ICICI Direct Review

List of Stock Brokers Reviews:

ICICI Direct is one of the topmost bank-based full-service stockbroking companies in India. It is a retail investment and trading arm of ICICI Securities which is further part of India’s top financial service provider ICICI group.

The broker has a presence across 87 locations in India with more than 200 offices in different forms and sizes for its clients.

Let’s have a quick look at this stockbroker:

ICICI Direct

Without a doubt, the brand equity gained by ICICI banking services in the past 2 decades helps ICICI Direct but at the same time, ICICI Direct is famous for its incredible customer service and vast offline presence across the country.

With more than 35 lakh customers across the country, it provides a range of trading and investment services. These segments include:

- Equity

- Derivative Trading

- Mutual funds

- IPO

- Fixed Deposits

- Bonds

- Non-convertible Debentures (NCDs)

- Currency Trading

- ETFs

- Insurance

- ICICI PMS

- Loans

- eLocker

One of the unique features of ICICI Direct is the 3-in-1 demat account which includes the Bank account, Demat account, and Trading account. This ICICI Demat Account feature is only available with stockbroking companies that have the leverage of a banking services parent company.

The broker allows for NRI Trading, for more – check this review on ICICI NRI Trading Account.

The advantage of having a 3-in-1 account is that you get a seem-less trading experience since your bank account is directly integrated to your trading account which helps in instant money transfer.

“ICICI Direct boasts of having an active client base of 8,70,070 – one of the highest in the country.”

In case of non-banking financial companies (NBFCs) such as Angel broking or Sharekhan money transfer from your bank account to your trading account takes some time that might elude you from making money at specific lucrative opportunities.

ICICI Direct provides different propositions to different sets of potential client base.

As per the broker, if you are a beginner trader, then you can use the assistance of its relationship managers that are mapped to your account to understand how you can carry out your trades. Along with this, to smoothen the trading process, the broker offers ICICI 3 in 1 Account.

The broker also provides financial learning through virtual classrooms for its clients. Some of the stock market courses are paid in nature though.

If you are an investor, then the broker provides a wide range of investment products (as mentioned above) along with its fundamental research for your reference.

Lastly, if you are an active trader, the broker provides you with a high-performance terminal application in the form of ICICI Trade Racer (discussed later) with an exhaustive number of features and speed.

Shilpa Kumar – Managing Director & CEO, ICICI Securities

ICICI Direct Trading Platforms

ICICI Direct provides state-of-the-art trading platforms for desktop, laptop, and mobile devices. Here are the details:

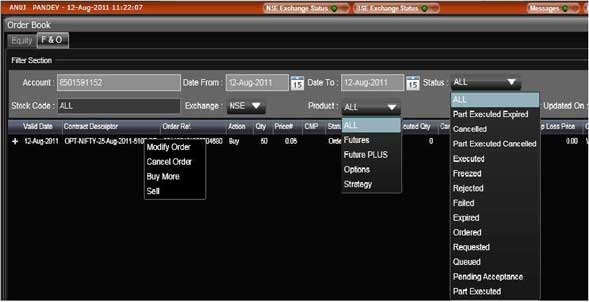

ICICI Direct Trade Racer

Trade racer is an executable file that can be installed on your machine and then from there clients can carry out their trading from their desktop or laptop. Some of the features this trading platform carries are:

- View all trending scrips within a single screen or interface

- With Live scanner feature, clients can instantly identify stocks that are making high or low

- With the Heatmap feature, stocks high or low can be identified directly with colour-coding without looking at data

- Customizable color layouts and market charts

Here is the demo of Trade Racer software:

“Clients who are able to generate monthly brokerage in excess of ₹750 gets free access to this trading platform while the ones that cannot are required to pay ₹75 per month as subscription cost of this software.”

The above line suggests that the broker favours the traders who trade on a regular basis and consistently generate business for them. However, small investors or beginners are, in a sense, penalized for low brokerage in the form of this unnecessary subscription cost.

Lastly, make sure that the computer or laptop you use for using this trading software, must have a decent configuration in terms of RAM, processor, memory and so on. Otherwise, you have to go through a mediocre-level trading experience.

ICICI Direct Trade Racer Web

Trade racer web is a browser-based version of Trade Racer software where users do not need to install and can be accessed from anywhere. Some of the top features of this platform are:

- Live and streaming quotes

- Drag and drop widgets facilitation

- Up to 5 watchlists

- User alerts and notifications

Other features include:

- Multiple watch lists with live streaming quotes

- Observe Current Limit, CMP with Best 5 bid/offer, modify allocation in a single window and more

The only concerning factor in this browser-based application is its user experience. For users, especially beginners, it may become difficult to understand the navigation and feature usage easily.

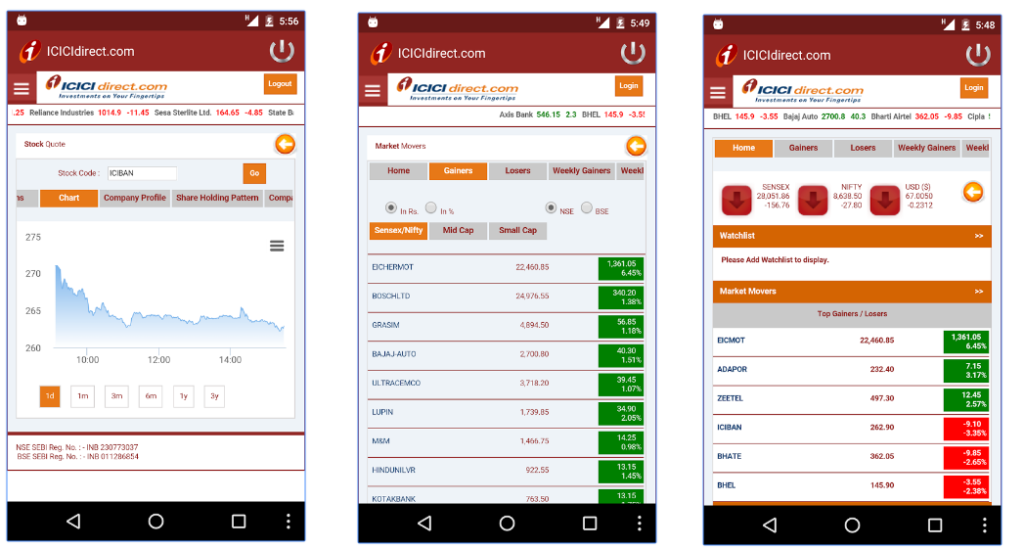

ICICI Direct Mobile App

This mobile app is one of the average performing trading mobile apps (our rating 6.1 out of 10) in India. The app comes with the following features:

- Latest quotes, scrips, market updates can be analyzed

- Portfolio tracking and market movement

- Live research calls and market tips

This is how the mobile app looks like:

Here is how the app looks at the Google Play store:

| Number of Installs | 1,000,000+ |

| Mobile App Size | 1.2 MB |

| Negative Ratings Percentage | 29.7% |

| Overall Review |  |

| Update Frequency | 12-14 Weeks |

| Android Version | 4.0 and Up |

| iOS Version | 8.0 and Up |

Thus, looking at the rating, update frequency cycle, and customer feedback, it seems pretty clear that the broker does not seem to have much focus when it comes to its mobile trading application.

Here is a quick video review for your reference:

In this day and age, when users are gradually moving towards mobile apps for day-to-day trading, it does not seem to be promising news for the clients of ICICI Direct.

ICICI Demat Account

To get into a trade with the broker you need to activate the ICICI demat account. ICICI Direct offers a 3-in-1 account thus you can link your trading, demat, and bank account for seamless transactions.

However there are certain charges to open the account, but the broker offers you an option to open free demat account by offering you different brokerage plans.

ICICI Demat Account Opening

Now when opening an account with this ICICI direct, you can fill the application form via both online and offline methods.

Of course, the ICICI Direct Registration online process takes lesser time but to make the account facility available for all kinds of investors, the broker provides offline account opening services too, where you can visit the branch and opens the account with the help of an executive.

- For the online method, just visit the website and follow the step-by-step instructions beginning with validation of your mobile number.

- Enter the PAN Card and Aadhar details and upload your signature.

- Link your bank details by selecting your bank.

- Next, to verify your detail you need to take a photo from your device.

- Process your e-sign by entering the Aadhar number. Make sure your Aadhar card is linked with your mobile number.

- All your personal information will be fetched and validated from Digi locker and on complete verification, your account details are shared with you in no time.

Charges for Demat Account in ICICI

Now to use the demat account services of any broker one needs to pay certain charges. These charges include account opening fees and account maintenance charges.

As already discussed that ICICI comes with different plans for its customers and hence this fee varies accordingly. Here ICICI direct demat account opening charges are NIL, however, if the customer chooses the ICICI NEO plan then there is a relaxation in AMC charges.

Here is the detail:

| ICICI Demat Account Charges | |

| Demat Account Opening Charges | Zero |

| Account Maintenance Charges | For NEO Brokerage: ₹300 (from the first year onwards) |

| For Other Brokerage Plan: ₹700 (from second year onwards) |

ICICI Direct Refer and Earn

Opening a demat account with ICICI Direct allows you to trade in different trading segments. But at the same time, you can use the broker’s service to reap additional benefits through its referral program.

ICICI Direct refer and earn demat account allow the registered user to refer the services to their friends who are willing to trade and invest in the share market and earn ₹500 on each referral.

To use this benefit, one has to log in to the mobile app and click on Refer and Earn tab. Post this, enter your registered mobile number and click on generate link.

Share the link with your friends. Once they open a demat account and start trading ₹500/referral gets credited to your trading account.

ICICI Direct Charges

You can have an ICICI Direct Free Demat Account under certain schemes and plans. Other than this, there are certain charges associated with the account opening and trading in different segments. These charges are discussed in detail below.

| ICICI Direct Account Opening Charges | |

| Demat Account Opening Charges | NIL |

As shown above, the account opening for this full-service stockbroker is free while the ICICI Direct AMC is pretty high at ₹700. However, the broker waives off the charges for the first year, thus you do not have to pay any fees at the time of account opening.

“The Call and Trade facility is charged at ₹25 per executed trade.”

ICICI Direct Brokerage Calculator

This full-service stockbroker charges these brokerage percentages, however, it really depends on the kind of plan you subscribe to.

| Equity Delivery | 0.55% |

| Intraday Delivery | 0.275% |

| Equity Futures | 0.03% to 0.05% |

| Equity Options | ₹35 to ₹95 per lot |

| Currency Futures | 0.03% to 0.05% |

| Currency Options | ₹10 to ₹25 per lot |

| Commodity | NA |

To understand how this works, you need to understand that it all really depends on your trade value.

For example, if you traded for ₹1,00,000 at the Equity Delivery level, then with a 0.55% brokerage charge, you are supposed to pay ₹550 as ICICI Direct equity delivery charges excluding taxes and any transaction charges.

That is pretty high an amount of brokerage when we compare it to some other economical full-service brokers and certainly with discount stock brokers.

On a similar level, ICICI Direct Intraday charges can be seen as a bit on the higher side too. That really depends on who do you compare it with.

“ICICI Direct has a minimum brokerage charge set at ₹35 per executed trade. That implies, irrespective of your trade value, you are supposed to pay at least ₹35 as brokerage charge plus taxes and transaction charges.”

Furthermore, the broker has few plans for its clients with different brokerage structures, such as:

I – Saver Plan

This plan works on the concept of the total turnover you create within a span of 3 months. There are multiple slabs ranging between ₹25 Lakhs and going as high as ₹5 Crore. Higher the turnover, lower the brokerage you end up paying to the broker (across segments).

I – Secure Plan

There is no commitment of turnover in this plan and you are supposed to pay a discussed brokerage rate in all your trades. You are advised to have a detailed discussion before you open your account and negotiate on the brokerage since it will be applicable in all your future trades.

ICICI Direct Prepaid Brokerage Plan

As the name suggests, you are supposed to make an initial payment (like a Paytm Recharge) to ICICI Direct. The higher the payment, the lower is the brokerage applicable to your trades. The commission generated from your trades will be auto-deducted from this initial deposit.

You can recharge again once the initial deposit is completely exhausted.

All these plans have some set of pre-conditions to each and based on your preference(s), you can make a selection.

Furthermore, it also depends on the segment you are investing in. ICICI Direct Option brokerage will be very different from ICICI Direct intraday brokerage. Make sure, you understand the difference.

Apart from that, there are plans such as ICICI Direct Prime Plan, ICICI Direct Neo Plan – and depending upon the kind of trader you are, you may wish to choose accordingly.

ICICI Direct Transaction Charges

Apart from the account opening and maintenance charges to go along with brokerage, you are supposed to pay a few taxes and transaction charges that finally become part of the total payment. As far as transaction charges levied by the full-service stockbroker is concerned, here are the details:

| Equity Delivery | 0.00325% |

| Equity Intraday | 0.00325% |

| Equity Futures | 0.00190% |

| Equity Options | 0.05000% |

| Currency Futures | 0.00100% |

| Currency Options | 0.04000% |

| Commodity | NA |

As per the industry standards, ICICI Direct charges pretty nominal transaction charges. There are a few stockbrokers such as Trade Smart Online and TradePlus Online, that charge hefty transaction charges after attracting customers with low brokerage charges.

Apart from that, each selling transaction requires you to pay DP charges in ICICI at a scrip level. Make sure you keep an eye on those expenses too.

ICICI Direct Margin

The full-service stockbroker is not really known to provide high exposure or leverage but then, again it depends on the kind of plan you have chosen. Based on that, the leverage values can be negotiated to an extent.

| Segment/Plan | Freedom | Pro | Ultimate |

| Equity | 10 times | 10 times | 20 times |

| Equity Futures | 4 times | 4 times | 8 times |

| Equity Options | 1 times | 1 times | 3 times |

| Currency Futures | 4 times | 4 times | 8 times |

| Currency Options | 1 times | 1 times | 4 times |

It is advised to be very sure of the implications of using Exposure to your trades. Unless you understand how it works and what are the potential risks of using it, it is suggested not to use exposure at all.

ICICI Direct Research

As a full-service stockbroker, ICICI Direct provides you with a wide range of research and recommendation products. It does not really matter what kind of trader or investor you are, the broker provides various kinds of tips (except commodity of course, since ICICI Direct does not provide commodity trading services).

For knowing more about Commodity Trading in ICICI Direct, you can refer to ICICI Direct Commodity Trading.

Some of the research products offered by ICICI Direct are:

- Market Insights

- Opening Bell

- Market Commentary

- Special Reports

- Market Outlook

- Monthly Derivative Reports

- Monthly MF Reports

- Trading Recommendations

- Momentum Pick

- Daily Support & Resistance

- Derivative View

- Investment Recommendations

- Equity Model Portfolio

- Quarterly Review

- Top Picks

- IPO Reports

- IPO Diary

- Allotment

As you can see above, the range is quite varied when it comes to ICICI Direct Research. As far as the quality of these research reports and tips is concerned, the broker provides good long-term investment tips.

However, for intraday or swing trading, it is advised that you perform a quick check at your end before placing the trade. For that it is good to know the difference between Swing Trading and Day Trading.

ICICI Direct Complaints

This stockbroker has received a relatively lesser number of complaints as compared to its peers in the industry. As per the latest numbers, the industry average is 0.02% or 2 out of 1000 clients reports a complaint against his/her broker.

In the case of ICICI Direct, the complaint percentage is 0.01% where it has received 112 complaints in this financial year.

With these numbers, potential clients of this broker can feel relieved as the broker does a reasonable job when it comes to the complaints it receives and the corresponding resolution it provides.

ICICI Direct Customer Care

ICICI Direct provides you with the following communication channels for service:

- Phone

- Offline Branches

- Web help

The expectations from the clients of such a huge brand name as ICICI Direct are generally high. This gets fuelled by the fact that it is a full-service stockbroker that charges premium brokerage charges in lieu of quality customer service and research. As far as the former is concerned, the quality is pretty average, especially in terms of personalization of communication.

The biggest concern of all is that the broker seems to give major attention to high net worth individuals or heavy traders.

Thus, users that are small to medium in terms of turnover or the ones who are beginners looking to enter into stock trading space, get minuscule attention. Make sure you do understand that aspect before opening an account.

“ICICI Direct has a repository on user education around basics and fundamentals of trading, Mutual funds, Futures, and options as well as investing. This is available for free and can be accessed from their website.

The complete course consists of 11 modules divided into 2 chapters. Although content-wise, its good but the way it has been structured, could have been improved.”

Is ICICI Direct Good?

Well, no doubt the broker offers great services, has a good experience in the broking industry, and provide the option to trade at the minimum cost by offering multiple brokerage plans, but if you are still confused about the reliability or security of the broker, then here are few disadvantages and advantages that help you in making a right decision.

ICICI Direct Disadvantages:

You must be aware of some of the concerns of opening your demat/trading account with this bank-based full-service stockbroker:

- Brokerage charges are relatively high as compared to other stock brokers. Most of the times, it is not even negotiable

- Complicated brokerage plans might create confusion

- Not Optimal for small investors of beginners as the broker charges for trading platform usage to go along with relatively high brokerage charges.

- Does not allow commodity trading.

- Mobile app quality is pretty mediocre.

- No LIVE chat support for a quick resolution

“ICICI Direct has received 21 complaints from its clients the financial year 2019-20.”

ICICI Direct Advantages:

At the same time, here are some of the quick benefits of using the services of ICICI Direct:

- ICICI Direct is the number 1 stockbroker in India in terms of its active client base.

- With the provision of 3-in-1 account, clients get an easier life for their fund transfers. In fact, the money is transferred back to your ICICI bank account as soon as you exit the trade.

- A large number of investment products at the disposal of clients and the broker allows trading and investing in different segments.

- Enjoys a huge brand name gained through its banking services

- Provides one of the top mobile and desktop-based trading applications for easy trade execution.

- Under the umbrella of the parent brand, you can use the Insurance services of ICICI Lombard.

- Offline assistance through its branches is availed with minimum hassles.

- Free research provided with a special focus on fundamental investments.

- A limited number of complaints percentage recorded at the National Stock Exchange as compared to most of the competitor stockbrokers.

- Good Till Cancelled (GTC) Orders allowed to be executed with the specification of the expiry date.

- Financial education at different levels of trading and investments.

Interested to open an account? Enter Your details here and we will arrange a FREE Call back.

Next Steps:

Post this call, You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

ICICI Direct Membership Information:

Here are the details on the different membership details of the full-service stockbroker with exchanges such as NSE, BSE etc:

| Entity | Membership ID |

| BSE Capital Markets | INB011286854 |

| NSE Capital Markets | INB230773037 |

| NSE Derivatives | INF230773037 |

| BSE Derivatives | INF010773035 |

| NSE Currency Derivatives | INE230773037 |

| Registered Address | ICICI Centre, H.T.Parekh Marg, Churchgate, Mumbai - 400 020 |

ICICI Direct Frequently Asked Questions

Before we wrap-up this review on ICICI Direct, let’s go through some of the most frequently asked questions (FAQs) about this broker.

What is ICICI Direct?

ICICI Direct is the broking arm from the banking company ICICI Bank. Using the services of this stockbroker, you can invest across multiple segments apart from the fixed deposit option that the bank provides to you.

You are supposed to open a demat and a trading account with the broker in order to do so.

Can I buy Mutual funds using ICICI Direct services?

Yes, the full-service stockbroker provides services across multiple trading and investing products, including Mutual funds.

How is the feedback on the mobile app of ICICI Direct?

The mobile app space is one of the grey areas or rather weak links when it comes to this bank based full-service stockbroker. The biggest concern being its update frequency cycle. It takes 7-8 months that the app sees a single update.

At the same time, if we talk about industry standards, other stockbrokers update their mobile app at least once in a span of 4-5 weeks while some of the best ones within 2-3 weeks.

Other concerns include basic design, limited features, slow speed and low usability.

How can I transfer my shares from ICICI Direct to any other broker?

It’s a pretty straightforward process. You can do this online or offline, depending on your preference. To know complete details about shares transfer from ICICI Direct to your stockbroker, you can check out this detailed review here.

What are the account opening and maintenance charges at ICICI Direct?

Opening a Demat and Trading account is free at this full-service stockbroker but you are required to pay ₹700 as annual maintenance charges (AMC), which is pretty high as per industry standards.

How to Unlock ICICI Direct Account?

If your ICICI direct account has been locked out, there are 2 ways to get it unlocked.

- Either you can enter your UserId provided to you by the broker or use the combination of the form number, your date of birth and valid PAN number. Once you provide any of these two options, you will be taken to the next screen where an OTP confirmation will be done before your account is unlocked.

- Otherwise, you can just provide your ICICI Bank Account number and you will be taken to the ICICI bank website, where you can log in. The demat account linked to your bank account will be unlocked.

How to Reset ICICI Direct Password?

The broker requires you to change/update/reset your password every 90 days and you must make sure that the new password must not be the same as any of the passwords you have used in the past.

In order to reset your account password, you need to enter your ICICI Bank account number and update it in your net banking portal.

You can rest your password using the Grid functionality as well.

How do I Close my demat account at ICICI Direct?

Closing an account is not as easy as opening one. You are required to complete few formalities otherwise you will get charged AMC on a regular basis. Check out this link for a complete understanding of how to close your demat account with the broker.

How can I invest in IPOs using ICICI Direct Services?

Investing in IPOs using ICICI Direct is pretty easy since this can be done using ICICI bank services. Both the accounts are going to be completely integrated and thus, the overall process becomes much simpler.

Does ICICI Direct assist users in learning about trading and investing?

The broker provides the following solutions to its clients around the basics and fundamentals of trading:

- iCommunity is an online forum where users can ask questions, get answers to their queries, follow others with an expert point of views.

- Online tutorials around basics of Equities, Mutual Funds, Options, Futures and technical analysis

- Virtual classroom learning

All these services are provided to the clients of the broker, however, the quality of the content shared cannot be guaranteed. There are stockbrokers who have been marketing their content to let users know about it. For some reason, ICICI Direct has not done that.

There may be two reasons of that – either they don’t understand that it needs to be marketed for people to know OR they are themselves not sure of the quality yet, that might potentially hit at their brand reputation.

Also, check out a detailed comparison of ICICI Direct Vs other stockbrokers:

ICICI Direct Branches:

This bank based full-service stockbroker is present at the following locations across India:

| States/City | ||||

| Andhra Pradesh | Vizag | Hyderabad | Warangal | Ongole |

| Rajahmundhry | Vijayawada | Guntur | Nellore | |

| Assam | Guwahati | |||

| Bihar | Patna | |||

| Chhatisgarh | Durg | |||

| Goa | Mapusa | Margao | Vasco | Panaji |

| Delhi/NCR | Gurgaon | Noida | Faridabad | New Delhi |

| Gujarat | Ahmedabad | Jamnagar | Anand | Vadodara |

| Vapi | Gandhinagar | Navsari | Valsad | |

| Rajkot | Nadiad | Surat | Banaskantha | |

| Porbandar | Bhuj | Bharuch | ||

| Haryana | Panchkula | Karnal | Faridabad | Rohtak |

| Panipat | ||||

| Himachal Pradesh | Shimla | |||

| Jharkhand | Ranchi | |||

| Karnataka | Bangaluru | Belgaum | Hubli | Mangalore |

| Udupi | Dharwad | Mysore | ||

| Kerala | Kochi | Ernakulam | ||

| Madhya Pradesh | Bhopal | Jabalpur | Indore | Gwalior |

| Alirajpur | Balaghat | Betul | Burhanpur | |

| Maharashtra | Nashik | Pune | Nagpur | Kolhapur |

| Aurangabad | Mumbai | Solapur | Thane | |

| Vasai | Kolhapur | Talegaon | Kalyan | |

| Latur | ||||

| Orissa | Bhubaneswar | Cuttack | Rourkela | |

| Punjab | Amritsar | Chandigarh | Jalandhar | Ludhiana |

| Bathinda | Mohali | Jalalabad | Kapurthala | |

| Patiala | ||||

| Rajasthan | Ajmer | Jaipur | Bikaner | Kota |

| Udaipur | Jodhpur | Alwar | Bhilwara | |

| Tamil Nadu | Chennai | Coimbatore | Erode | Madurai |

| Trichy | Gandhinagar | Vellore | GobichhetiPallayam | |

| Telangana | Hyderabad | Secunderabad | Warangal | |

| Tripura | Agartala | Udaipur | Unakoti | |

| Uttar Pradesh | Agra | Allahabad | Bareilly | Dehradun |

| Lucknow | Meerut | Varanasi | Saharanpur | |

| Uttarakhand | Dehradun | Haldwani | Nainital | |

| West Bengal | Durgapur | Kolkata | Nadia |

More on ICICI Direct

If you wish to learn more about ICICI Direct, here are a few references for you:

Wonderful article! That is the type of info that are supposed to be shared across the web.

Disgrace on Google for now not positioning this submit upper!

Come on over and seek advice from my web site . Thanks =)