How to Short Sell in Zerodha App

Check All Frequently Asked Questions

Having a trading account with Zerodha and want to earn profit in the bearish market condition, but don’t know how to short sell in Zerodha App?

Well! if you are looking for the steps to be followed to do short selling then here are the complete details. But before we start, here it is important to know that you can only do intraday trading to short-sell in the equity segment.

Let’s now check the steps of how to short sell in Zerodha app.

How to do Short Selling in Zerodha Kite?

For a newbie who wants to place any kind of trade using Zerodha Kite, the first and foremost thing is to open Zerodha demat account. Once you have an account you get Zerodha User Id and password that you can use to log in.

Post this, look for the stock for which you want to do short selling in Zerodha, and follow the steps below. But before that you have to maintain a minimum upfront margin and later non-upfront margin to avoid any Zerodha penalty charges.

- Add the stock or futures contract to your share market watch list by clicking on the + sign.

- Click on SELL.

- Add the volume of stocks you would like to sell in the “Quantity” section.

- Instead of choosing Cash and Carry (CNC), you need to choose Margin Intraday Square Off (MIS).

- Kite will give the estimated margin necessary to place the order at the bottom of the screen.

- Make certain that the required amount of money has been deposited into your account.

- When the window opens, click SELL instantly.

- That’s it.

In order to execute the order in equity cash in the first few minutes of the market hours you can choose to place pre market order in Zerodha which allows you to enter your order details between 9:00 AM-9:08 AM.

How to Check Sell Order in Zerodha?

Most of the time the order gets canceled due to certain reasons. In that case, you can check the status by following the steps below:

- To confirm if your “short sell” order has been successfully completed, visit the “Orders” tab.

- In that case, click “Positions” underneath the “Portfolio” tab.

- Here the sold share with all the details (executed or canceled) will be displayed.

How to Square Off Short Sell in Zerodha?

Since short selling is only allowed for intraday trading, hence it is important to square off your position before closing time.

For this you have to follow the steps below:

- When you’re prepared to exit your short sell position, scroll to ‘Portfolio’ and then ‘Positions.’

- Click on the firm’s name which you shorted.

- Then click “Exit.”

- Voila! Your first “short sell” trade is completed.

Try placing one order first in order to fully grasp what “short selling” involves. Sell whichever share you want first. Examine your profit or loss in “Positions” thereafter.

You will understand you are making losses if the price escalates. This is the complete opposite of buying first, as you will benefit if the price rises when you buy first.

Zerodha Short Selling Charges

As discussed above, short-selling trades are only executed by choosing the intraday order type hence brokerage is imposed as per Zerodha intraday charges.

For example, you short-sell 50 Reliance shares trading at ₹2000 each and later square off the trade at ₹1900 each. The turnover value of the trade is [(50*2000)+(50*1900)] ₹1,95,000.

As per the brokerage, you need to pay 0.03% or ₹20 whichever is lower.

Calculating the brokerage charges for the above trade:

0.03%*1,95,000=58.5

This is more than the maximum fee per trade i.e. ₹20 hence you end up paying only ₹40 for the above trade.

To save the impact cost of the trade, you can try Zerodha iceberg order where your order is divided into multiple legs. Also, there is no additional Zerodha iceberg order charges thus offering you the opportunity to maximize your profit.

Brokerage Calculator Zerodha Intraday

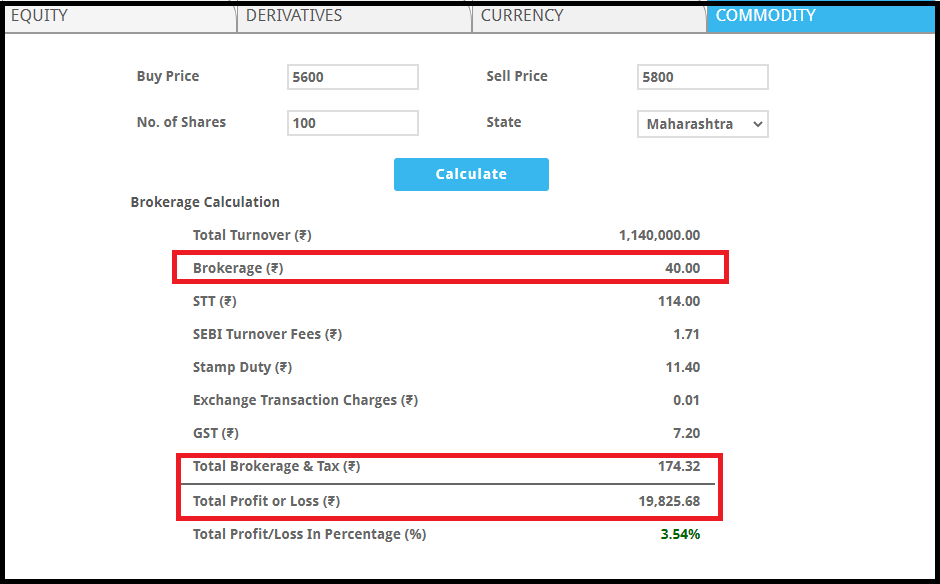

Short selling in Zerodha includes brokerage and other taxes. These taxes impact your overall profit and hence it is important to consider them while trading.

No doubt, you can easily find the details on these charges but when it comes to calculation, it is complex and sometimes difficult to understand.

To make it easier, you can check all the charges detail for intraday using the calculator. Here just by entering a few details like buy, sell price, and quantity the brokerage and other fees are displayed on the screen.

Conclusion

One of the greatest things about stock markets is that it doesn’t actually matter whether the stock market is moving up or down, as there is an opportunity to profit from either scenario.

When one has a positive perspective, buying a share is the best course of action, but there are also possibilities when one has a bearish view. The technique of short selling is one of them.

Want to maximize your return by investing in share market? If yes, then get in touch with us now and we will assist you in choosing the right stockbroker in opening a demat account online for FREE!

More on Zerodha