Jainam Share

List of Stock Brokers Reviews:

Jainam Share Consultants is an Indian full-service stockbroker, based in Surat, Gujarat.

The firm was incorporated in 2003 as a broking business for equity markets and in a couple of years also expanded into commodity trading by establishing Jainam Commodities Pvt. Ltd. – their sister concern for the broking business in the commodities market.

Jainam Share Review

Jainam Share holds memberships of the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and the MCX Stock Exchange (MCX-SX) of India for trading in equity markets. For commodity trading, the firm has the membership of the National Commodity & Derivatives Exchange of India (NCDEX) and the Multi-Commodity Exchange of India (MCX).

Apart from the standard broking services such as:

- Equity

- Derivative Trading

- Currency Trading

- Online Share Trading

- Depository services

- Mutual funds

- Insurance

- Fixed deposit

- IPO

Jainam Share also offers research services like fundamental equity analysis and reports, special market reports, IPO analysis, live information desk, investment advisory services, and value-added HNI services.

Also review Equity Investment Types in detail.

The firm has spent fifteen years in the broking business, resulting in a client base of 57,799 in Know Your Customer (KYC) and 40500+ clients in depository participants (DP).

As far as the Active Client base is concerned, Jainam Share clocked 7,195 active clients in the financial year 2019-20.

They have established 450+ outlets for their investors in equity trading in the stock exchanges across the country.

Jainam share believes in adding value for all their customers, be it corporates, retails or HNI Individuals. With this vision, they aim to be the most preferred organization for financial services in India one day.

Read on to know more about the various trading platforms, research services, brokerage details and pros & cons of Jainam Share Consultants Pvt. Ltd.

Jainam Share Trading Platforms

Jainam Share Consultants have established PROSEC Online – a dedicated enterprise for trading technology. PROSEC Online provides the investors of Jainam Share various trading platforms and analysis tools for a hassle-free trading experience.

Here’s a list of some of the noteworthy trading platforms and tools available to Jainam Share investors.

Jainam Share Web

This application offers you a personalized portal with all the information about your debt and equity investment using a single login.

This can only be accessed by those who are existing investors in Jainam Share and have a Unique Client Code (UCC). Using this portal, a client may perform the following features:

- Monitor the performance of the shares they hold

- Get live updates about the markets (NSE & BSE)

- Place buy and sell orders for their holdings in both – debt & equity

- Place buy and sell orders for their holdings in the exchange of their choice

- Trade-in Futures & Options in NSE

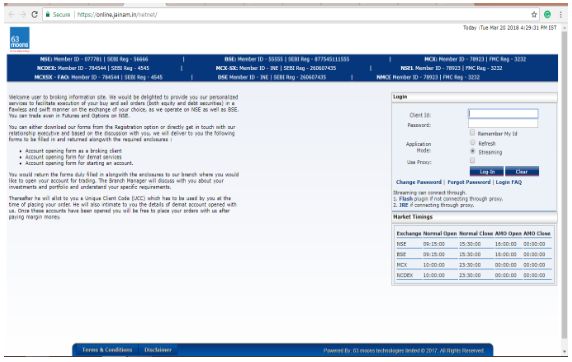

This is how the web trading application looks like:

Jainam Share Smart Office

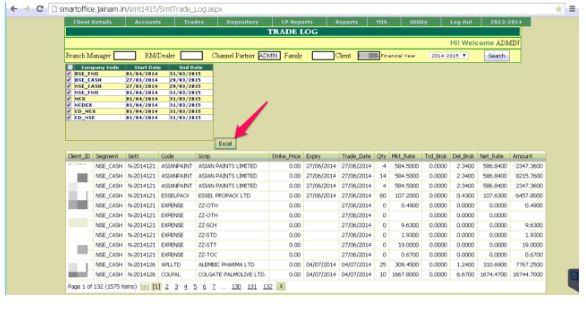

A well-equipped back-office software to help clients track and manage their investments in an efficient way. Designed by Jainam Share sister concern PROSEC Online, Smart Office is not just used by Jainam Share but by many share broking firms around the country. It features:

- Auto-login – Enabling the generation of a new password with the least inconvenience whenever needed.

- Taxation Solutions – This helps investors calculate their short-term and long-term gains along with tax implications, based on their transactions.

- Bonus merger demerger split – Smart Office automatically updates shares in the account, based on the inflow and outflow

- Reports non-request – This trading platform makes it convenient for clients to place requests for different statistical reports on the share markets as per their needs.

- Generates the investor capital gains report

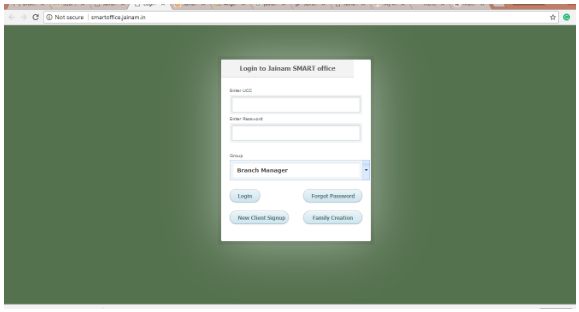

Here is a quick look at the terminal software:

Jainam Share App

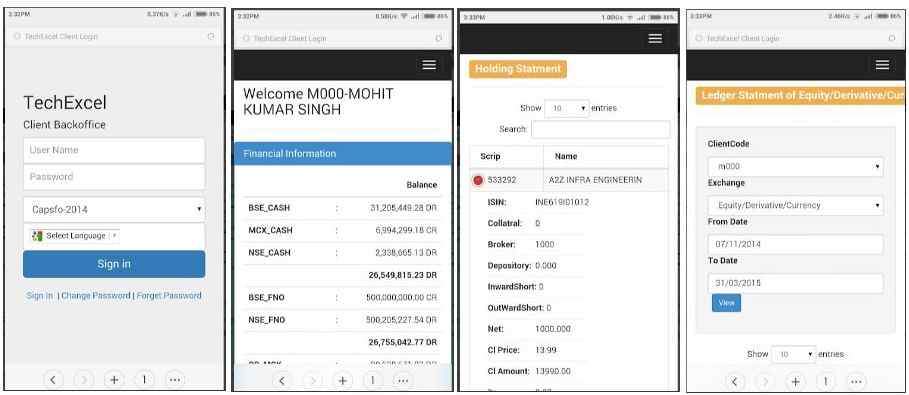

Jainam Share has also developed a trading app for its investors who are already registered users of the Smart Office software and for new investors as well. Though the app does not offer all the functionalities of the Smart Office desktop trading software, it has its advantages:

- Compatible with Android, Windows and iOS

- Real-time Trade Confirmation for Equity/Derivative/Currency/Commodity

- Real-time M2M calculation on an open position

- Provides details of the ledger balance, stock status and the open position

- Holding @ Real-Time Value

- Statement of Account

However, with as low as 1000+ installs this App hasn’t been rated higher than 3.1 out of 5 on the Google Play store – which is reason enough to doubt the quality of user experience. User reviews on the various App Stores are also not impressive.

Here are some looks at the app:

NEST Trader

Another ingenious trading platform designed by the PROSEC Online team for the benefit of Jainam Share investors. The advantages of using the NEST Trader are –

- An integrated online trading platform designed to ensure that clients never miss a market opportunity

- Easy to use and reliable real-time quotes

- Well-structured to help clients manage their investments easily and receive timely updates

- Quick order routing

- Fully customizable interface

- Single window trading across NSE, BSE, and MCX.

Jainam Share Research

Informed investors are some of the happiest and most prosperous investors in the market. Keeping this principle in mind Jainam Share put together a team of professional researchers who track the daily activity of the stock markets and derive useful insights.

The research team tracks the major events as they occur and offer reliable advice for the clients of Jainam Share.

They provide such information through:

- Daily Morning Newsletter – An e-mail newsletter outlining the previous day’s activities and analysis of the market performance is sent to the investor’s inbox on a daily basis.

- Weekly Outlook – A detailed report with trends and analysis for the benefit of Jainam Share clients. This report is also shared with the popular market insight portals and information websites.

- Fundamental Equity Analysis & Reports – Dedicated analysis and reporting of the NSE, BSE and MCX equity markets.

- Special Market Reports – The content and timing of this report depends on the market event it is prepared for. It may speak of the analysis of an important market event in an overseas stock exchange or may concern an Indian market.

- IPO Analysis – A report generally released after significant IPOs are floated.

Other reports/services offered by Jainam Share Research Team include:

- Results Previews

- Technical reports

- Live Intra-day & Momentum Calls

- Short Term Delivery Calls

- Derivatives Strategies

- Live Information Desk

- Portfolio Restructuring

- Market Knowledge Seminar

- Value Added HNI services

Jainam Share Customer Service

As a leading share broking firm Jainam Share Consultants offer a plethora of services to its client base. As far as customer support is concerned, you can get in touch with this stockbroker through the following channels:

- Phone

- Offline Branches

As you can see, there are very limited channels through which you can contact the broker. Furthermore, Jainam Share is one of those brokers that relies heavily on its offline channels and has limited online traction. Thus, make sure you understand the values it provides to you before making a final judgment as far as customer support is concerned.

At the same time, Jainam Share fell into trouble with SEBI and was fined upwards of five hundred thousand Indian Rupees in the year 2015. This was due to a change in the POA regulation which all stockbroking businesses were supposed to update for all their clients.

In an inspection by SEBI on Jainam Share done fifteen months after the POA regulation change – it was revealed that most clients of Jainam Share were yet to be updated as per the new regulation. This penalty was paid for by Jainam Share.

This incident though is glaring in the eye as the biggest customer service slip up by the firm to date.

Jainam Share Charges

Here are the details on the different kinds of charges levied by this full-service stockbroker:

| Demat Account Opening Charges | ||

| Name of the charges | Explanation | Amount (₹) |

| Demat account opening fee | Charged by brokers on account opening. Usually different as per the different scheme | Agreement Charges – As per actuals |

| Demat account AMC | Annual account maintenance fee | Individual A/c – ₹200 p.a.,

Non-Individual A/c – ₹600 p.a. |

| Advance Deposit | Applicable to schemes with lifetime free AMC | NIL |

| Other Demat Charges | ||

| Dematerialization Charges | Charge to convert physical certificates to electronic form | ₹50 per DRF |

| Rematerialization Charges | Charge to convert electronic shares to physical certificates | As per CDSL Actuals |

| Transaction Charges (Credit or Buy) | Demat transaction charges to buy shares | NIL |

| Transaction Charges (Debit or Sell) | Demat transaction charges to sell shares |

|

| Pledge Creation Charges | Charges paid to depository participant when he creates a pledge on the securities lying in the Demat account in favor of the lender | ₹25 per request |

| Pledge Creation Confirmation Charges | NIL | |

| Pledge Invocation Charges | Charges paid to invoke the pledge | ₹25 per request |

Check this Jainam Share Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty, etc.

Jainam Share Margin

The firm allows exposure to the clients based on the margin available in the form of funds or approved securities with Jainam Share, valued after deducting an appropriate cut. Details of exposure and margins as chargeable to clients are:

- The client must then pay applicable initial margins, withholding margins, special margins, or such other margins as are considered necessary by the Exchange.

- Investors need to maintain a minimum balance with the firm before the transaction depending upon the channel of trade they will use.

- Relaxation of margins depends on client-level positions, volatility in a particular stock, or the market overall.

- Exposure also varies as per market circumstances, quality of collateral given by the client, and past trading performance.

Jainam Share Advantages

After understanding the various facets of Jainam Share’s stockbroking business, here is a list of the advantages of choosing Jainam Share Consultant:

- Large country-wide presence for physical trading and investment assistance

- A wide variety of customer-friendly trading platforms – online and offline

- Real-time monitoring of their market activity by trading platforms allowing for investors to make quick decisions to avoid losses or to avail profitable opportunities

- A team of research professionals who provide useful insights to investors for better understanding the market

- Daily and weekly reports with market analysis and insight for the benefit of the consumer.

- Lower brokerage charges as compared to other full-service brokers in the industry

Jainam Share Disadvantages

According to the analysis, a few disadvantages of the Jainam Share broking business have also come to light. Some of those are:

- Low performing mobile app – at a time when most broking businesses are taking their operations online, Jainam Share has a poorly performing mobile app which needs to be improved

- The website trading platform serves only as a monitoring and ordering medium. It does not support all functions as the trading software

- POA controversy – Even though it was a case from three years ago, Jainam Share’s name has come up in a controversy about the power of attorney regulations which broking firms must follow for each of their clients. The broking firm was compelled to pay a fine of ₹500,000 to SEBI and the incident adversely affected the image of Jainam Share

You can read this review in Hindi as well.

Jainam Share Membership Information

Here is a quick look at some of the membership details of this stockbroker with a few exchanges and regulatory bodies of the stockbroking space in India:

National Stock Exchange of India Limited (NSE):

SEBI Reg. No. INB231216939 (CM) / SEBI Reg. No. INF231216939 (F&O) / SEBI Reg. No. INE231216939 (CDS)

Bombay Stock Exchange Limited (BSE):

SEBI Reg. No. INB011211639 (CM) / SEBI Reg. No. INF011211639 (F&O)

MCX Stock Exchange Limited (MCX-SX):

SEBI Reg. No. INE261216939

United Stock Exchange of India Ltd. (USE):

SEBI Reg. No. INE271216939

Multi Commodity Exchange of India Limited (MCX):

FMC Code MCX/TCM/CORP/0924

National Commodity & Derivatives Exchange Limited (NCDEX):

FMC Code NCDEX/TCM/CORP/0723

National Spot Exchange Limited (NSEL):

Trading Member ID: 57700

Jainam Share Recommendation

In a volatile market, newbie investors are always looking for a secure trading partner who can offer reliable advice and investment tips to them. For such new investors, who’re looking for hand-holding and basic advice Jainam Share Consultants does not look like a good choice.

Jainam Share would be more suited to seasoned investors who can easily navigate through the detailed real-time information provided by Jainam Share’s research team and trading platforms. Experienced investors would easily filter through the information given to them and make investment decisions on their own.

However, seeing as Jainam Share does not have a glorious past in customer service and was involved in POA controversies in the past – it would not be ideal for new investors.

In case you are looking to get started with share market trading and want to open a Demat account – just fill in some basic details below.

A callback will be arranged for you:

More on Jainam Share

If you wish to learn more about this full-service stockbroker, here are a few references for you: