IIFL Securities

List of Stock Brokers Reviews:

IIFL Securities is one of the full-service stockbrokers in India from IIFL Holdings Limited. It is one of the leading financial services providers that offer innumerable services ranging from offering loans, mortgages, and brokerage services.

The firm was incorporated in 1995 and is continuously growing since then. Currently, it has offices in more than 4000 locations spread across 900 cities in India including IIFL Mumbai.

The stockbroker is affiliated to both the major stock exchanges of India – National Stock Exchange (NSE), Bombay Stock Exchange (BSE).

Along with this, the company has its international presence as well along with offices in Hong Kong, Dubai, New York, Singapore, Geneva, London, and Mauritius.

Let’s dig a bit deeper and understand whether this full-service stockbroker is a suitable broker for you or not.

IIFL Review

IIFL Securities or India Infoline Securities Pvt. Ltd. is renowned and one of the leading players offering the best services in both retail and institutional segments. The company moves forward with the major goal of innovating and reinventing new strategies.

Along with this it has set a digital footprint in the trading world and has come up with major and highly advanced trading platforms.

Becoming a customer of the company helps you in gaining the advisory and research services that help you in trading across different segments without flaws.

“IIFL has an active client base of over 2.5 Lakh as of 2020 i.e. this financial year.”

As per recent research, IIFL has relatively a stronger presence in the northern part of the country especially in Delhi, Gurgaon, Noida, Punjab, Rajasthan, and thus, finding a branch across these regions is relatively easy.

IIFL Founder

IIFL Securities was founded by Nirmal Jain with the strong support of Canadian Investors Prem Watsa (private equity firm General Atlantic and CDC Group).

Nirmal Jain is one of the successful entrepreneurs who slowly took the firm towards growth. In the year 2000, IIFL entered into the market as a full-service brokerage firm and started widening its network.

Later he diversified his business by offering various other services like life insurance, mutual funds, equity trading, and lots more.

By 2018, the company grew strong with the 23% direct or indirect ownership of Nirmal Jain.

Also, know about How to trade in IIFL and How to sell Delivery Shares in IIFL.

IIFL Full Form

The full form of IIFL is ‘India Infoline’. It has been called as India Infoline Limited, however, off-late the brand has been pushing itself as IIFL across the board.

They have, in fact, rebranded themselves into this short form across different business verticals too.

https://www.youtube.com/watch?v=2lqfrn7xC6A

IIFL, commonly known by the India Infoline Pvt Ltd that ranks among the leading financial services providing firms.

Formerly known by the name India Infoline Investment Services Limited, the firm was renamed as India Infoline Finance Limited in November 2011.

Today, the company has acquired a dominating position in both retail and institutional sectors and becomes the first Indian broker to get membership of the Colombo Stock Exchange and approval to be a member of the Singapore Stock Exchange.

Also, read IIFL Exchanges.

It launched 5Paisa full-service brokerage to offer the brokerage plan at the least sum of 0.05% in 2000 and in the year 2005 successfully listed in BSE and NSE.

IIFL Trading

IIFL Trading allows customers to buy and sell stocks by paying little brokerage charges as a commission to the broker.

With the advanced trading tools and platforms, you can now gain the experience of seamless trade.

To get access to trade, the trader has to open an account with the firm.

The account opens the gateway to trade in different trading products including equity, currency, commodity, etc.

No wonder, you would be able to reap the maximum benefits and better experience of an unbeatable and unique combination of technology and research.

Thus, you can invest in stocks with minimum risk and higher chances of gaining profit.

With lots of trading features like two-factor authentication, single login, advanced trading platform, low brokerage, you can gain the ultimate and great trading experience.

IIFL Virtual Trading

IIFL Virtual Trading is something that proves to be highly beneficial for those who are new in the trade market. It is the method of imitating the trade within the financial market without bringing in use the real money.

This is highly helpful as it helps beginners in practising the trade and avoiding the risk involved in the investment.

In all, the virtual trading platforms and games help you in gaining proficiency over trade and in generating profit right from the beginning.

IIFL Products

As already discussed, IIFL Holding Ltd. comes up with many different products and services ranging from finance, wealth and asset management, investment banking, institutional equities to property advisory services.

IIFL Securities offers all its services through its various subsidiaries and its online portal.

Here is the complete list of products and services offered by the firm.

- Equity

- Currency Trading

- Mutual funds

- Commodity Trading

- IPOs

- FD

- IIFL PMS

- Bonds

- NCDs

- ETFs

- Loans

The full-service stockbroker has its corporate office based out of Mumbai with an employee strength of around 8,000.

The broker has even set up a discount broking arm in Thane, Mumbai with the brand name 5Paisa that is pretty competitive in its pricing and other offerings.

IIFL Equity

IIFL Equity one of the product ranges of the company helps you in placing orders at a pre-defined price or for pre-specified quantity in scrips at regular intervals.

Investing in equity represents the ownership in the company acquired through the investment of capital that helps in running a business. The capital is raised through the issue of shares to the public.

These shares can either be bought directly from the company or through a trade done on the stock exchange.

Although investment in equity, here IIFL equity involves lots of risks it offers high returns to investors in the long run.

IIFL Mutual Fund

IIFL Mutual Fund is one of the best-suited products that help investors in generating wealth. It offers different products and risks associated with it.

IIFL mutual fund is the product offered by the stockbroker that gives the customer to invest in SIP plans as per their needs over some time.

The user can gain access to different mutual funds through 42 AMCs and advanced technology-based trading platforms. Thus, the customers willing to invest in IIFL mutual funds can track and manage their investment through one account.

IIFL Commodity Trading

As already discussed, IIFL Securities is a leading brokerage firm that offers broking services in various segments including commodities.

IIFL commodity trading allows the trader to trade in movable property like gold, silver, and other metals. Also, the trader can trade in agricultural commodities.

IIFL Commodity Brokerage Calculator makes the process easy in commodity trading in IIFL.

Trading in commodities brings diversification in the portfolio, leverage with IIFL margin, provides a high level of liquidity, etc.

IIFL Currency

IIFL Currency offers traders the chance to leverage the fluctuations in exchange rates to make profits. Similar to the commodity trading segment, currency trading comes with a higher probability of earning profit in the trade market.

In this, the trader deals with the exchange of currency and earns profit by availing the difference in the value of currency over time.

Grab the best trading experience with IIFL securities and invest smartly with the help of the research team.

IIFL Bonds

Apart from the conventional ones discussed above, IIFL bonds is another exciting product that investors and traders are beginning to fancy increasingly with each passing day.

As for IIFL bonds, the firm claims to provide returns to the tune of 10.5% per annum. It has been rated well by Crisil and investors can avail the option of monthly interest as well.

The return percentage, however, may vary in the range of 9.84% to 10.5% depending on the holding period from 15 months to 69 months.

The last one was issued at a price of ₹1,000 per NCD with a minimum investment capital of ₹10,000.

Apart from these, there are some additional services for customers.

IIFL Research

When it comes to research, IIFL Securities has figured out a specific structure segregating different recommendation products based on client requirements.

Here are the details:

| IIFL RESEARCH REPORTS | ||

| Report Name | Types | |

| IIFL Recommendations | Idea2Act | Monthly Mutual Fund Report |

Report Name Types Company/Sector Reports IPO Note Sector/Thematic Report

Report Name Types Monthly Reports Monthly Investment Report Monthly Mutual Fund Report Rollover Analysis

Report Name Types Daily/Weekly Reports Weekly Recap Market Mantra Currency Mantra Commodity Mantra Commodity Weekly Evening Commodity Update

As far as the quality of IIFL research is concerned, the broker does a fairly good job.

Traders can make use of IIFL Research Reports to carry out technical research on a stock, whereas investors can use them for making long-term investments.

However, the technical research or tips for short-term i.e. intraday trading or swing trading are around average in accuracy and thus, quality.

Thus, it is better to know the difference between Swing Trading and Day Trading for making a decision about investment.

IIFL Wealth

IIFL Wealth is a separate entity from its broking business and is linked more towards the wealth management of its clients coming from different genres of life.

The firm claims to house around 1000 employees with a presence across 26 locations.

One differentiating factor that goes in favour of IIFL wealth is its segregation of clientele and the corresponding servicing of different segments.

The segregation is done based on:

- First Generation Investor

- Family Business Owner

- Public Figure/Celebrity

- Professional

- NRI Client

With this unique way of client profiling, the firm seems to manage the client requirements and funds management accordingly.

IIFL ONE

IIFL ONE looks to cater to the need of HNI clients for Portfolio Management Services. The platform offers complete transparency in fee structure and is present in 2 offerings

- Fee-based 2. All-In-Cost

IIFL ONE is especially meant for the HNI clients who want to avail the of customized portfolio management services and discipline for their personal portfolio at a very competitive price.

The platform also gives them access to lending terms, wealth structuring, and estate planning services, etc.

IIFL PMS

IIFL asset management brings another important clear, robust, effective, and actively managed investment solution that helps the investor in safeguarding investment and in minimizing risks and volatility.

IIFL PMS portal was founded by Mr. Karan Bhagat in 1995 to offer both discretionary and non-discretionary services for clients.

It delivers the investment philosophy based on the hybrid, data-driven, and high-conviction strategy. It makes use of hi-tech data-driven approaches that help in generating risk management and in availing good returns over time.

Also, the management teamwork in collaboration with investors to understand the nuances of finance and to understand the risk factors. This helps them to guide their investors to make wise and fruitful investment decisions.

IIFL App

This full-service stockbroker has an array of trading platforms available across all kinds of devices. Here are the details of the top-notch and tech-based trading platforms of IIFL Securities:

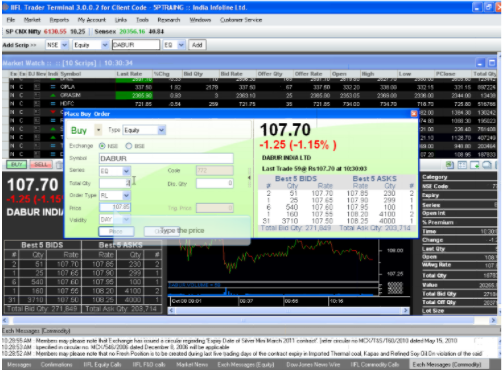

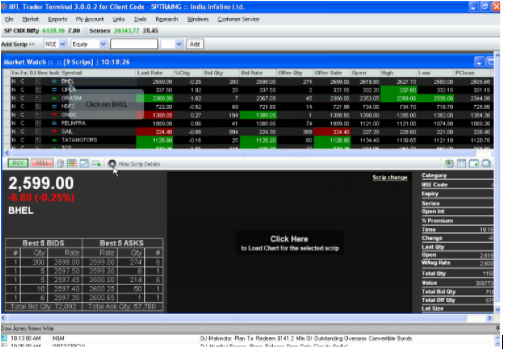

IIFL Trader Terminal

IIFL Trader terminal is an executable application that can be installed on a laptop or a desktop to carry out trading.

A .net framework needs to be installed before installing this particular application. As of now, it is available only in the windows version but is loaded with these features such as

- Real-time market watch updates

- Highly secure with various authentication measures

- Quick and confirmed order executions with decent speed and performance

- Access to market calls, research reports, and market mantras for users looking for technical and fundamental analysis.

- Multiple types of IIFL charts, technical indicators, heat maps for analysis

- Customization and personalization are allowed at multiple levels with users allowed to change the dashboard widget set alerts and notifications.

- IIFL Fund Transfer to and from the trading account across more than 40 prominent banks of India including ICICI, Axis, HDFC, etc.

Here are some of the screenshots of IIFL trader terminal for desktop

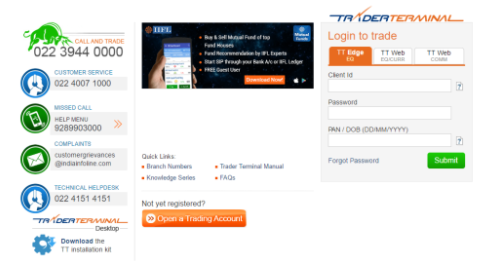

The trader terminal application is also available as a browser-based trading platform.

Users do not need to download or install any software in this case but just visit a particular link, log in and then they can start trading directly from any desktop or laptop.

Depending on what particular segment you like to trade, there are different logins for

- Equity

- Currency

- Commodity

This is a single sign-on application with:

- Data tools and charts

- High-speed order execution

- Heatmaps

- Latest market tips and research reports

This is the login screen of the web trader terminal

Along with this, the broker offers the web trading application called IIFL TT Web that allows you to directly reap the benefit of trade. Just login with the login credentials and start planning your investment.

Also Read: How to Buy Shares in IIFL App?

IIFL Markets

IIFL Markets App is a new age trading mobile app from India Infoline and is available for Android, iOS, and Windows users as well.

It is one of the top-rated mobile apps at the Android store with a 4.4 rating from more than 20,000 users. Some of the features of the mobile app include:

- One swipe trading feature allows you to trade with a single swipe only making sure you don’t lose out on the apt opportunities.

“IIFL Markets is proven to be one of the top-performing mobile apps in India with multiple features and reasonable speed. Get a guest login by providing your details here and the username and password will be emailed back.”

- Stock watch lists up to 50 scrips help you to handle the stock market portfolio in a much better way.

- Users can apply for IPO/OFS using the IIFL Securities mobile app itself. Not many brokers provide that provision in their mobile apps.

- A unique message board feature allows users to understand other’s take on the market situation.

- Users can set up alerts from different aspects such as Price threshold, stock price percentage increase/decrease limit, etc.

- The app helps guide customers in opening and run their IIFL Demat Account.

- Also, you can easily put stop loss in IIFL app and trade by minimizing your risks and losses.

Here is the mobile app tutorial on How to Use IIFL Market App

Here are the stats of the mobile app from Google Play Store:

Number of Installs 1,000,000 - 5,000,000 Mobile App Size 17 MB Negative Ratings Percentage 9.01% Overall Review

Update Frequency Cycle 3-4 weeks Android Version 4.1 and Up iOS Version 8.0 and Up

IIFL Mutual Fund App

IIFL Mutual Fund app is another important software offered by IIFL Securities that was created for both android and iOS platforms. This app is helpful to invest in mutual funds online.

Using this app, you can buy, sell, SIP, and monitor your mutual fund investment easily and conveniently. Also, the app helps view the scheme, and in grabbing the latest news and other relevant information.

* Apart from this there is another software, IIFL TTIris that provides you with trading tips and market movement in real-time.

IIFL Account

IIFL Securities offers two different types of accounts; Demat account and Trading account.

However you can have either of the two accounts with the firm, but it is good to reap the benefits of the IIFL 2-in-1 account.

This helps you to experience seamless trading and in hassle-free transactions for buying and selling stocks.

You can open the account via both online and offline methods. Once you open the account you will get the login credentials which gives you access for various available trading platforms.

With the IIFL account, the customer can avail many benefits like:

- Single login id to access every platform and to trade in different segments.

- Also, the account offers you the Next Generation Solution that helps you in availing the real-time streaming quotes and quick order execution.

IIFL Demat Account

IIFL Demat account is the gateway to trade. To open a Demat Account you have to undergo the account opening process and submit all the documents for the demat account.

If you already have a demat account with any other broker and want to transfer your bought shares then it is a must to know about How to Transfer Shares in IIFL Demat Account? to make your trading easy and hassle-free.

However, the Demat Account opening charges of IIFL is Nil but it is mandatory to pay AMC charges on the yearly basis to keep your account active.

IIFL charges ₹400 as the AMC charges from the second year onwards.

Further, the list of IIFL Demat Account charges has other charges such as DP charges, custodian fees etc

Once you are done with the account opening process you will be provided with the Demat Account number that is required whenever you trade.

Demat Account is where all your shares, mutual fund, bonds are secured in an electronic form.

Thus, it gives you a convenient way to track your securities and investment online.

You can open the IIFL Demat Account individually or have a joint account.

Apart from this, you can fill the IIFL POA form to give your broker the right to debit the shares from your Demat Account.

IIFL Trading Account

IIFL trading account is the account that contains your cash and holdings. With the IIFL Trading account, it becomes easy for traders to buy and sell their stocks in the market easily.

To open the trading account, you need to enter certain personal information and submit relevant information for validation.

To open a trading account, the customer has to pay the one-time IIFL trading account charges of ₹750.

So open the trading and demat account with the firm and reap the maximum trading benefits.

IIFL Charges

When you open an account with IIFL Securities, there are a couple of charges that you need to take care of. This includes IIFL Charges for Trading and Demat account facility:

| IIFL CHARGES | |

| Trading Account Opening Charges | NIL |

| Demat Account Opening Charges | NIL |

| Annual Maintenance Charges (AMC) | Free AMC for 1 year since plan activation & ₹450 per year post that |

Thus, as you can see the account opening and maintenance charges are very much the same to those of the other stock brokers in India.

Thus, in a sense, it may be put in the bracket of Premium Stock Brokers of India.

IIFL Brokerage Charges

IIFL Securities has a brokerage plan named IIFL Z20 plan that offers extremely affordable brokerage charges to its clients. This brokerage plan is amazing as the charges have been slashed by a large percentage.

IIFL delivery charges have been reduced to zero. Other than this, the broker imposed minimal brokerage for other trading segments and is limited to ₹20 or 0.05% per trade.

IIFL Equity Brokerage

As already discussed there are no brokerage fees for equity delivery in IIFL. However, for equity options, the charge is Flat ₹20 per executed trade.

Other than this, IIFL equity intraday brokerage is ₹20 or 0.05% per trade. It means that the client has to pay a maximum of ₹20 as a brokerage charge.

For simpler understanding, this information has been tabulated below:

IIFL Securities Brokerage Plan Trading Segment Brokerage Charges Delivery Trading ₹ 0 for all trades and segments Equity Intraday ₹ 20 or 0.05% per executed trade, whichever is lower Equity Options Flat ₹ 20 per executed trade Currency ₹ 20 or 0.05% per executed trade, whichever is lower Commodity ₹ 20 or 0.05% per executed trade, whichever is lower Futures & Options ₹ 20 or 0.05% per executed trade, whichever is lower

IIFL Options Brokerage

As already discussed, that the Z20 plan offers much relaxation to investors and traders. Similar to trade-in options in IIFL, you can execute the trade by paying the brokerage of ₹20 per lot or 0.05% per trade.

Here is the detail of options brokerage in IIFL:

| IIFL Options Brokerage | |

| Equity Options | ₹20 per lot |

| Commodity Options | ₹20 per lot or 0.05% per trade (whichever is lower) |

| Currency Options |

IIFL Transaction Charges

Here is the full list of IIFL Transaction charges:

The transaction charges have been changed to being according to the Statutory charges stated by the corresponding stock exchange.

As per the industry standards and the value prescribed by SEBI, this stockbroker charges reasonable transaction charges from its clients.

This is unlike few stockbrokers that charge much higher transaction charges after displaying low brokerage charges.

So from that perspective, India Infoline is a trustable broker.

IIFL Margin

Here are the details on the margins provided by this full-service stockbroker:

Equity Upto 20 times Intraday & 3 times for Delivery Equity Futures Upto 3 times for Intraday Equity Options Buying no leverage, Shorting upto 3 times Currency Futures Upto 2 times for Intraday Currency Options Buying no leverage, Shorting upto 2 times Commodity Upto 3 times for Intraday

IIFL Customer Care

IIFL Securities has the following communication channels for its clients to reach out to them:

- IIFL Securities Toll-Free Number

- Phone

- Offline branches

- Missed Call Service

Although IIFL has multiple communication channels, when it comes to service there seems to be some sort of bifurcation done which is pretty hard to understand.

The broker seems to have a structure defined where medium to heavy trading clients are given much more emphasis from the customer service team.

Thus, beginners or small investors might have a hard time (initially) in getting their voices heard.

But once you are into the system, then you will be able to understand the intricacies in place. Then it becomes much easier and quicker for you to use the services of the full-service stockbroker.

IIFL Advantages

Some of the advantages of opening an account with IIFL Securities are:

- Huge presence across different parts of the country with over 4000 branches

- The broker was established more than 20 years back in 1995, thus, stability and trust factor are certainly there.

- Allows to invest in all sorts of segments

- The mobile app IIFL Markets is one of the top-performing ones in India.

- High tech trading platforms, especially on mobile

IIFL Disadvantages

Here are some of the concerns about IIFL Securities that you must be aware of:

- India Infoline is one of the highest complained about broker on BSE and NSE

- Some of the prominent concerns raised have been around customer service

- Investing in some of the segments such as Mutual funds is not as easy as some of the other full-service brokers

“IIFL has received 7 complaints in this financial year of 2019-20, which is 0.01% of their overall client base. The industry average is also 0.01%.”

Interested to open an account?

Enter Your details here and get a call back right away.

Next Steps:

Post this call, you need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of the documents required for the demat account.

IIFL Membership Information

Here is the membership information of the IIFL Securities with different exchanges and intermediate parties:

Entity Membership ID BSE INB011097533 NSE INB231097537 BSE Currency INF011097533 MCX INB261097530 Registered Address IIFL Center, Kamala City, Senapati Bapat Marg, Lower Parel (West), Mumbai - 400013

The details can be verified from the corresponding websites of the exchanges.

IIFL Partner

IIFL Securities the full-service stockbroker allows to partner in the form of an IIFL sub-broker or authorized person (IIFL advisor is the internal term used).

There are a set of conditions one needs to follow along with a basic initial investment of ₹25,000.

As per the broker, the advisor gets IIFL AAA Tab to access IIFL AAA that further helps them to track the progress of its clients.

Furthermore, revenue sharing may vary, based on multiple factors including the size of your client, business location, etc. but generally falls within the range of 40% to 70%.

IIFL Address

As mentioned above, the broker has presence across 1000s of locations in India and outside. However, if you are looking for their registered offices, here are the addresses:

Registered Office

IIFL Home Finance Ltd

IIFL House, Sun Infotech Park,

Road No. 16V, Plot No. B-23,

MIDC, Thane Industrial Area, Wagle Estate,

Thane – 400604

Corporate Office

IIFL Home Finance Ltd

Plot No. 98, Udyog Vihar Phase IV,

Sector 18, Gurgaon, Haryana 122016

IIFL Branches

Although most of the services of IIFL Securities are available online and can be easily available by visiting the website, the firm is distributed all around through its wide network of branches.

The potential or existing customers can visit their local IIFL branches to open their IIFL Trading and Demat Account.

If you are in the area where there is no nearest branch then you can visit the website and open the account online and access your account via online trading platforms.

The full-service stockbroker has a presence in the following locations through their sub-broker and franchise networks:

States/City Andhra Pradesh Chittoor Hyderabad Kakinada Anantpur Rajahmundhry Vijaywada Vizag Nellore Ongole Secundrabad Guntur Tirupati Assam Dispur Guwahati Jorhat Siliguri Tinsukia Ulubari Kokrajhar Lakhimpur Bihar Patna Chhatisgarh Bilaspur Raipur Korba Durg Bhilai Delhi/NCR Gurgaon Noida New Delhi Gujarat Ahmedabad Anand Vadodara Bhavnagar Gandhinagar Junagadh Morbi Navsari Palanpur Rajkot Surat Unjha Veraval Haryana Faridabad Jagadhari Karnal Panipat Rewari Yamunanagar Jharkhand Dhanbad Jamshedpur Ranchi Karnataka Bangaluru Hubli Mangalore Mysore Shimoga Tumkur Kerala Kochi Kottayam Thrissur Trivandrum Aluva Calicut Kannur Kayamkulam Kollam Kunnumkulam Palakkad Pathanamthittha Madhya Pradesh Gwalior Indore Jabalpur Ratlam Satna Maharashtra Amravati Kolhapur Mumbai Nagpur Nashik Pune Navi Mumbai Thane Orissa Bhubaneswar Raurkela Punjab Amritsar Chandigarh Jalandhar Ludhiana Bathinda Ferozepur Patiala Sangrur Rajasthan Ajmer Bundi Jaipur Jodhpur Sikar Kota Sikkim Sikkim Tamil Nadu Chennai Coimbatore Kumbakonam Madurai Trichy Ooty Salem Sathymangalam Tirupur Telangana Khammam Tripura Agartala Uttar Pradesh Agra Aligarh Bareilly Kanpur Lucknow Meerut Varanasi Moradabad Ghaziabad Allahabad Uttarakhand Dehradun Haldwani Haridwar Rudrapur Roorkee West Bengal Durgapur Gangtok Kolkata Kharagpur Siliguri

IIFL Forms

When it comes to forms of IIFL Securities, obviously, there are two kinds of forms that the clients are primarily looking for:

Although the account can be opened online, if you are old-school, then you can just download any of these forms, take a print out, fill them up and deposit at the closest IIFL Securities branch or office.

The corresponding action will be taken by the broker as per the form submitted.

Conclusion

IIFL is certainly one of the most promising full-service stock brokers in India. It presents multiple values to its clients through its focus on technology with its mobile apps, wide offline presence, multiple brokerage plans, and so on.

Established in 1995, IIFL Securities not only has an enviable physical presence with offices in more than 4000 locations across 900 cities of the nation but also has an impressive client base of around 2.8 lakhs.

Having an account with the stockbroker offers investors the option to explore almost all of the investment instruments. Be it equity, commodities, currency or ETFs and NCDs, with IIFL Securities there is no shortage of options.

The biggest appeal of IIFL Securities is their high tech, cutting edge trading platforms accessible across various devices and flexible brokerage plans to suit the client’s preference.

However, IIFL clients have shown concerns around below-average customer service. Thus, it becomes difficult for beginners or small investors to use this broker’s services.

Furthermore, with the advent of discount brokers, the competition for brokers such as IIFL becomes even more intense.

IIFL FAQs

Here are some of the frequently asked questions about this full-service stockbroker

- Is there any minimum account balance I need to maintain with IIFL Securities?

No, India Infoline does not keep any condition on its clients to maintain a minimum balance. However, to open an account with this full-service stockbroker, you need to start with at least INR 10,000 as the initial account deposit.

2. What are the account opening and maintenance charges?

The account opening charges at IIFL are pretty high at ₹750 for the Trading account and ₹555 for the Demat account.

If you look at the industry benchmarks, generally account opening is in the range of ₹200-₹700, while here it is around ₹1300 for both the accounts.

3. How is the research quality through its trading calls and reports?

This full-service stockbroker is known to be one of those stockbrokers that provide quite accurate tips and recommendations. Their research team is pretty prominent and visible across multiple media channels.

Furthermore, this full-service stockbroker is known to come up with multiple innovations in the research domain every now and then.

4. What are the brokerage charges levied by IIFL?

The broker offers multiple brokerage plans for its clients. Overall brokerage is high, especially for small investors or beginners.

However, if you can produce high stock market turnover every month or subscribe to any of their subscription plans by paying a specific amount at upfront, then you can negotiate for lower brokerage charges across segments.

5. Is IIFL Safe?

Yes, IIFL has been around for a while now (22 years to be precise).

This, the broker is certainly stable in its operations. It has an employee base of >8000 and a sub-broker/franchise network of >4000 across India. Thus, the broker, with its numbers, looks promising and reliable.

6. What are the transaction charges?

The transaction charges at IIFL are pretty reasonable at 0.00325% of your trade value for Equity Intraday and delivery. For more details, you can check the ‘Transaction charges’ section above.

7. How is the customer service quality?

Although IIFL offers multiple communication channels, the quality of the service certainly has some sort of inclination towards medium to heavy traders.

In fact, such traders are provided with exclusive one to one relationship executives to help and guide such clients with their portfolios.

Beginners or small investors do get relationship managers too but those executives handle numerous clients with similar tips and recommendations.

8. In what segments I can trade using IIFL services?

With the services of IIFL, you can trade and invest in more than 10 products such as Equity, Mutual funds, Insurance, Commodity, Currency, Fixed Deposits, Bonds, and more.

Thus, in a sense, you don’t require any other financial house for your investment needs of different kinds.

Also, check out the comparison of IIFL Vs other stockbrokers here

Thinking to open a Demat Account? Please refer to the below form

Know more about India Infoline(IIFL)

If you are looking to know more about this broker, here are a few reference links for you

IIFL is a fraud and with people full of frauds. their staff named Rahul(rahul.karandikar@iifl.com/+91-8169247973) had been luring me with all cheap offers they have and i wanted to put it in email so i have proof of everything he said. he didnt do both the times in dec and in may. and in just one week after he spoke, my email to him has failed by saying his id is disabled. just when he is talking to investors, why the id be disabled unless he or IIFL is fraud

IIFL NOT TO BE TRUSTED AND NO INVESTORS SHOULD DO BUSINESS WITH THOSE FRAUDS WHATSOEVER

THESE PEOPLE ARE FRAUD, THEY HAVE SOLD ALL MY SHARES WITHOUT INFORMING ME AND WHEN I CHECKED THE LEDGER SHEET THERE WERE HIDDEN CHARGES ALSO. I HAVE FILED A COMPLAINT TO SEBI FOR THE SAME. PLEASE SAVE YOURSELF FROM GETTING LOOT FROM THESE PEOPLE, WORST AND FARUDY TRADING PLATFORM EVER.

Hi Shubham,

I have also similar problem with IIFL, what is the outcome of your complaint to SEBI? It will help me in fighting my case

They will just cheat you in a way that you won’t be knowing it. They will offer you best rate But with the passage of time, they will increase the interest rate to the level that you won’t realize that you are paying extra money as the EMI will remain same even when the Principal Amount will decrease and in the same ratio they will increase the interest rate. Don’t take loan because once all the formalities have been done, they will impose the Insurance also. which will cost about 4% of total amount.

They wont charge any processing fee. they will lure.

customer service is worst.you can’t contact them. stupid service.

Rather go for HDFC, SBI or a Big bank. They will take processing fee but provide much better services. Here IIFL don’t take any processing fee but they increast interest rate and will burden you with Insurance(compulsory) of Loan also. which will be much costlier than the processing fee by Banks such as HDFC or SBI.