iTradeOnline

List of Stock Brokers Reviews:

iTradeOnline is a discount stockbroker from the house of Trustline which is a Noida based full-service stockbroker. Established recently, iTradeOnline although is a discount stock broker but it still offers free research and recommendations in Equity, Commodity and currency segments.

iTradeOnline Review

This initiative from Trustline certainly gives impetus to the fact that full-service stockbrokers are feeling the heat from the wave of discount stock brokers and thus, they are coming up with their own discount broking initiatives.

We have seen that with 5Paisa from IIFL, Trade Smart Online from VNS Finance, My Value Trade from Master Capital and so on.

Nonetheless, as far as iTradeOnline is concerned, the discount broker has memberships with BSE, NSE and MCX.

As of now iTradeOnline has limited geographical coverage and caters to users from locations including Gujarat, Madhya Pradesh, Andhra Pradesh, Jammu and Kashmir, Meghalaya, Mizoram, Sikkim and Maharashtra (except Mumbai).

You can trade in the following segments:

- Equity

- Commodity

- Currency

- Derivatives

Dr Mukesh Kansal, Chairman and MD – Trustline

iTradeOnline Trading Platforms

Trade Basic

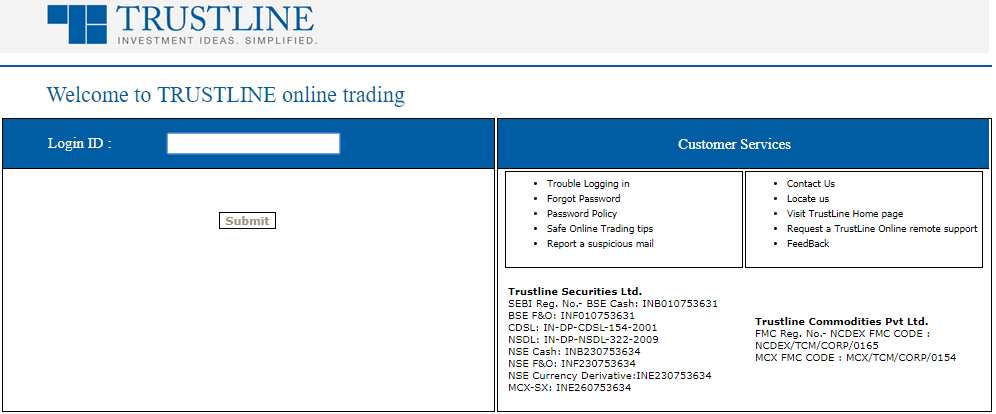

Trust Basic is a web-based browser application supported by Trustline for iTradeOnline.

There is no need to download or install anything to run this application. The user is required to visit a specific link through any browser, be it Internet Explorer, Google Chrome, Safari or Firefox.

This lightweight application works well in 1024 X 768 screen resolution and has been developed by a third party Omnesys technologies. Some of the basic features of the application include:

- Real-time streaming quotes

- Customized market watch lists

- Responsive application design allows users to trade across different devices including mobile, laptop, desktop, tablet or computer.

This is how the application’s login screen looks like:

However, there are few concerns with the application as well, including:

- A limited number of features

- Very few options to perform technical or fundamental analysis

- Speed or performance of the application can be improved.

iTrade Mobile

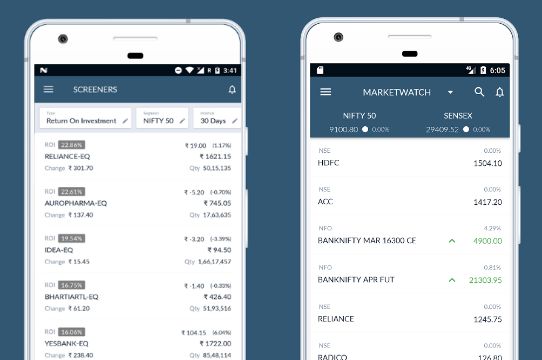

The mobile app from iTrade comes with a reasonable number of features and has a quick update frequency cycle of 3-4 weeks.

This happens for a specific reason as the broker is relatively new in the market and that is why features need to be introduced in every release or update done on the mobile app.

It provides you with the following provisions:

- Market screeners provide an idea of the top stocks of the day

- Latest business news and market information

- Real-time charts with multi-timeframe conversion, technical indicators, drawing tools etc to perform technical or fundamental analysis

- Personalized notifications and alerts on the specific stocks being monitored

- Multiple types of orders including market, limit, stop-loss (SL), Aftermarket orders (AMO), IOC etc allowed to be placed on the mobile app

- Fund transfers between trading and bank accounts allowed

- App available in both iOs and Android versions

This is how the mobile app – iTrade looks like:

At the same time, there are few concerns with the application as well:

- No option to place GTC options and bids

- The app gets stuck at times (it’s not a regular concern, but yes, happens at times)

Here are the stats of the mobile app from the Google Play Store:

| Number of Installs | 1,000-5,000 |

| Mobile App Size | 11.3 MB |

| Negative Ratings Percentage | 14.6% |

| Overall Review |  |

| Update Frequency | 2-3 weeks |

Trust Power

Trust Power is a windows based terminal application that needs to be downloaded and installed on your computer or laptop. Once you do that, just enter the credentials (username and password) received from the broker to start trading.

The terminal software comes with the following features:

- Decent speed and performance

- Online fund transfers allowed

- Market watchlists

- Features such as charting, technical indicators available for technical analysis.

iTradeOnline Customer Service

When it comes to customer support and service, iTradeOnline provides the following communication channels:

- Phone

- Social Media

Even though we give away the benefit of the doubt to a new broker such as iTradeOnline but still the broker needs to work at least on the quality part of communication. iTradeOnline needs to work on the turnaround time and overall quickness to the query resolution time.

In other words, if you are a client of iTradeOnline, keep your expectations pretty low as far as customer support is concerned.

iTradeOnline Charges

Since iTradeOnline is a discount stock broker, thus, the overall pricing is pretty reasonable. Let’s look at all the charges in length here:

iTradeOnline Account Opening Charges

To open and maintain your trading and demat account with iTradeOnline, you are required to pay the following charges to the broker:

| Trading Account Opening Charges | ₹200 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges (AMC) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹300 |

| Demat Account Lifetime Annual Maintenance Charges (AMC) | ₹1000 |

In a sense, there are a couple of AMC plans offered by the discount broker. One, a yearly recurring AMC of ₹300 which needs to be paid every year and two, a one time cost of ₹1000 as lifetime AMC.

iTradeOnline Brokerage

When it comes to brokerage, iTradeOnline offers the following brokerage rates for trading across different segments:

| Equity Delivery | ₹20 per executed order or 0.10% of Turnover whichever is lower |

| Equity Intraday | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Equity Futures | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Equity Options | ₹20 per executed order |

| Currency Futures | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Currency Options | ₹20 per executed order |

| Commodity | ₹20 per executed order or 0.01% of Turnover whichever is lower |

| Call and Trade | ₹20 per executed order |

| Physical copies of contract notes | ₹20 per contract |

Use this iTradeOnline Brokerage Calculator for complete charges and your profit

iTradeOnline Advantages

These are the advantages of iTradeOnline as a discount stock broker:

- Low brokerage rates with a cap of ₹20 per executed order

- Wide range of trading platforms

- Free fund transfer facility available (bank charges separate)

- Research, tips and recommendations provided at both fundamental and technical levels.

iTradeOnline Disadvantages

Here are few concerns about the applications at the same time:

- Performance of trading platforms can be improved along with the addition of new features on a regular basis.

- Limited number of trading and investing products

- Customer support is of mediocre quality

iTradeOnline Membership Information

Here are the membership details of Trustline, the parent company of iTradeOnline:

| Entity | Membership ID |

| BSE | INB010753631 |

| NSE | INB230753634 |

| NSDL | IN-DP-NSDL-322-2009 |

| CDSL | IN-DP-CDSL-154-2001 |

| PMS | INP000004268 |

| MCX | INB260753638 |

| NCDEX | INZ000088230 |

| Registered Address | Trustline Tower, B-3, Sector-3, Noida - 201301 (U.P) |

Are you looking to talk and Open a Trading Account?

Just provide your details in the form below and we will set up a callback for you, right away!

More on iTradeOnline:

| iTradeOnline Review | iTradeOnline Transaction Charges | |

| iTradeOnline Brokerage Calculator | ||

Video Review Video Review | ||