HPLiga

List of Stock Brokers Reviews:

HPLiga is a broking firm that has been offering stock and commodity trading since the year 2004. It offers competitive brokerages, high intraday margin and advice from experts for trading. They provide daily trading analysis, reviews of the stock markets, latest news and trading calls to their clients.

The broker falls under the category of full-service stockbrokers.

They also provide the facility of trading on diamond futures launched by Indian Commodity Exchange Limited (ICEX) which is a SEBI regulated online Commodity Derivative Exchange.

In this review, we will have a look at the multiple aspects of this broking house, including its brokerage, trading platforms, service, margin, account charges and a lot more.

The idea is to make sure you understand the details and make a call whether you would want to open your Demat account with this broker or not.

HPLiga Review

HPLiga, AP Certified through Fortune Trading Corporation & Fortune Capital Services Pvt. Ltd., is an experienced broker with intraday trading tips and advice for its clients on the basis of many advanced technical indicators.

HPLiga has got to do a lot of work in order to become a trusted and reliable broking firm in order to expand its active client base. This can be made possible by providing value to its existing clients and work on the feedback given by them.

Now, let us try to understand the quality of its platforms by analyzing their strengths and weaknesses.

HPLiga Trading Platforms

HPLiga offers multiple trading applications to its clients. All come loaded with different sets of features and risks. Let’s see which one might work the best for your trading requirements:

Web-Based Trading Platform

This platform is user-friendly and comprises of many good trading friendly features like –

- Multiple charts can be viewed in a single screen

- Different Technical Analysis Tools Based on Technical Indicators

- Availability of Historical Quotes

HPLiga Advanced Mobile Application

This mobile app can be downloaded on Android as well as apple devices. Its main features have been described below –

- Advance Charts Facility with more than 50 indicators and trend scanners.

- Cover order facility for all segments

- Availability of bracket order facility with trailing stop loss.

- Multiple data points for the stock market analysis

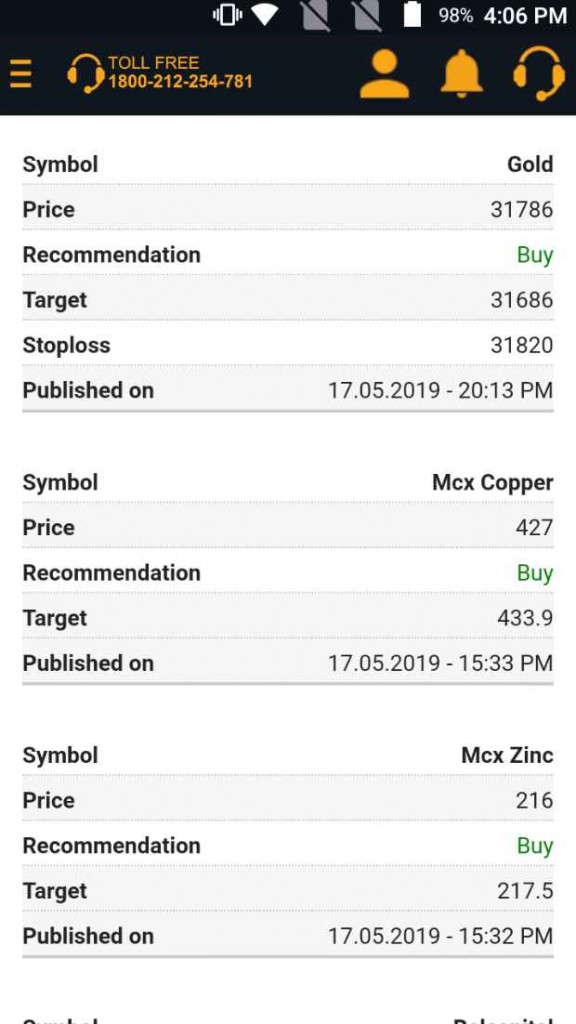

Here is a quick look of this app for your reference:

There are some issues that have been reported with the HPLiga mobile application and risks of using it like –

- The design of the app seems very basic and a lot can be done to make the user experience better.

- Presentation of stocks-related data should be made simple for better understanding and quick trading.

- Although the overall rating of the app is good, the number of reviews is too less (just 17) to rely on and make a decision according to them.

Some statistics related to HPLiga Mobile Application from the Google Play Store:

| Number of Installs | 1,000+ |

| Mobile App Size | 5.3 MB |

| Negative Ratings Percentage | 15% |

| Overall Review |  |

| Update Frequency | 6-8 Months |

Buy-Sell Signal Charting Platform

This is free of cost subscription tool which is available for all HPLiga trading account holders. This platform helps in making trading plans according to one’s trading style with specific rules defining what, when and how to trade in order to increase one’s wealth.

Different signals are generated for positional, swing and intraday trading.

The signals are generated in the presence of a strong trend. Less number of signals are generated when the market moves sideways as it is a no trading zone at that time.

The tool analyses the personality and trading style of a trader on the basis of 7 parameters. It enlists all the strengths and weaknesses of a trader. Some of the best features of this software have been discussed below –

User-friendly – Easy to learn and use. It is supported by multiple charts. One can customize its interface according to one’s preferences.

Alerts Generation Facility – Buy and sell signals are generated on the basis of real-time data and sent directly to clients’ mobile phones.

Buy and sell signals are generated on all futures and options stocks, 3 indices, all the allowed currency pairs for trading in India and 9 commodities. A stop loss of 0.05% to 1.5% is to be applied.

The trading signals are generated 30 minutes after the opening of the stock market.

Intraday Trading Strategies – They provide a formula-based advanced intraday strategy based on 4 advanced technical indicators. It works on NSE, Futures and options, MCX and currency markets.

High Accuracy – Accuracy of the tool is quite high due to the advanced nature of their technical analysis. It is around 90% as per their website.

Technical Support – Remote desktop support facility is available in market hours along with LIVE chat and technical support.

Also, call and trade facility is available for offline traders. One can also make use of live chat support and support through emails, WhatsApp and phones. Customer support is available 24/7.

HPLiga Brokerage

HPLiga has one of the lowest brokerages in the industry when it comes to its comparison within the full-service stockbroking fraternity.

Here are the brokerage details:

- Equity Intraday: 0.005%

- Equity Delivery: 0.05%

- Commodity Trading: 0.005%

Let’s take a quick example to understand the brokerage charges at length:

In case you bought a stock ABC and had its 400 shares at a price of ₹2500 per share, thereby, making the total transaction turnover standing at ₹1,000,000.

Then you sold these shares at a price of ₹2750 per share, thereby, taking the turnover in this sell trade to ₹1,100,000.

Although, you think you made a profit of ₹(2750 – 2500) * 400 i.e. ₹1,00,000 but there will be charges involved that will eat up your profit share.

One of those charges is the brokerage. Now, in this case, the brokerage will be: ₹((2750 + 2500) * 400) X 0.005% i.e. ₹105

For more information, you can check out this HPLiga Brokerage Calculator for your reference.

HPLiga Margin

All NSE futures are covered as far as margin trading is concerned. The intraday default limit of trading in stocks is 20 times. One can trade NIFTY at ₹3200 margin and Bank NIFTY at ₹1750 margin. The 20 times margin is fixed for all commodity and equity futures irrespective of any condition.

Placing cover orders can give one a margin of up to 40 times as they are a little less risky. The exact margin will depend on the stop loss applied to each order.

All MCX commodities are covered. The default intraday limit for trading in commodities on MCX is 15 times. One can trade crude at ₹3200 margin and gold at ₹9700 margin.

Before entering any transaction, one can get a detailed view of all the charges and margin requirements that are going to be involved in the particular trades.

Besides these, HPLiga also provides the facility of ICX diamond trading at ₹200 per lot.

The brokerage and margin requirements applicable specifically for HPLiga have been discussed above. Other than these, there are some government charges and transaction charges that are applicable to every transaction.

They have been mentioned below –

1. STT

Here are the details on the securities and transaction taxes levied across segments:

- For delivery equity – 0.1% on both buy and sell sides

- For intraday equity – 0.025% on sell-side

- For Futures (Equity) – 0.01% on sell-side

- For Options (Equity) – 0.01% on sell-side

- For MCX Intraday – 0.017% on sell-side (on premium) & 0.125% to buyer (on exercise)

- For MCX Carry Forward – 0.01% on selling turnover

2. Transaction Charges

Similarly, you need to pay transaction charges on your trades as shown below:

- For delivery equity – ₹325 per crore

- For intraday equity – ₹325 per crore

- For Futures (Equity) – ₹325 per crore

- For Options (Equity) – ₹190 per crore

- For MCX Intraday – ₹5000 per crore

- For MCX Carry Forward – ₹390 per crore

3. GST or Good and Services Tax

This is a flat percentage applied on your trades across segments at 18% on brokerage charges and transaction charges

4. SEBI Charges

These charges are levied at ₹15 per crore. This particular charge tax is the same across the segments.

Lastly, Stamp duty is also charged for every transaction. However, the amount or percentage is dependent on the state where the client is based.

HPLiga Benefits

Now, let us discuss various advantages of the broking platform HPLiga.

1. Low Brokerages – The brokerage charges charged by HPLiga are one of the lowest in the industry.

2. Free of cost Charting Platform – This platform has been approved by SEBI and helps in generating trading signals for positional, swing and intraday trading.

3. Exposure on Intraday – HPLiga offers 20 times intraday limit for every intraday transaction inequities. The intraday limit for commodities is 15 times.

4. Easy Account Opening Process – One can open a trading and demat account with HPLiga by following a simple process with the help of a few basic documents.

5. Technical Support – HPLiga has an experienced and dedicated team of professionals who are available for clients 24/7 through live chat, emails and phone calls.

6. Lifetime Free Accounts – The account opening fee with HPLiga is 0 and they are lifetime free accounts like PAN card, Aadhar card, passport-sized photos, last six months bank account statement, in-person verification, photo of one’s signature, etc.

7. Analysis of Trader’s Personality and Trading Style – This is one of the most unique features of HPLiga. It judges the strengths and weaknesses of traders which help them in becoming better and trader better gradually with time.

For more information, you can check this detailed review on Documents required for demat account.

HPLiga Concerns

Every coin has two sides. Although there are many advantages of opening an account with HPLiga, there are a few disadvantages of HPLiga platforms such as:

1. No IPO Facility – One cannot participate in an Initial public offering through HPLiga. Similarly, one cannot take part in follow on public offering as well.

2. Absence of Algo Trading – This broker does not provide the facility of algo trading where traders can frame their strategies and trades can be automatically placed on the stock exchanges as and when the conditions are fulfilled.

Conclusion

HPLiga is an experienced broking platform which provides a user-friendly interface for trading in equity, futures and options, commodities and currency market.

One of the best facilities of HPLiga is its free charting platform (SEBI Approved) which provides buy and sell signals on the basis of technical analysis done using most advanced technical indicators.

Also, diamond trading can be done through its platform. The brokerages and margins figures are quite competitive and attractive. After analyzing different pros and cons of HPLiga and viewing the trading platform, one can take a decision to open a trading and commodity account with HPLiga.

In case you are looking to get started with stock market trading or investments, let us assist you in taking the next steps ahead. Just fill in a few basic details to get started:

More on HPLiga

If you wish to learn more about this stockbroker, here are a few references for you: