ISS Enterprise

List of Stock Brokers Reviews:

ISS Enterprise Limited, formerly known as ISE Securities Limited, is a wholly-owned subsidiary of Inter-connected Stock Exchange of India Limited (ISE). SEBI permits a stock exchange to operate a subsidiary to become a member of large stock exchanges.

In total, the broker has an offline network of 80 branches across the top cities in the country, primarily first-tier ones.

ISS Enterprise Review

ISS Enterprise was incorporated in 2000 as a trading and clearing member of BSE and NSE.

This full-service stockbroker is operational as a member of the capital market segment and futures & options segment of NSE and capital market segment of BSE.

The full-service stockbroker works through the system of sub-brokers and does not undertake any security dealing on its own account.

A trader needs to connect with a sub-broker who, in turn, will be associated with ISS Enterprise. Furthermore, the broker collects margins from its sub-brokers.

This broker provides stockbroking services and helps the clients in cost-effective and efficient trading and settlement services. The company also serves as a depository participant with CDSL and provides depository services at efficient prices.

This stockbroker deals in the equity market, derivatives, commodities, IPOs and mutual funds (more in this later).

ISS Enterprise Active Clients

As of 2020-21, ISS Enterprise has 15,102 active clients. The company takes all the required measures to maintain and secure its client base, and relationships with them.

The clients include retail investors, corporate investors, high net-worth individuals and others, all dealing through sub-brokers.

ISS Enterprise Products and Services

ISS Enterprise provides products and services in equity, derivatives, and commodity, IPO & Mutual funds segments. The company is backed with extensive research in order to provide efficient broking advice to its clients.

At the same time, it is also in the distribution of financial products like mutual funds and related advice and provides investment advisory services as well. It also provides demat services and depository services to its clients.

ISS Enterprise Trading Platforms

The stockbroker provides a third-party terminal software as well as an in-house web-application software for your share market trading and investments.

Here are the details:

ODIN -Trading Platform

ISS Enterprise provides trading services through ODIN. It is an application-based trading platform which helps the clients to connect to the broker’s server through the internet. It has all the features required by active traders.

It provides an anytime anywhere trading facility, fast performance and low bandwidth requirement. The quotes are accessible on a real-time basis and the platforms can directly be used for buying and selling orders on the exchanges.

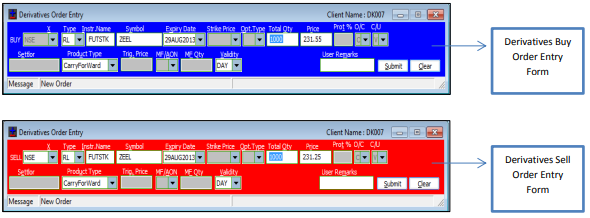

This is how the application looks like:

There are a couple of concerns with this application that you must be aware of:

- The trading platform is relatively bulky. Thus, you would need a laptop or computer with relatively higher RAM and processing speed for a smooth trading experience.

- The overall user experience of the application can be improved in terms of navigation, ease of use etc.

SPARC-Web Platform

ISS Enterprise provides web trading platform through SPARC. The platform is used for back office requirements of the clients like checking the ledge balance, holdings and orders. The platform can also be used for customer care services.

At the same time, this stockbroker does not provide a mobile application yet which is really surprising. This comes out as one of the biggest disadvantages of using this stockbroker for your stock market trading.

ISS Enterprise Research

Although ISS Enterprise is a full-service stockbroker, it still provides almost no research to its clients. Whatever research is provided, it is of mediocre quality as far as accuracy is concerned.

At the same time, the stockbroker provides “paid” research service to its clients, which is actually a misfit in the stockbroking space. This is because service such as research and recommendations come complimentary when you open an account with a full-service broker.

Nonetheless, following are the subscription-based services provided by ISS Enterprise:

- Friday Telefolio: ₹7500, for ISE Clients: ₹3750

- Wednesday Telefolio: ₹7500, for ISE Clients: ₹3750

- Friday Telefolio Plus: ₹10000, for ISE Clients: ₹5000

- Wednesday Telefolio Plus: ₹10000, for ISE Clients: ₹5000

- Friday + Wednesday Telefolio: ₹13000, for ISE Clients: ₹6500

- Friday + Wednesday Telefolio Plus: ₹18000, for ISE Clients: ₹9000

Depending on your requirement, you may choose to buy any subscription plan for your trades.

ISS Enterprise Customer Care

ISS Enterprise has reasonable customer care services.

The customers deal with the sub-brokers, however, any concern can be raised directly with the company as well. The communication with the company can be made through phone, emails, chat or on the offline branches.

There are help desks as well, and relationship managers are assigned to a set of intermediaries.

ISS Enterprise Pricing

- It is to be noted that the pricing structure of ISS Enterprise varied from sub-broker to sub-broker. The account opening charges and the annual maintenance charges are specific to the sub-broker who, in turn, pays a commission to the company.

- For the demat account, there are no account opening charges and an annual maintenance fee of ₹300 for individuals and ₹1000 for corporates. There is also a transaction fee of ₹15 per transaction.

- With reference to ISS Enterprise, it charges 0.025% securities transaction tax on NSE and BSE cash intraday and delivery trading, 0.017% on the sell side, and 0.125% on the sale of an option in NSE Futures & Options segment.

- The transaction charges charged are 0.0035% on NSE and BSE cash intraday and delivery trading.

- Additionally, ISS Enterprise charges stamp duty charges, service tax and SEBI fee on intraday, delivery and futures & options trading.

ISS Enterprise Brokerage

Here are the brokerage charges levied by ISS Enterprise to its clients:

- Again, the brokerage is specific to each sub-broker.

- ISS Enterprise charges a brokerage of 0.0075% on intraday trading and 0.02% on delivery trading done through ODIN and Net Branch, and 0.0125% for intraday and 0.035% for delivery trading through Net Profit.

Having said that, it also depends on your initial deposit and the trading turnover on the stock market. Higher the amount, lower is the brokerage amount you end up paying to the broker.

Check this ISE Securities Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

ISS Enterprise Margin

- Apart from the margins provided by the sub-broker to the trader, ISS Enterprises collects margins from the sub-brokers to allow trading limits.

- VaR margin-based exposure limits are given to the sub-brokers.

- Margins are transferred to the Exchange for obtaining trading limits.

Overall, speaking from the industry perspective, this stockbroker provides some of the lowest margin values to its clients, which works as another turn-off.

ISS Enterprise Advantages

Here are some of the positives of using the services of ISS Enterprise for your share market investments:

- The stockbroker has a brand image that lends its security. The transactions are very safe and secure.

- The customer base is very wide and the offline locations are numerous. The customers are assigned relationship managers to take care of their concerns.

- The company has a good track record of compliance.

ISS Enterprise Disadvantages

At the same time, the following are the concerns you must be aware of as well:

- There is no possibility to deal with ISS Enterprise directly.

- The mediation of sub-brokers increases the brokerage fee and transaction charges to some extent.

- There is no mobile application yet.

In case you are looking to start trading and want to open a reliable demat account, let us assist you in taking the next steps forward:

ISS Enterprise Membership Information

Find the membership information of ISS Enterprise with different regulatory bodies in the stockbroking space:

| Entity | Membership ID |

| BSE | INB011077733 |

| NSE | INF231077737 |

| MCX-SX | INE261077737 |

| Registered Address | ISE Securities & Services Limited "Dakshna" Building, 6th Floor, 601 & 602, Near raigad Bhavan, Sector-11,CBD-BELAPUR, Navi Mumbai-400 614 |

ISS Enterprise Branches

Presently, ISS Enterprise has 80 branches in India in Agra, Ahmedabad, Ahmednagar, Allahabad, Aurangabad, Bahadurgarh, Balasore, Baroda, Belgaum, Bhandara, Bhopal, Bhubaneshwar, Bina, Burdwan, Burhanpur, Chaibasa, Chapra, Chennai, Chhatrapur, Coimbatore, Cuttack, Darbhanga, Delhi, Dhakuria, Dhanbad, Ghaziabad, Goa, Guwahati, Gwalior, Hissar, Hubli, Hyderabad, Indore.

Furthermore, there are offices in Jaipur, Jalandhar, Jamnagar, Jamshedpur, Jharkhand, Kalyan, Kanpur, Karaikudi, Karnal, Karur, Katni, Khandwa, Kinnigoli, Kloor, Kolkata, Lashkar Gwalior, Lucknow, Madurai, Mangalore, Mumbai, Nagpur, Navi Mumbai, New Delhi, Noida, Ongole (A.P.), Palani, Patna, Perumannur.

Finally, ISS Enterprise has presence in Pune, Punjab, Raichur, Raipur, Rajapalayam, Rajkot, Ranchi, Sagar, Salem,Sambalpur, Sangli, Sasaram, Silchar, Siliguri, Sirsa, Surat, Thane, Thiruvananthpuram,Tirupur and Vadodara.

More on ISS Enterprise

If you wish to learn more about this full-service stockbroker, here are a few references for you: