How to Put Stop Loss in IIFL App?

Check All Frequently Asked Questions

Generally, an investor or trader places a stop loss to limit his losses in the situation of unfavorable market conditions by either “buying” or “selling” his desired order. Having an account in India Infoline then here is the detail of how to put stop loss in IIFL App?

There are two types of stop-loss orders in the IIFL App, and understanding them is highly crucial as it can save your money during the market ups and down situation.

A stop-loss order is placed to limit the loss that one may face while executing the order. It is of two types stop-loss limit order and stop-loss market order.

A stop-loss limit order is placed with a defined price + trigger price. Here the trigger price is the amount on which the trade will be executed.

But have you ever wondered how to calculate stop loss.

Let us understand more about the Stop Loss in the IIFL App.

How to Place Stop Loss in IIFL APP?

You can either place a “buy” or “sell” order on the IIFL Trading Platform, but before that, it is important to note that you must have an IIFL Demat account and Trading account.

Now to place stop loss in IIFL app, there are two cases.

- If you have a sell position, then you place buy stop loss order in IIFL app

- If you hold a buy position, then you will keep a sell SL.

You can easily place stop loss order in IIFL with the help of CNC and MIS. Here CNC is for delivery trading while MIS is for Intraday Trading across equity, mutual funds, derivatives (futures trading and options trading), and commodity segment.

Thus, you can easily place the stop loss order in both delivery and intraday segment using IIFL trading platform.

When an Intraday trader puts a stop-loss order on his “sell” order or MIS order, his stop-loss will be automatically squared off as a buy order at 03:15 PM (Equity), 03:20 PM for Futures & Options, 04:45 PM for currency trading, and around 02:40 PM for Commodity, which are the Intraday square off time for each segment..

Contrary, for the CNC, i.e., delivery trades, the “buy” orders can be held for a long duration than MIS orders. However, if you buy and sell orders on the same day, it will be counted as Intraday Trading.

How to Place Stop Loss Sell Order in IIFL?

To place a stop loss order in IIFL, you can either place a buy or sell order through IIFL Market App or IIFL Trader Terminal.

Here’s how to place a Stop Loss order in the IIFL Markets App for “sell”-

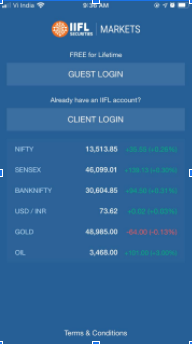

- Download or open the IIFL Markets App on your phone.

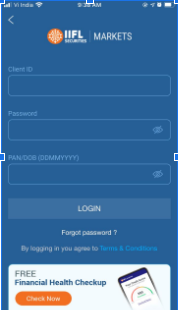

- Enter your credentials to have access to the App.

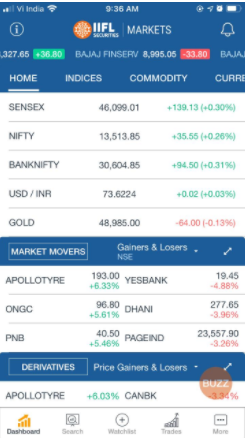

- Select the desired stock by using the “search button” or finding through the watchlist.

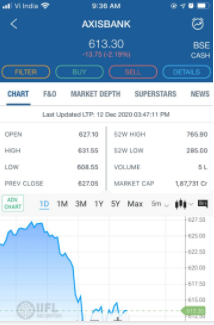

- Once you click on the stock, you can view complete details related to it, such as IIFL Charts, F&O, market depth, news, and research. Along with the same Filter, Buy, Sell, and Details will be shown on the top bar.

- Now click on the “Sell” button, and choose the desired category- Delivery or Intraday Trading.

- Next, enter the desired quantity, SL Price, SL Trigger Price, Disclosed Quantity, and Validity.

- After final confirmation, your Stop-Loss order will be placed.

- Further, you can also choose AMO or After Market Orders.

To understand the concept in a better way let’s take an example.

Let’s suppose you have a sell position at ₹100 per share and you want to place stop loss in IIFL app, then here you will place a buy SL order by entering the price and trigger price.

Since you are placing sell stop loss order, it get triggered first thus you have to keep the value of trigger price lower than the stop loss price.

Now let’s say that the range is ₹0.10 and you keep the trigger price equals to ₹115 and stop loss price 115.10.

If the price rises and reaches ₹115 the order gets triggeredand the buy order request is sent to the exchange. In the next very step, as the price reaches the value lower than 115.10 the order gets executed.

How to Place Stop Loss Buy Order in IIFL?

A major question that arises in your mind is “ how to place stop loss buy order in IIFLapp”. Well, the answer is pretty simple and easy.

A stop-loss buy order in IIFL or India Infoline can either be done as MIS( for Intraday Traders) or CNC (for Delivery Trading), depending on trader and investor requirement requirements.

Here’s how to place a Stop Loss buy order in the IIFL Markets App –

To place the stop loss buy order you have to follow the similar steps mentioned above.

The only difference is after selecting the trading segment, selecting scrip, and entering other details (SL Price, Trigger Price, Disclosed Quantity, Validity) click on the “BUY” button.

However, while buying or selling the stop-loss orders, the investor must specify the Buy Order type as “SL or Stop Loss” rather than Limit or Market.

Let’s take an example.

Here let’s consider that you buy a particular stock at ₹20 per share. To minimize the loss you place the stop loss at ₹18. Now, at the end of the trading hours, the stock price closes at ₹21 but overnight some kind of catastrophic news hit and the company’stock price drops to ₹10.

Since you had placed a stop loss order of ₹18, the order get executed at that particular price thus preventing you from facing loss. This is how stop loss order works.

IIFL Stop Loss Validity

The validity of the stop-loss order in IIFL app is of different types, which you can view in the validity section once you select the “Stop-Loss” category for a particular stock.

Types of Stop-Loss validity in IIFL:

- Day: A day is the validity of an order when the buying and selling of a stop-loss order occur on the same day; if not, then the securities expire automatically.

- Valid Till Date: Valid Till Date or VTD is the new facility offered by IIFL in its Trading platforms. Using this validity option, you can place buy and sell Limit orders in scrips of your choice, mentioning the period you want the order instruction to be effective. The duration selected by you should be within the maximum validity date defined by IIFL.

- Immediate or Cancel: Immediate or Cancel (IOC) orders are executed immediately or canceled automatically by the Indian Exchanges.

- Valid-till-cancelled: VTC is another type of stop-loss validity in IIFL. It refers to an order to buy or sell a stock at a fixed price that remains in effect until the visitor cancels the order or the trade is completed.

- EOS or End of Settlement: EOS is another validity process in which particular margin positions in a specific segment are recognized and squared off by India Infoline on a profitable basis. This only happens when the position is not squared off within the timeframe.

Closing Thoughts

IIFL offers a user-friendly trading platform to make efficient use of different order types. To trade by minimizing losses, it provides an option to stop loss.

Just pick the stock, enter details along with stop loss value to keep you prevented from the volatility of the market.

Hope this article offers you in-depth detail and helps you to trade by minimizing your losses.

Want to trade open a demat account for free. Fill the form below and a call back will be arranged for you in no time.

More on IIFL