Indira Securities

List of Stock Brokers Reviews:

Indira Securities or IndiraTrade, a full-service stock broker based out of Indore, was founded by the Indira Group in 1987 and has provided reasonable services ever since.

The broker became a CDSL member in the year 2002 and of NSE in 2008. A few years back in 2016, it got the authorization for portfolio management services.

Indira Securities Review

The company provides broking services in equity, commodity trading and derivative trading, along with depository services, NRI Demat Account, portfolio management services, mutual funds services and merchant banking.

Here is a quick summary of some of the services provided by Indira Securities are:

- Equity trading

- Research & Advisory

- Derivatives Trading

- Commodity Trading

- Algo Trading

- Depository Services

- IPO

- Mutual Funds

- Dematerialisation, Rematerialisation and Pledging of shares

- Merchant banking services

Indira Securities Active Clients

As of 2020, Indira Securities reported 6,226 active clients.

The clientele of this full-service stockbroker ranges from small conscious investors to high net-worth individuals to corporates. The company also caters to non-resident Indians, with specialised services for them.

The number of active clients mentioned above places Indira Securities among one of the smaller stockbrokers in the country.

For More: Top Stockbrokers with Highest Active Clients

Indira Securities Research

Indira Securities helps the investors in keeping themselves updated about the market through its comprehensive research and reports. The reports include:

- Morning Reports

- Weekly Reports

- Sector Reports

- Monthly Newsletters

- Company Research Reports

- IPO Reports

- Alpha Delivery Pick

- Research Performance

- Special Reports

This full-service stockbroker also has a division named Indira Gurukul for providing training and advisory to the individuals. It provides training programs and share market courses, along with breaking news, information and advice related to trading.

Indira Securities Trading Platforms

Indira Securities provides both a web-based online trading interface and an application-based trading platform.

Indira Investor Web

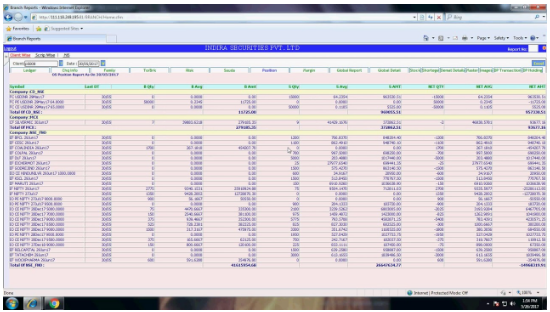

The web trading platform of Indira Securities is sophisticated and based on the “NETNETHT” technology. The transactions are seamless, fast and secure.

The platform can be used for trading through the website from anywhere in the world. It has all the features like:

- Advanced charts,

- Market Watch,

- Live updates and alerts.

The platform can be used to place, cancel or modify orders, and to view the order book, transactions book and account balance.

Indira Trader Terminal

The application-based terminal involves downloading the Diet Software on the desktop. The software can then be used to trade. ODIN Diet is an excellent software with access to real-time market data, market watch, smart order execution and dynamic portfolio.

It has various decision support tools like real-time charts, numerous calculators, Greek Neutraliser and Greek Market Watch, Pivot Point Support/Resistance Watch and Heat Map.

The software provides unmatched user experience and seamless integration through the back office, mutual fund module, IPO module and RSS feeds. The software also supports fund management by payment gateway integration.

You can read this review in Hindi as well.

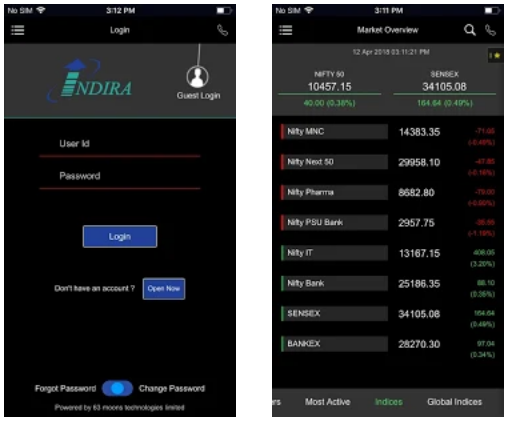

I-WIN- Mobile Trading Application

The mobile trading app for Indira Securities is called I-Win. The application provides a live stream feed and an online trading platform for all Indian exchanges, for all segments.

The app can be used to access data, reports and live research calls. The users also have access to the back office details like ledger balance, holdings, bills etc. The application has excellent features, however, it lacks user-friendliness.

Indira TradeInsta

Indira Securities provides an in-house mobile trading app as well. The application is, as of now, at a nascent stage, in terms of the overall features it has to provide. However, the broker has been updating the app on a regular basis bringing in newer features every time.

Some of the top features you can access in this app are:

- Live market feed from different indices

- Access to your positions, holdings, margins

- A quick check on analytics, watchlists, your portfolio

This is how the app looks like:

Some of the concerns raised by the users of this app are:

- Basic user interface and designs

- Only a limited number of features to access are available

Here are a few stats of this mobile trading app from the Google Play Store:

| Number of Installs | 1,000+ |

| Mobile App Size | 21 MB |

| Negative Ratings Percentage | 4% |

| Overall Review |  |

| Update Frequency | 4-6 Months |

Indira Securities Customer Care

The customers and clients of Indira Securities can get in touch with them through:

- Phone

- Branch Offices

- Post

The customer care provided by this full-service stockbroker is good, with dedicated relationship managers and a compliance officer.

Indira Securities Pricing

Here are the pricing and charges related to your Demat and trading account with this stockbroker:

- The company provides three options for opening an account.

- For the first option, the account opening fee is ₹100 and the annual maintenance charges vary based on the valuation of the stock in the account. If the valuation is less than ₹50,000, there is no AMC, if the valuation is between ₹50,000 and ₹2,00,000, the AMC is ₹200 per year and if the valuation is above ₹2,00,000, the AMC is ₹460 per year.

- In the second option, the account opening fee is ₹1,500 and there is no AMC.

- In the third option, the account opening fee is ₹3,000, with no AMC and the entire amount of ₹3,000 gets refunded on closing the account.

Here is a quick summary:

| Account Opening Option | Initial Margin | Account Opening Charges | Annual Maintenance Charges |

| Option 1 | <₹50,000 | ₹100 | ₹0 |

| ₹50,000 and ₹2,00,000 | ₹100 | ₹200 | |

| >₹2,00,000 | ₹100 | ₹460 | |

| Option 2 | NA | ₹1500 | ₹0 |

| Option 3 | NA | ₹3000 (Refundable) | ₹0 |

Indira Securities Brokerage

When it comes to brokerage, Indira Securities charges the following brokerage rates across your trading segments:

- The brokerage charges are 0.03% for intraday trading and 0.3% for delivery trading.

- For Options trading, you are required to pay ₹60 per lot and for futures trading, you will be paying 0.05% of your trading value.

Remember, the brokerage charges of full-service stockbrokers are always a percentage of your overall trading turnover. For example, if you trade for ₹75,000 in the delivery segment, then you will be paying ₹225 as brokerage to your broker.

Here is a quick summary on the brokerage charges charged by this full-service stockbroker:

| Equity Delivery | 0.3% |

| Equity Intraday | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹60 per lot |

| Currency Futures | 0.03% |

| Currency Options | ₹60 per lot |

| Commodity | 0.03% |

You must check out this Indira Securities Brokerage Calculator for details on the sorts of charges and taxes applied on your trades if you use the services of VRise Securities.

Indira Securities Margin

Here are the exposure values provided by Indira Securities across segments:

- The exposure provided for intraday trading is up to 10 times.

- The leverage provided for delivery trading is up to 3-4 times. It can increase to 5-6 times, depending on the credibility and usage of the client.

Indira Securities Advantages

Some of the positives of using the services of this stockbroker are:

- The company has optimum brokerage charges.

- The research team is skilled and experienced, with a high hit ratio.

- The technology provided for trading is sophisticated and advanced.

Indira Securities Disadvantages

You must also be aware of the negative side of the coin and thus, here are a few areas of concern about this stockbroker:

- The physical presence of Indira Securities is limited to a few states.

- Low brand Equity.

Indira Securities Membership Information

The stockbroker is associated with many regulatory bodies of the Indian stockbroking space and here are the membership details:

| Entity | Membership ID |

| SEBI | INZ000045136 |

| BSE | INB011286631 |

| NSE | INE231286635 |

| PMS | INP000005018 |

| CDSL | IN-DP-CDSL-75-2000 |

| MCX | 12375 |

| NCDEX | 00078 |

| Registered Address | Indira Securities Private Limited Indira House, 3rd Floor, 5 Topiwala Lane Opp. Lemington Road Police Station Grant Road (East) Mumbai- 400007 Maharashtra, India |

In case you are looking to get started with stock market trading or investing in general, let us assist you in taking the next steps forward:

Indira Securities Branches

The head office of Indira Securities is located in Indore, with a registered office in Mumbai. The regional office for West is in Jaipur and for North is in Rishikesh.

The other branch offices are located in Indore, Ujjain and Shivpuri in Madhya Pradesh and Nellore in Andhra Pradesh.

More on Indira Securities

If you wish to learn more about this stockbroker, here are a few references for you: