly volatile, it dropped to ₹1520 in the mid of the day, but after touching its lowest price of the day, it shot up and hit ₹1600 value before closing.

Thus, Rishi was able to make a profit of ₹50 per share and exit the trade with a total profit of around ₹5000.

Similarly to Rishi, you can determine your risk appetite, by analyzing the trends of the market and set the stop loss at the right price point using the percentage method.

This method helps you in calculating the stop loss using the percentage method, but at the same time, it involves a lot of manual analysis and study. Along with this, the wrong analysis of shares, can lead to severe losses or escape from making a profit.

To overcome this drawback, one can rely on other methods discussed below.

How to Calculate Stop Loss Using the Support Method?

Here comes another way to calculate the stop loss, i.e., the support method.

The support level is the point from where the stock does not fall down. In short, the support level is the area from where the price of the stock often stops dropping.

To make it easier to understand, let’s check the steps on how to calculate stop loss using the support method.

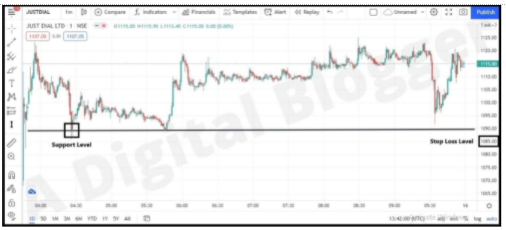

- Open a stock in which you want to trade-in.

- Get a one-day chart and find out its support level.

- Create a trendline and set the stop loss below the support level.

In the below chart, it can be seen that again the stock hits the support level at ₹1090. So in case, if Rishi had fixed a stop loss on the same support level, in that case, he might have exited the stock by making fewer gains.

So here Rishi bought shares of Just Dial at ₹1093 and set the stop loss just below the support level (₹1090) at ₹1087.

Thus, here all you have to do is to analyze the support level of the last trading days and the current trading session to get a clear idea of where to set the stop-loss price.

It is essential to check the support level and sets the stop loss accordingly as if it is not done without clear knowledge, method and steps, the trader might get lesser profit.

How to Calculate Stop Loss Using Moving Average Method?

Last but not the least, here is yet another method that helps you in calculating the stop-loss price for trading,

The stop-loss price can be easily set using the Moving Average. To get better results or assured stop loss value, one can use 33 Days EMA.

For the trade other than intraday, you can use a slow EMA of 200 days or 50 days accordingly.

Now here comes the question of how the EMA in the charts can actually help you to calculate the stop loss.

Well! it’s simple.

- All you have to do is open a trading app and pick the stock you want to trade-in.

- Open the one-day chart and set the EMA of 33 days.

- Now analyze the trend line along with the closing price of the share.

- Since EMA gives you the idea of where the stock price is moving in the last few days, hence one can easily determine the price up to which a particular share can drop in a particular trading session.

- Here the stop loss must be set just below the line of the EMA.

So let’s say, if a particular share is trading at ₹2000 per share with the 33 days EMA of ₹1955 then one can enter into the long position by setting the stop-loss a little below then ₹1955 i.e. around ₹1950.

In all, using the correct period of EMA while trading can actually help you in determining the support level and eventually the stop loss.

How to Calculate Trailing Stop Loss?

Till yet, you have learned about the ways by which you can exit the trade at the right time thus minimizing our losses. But what if the share has the potential to give you a higher return and still you end up making up the losses just because the price hits the stop loss.

In order to enhance the efficacy of stop-loss, you can use another and advanced way of setting the trailing stop loss.

Unlike stop-loss order, it is set in percentage only and as the name goes, as the stock price increases, it trails behind in the percentage set by you.

Thus, every time the share price increases the new stop-loss price is set thus preventing you from facing many downsides.

Does it seem to be confusing?

Let’s make it easier with the help of another example.

Buying Price of Share=₹100

Stop Loss=₹95

Trailing Stop Loss=0.5%

Now the stock price moves to ₹105.

Since the stop loss trails by ₹0.5 for every ₹1 growth in the share price, hence the new stop loss at ₹105 would be ₹97.5.

You can use the above methods to set the stop loss and trailing stop loss.

Now it is clear to much extent that setting a stop loss for trading demands an understanding of the technical aspects of the stock. It is therefore important for a beginner to learn the basic and advanced concepts of the market.

There are many ways to understand the market but to begin with one can rely on technical analysis books. There are many books that cover important topics of support, resistance, chart patterns, indicators, etc, which makes it easier to do risk-free trading.

Conclusion

Above are the three ways by which you can calculate and set the stop loss at the right price point to minimize your losses without skipping the chance to earn profit.

Now along with the stop loss, you can also set and calculate the target price for a particular trade. This helps you in booking the profit at the right value.

So let’s say you buy a stock at ₹100 and set a stop loss at 5% i.e. at ₹95. Here the target price is generally set at 1.5 times more than the stop loss value i.e. at +7.5 value and thus one can book profit by setting the target at ₹107.5.

In all, intraday trading is not only all about the technical analysis of stocks but also the right calculation, and usage of trailing stop loss to reducing trade loss and in booking profit at the right price value.

To get a fair idea of the stop loss value, it is good to choose the stockbroker that offers highly interactive charts and indicators to make calculation easy.

Not having an idea, get in touch with us and open a Demat account with the renowned stockbroker.