Kotak Trading

Trading has become the new cool in the world today and therefore many stockbrokers are coming forward with better broking and trading services. In this article, we will be discussing Kotak Trading in detail.

Kotak Securities is a bank-based stockbroker offering renowned services for years. So, to experience its services the foremost step is to have a Kotak Demat account and a trading account. Once you are through this process, you can easily begin trading.

Let us begin by having a look at the Kotak Securities trading account.

Kotak Trading Account

Kotak Securities is a great way to start your trading journey. You need to have a Demat account and a trading account to begin the process. Kotak Securities gives you various options to do that.

Kotak 2 in 1 Trading Account

Kotak Securities gives you the facility of enjoying the benefits of a trading account and a Demat account together. This prevents you from the hustle of juggling between different accounts.

The best part is that it also gives you the advantage of linking a third-party bank’s savings account and beginning your trading.

The banks available for the linking are Axis Bank, HDFC Bank, Kotak Mahindra Bank, ICICI Bank, IndusInd Bank, and State Bank of India (SBI).

It is a convenient way and the funds get transferred to your account in T+2 days. It also gives you the facility of choosing different trading platforms which we will discuss further.

Kotak Trinity Account

Kotak Securities also gives an option of opening a 3 in 1 account, that has the benefits of a Demat account, trading account, and a bank account all in one.

You get a savings account with Kotak Mahindra Bank along with it. The process of fund transfer becomes easier as you can directly transfer them using the Kotak Securities website.

You also get access to their various platforms, updates, and recommendations.

Kotak Securities Trading Account Opening

If you want to start trading then you need to open your account as well. The process of opening an account is a simple one. You can open your account either offline or online.

The only difference being that in the case of offline you will have to visit your nearest branch.

- You need to go to the go-to Kotak Securities website and fill in the form online.

- Submit the necessary documents that include, PAN card, aadhar card, bank account details, and a valid signature.

- Enter the OTP for the verification which will further be used for the in-person verification.

- On the validation of your identity, you will receive a confirmation email with your User Id and Password.

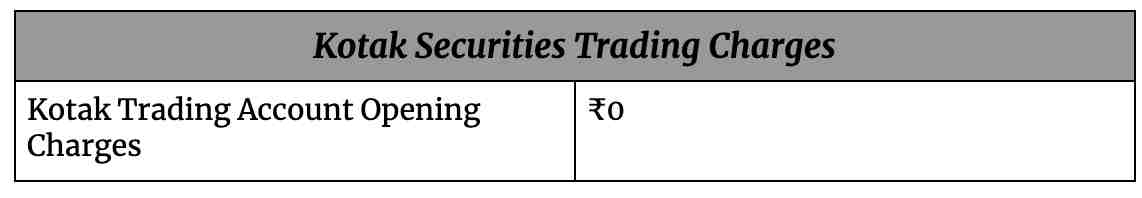

Kotak Securities Trading Charges

Kotak Securities like other stockbrokers charges some trading charges as well.

The trading charges include the account opening fees and the brokerage imposed by the broker to execute a trade in different segments.

Other than this there are DP charges imposed on the selling of shares from the Demat account.

Let’s start with the trading account opening charges.

Kotak Trading Account Charges

The bank-based broker is known for offering many benefits and the foremost is the FREE account opening.

So, if you want to get into a trade with the broker, you can start now without paying any fees.

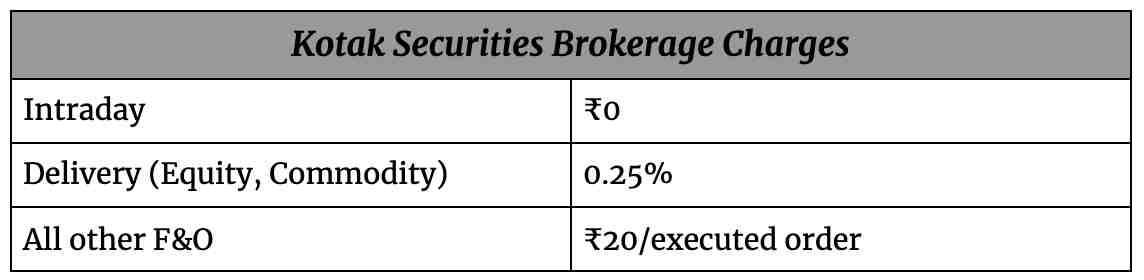

Kotak Trade Free Plan

Next to the account opening, there are the brokerage fees. The broker is known for its least brokerage fees among other bank-based stockbrokers.

To offer relaxation to intraday traders, it introduces the Kotak Trade Free Plan that allows day traders to trade for FREE thus they can now execute multiple trades without worrying about the fees.

While in the equity delivery and commodity segments, it imposes fees of 0.25% per trade. For Futures and Options, however, the flat fees of ₹20 are being charged.

The Kotak trading charges are as follows:

Note- In intraday trading, 1 paisa per scrip is charged because of the regulations.

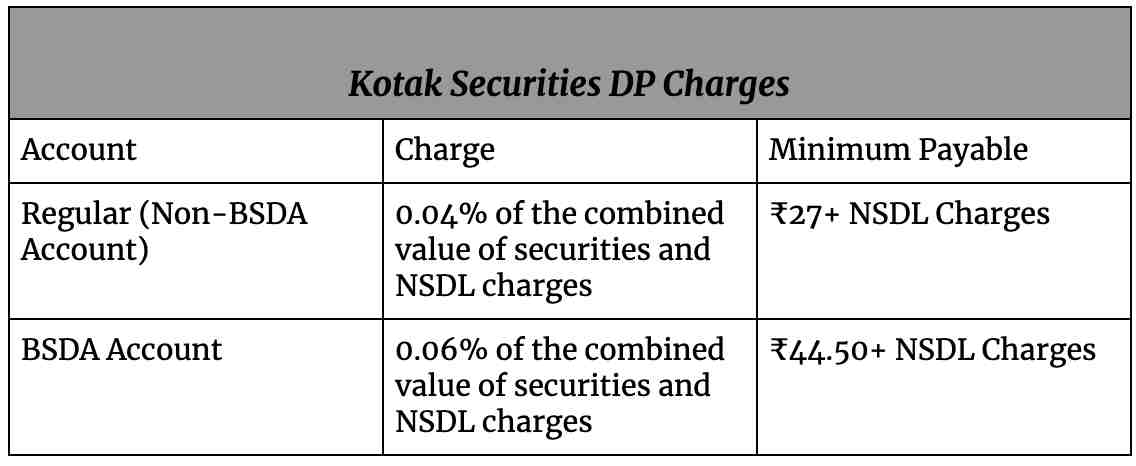

Kotak Securities DP Charges

Next comes the DP charges, the fees that most of the traders usually remain unaware of.

Also known as debit transaction charges, this fee is generally levied on the sell-side.

For a regular account, the DP charges are 0.04% of the combined value of securities (₹27 is minimum fees), while for the BSDA account, this fee is 0.06% of securities value (₹44.50 is the minimum fees).

Kotak Securities Trading Login

After successfully opening a trading account, you need to log in to start your trading process. You need to activate your account. The Kotak trinity account usually activates in 10 working days.

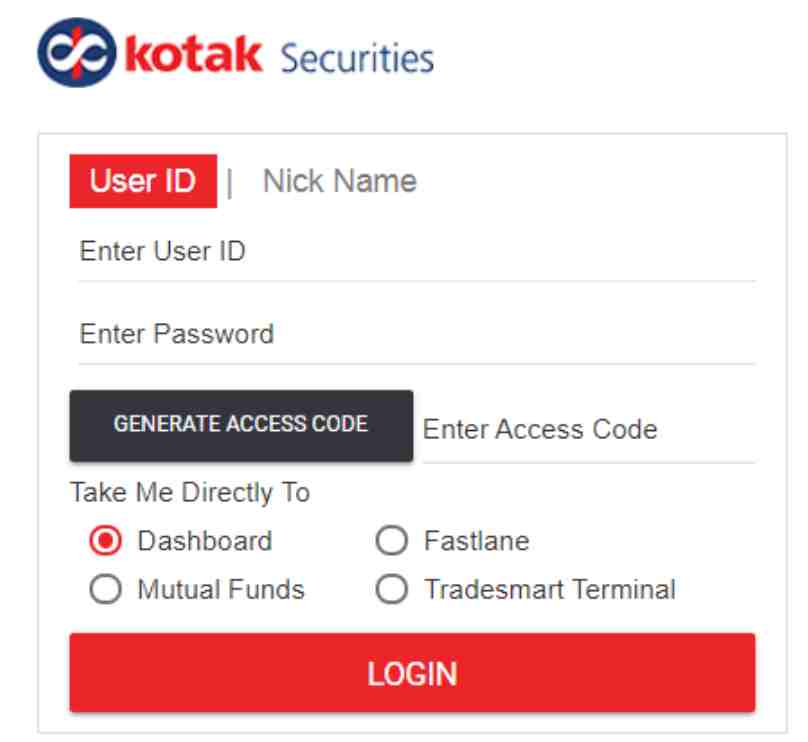

The login process is easy and similar to the majority of the terminals. The steps to log in to your trading account are as follows.

- You can access the login page from the Kotak Securities website.

- Now enter the user ID and password provided to you.

- After this, generate an access code.

- After the successful generation of the access code, click on confirm.

After following these steps, you will be successfully logged in and you can easily begin your trading.

Kotak Securities Trading Online

Kotak Securities offers a wide range of trading platforms that helps the trader to trade online.

The online trading platform includes the mobile app, desktop app, and trading terminal.

Let us have a look at the trading platforms available in Kotak Securities.

Kotak Stock Trader

While we are constantly glued to the screen of our smartphones, it is an added advantage if given a chance to trade using a mobile trading app.

Kotak Stock Trader is a mobile trading app that you can download easily from the Playstore (for android) and Appstore (for iOS).

Some of the features of the Stock Trader app are,

- You get to make your trading decisions on the go seamlessly.

- You also get timely updates so that you never have an opportunity to make profits.

- Keep a record of all your investments.

- You can easily track your portfolio in real-time.

- It is easier to make watchlists.

- It offers various charts and indicators that help you in gaining a better understanding of how to do intraday trading in Kotak Securities.

Kotak Trade Smart

Kotak Securities also has a trading terminal that also has a lot of advantages. You can easily log in to the trading terminal using the Kotak Securities website. Some of the features of the Kotak Trade Smart terminal are as follows.

- You get access to all the market updates.

- You can also use advanced charting techniques to make the right decisions.

- Also access to heat maps and sentiments.

- You get access to powerful watchlists.

Kotak KEAT Pro X

If you are used to big screens then you can use Kotak KEAT Pro X that you can download on your MAC or windows.

It also has a lot of features that you can take advantage of.

- It is available to all the clients of Kotak Securities at absolutely no cost.

- You can execute all your trades on a single platform.

- You can easily customize your watchlists.

- You are in charge of your portfolio and you can easily get a hold of it.

- There is also a facility to live stream markets for accurate data.

Kotak Securities Trading Demo

On opening a Demat account with the broker and downloading the trading app mentioned above, you can get into a trade right away.

- To begin with, login to the app and pick the sectors you want to trade or invest in.

- You can add shares to the watchlist with a single tap.

- Analyze the stocks depending upon your preference and risk appetite.

- For long-term investment, the app offers the feature of fundamental analysis of stocks, while for the short-term trade you can use the charts and indicators.

- Make a buy or sell decision. To execute the order, click on the buy/sell button.

- Enter the price, quantity and select the order type in the order placement window and click on confirm the order.

- You can track your portfolio or order details in the app conveniently.

- Apart from this, the app allows you to apply for an IPO directly.

Kotak Securities Trading API

If you want to have a personalized trading experience where you can apply your trading strategies completely, you can use Kotak Securities trading API. With its help, you can design your own trading terminal and trade easily.

The traders, developers, and start-ups all can benefit from the Kotak Securities trading API.

As a trader, you get the opportunity to test the historical data and the trading strategies for your full benefit.

Developers can make their own trading terminal and can integrate live market broadcasts. They can also take the help of historical data to analyze and perfect the market strategies.

It is great for start-ups as well as you get access to design a platform for yourself at absolutely no cost and also, you reach the widespread client base of Kotak Securities.

Some of the main features involve,

- It is user-friendly.

- It is free of cost.

- Kotak Securities has a name in the industry which gives it an edge.

- There is a dedicated team to answer all your queries in case you get stuck somewhere.

You just need to register with th broker to reap all these Kotak demat account benefits.

Is Kotak Securities Good?

So, if you are keen to begin trade or investment in the stock market, then you can start with Kotak Securities.

The broker has a good service background and offers customer support services through multiple offline branches.

Apart from this, you can open a 3-in-1 account without paying any account opening fees.

The broker offers an advanced and user-friendly trading platform that further makes it easy for beginners and other traders to analyze and trade in different segments.

Why not experience the services yourself? Just fill in the basic details in the form below and open a Demat account for FREE!