FundsIndia

List of Stock Brokers Reviews:

FundsIndia is one of its own kind of online investment platform in India where users can invest and trade across multiple segments completely online. Based out of Chennai, FundsIndia was established in 2009 and has been able to gain user traction in the last few years.

The platform provides a Robo advisory service titled Money Mitr to its clients that provide automated and personalized recommendations to users based on their requirements and risk appetite.

FundsIndia Review

FundsIndia, apart from its office in Chennai, has a presence across Chennai, Mumbai, Delhi, Bengaluru, Pune and Kolkata.

FundsIndia Demat Account

It is one of the very few investment houses that offer free brokerage (up to a total turnover of ₹1 Lakh) and provides financial advice at the same time. FundsIndia is registered with SEBI and ARN & allows you to trade and invest in the following financial products:

- Equity

- Mutual funds

- Fixed Deposits

- Super savings account

- SIP with Insurance

- IPO

- NCDs

Having said that, the investment house has a larger inclination towards mutual funds investments as compared to other financial classes. This can be validated based on the foundation it started with and the kinds of technology-based innovations and partnerships it has done in the recent past.

C.R. Chandrasekar, co-founder & CEO

FundsIndia Trading Platforms

Although the investment firm has a limited range of trading platforms, still is able to deliver reasonable quality through this softwares. You need to understand that yes, there are much better and mature trading platforms in the stockbroking space in India but still the ones offered by FundsIndia offer a decent experience.

Let’s talk about these applications one by one:

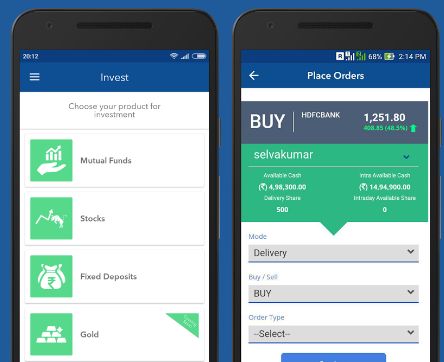

FundsIndia App

This mobile app from this investment firm has been able to gain user confidence in quick time, especially because of its regular update frequency cycle. Some of the top features of this mobile app include:

- Investment across mutual fund SIPs and equity allowed through the mobile app

- Robo-advisory feature available, something like ARQ provided by Angel Broking

- Basic features such as Market watch list, alerts and notifications etc added

- Investment news and recommendations available within the app

At the same time, here are some of the concerns related to the mobile app:

- Asset allocation and funds segregation not cleanly displayed

- Concerns observed in the filtering section, funds do not get displayed

Here are some of the stats about this mobile app from Google Play Store:

| Number of Installs | 100,000 - 500,000 |

| Mobile App Size | 13.73 MB |

| Negative Ratings Percentage | 14% |

| Overall Review |  |

| Update Frequency | 3-4 weeks |

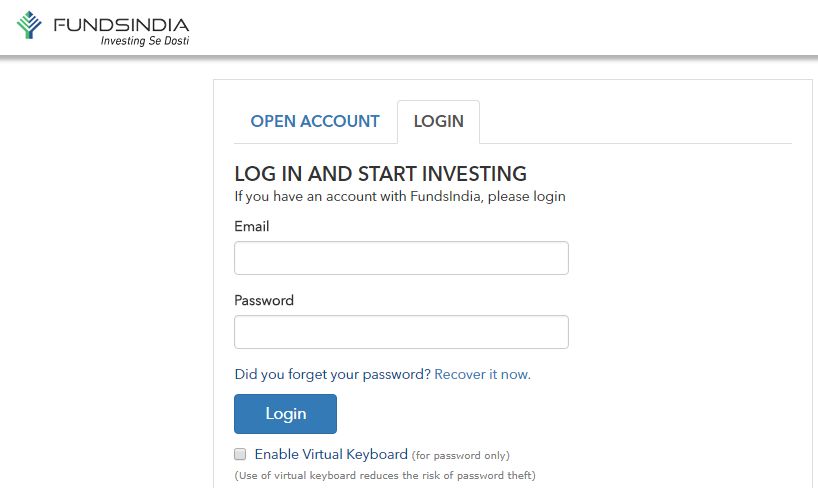

FundsIndia Web

The investment platform, FundsIndia, also has web-based browsing investing software. This does not require any download or install and you are just required to browser the login page, put in your credentials and you can start managing your investments from there itself.

And of course, you can perform commodity as well as currency trading apart from the equity investment using this app.

This is how the login screen of this web application looks like:

This web application offers limited features, is lightweight in nature and can be used across devices due to its responsiveness.

FundsIndia Research

Although FundsIndia charges reasonable prices, it still provides research and recommendations across different financial products, especially for mutual funds and long-term equity investment types.

The investment platform has a small but capable in-house research team that published weekly reports on a regular basis. These reports give a complete round-up of the financial domains along with detailed fundamental analysis.

Here are some quick points on the research methodology carried out by this investment firm:

- Advisors keep track of the economy’s momentum and the performance of mutual funds on a generic basis

- The Mutual Fund Research Desk reviews the portfolio periodically to ensure that the portfolio delivers at a consistent level, especially in line with the Indian economic growth

- At the same time, if there are any concerns or any corrective action that needs to be taken, the Research Desk triggers an email to users in which they suggest rebalances as well.

However, FundsIndia does not provide any quick gain tips or recommendations or any technical analysis for that matter. Thus, if you are looking to perform trading at an intraday level, then you are more or less on your own when it comes to taking calls on your buys and sells.

FundsIndia Customer Care

When it comes to Service, it is one of the most crucial aspects, especially for users that track their investments on a regular basis and are open to switch and move their investments.

FundsIndia provides the following communication channels to their clients for support:

- Webchat

- Indian phone support

- NRI phone support

- Skype

The number of communication channels is pretty diverse in their range and customer has most of the online channels to reach back to this investment platform. However, if you are looking for local help or assistance through a branch or sub-broker office, you will be disappointed as there is no physical presence apart from the corporate offices.

Nonetheless, users relying on the above-listed communication channels get reasonable support and service. The only feedback that FundsIndia can certainly work on their turnaround time.

FundsIndia Charges

This investment firm has kept its pricing in such a way that it comes out pretty suitable for small investors. This can be understood by the fact that the investment platform does not charge any brokerage for any equity turnover below ₹1 Lakh.

As far as other charges are concerned, here are the details:

FundsIndia Account Opening Charges

To open an account with FundsIndia, you are not required to pay anything. Furthermore, AMC (Annual maintenance charges) for your trading account are levied, but these charges are applicable from the second year only.

Here is the information:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹200 (applicable from 2nd year) |

| Demat Account Annual Maintenance Charges | ₹0 |

FundsIndia Brokerage

When it comes to brokerage rates, FundsIndia acts like a conventional discount stock broker and charges a flat rate as brokerage across the financial segments (Equity, Derivatives) it supports.

At the same time, investing in mutual funds is completely free.

You can use this FundsIndia Brokerage Calculator for more information.

Here are the details:

| Equity Delivery | ₹20 per executed order |

| Equity Intraday | ₹20 per executed order |

| Equity Futures | ₹20 per executed order |

| Equity Options | ₹20 per executed order |

FundsIndia Transaction Charges

Here are some other charges that you need to consider unless you want to get surprised later in your trades:

| Transaction Charges | 0.0035% |

| Stamp Duty | 0.01% of trade value |

| Securities Transaction Tax (STT) | 0.1% |

| Call and Trade | ₹20 |

| Demat Statement Charges | ₹25 (first 2 statements are free) |

FundsIndia Margin

The broker offers limited exposure or leverage multipliers, although the interest rate is as low as 12% (one of the lowest numbers in the industry) as 5-day margins.

Here are the details:

| Equity Delivery | Upto 5 times |

| Equity Intraday | Upto 5 times |

| Equity Futures/Options | No Leverage |

FundsIndia Disadvantages

Here are some of the concerns about using the services of FundsIndia:

- No support in currency or commodity segments.

- Research not available for intraday traders

- Turnaround time of customer support can be improved

- Low exposure values offered

- Limited range of investment platforms

FundsIndia Advantages

At the same time, here are some of the positives of using FundsIndia as your investment platform:

- Free account opening

- Mutual funds investment is absolutely free for users

- Low brokerage charges

- Research at a fundamental level along with assistance on mutual funds is availed to users on a regular basis

- Robo advisory is provided as part of the research, cutting out any potential human errors in judgments

- Allows you to place a Limit order, market order and stop-loss orders

FundsIndia Membership Information

Here are the details of different licenses obtained by FundsIndia from various regulatory bodies:

| Entity | Membership ID |

| SEBI | INB011468932 |

| ARN | 69583 |

| Registered Address | Wealth India Financial Services Pvt. Ltd., 3rd Floor, Uttam Building, No. 38 and 39, Whites Road, Royapettah Chennai - 600014, Tamil Nadu |

Looking to open a demat and/or trading account?

Just enter your details here to get a call back:

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

More on FundsIndia:

If you are looking to learn more about this broker, here are a few reference links for you: