What is Order Complexity in Upstox?

More on Upstox

Wondering what is order complexity in Upstox?

Well before getting into it here is a brief about the order complexity!

Order complexity is a term for special trade orders that involve one or more legs and intend to minimize losses and ensure profits. Such orders include bracket orders or OCO (One Cancels the Other), cover orders and After Market Orders. Order complexity in Upstox is a selection tool to determine the type of order you wish to place.

The Upstox trading platform offers four options under “order complexity” while placing an order. Let’s know all of them in detail. Dive in!

Order Complexity In Upstox

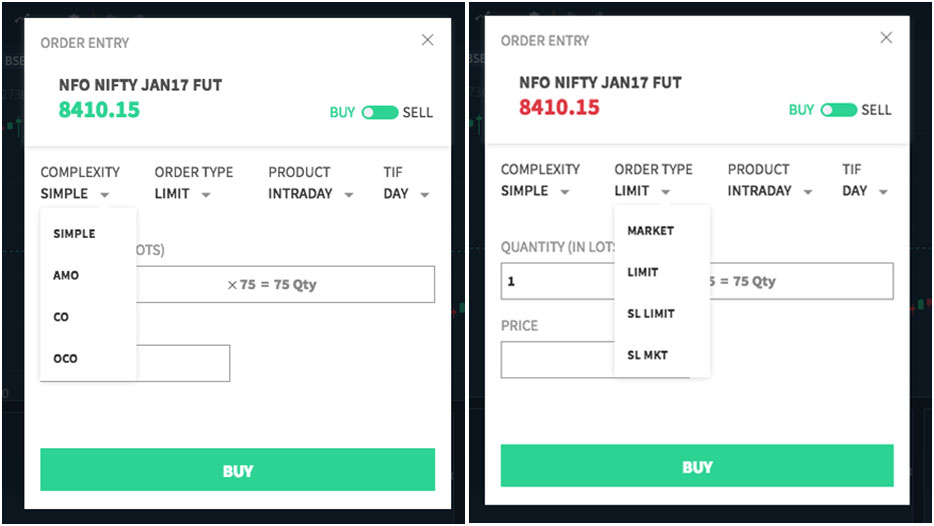

As already mentioned, Upstox provides four order complexity option while placing an order. These are – SIMPLE, AMO, CO, and OCO.

Here, AMO stands for “After Market Order”, “CO for Cover Order” and OCO for “One Cancels the Other order”.

AMO is a special order that can be placed before and after the market hours i.e. before the market opens – between 4 am and 9 am & after the market closes – between 6:30 pm and 12 am. It is best suited for those who are busy during the market hours and still wish to trade.

A cover order another special intraday order that includes 2 legs. The first leg is a normal “buy” or “sell” order while the second one is a square off order. You define the maximum probable loss you can bear in order to earn high margins.

Bracket order or OCO order in Upstox is also an intraday order in which 3 subsequent orders are placed in a single order. This first one is the initial positioning “buy” or “sell” order while the second and third are the stop-loss and square off orders respectively.

For these special orders, you need to either set a Upstox trigger price/stop-loss price or the upstox square-off/take profit amount. You may also choose on installment price for trailing stop-loss.

Upstox also has the provision to modify these orders. Simply visit the order book and right-click on the order to modify it. You can exit a particular order as well by using the same procedure. However, an exit order is executed on the current market price.

Upstox Order Complexity Types

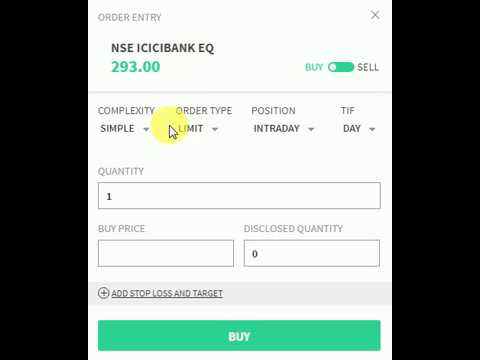

To place an order on Upstox, you must first log in to the Upstox pro web or the mobile app. When you click on “Complexity”, a drop-down menu appears showing the following options – simple, AMO, CO, and OCO.

Do not confuse “Complexity” with the order type.

Select the complexity as “SIMPLE” while placing orders during the market timings. In this, the “buy” and “sell” price depend on the range in which the stock’s price has moved (in that particular session/time).

“AMO” is set as the complexity when the order is placed before or after the market hours. However, the price range in such orders is limited to the upper and lower band price of a particular stock.

“CO” and “OCO” are set as the complexity when you wish to set a stop-loss trigger price and a take-profit price for an order. Not only do they minimize the probable losses but also offer higher chances of profit.

Conclusion

Upstox trading is a versatile platform in terms of the order types offered. It also offers to trade in certain complex types of orders which have already been discussed above.

Hope this article on “Order complexity in Upstox” made things clear for you. Happy investing!

If you wish to open the Demat Account

More on Upstox