ZenMoney

List of Stock Brokers Reviews:

ZenMoney Securities Limited or ZSL is one of the leading financial services company. It was incorporated in 1995 and is the first corporate member from Hyderabad, and the first Andhra Pradesh based brooking firm to start trading on NSE.

ZenMoney Review

ZenMoney is registered for trading in the cash market and futures & options on NSE and BSE, and for trading in commodities on MCX and NCDEX. The company is also registered for depository services in both NSDL and CDSL.

The broker is known for providing long-term, value-based investment advice to the customers for them to make money.

The other services include mutual funds advisory services, portfolio management services, NRI investor services, fixed income securities, fixed deposits, RBI bonds, and tax saving bonds.

Some of the top investment products you may choose to put your funds into are:

- Equity Trading

- Mutual Fund Investments

- NRI Demat Account

- Derivatives Trading

- Commodity Trading

- Currency Trading

- IPOs

- Insurance

- Real Estate

Thus, it can be observed that the broker provides a wide range of investment products to choose from.

ZenMoney Active Clients

As of 2020-21, ZenMoney reported 16,823 active clients. The client composition consists of retail investors, high net-worth individuals, and corporate clients.

This number puts the stockbroker among some of the smallest stockbrokers in the country.

For More: Top Stockbrokers in India with Highest Active Clients

ZenMoney Trading Platforms

Like any other stockbroker, this full-service stockbroker provides multiple trading applications for its clients. Here are the details you can refer to:

Zen Tr@de- Internet Trading Platform

The internet trading platform of ZenMoney, Zen Tr@de, is simple, reliable and easy to use. It is an integrated Dealer Terminal and internet trading platform, with the option to trade in a branch or on the internet or both.

It provides fast execution and fast price updates.

The platform is integrated with the Zen DP account for seamless settlement and provides the choice of Browser-based or EXE based trading.

The trading platform provides streaming market quotes, multiple market watch, and access to trade in NSE/BSE and NSE FAO segments.

There are different limits for intraday and delivery trading. The clients can access their statements on the platform. The statements include stock statements, cash statements, mutual funds and net worth statements.

The platform also has integrated payment gateways which facilitate the online transfer of funds from the banks for instant limits.

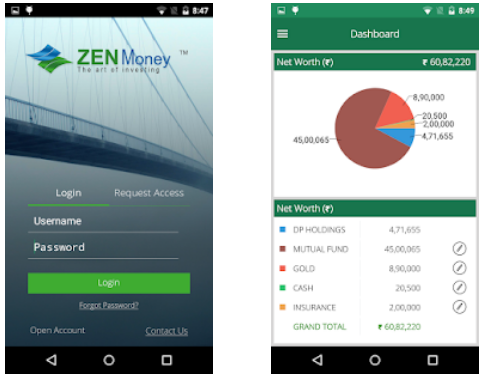

ZEN Money- Mobile Application

ZEN Money is designed to make the transactions simpler and user-friendly for the clients of ZenMoney. The clients can view their stock holdings, mutual funds, gold, cash & insurance details, all in one app.

The app can be used to verify the stock transactions details anywhere, anytime. The general overview includes ledger, holdings, and transactions, along with the net worth of graphical representation and the credit/debit amount of each stock.

ZEN Money also helps to verify the NSDL/CDSL details & balance amount holdings and transactions.

Here is a quick glimpse of some of the features provided by Zen Money:

- Investing in different financial segments

- Ledger details

- Charts for technical and fundamental analysis

Some of the concerns, at the same time, you should know about the Zen Money mobile app are:

- Limited App Update Frequency Cycle

- Basic User Interface

Also, you can check some of the stats from the Google Play Store:

ZenMoney Products & Services

ZenMoney provides stockbroking services to the investors in the capital market segment of NSE and BSE and futures & options segment of NSE and BSE.

Internet trading is also provided through trading platforms. Commodity trading services are also provided at MCX and NCDEX. ZenMoney also supports currency trading.

The other significant services of ZenMoney include mutual funds investment with updates every day and facility to view account information anytime. The depository services of ZenMoney provide flexible and cost-effective means for trading and settlement of dematerialised shares.

The broker also provides IPO services.

ZenMoney further provides a total solution to the NRI clients by helping them to buy and sell shares through the Indian stock exchanges.

The broker also excels at portfolio management services for its clients. The portfolio management services are backed by extensive research.

The other products of ZenMoney include capital gain bonds, infrastructure bonds, corporate fixed deposits, a new pension system, insurance and real estate.

ZenMoney Research

ZenMoney has an experienced team of research staff. The research and the advisory team does in-depth analysis and provides the clients with the updates, tips and reports which help them manage their investments in a better way.

The reports include:

- Daily and Weekly Market Reports,

- Daily and Weekly Derivatives Reports,

- Daily and Weekly Mutual funds reports,

- Weekly commodities Reports,

- Bulk & Block deals,

- Insider trading,

- Pledge Share Reports,

- Company Reports,

- Industry Reports,

- AGM reports,

- IPO reports,

- Budget/monetary policies,

- Weekly, Monthly and Special recommendation lists,

- Delivery calls and

- Investment and trading ideas.

As far as the quality of the ZenMoney research is concerned, the broker does a reasonable job in its long-term investment reports across segments.

However, when it comes to intraday tips or short-terms reports, it is advised you to perform a quick check before putting your money in a trade.

ZenMoney Customer Care

The customer care services of ZenMoney are excellent. The clients can contact the company through emails and telephone, or at the branches.

There are dedicated emails and phone numbers for help desk, internet trading, DP services, mutual funds, portfolio management services and research.

There are specialised services for the non-resident Indians and dedicated relationship managers.

Having said that, from a competitive perspective, ZenMoney does around an average job in providing assistance to their clients.

ZenMoney Pricing

Before choosing a stockbroker for your trades, you would definitely want to have a quick check at the pricing part. Here are the account-related charges levied by ZenMoney:

- There is no account opening fee for the trading account.

- For the demat account, the opening fee is ₹500, with annual maintenance charges of ₹300 per year.

- DP transaction charges are ₹50 per transaction.

ZenMoney Brokerage

Furthermore, here are the brokerage charges levied across different trading segments:

- The brokerage is 0.05% for intraday and 0.5% for delivery trading.

- The brokerage for equity futures is 0.04% and ₹70 per lot for equity options.

- The brokerage for currency futures is 0.04% and ₹50 per lot for currency options.

- The brokerage charges for commodity trading are 0.03% of the turnover.

Here is a quick summary of these charges:

Looking at the brokerage rates, ZenMoney seems to be one of the expensive stockbrokers in the country. It is certainly adviced that you negotiate with the broker executive before actually opening your account with this broker.

Generally, the brokerage can be lowered to a much better number if your initial deposit is high or your trading turnover is upscale.

You can use this Zenmoney Brokerage Calculator to know about the complete charges levied to the clients of the broker.

ZenMoney Margin

This broker provides reasonable exposure values across the segments as mentioned below:

- The margin for intraday trading is up to 10 times and for delivery trading is up to 3 times.

- The leverage for futures is up to 3 times.

Here is a quick summary:

ZenMoney Advantages

Some of the benefits of using the services are:

- The research division is highly skilled, with a very good hit ratio.

- The technology is advanced and the trading platform is an integration of Dealing Terminal and internet trading terminal.

ZenMoney Disadvantages

At the same time, you must be aware of some of the concerns about this stockbroker:

- The location and services are restricted to certain states of India only.

- The brokerage charges are high compared to the competitors.

ZenMoney Membership Information

Also, make a quick check on the membership information of ZenMoney with different regulatory bodies of the stockbroking space in India:

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps forward:

ZenMoney Branches

The broker has its head office in Hyderabad and has over 70 branches and associates in Andhra Pradesh, Tamil Nadu, Maharashtra, Karnataka, West Bengal and Orissa.

It operates from over 140 locations, with about 500 terminals. The company has 46 VSAT installations in Andhra Pradesh and one in Tamil Nadu, with over 10 MCX and NCDEX terminals catering to its investors.

More on ZenMoney

If you wish to learn more about ZenMoney, here are a few reference articles for you: