Goodwill Commodities

List of Stock Brokers Reviews:

Goodwill Commodities is a full-service stockbroker, known for expertise in commodities trading and investment. This Chennai based full-service stockbroker was established in the year 2008.

Are you looking to open a trading account with them? Why don’t you check the different services it has to offer, the quality of different propositions and then decide whether this broker is the right fit for your investment needs?

Let’s get started!

Goodwill Commodities Review

As of now, Goodwill Commodities has a presence in around 27 locations through its sub-broker and franchise offices in India. If you are someone who is looking to be a business partner, here is a detailed review of the Goodwill Commodities partner program. Apart from that, the broker has an in-house research team that works with the clients on a regular basis.

Furthermore, the broker has a partnership with 24 banks to which you can perform any fund transfers as per your preferences.

“Goodwill Commodities has an active client base of around 16,542 for the year 2020.”

Using the services of this full-service stockbroker, you can trade and invest in the following segments:

For mutual funds specifically, Goodwill commodities has recently set up a separate business portal named ‘MutualFundsKaro.com’. This niche product can specifically help in your building your mutual funds’ investments and portfolio.

Goodwill Commodities Trading Platforms

The broker provides multiple trading platforms across devices, such as:

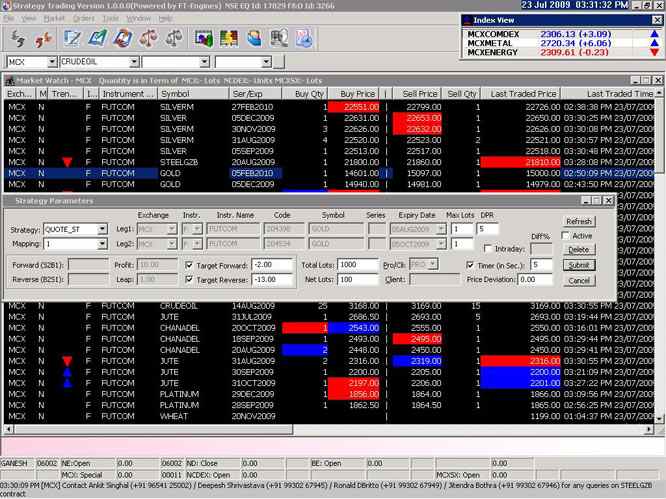

ODIN Diet

This is an outsourced 3rd party software provided to the clients of Goodwill. This is a pretty mature terminal based trading application with multiple features and reasonable performance. Here are some of the features of this application:

- Allows users to develop and run multiple strategies for their technical and fundamental level trades.

- This trading application is pretty exhaustive in terms of a number of features, especially for analysis.

- Built-in features and intelligence that allows clients to look for market opportunities.

The only concern with the usage of out-sourced trading applications such as ODIN Diet is that the control of the addition of new features or facilitating of fixing bugs or issues raised by clients through comments and feedback do not get incorporated quickly.

The whole process is a tad complicated and involves multiple parties before it finally happens if it happens.

This is how the ODIN Diet dashboard looks like:

Generally, trading platforms such as ODIN Diet are free to use, but few broking houses do charge for the usage. However, in this case, usage of this trading platform is free and there are no charges levied at any level by the broker.

Nest

NEST is a terminal-based trading platform developed by Omnesys technologies. Not only Goodwill commodities, a lot of stockbrokers completely rely on the solution for their clients and don’t really focus on developing their own in-house trading application.

They just subscribe to its license and start availing this application to their clients. As far as Nest Trader is concerned, the following features are provided to the users:

- Provision to add multiple Market watch lists.

- Users can add different market watchlists to groups to keep the whole monitoring process segregated.

- With Snap Quote feature, the user can check out the current situation of a particular scrip.

- With the “Ticker” feature, the user can add specific scrips and whenever there is any trade in the added scrips, the trade details (trade price and quantity) are displayed on top of the terminal in the ticker space.

- With the “Combined Market Depth” feature, the user can see the top 10 bid and ask along with the quantity and price of the stocks.

- Charting functionality for technical and fundamental analysis with different types of charts available.

This is how the application looks like:

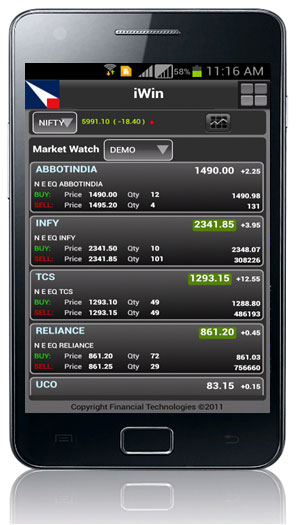

iWin

Another outsourced trading platform, iWin is a mobile app for trading provided by Goodwill to its clients. This application is designed, developed and maintained by the house of FinTech or Financial Technologies.

It is an “okayish” mobile app with some decent features for trading.

The app, however, has a lot to improve as far as user experience is concerned. Some of the features of the mobile app are:

- Unlimited Market Watch Option

- Charting for technical analysis

- Multiple order type placement

This is how the app looks like:

These are some of the stats around the mobile app from Google Play Store:

| Number of Installs | 5,000 - 10,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 21% |

| Overall Review |  |

Goodwill Web Trading App

The web-based trading application provided by Goodwill commodities is a lightweight trading application and does not require any download or install. To access this, you can go to the website of this full-service stockbroker, click on ‘Login to Trade’, put in your credentials and start trading.

The only concern while using this application is that unlike other web trading apps, Goodwill web trading app is not responsive in nature.

In other words, you cannot access it using a mobile or a tablet device. This can only be accessed through a desktop, computer or a laptop.

Here is the login screen for the web application:

Apart from these discussed apps, the broker also provides a mobile app named Goodwill Commodities Trading app – GAMA and GIGA.

Goodwill Commodities Customer Care

The broker provides the following channels of communications to its clients:

- Phone support

- Chat

- Email support

- Webform

The number of communication channels is limited to the broker but the quality of service is reasonable. Be it knowledge of the executive support or resolution quality, the broker does a decent job. However, you might face issues in a couple of ways.

Firstly, there might be language-level issues and if you conversing in a regional language (or even in Hindi at times), the communication might not be clear. Secondly, the time taken to resolve your query or concern does not really have any SLA attached to it.

The turnaround time is one thing that needs immediate attention from the broker and a specific procedure to adhere to timelines must be set up.

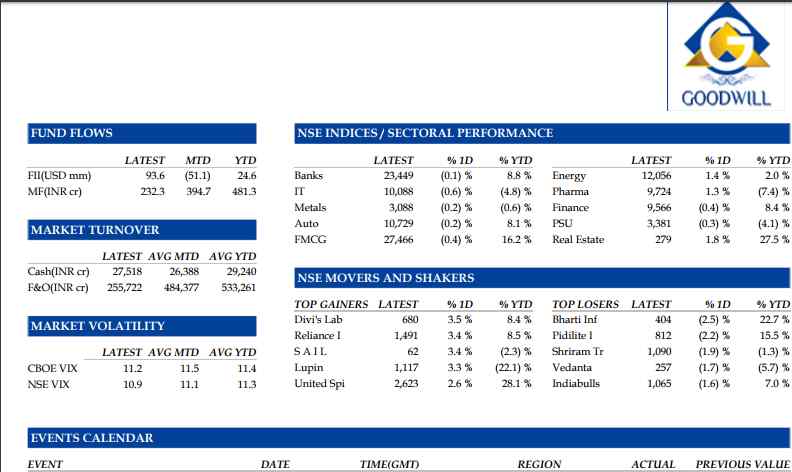

Goodwill Commodities Research

When it comes to research, Goodwill commodities, as the name suggests is one of the experts as fat as commodity segment is concerned. When it comes to other trading products, the full-service broker provides just average quality of accuracy in its tips and recommendations.

Goodwill commodities provide research in the following trading and investment products to its clients:

- Daily Report

- Equity daily

- Commodity daily

- Currency daily

- Fortnightly Report

- Equity Fortnightly

- Commodity Fortnightly

- Monthly Report

- Equity monthly

- Commodity monthly

- Currency monthly

This is how one of the reports provided by Goodwill looks like:

Compared to other full-service stockbrokers, the research products and reports provided by Goodwill commodities are pretty limited in nature.

Thus, if you are looking for research at an exhaustive level with much finer details and attention, it’s better to check out other full-service stockbrokers. You can also refer to this detailed article on Top Research Stock Broking Houses in India.

Goodwill Commodities Pricing

Although Goodwill is a full-service stockbroker, it charges pretty reasonable costs across different facets. Here are the details:

Goodwill Commodities Account Opening Charges

Here are the details on account opening from the broker:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹0 |

Goodwill Commodities Brokerage

You will be required to pay the following charges across different segments:

| Equity Delivery | 0.3% |

| Equity Intraday | 0.01% |

| Equity Futures | ₹30 per lot |

| Equity Options | ₹50 per lot |

| Currency Futures | ₹30 per lot |

| Currency Options | ₹50 per lot |

| Commodity | ₹50 per lot |

Use this Goodwill Commodities Brokerage Calculator for complete charges and your profit.

Goodwill Commodities Transaction Charges

At transaction charges level though, you are required to be circumspect of the fact that the broker charges relatively higher charges. Thus, as a user, you should negotiate with the broker on these payments too.

Once finalized, make sure to get all values documented and emailed from an official account to avoid any future altercations.

Here are the details:

| Transaction/Turnover Charges | |

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.004% |

| Equity Options | 0.06% |

| Currency Futures | 0.004% |

| Currency Options | 0.06% |

| Commodity | 0.05% |

Goodwill Commodities Margin

As far as exposure is concerned, the broker offers pretty good values across segments as shown below:

| Equity | Upto 20 times for Intraday |

| Equity Futures | Upto 15 times |

| Equity Options | Upto 10 times |

| Currency Futures | Upto 15 times |

| Currency Options | Upto 10 times |

| Commodity | Upto 20 times for Intraday |

Although, we would like to advise our users that exposure or leverage can be risky in their usage. Thus, unless you understand the intricacies and implications of the concept, do not put your money into it. It has the capacity to eat up your trading account balance and a lot more.

Goodwill Commodities Disadvantages

There are few concerns associated with this broker and users must make sure that they understand these limitations before opening their accounts with the broker. Here are the cons as listed below:

- No focus whatsoever on developing in-house trading platforms

- Transaction charges higher than the industry average

- Paid usage of the mobile trading app

- Language limitations and high turnaround time in customer service

- Average quality and quantity of research in Equity and currency

Goodwill Commodities Advantages

Furthermore, you will get these positives when you open your account with the broker:

- Reasonable intraday brokerage

- Pretty high exposure values

- Good commodity level research

- Good quality customer service in terms of resolution quality

Are you looking to talk to the executive for Account Opening?

Provide your details in the form below and we will set up a callback for you:

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Goodwill Commodities Membership Information:

Here is the membership information of the broker with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | 6648 |

| NSE | 90097 |

| SEBI | INZ000049087 |

| CDSL | IN-DP-CDSL-309-2017 |

| Registered Address | Goodwill Comtrades Pvt.Ltd. New No #9(Old No 4/1) 2nd Floor, Masha Allah Building, Bheema Sena Garden Street, Off: Royapettah High Road, (Near Thiruvalluvar Statue), Mylapore Chennai, TamilNadu - 600 004 |

The details can be verified from the corresponding websites of the exchanges.

Goodwill Commodities FAQs

Here is a quick look at some of the most frequently asked questions about Goodwill commodities as a stockbroker:

The name of this stockbroker is Goodwill Commodities. Do they provide trading services only in the Commodity segment?

Yes, although the name of the broker has ‘Commodities’ in it, you can avail investment and trading services in other segments as well, including – Equity, Currency, Mutual funds, derivatives and IPO.

Are the margin values high in the case of this broker?

Goodwill Commodities provides reasonable margin values i.e. at Intraday level you can get as high as 20 times of your trading account balance or initial margin while in Derivatives trading, it stays in the range of 10-15 times.

The broker seems to be high? Is it negotiable?

At 0.3% for Delivery trading and ₹50 per lot for Commodity trading, Goodwill Commodities brokerage may seem high. However, with a higher initial deposit, you may get a better deal i.e. lowered brokerage charges.

It also depends on your negotiation skills with the broker executive when a lot of potential clients discuss the final brokerage charges and other related payments before account opening.

What are the Goodwill Commodities account opening and maintenance charges?

The broker provides a free demat as well as trading account to its clients. Furthermore, the annual maintenance charges or AMC is also at zero cost.

Is Goodwill Commodities better than Zerodha or Angel Broking? If yes, how?

Each broker has its own pros and cons. At the same time, each trader has his/her own requirements from a broker. For broker comparisons, you can check out Goodwill Commodities comparisons with other brokers in the below section.

You can check out the detailed comparisons of Goodwill Commodities vs Other stockbrokers here:

More on Goodwill Commodities:

If you wish to learn more about Goodwill Commodities, here are a few reference links for you: