What Is Delivery In Angel Broking?

Check All Frequently Asked Questions

Are you an investor who is linked with Angel Broking? Did you want to know about- ‘What is delivery in Angel broking?’

But before moving to the main question, let’s get a brief background and information about Angel broking.

By looking at the active clients of Angel Broking around 10,68,666 has become the largest retail broking house in India. The services like Angel Broking margin funding, loans against shares, etc., are provided by them.

Before heading towards ‘What is delivery in Angel broking,’ it is essential to tell the people that Angel Broking is a firm that is technologically advanced and also provides its services online via mobile app or software.

We will be discussing what is delivery in Angel broking in the below sections:-

Delivery Trading In Angel Broking

To understand What is delivery in Angel broking, let’s discuss the delivery trading in Angel broking. We will address equity distribution in this segment.

The delivery trading is something in which the investor can hold the shares for as long as he wants, once it is delivered to him.

In this, the investor has the full right to sell the stocks whenever he wants after looking at the right profits. The profit is dependent upon the right delivery trading strategy for that it is better to know the Delivery trading rules and make the strategies accordingly.

In the angel broking equity delivery, the investor buys the share and holds it in their demat account for some time, know angel broking equity brokerage charges from angel broking brokerage calculator easily.

Brokerage For Delivery In Angel Broking

Now, one more section will deal with ‘What is delivery in Angel Broking?’. In this section of the document, we will discuss the brokerage for delivery in Angel Broking.

The following chart will show the delivery trading charges in Angel Broking:

The brokerage’s above table for delivery in Angel Broking shows that the Classic plan of equity delivery charges 0.40%.

In contrast, the preferred plan charges 0.280%, the premier plan charges 0.220%, and the elite plan charges 0.160% brokerage.

So here is the table that shows the Angel Broking charges:

How To Buy Delivery In Angel Broking

Apart from ‘What is delivery in Angel broking,’ now let us understand ‘How to buy delivery in Angel Broking?’

The question is, ‘How to buy delivery in Angel Broking?’. An investor can invest in the delivery through the online process. Here is the procedure mentioned below:

- Download Angel Broking App from the Google play store

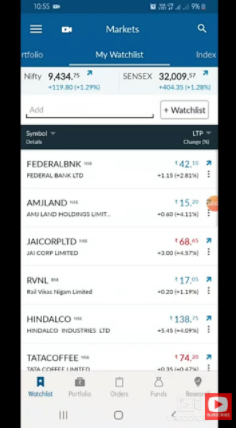

- Open the Angel Broking app

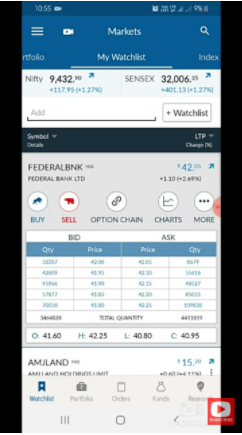

- Choose the stock to be invested in

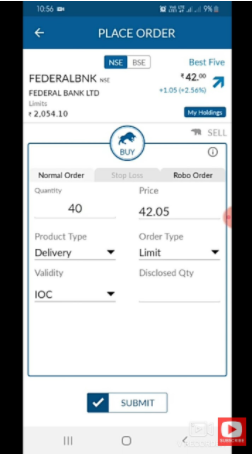

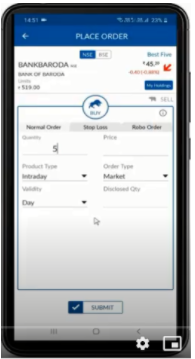

- Now click on buy, and you will get various options to fill, such as the quantity, price, product type, trading order type, validity

- Select ‘Delivery’ as a product type, select IOC on validity, set the price and quantity, and then click on submit.

Hence, in this way, you can buy the delivery in Angel Broking.

Convert Intraday To Delivery In Angel Broking

To understand ‘What is delivery in Angel broking,’ learning Intraday’s conversion to delivery is also essential.

In this section, we will discuss converting Intraday to Delivery in Angel Broking. For that, here are a few points.

Let’s start:

- The Angel Broking software allows you to log in

- Choose the stock you want to buy.

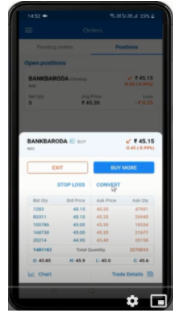

- Click on the stock to convert Intraday trading to Angel Broking delivery trading.

- After clicking the stock, the two options will appear on the screen, i.e., Stop-loss or Convert. Now, click on ‘Convert.’

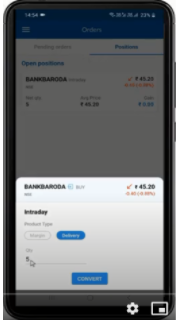

- Here, you will get two options- Margin or Delivery. Select ‘Delivery’ and then click on ‘Convert.’

- Finally, your conversion will be successfully converted from Intraday to delivery.

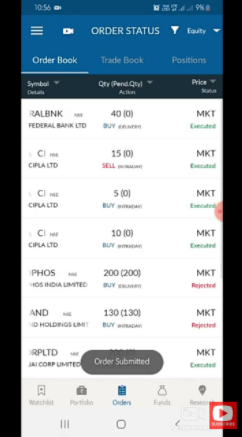

In simple words, to convert intraday to delivery in Angel Broking, you can visit the Trade Book in the app, which is under the Order status tab.

After clicking the stock or trade, you can click on ‘Convert Product type’ and select Delivery from the option.

For More details on margin, read Margin for Delivery Trading in detail.

Leverage For Delivery In Angel Broking

In this section, one more concept for What is delivery in Angel Broking will be covered.

Let’s start!

In the ‘Brokerage for delivery in Angel Broking’ section, it was mentioned that the brokerage charges are zero for the delivery trading.

To learn more about it, first, let’s understand the meaning of LEVERAGE. Leverage is the tradition to use borrowed capital to make an attempt to maximize its future returns.

Angel Broking offers the Exposure/Leverage on delivery up to three times (3x).

Leverage is the tradition to use borrowed capital to make an attempt to maximize its future returns.

Conclusion

As a member of BSE, NSE, MSEI, NCDEX, MCX, and registered Depository Participant with CDSL, Angel Broking has the responsibilities to cope up with, and it is doing a great job in maintaining it.

The question “What is delivery in Angel Broking?” is discussed in this document under different sections.

In delivery trading, you can keep the shares if the market is low and then sell them when rates are suitable because there is no time involved.

Angel Broking offers up to three times (3 times) exposure/leverage on delivery.

Angel Broking offers the brokerage plans charges as well as non-brokerage charges to its clients.

If you want to trade in delivery trading, Angel Broking is the firm that can be a reliable company for you.

Wish to open a Demat Account? Please refer to the form below

Know more about Angel Broking