Bansal Finstock

List of Stock Brokers Reviews:

Bansal Finstock Private Limited was incorporated in 2009 to carry out the financial businesses of Bansal Group. The full-service stockbroker is a member of BSE, NSE, MCX, NCDEX and MCX-SX and is also registered with SEBI as a broker for broking services.

Bansal Finstock Review

This stockbroker is also registered as a depository participant with CDSL.

Bansal Finstock provides services for trading in cash and derivative segments of equity, currency and commodities. The other products of the company include insurance, mutual funds, loans, IPOs, NRI services, deposits and bonds.

Bansal Finstock Active Clients

Bansal Finstock reported 10,000 active clients as of 2020-21. The clients include retail, individual and corporate clients, including non-resident Indians and high net-worth individuals.

Looking at the active client numbers, Bansal Finstock falls under one of the smaller stockbrokers in India.

Also Read: Top Stockbrokers with Active Clients

Bansal Finstock Products & Services

The primary service of Bansal Finstock is to provide broking service to the investors in the equity and derivatives segment. The company helps its clients to harvest money using its smart and efficient advisory services. It provides all the investment base services under one roof. It is a member of all the major stock exchanges of the country.

Along with the equity and derivatives segment, Bansal Finstock also provides trading services in currency and commodity. Another important service is the one as a depository agent. It is registered with CDSL.

The depository services include Demat services which provide a simple and paperless way to the clients to keep a track of their investments.

The demat services include dematerialisation of shares, rematerialisation of shares, pledging of shares, electronic custodial services, maintenance of beneficial holdings, and electronic credit against corporate holdings.

This stockbroker is known for its specific services to the non-resident Indians. They help the NRIs to maintain a strong financial asset base in India and keep them linked to their country, with personalised services.

Other products of Bansal Finstock include IPO, life and non-life insurance products and mutual funds. Their insurance products are tailor-made for different segments of clients and the network is spread across the entire country.

Bansal Finstock Trading Platforms

The full-service stockbroker offers a range of trading applications across terminal, web and mobile platforms. Although the overall performance is around average with a reasonable room of improvement, however, the trading platforms can be used as per your convenience and preference.

Here are the details:

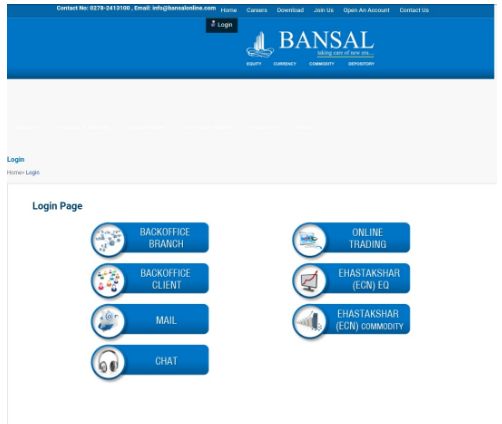

Web-based Platform

The web-based platform of Bansal Finstock is provided by net.Net and is called BANSAL Net. Net. It is a comprehensive platform that facilitates the clients to execute their buy and sell orders, in both equity and debt securities, in a seamless and fast manner, on the exchange of their choice.

The platform also allows trading in Futures & Options on NSE.

Desktop Trading Software

The desktop trading platform of Bansal Finstock is BANSAL Nest. The platform is embedded with many technical indicators and charts and gives a comprehensive perspective on the shares.

The application also helps to look at the market statistics of the stocks, compare and analyse them. The orders can be placed, closed and cancelled, and the investor can also view the total cash margin limits along with the margins utilised. The users can create market watch groups, and view their open, traded, rejected orders.

The system is also capable of generating order reports, trade reports, back office and DP reports.

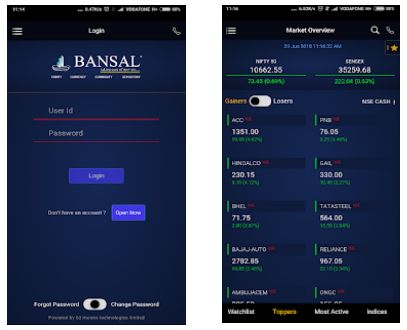

Mobile Application

The mobile application of Bansal Finstock is called Bansal Wave. It is fairly new in the market. The application facilitates the investors in buying, selling and checking various reports at their fingertips.

The mobile application is purely next-generation with advanced features like live market data from the exchanges, various reports for the trading account, chart view for better judgement of the scrips, and speedy and hassle-free trading experience.

Apart from the above-mentioned applications, Bansal Finstock also provides terminal softwares such as ODIN Diet. It is suggested that you get all the pricing details from the executive of the broker before opening your account since some stockbrokers levy software usage charges as well when they provide third-party applications like ODIN or Now.

Bansal Finstock Customer Care

Bansal Finstock provides okayish customer care services through its experienced and skilled team. The clients can get in touch with the company regarding their grievances through the following communication channels:

- Phone

- Web-form

In this day and age of competitive business, the number of communication channels is definitely limited. Not only that, the overall quality of customer support for the stockbroker is around average and has a certain room for improvement.

Bansal Finstock Charges

Here are the pricing details at a generic level the stockbroker charges to its clients:

- The company charges Rs 100 as document charges for opening a Demat account with them.

- The account maintenance charges can either be Rs 300 per year or Rs 999 as a one-time payment for life.

- The dematerialisation charges are Rs 5 per certificate and the rematerialisation charges are Rs 10 per certificate.

- The transaction charges are Rs 15 per transaction within Bansal and Rs 25 per transaction from Bansal to another depository participant.

- The company also has same-day execution charges of Rs 25 per transaction and freeze or de-freeze charges of Rs 25 per transaction.

Bansal Finstock Brokerage

When it comes to brokerage, remember it is one of the most important payments since they will be recurring in nature as long as you trade in the stock market.

In case of this full-service stockbroker, the brokerage charges are as follows:

- The brokerage charged by this full-service stockbroker is 0.03% for intraday trading and 0.3% for delivery trading.

- In derivatives, the broker charges (depending on your deposit and trading turnover) in the range of INR 60 to INR 200 per lot.

Check this Bansal Finstock Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

Bansal Finstock Margin

Here are the details on the limits you get across different trading segments:

- Bansal Finstock offers 10 times margin on intraday trading and 3 times on delivery trading.

- The exposure or leverage provided improves with the clients’ usage and credibility.

Bansal Finstock Advantages

Here are some of the top advantages of using the services of Bansal Finstock as a stockbroker:

- The pricing structure of the company is quite competitive.

- The company is quite innovative in its approach and provides appropriate business solutions to the new-age investors.

- The technology is seamless, smooth and secure.

- The company has customised services for the non-resident Indians to help them maintain a financial base in India.

Bansal Finstock Disadvantages

At the same time, here are some of the concerns you must be aware of if you decide to open your account with Bansal Finstock:

- The customer care services of the company are not comprehensive and quite efficient.

- The company has quite a limited number of branches across the country.

- Bansal Finstock’s mobile application is fairly new and has certain user-interface issues. Charting also needs improvement as there is lack of clarity and issues in terms of inputting indicators and studies.

Bansal Finstock Membership Information

Here is a quick look at the membership information of Bansal Finstock with different regulatory bodies of India:

| Entity | Membership ID |

| BSE | INF011377133 |

| NSE | INE231377137 |

| MCX-SX | INF261377130 |

| FMC | MCX/TCM/CORP/0155 |

| MCX | INZ000056334 |

| NCDEX | TCM/CORP/0969 |

| Registered Address | Plot No:2137 A, Near Golden Arc, Atabhai chowk, Bhavnagar - 364 002 |

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps:

Bansal Finstock Branches

Bansal Finstock has its branches in Ahmedabad, Bhavnagar, Jamnagar, Rajkot and Mumbai. The company also has its franchises in New Delhi, Veraval, Bangalore, Thodupuzha and Chennai.