Marwadi Shares

List of Stock Brokers Reviews:

Marwadi Shares and finance limited is a full-service stock broker based out of Rajkot, Gujarat. The 740+ employee strong broker is present in multiple locations with more than 95 branches and 1450 franchises across different parts of the country.

Furthermore, the broker claims to have clients from more than 3400 locations with its offline presence boasting 2200+ trading terminals with its partners.

Established in the year 1992, this broker allows fund transfer through multiple channels such as NEFT, RTGS and various payment gateways.

“For this financial year 2019-20, Marwadi Shares has 82,574 active clients using its services on a regular basis.”

With the membership of different bodies such as NSE, BSE, NSDL, CDSL, MCX, NCDEX, the full-service stockbroker allows its clients to trade and invest in the following segments:

- Equity

- Commodity Trading

- Derivative Trading

- IPO

- Mutual Funds

- Portfolio Management Services (PMS)

- Insurance

Chairman and Managing Director, Marwadi Shares

Marwadi Shares has a pretty low focus when it comes to trading platforms. Be it the web-based browser application or terminal software, the broker provides out-sourced trading softwares, while they do maintain an in-house developed mobile application.

In this day and age, relying on mature applications is one thing which basically keeps it safe for the broking house, but with the advent of discount stockbrokers that have a huge focus on technology, the overall broking space is only getting mature.

Clients of this full-service broking house get access to the following trading platforms:

ODIN Diet

This terminal-based software is an outsourced 3rd party software provided to the clients of Marwadi Shares. ODIN Diet is a mature terminal based trading application with multiple features and reasonable performance. Here are some of the features of this application:

- Built-in features and intelligence that allows clients to look for market opportunities.

- Allows users to develop and run multiple strategies for their technical and fundamental level trades.

- This trading application is pretty exhaustive in terms of the number of features, especially for analysis.

The only concern with the usage of out-sourced trading applications such as ODIN Diet is that the control of the addition of new features or facilitating of fixing bugs or issues raised by clients through comments and feedback do not get incorporated quickly.

The whole process is a tad complicated and involves multiple parties before it finally happens if it happens.

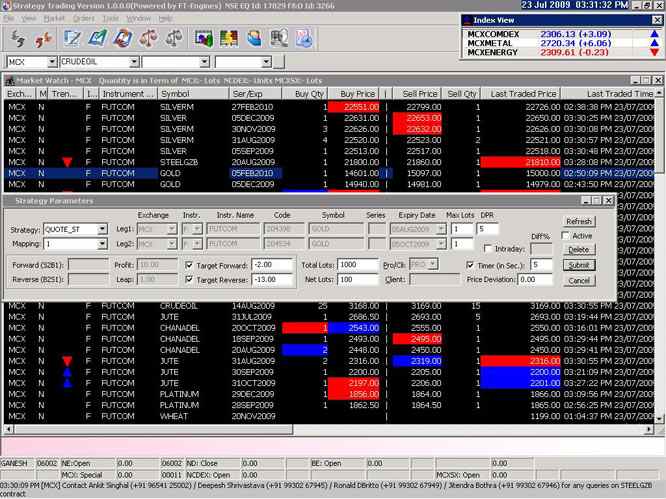

This is how the ODIN Diet dashboard looks like:

Generally, trading platforms such as ODIN Diet are free to use, but few broking houses do charge for the usage. However, in this case, usage of this trading platform is free and there are no charges levied at any level by the broker.

NSE Now

NSE Now is a web-based trading solution that is also outsourced by Marwadi Shares. It can be accessed using any prominent browser such as Chrome, Internet Explorer, Firefox etc.

You, as a client, don’t need to download or install anything to access trading. And the best part is, this can be accessed from any device be it, a mobile, laptop, tablet or a desktop.

NSE Now is responsive in nature and takes care of the screen resolution by itself, thus, providing you with the optimum user experience. Here are some of the features of NSE Now:

- Lightweight application

- Multiple charting types with technical indicators

- Different order types allowed

- Easy fund transfers

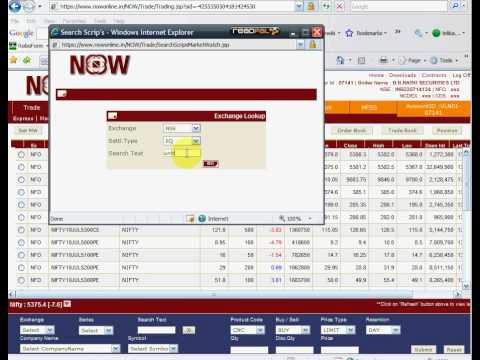

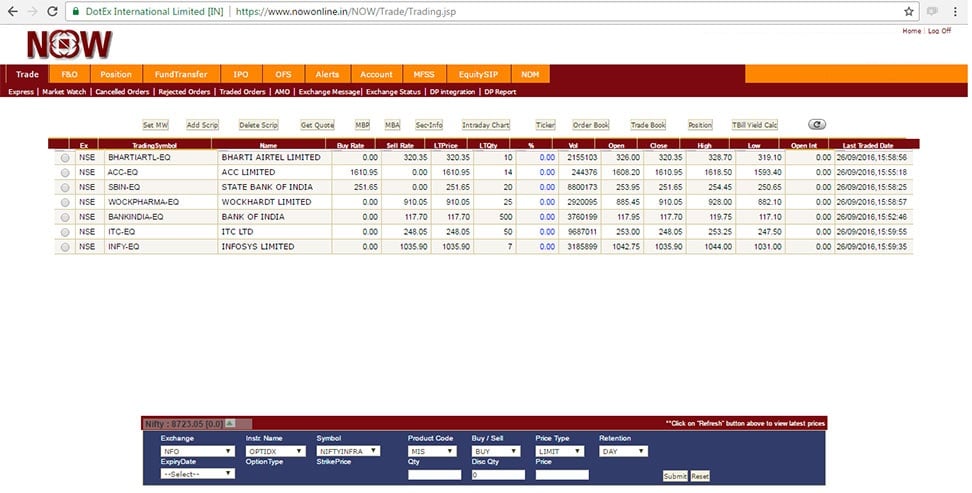

Here is the look and feel of NSE Now application:

Marwadi Trade Mobile App

The mobile app provided by this full-service stockbroker is quite basic in its design and functionality. The app looks inspired by other top mobile trading apps such as iWin and provides an average user experience. Some of the features of the mobile app include:

- Real-time market watch available

- Multiple types of order reports such as Trade Book, Net position, Funds view etc provided

- Historical charts for fundamental analysis

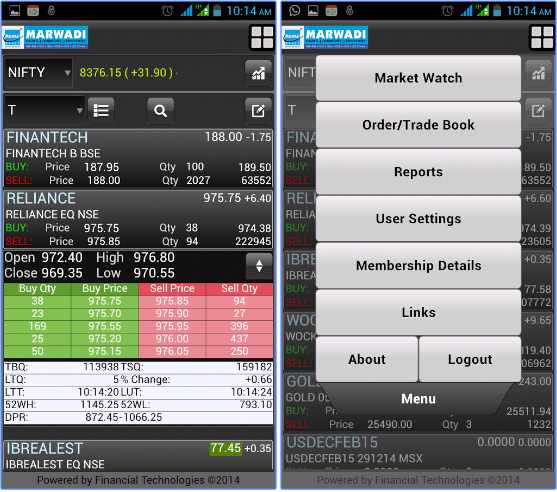

This is how the mobile trading app looks like:

At the same time, some of the concerns raised by users of this mobile app are as follows:

- App user experience is around average with a lot of users finding it hard to navigate among different features.

- Login related issues reported by some users.

- Stock market feeds are a bit clumsy and can be quickened.

This is how the app is rated at Google Play Store:

| Number of Installs | 10,000-50,000 |

| Mobile App Size | 31 MB |

| Negative Ratings Percentage | 15.8% |

| Overall Review |  |

| Update Frequency | 24 weeks |

The broker provides one of the worst services and support to its clients as well as to users looking to open a trading account with the broker. It is available to its clients through the following communication channels:

- Phone

- Offline branches

- Fax

The broker lags in multiple aspects when it comes to customer service. First of all, it needs to train its support team that they need to be courteous and polite while talking to users.

We did a test run through 5 different users with different queries and concerns and one thing apart from casual ethics was the communication style of the support staff. They are pretty lazy and passive during interactions and it seems they are not even trained with all the requisite details and queries, a user might ask.

Furthermore, the broker needs to work on the turnaround time taken to resolve a query. At times, the nature of the concern requires immediate attention and the user has a lot at stake.

In such situations, the service team must act proactively and quickly so that the user does not incur any loss due to their client handling.

At the same time, the broker can think of adding in other communication channels such as Toll-Free number, web form, chat etc so increase its coverage among the client base. All this gives much-needed confidence to users before they finalize opening the trading account with the broker.

The broker provides research across fundamental and technical scales for various segments such as Equity, currency, commodity etc. However, there is no clear segregation of these research reports and recommendations at the segment level.

This leads to unnecessary confusion and time wastage among the client base. The research team of the broker is also at an average level when it comes to prominence and visibility among different channels, be it TV, print, journals etc.

Thus, users are advised to perform their technical as well as fundamental analysis to subscribe to any advisory firm to get professional assistance instead of relying on this full-service broker for their recommendations. Using its research and tips directly can be hazardous to your portfolio at both intraday as well as long-term level.

In the case of full-service stockbrokers, you must be extra cautious with their different charges types.

Marwadi Shares, although, is a reasonable full-service stockbroker in its different charges, but it is always better to get each final negotiated price documented and emailed from an official email id of the broker to avoid any future altercations.

Here are the details of different pricing setups for this full-service stockbroker:

To open your demat account and trading account with the broker, you are supposed to pay the following charges as shown:

| Trading Account Opening Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹450 per year or one time payment of ₹2500, out of which ₹2250 will be refunded |

As shown above, either you can go for the plan where you pay ₹450 every year as annual maintenance charges (AMC) and thus, it’s a recurring cost. Or, you may choose to pay a one time cost of ₹2500 and you do not need to pay AMC charges anymore.

Once you choose to close your account with the broker, you will get ₹2250 refunded to your bank account. Thus, it really depends on your trading commitment in terms of the time period you are looking to invest in the stock market.

Opening demat and trading accounts, however, is free with Marwadi Shares.

As far as the brokerage is concerned, the full-service broker charges a percentage based brokerage charge. Thus, the higher your trade value, the higher the brokerage value will be charged to you.

At the same time, there will be a minimum brokerage charge (in the range of ₹20 to ₹25) applicable if your trade value is reasonably low.

Here are the complete details of brokerage rates applied by Marwadi Shares:

| Equity Delivery | 0.30% |

| Equity Intraday | 0.06% |

| Equity Futures | 0.02% |

| Equity Options | ₹100 per lot |

| Currency Futures | 0.02% |

| Currency Options | ₹100 per lot |

| Commodity | 0.02% |

Apart from the options segment, the brokerage in the rest of the trading segments is around average from the industry perspective. For options trading segment, the brokerage is placed at ₹100 per lot which is definitely expensive.

Use this Marwadi Shares Brokerage Calculator for complete calculation of all sorts of charges and your profit in the trade.

Apart from account opening and brokerage charges, a stockbroker levies multiple other charges such as stamp duty, transaction charges, STT etc. Here are the details of transaction charges levied:

| Equity (Cash & Delivery) | 0.00325% |

| Equity Futures | 0.0020% |

| Equity Options | 0.053%(on Premium) |

| Currency Futures | 0.00125% |

| Currency Options | 0.0435%(on Premium) |

| Commodities | 0.0030% |

Users looking to get higher returns from their trading account balance can use exposure or leverage on top of their balance. Having said that, exposure is certainly a risky capital and has all the potential to eat up your trading account balance. Furthermore, the loss may cross their actual capital too.

Thus, unless you understand the intricacies and risks associated with the concept, our advice is to avoid using exposure on top of their trading account balance.

In the case of Marwadi, here are the exposure details:

| Equity | Upto 10 times Intraday |

| Equity Futures | Upto 2 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 4 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 2 times for Intraday |

As shown above, the exposure values provided by the broker are not that high. You are advised to take your judgment accordingly.

Here are some of the major concerns with this stockbroker:

- Low-quality research

- Customer service is a big concern with the broker

- No in-house focus on technology and trading platforms

- The margin provided is pretty low

“Marwadi Shares has received 1 complaint this financial year from its clients with a complaint percentage of 0.001%. The industry average is 0.01%.”

At the same time, you get the following benefits using the services of this full-service stockbroker:

- A wide range of trading products

- A decent number of offline branches and offices across India

- Reasonable brokerage charges

Conclusion

“Marwadi Shares and Finance Limited is a below-average full-service stockbroker and provides pretty mediocre services through its trading platforms, research, customer support and so on.

Although the broker has been around for more than 25 years it has not been able to build its reputation, neither at the retail level nor at the institutional level.

You are advised to perform your due research before committing to this broker for trading and investing requirements.”

Are you looking to Open a Demat and Trading Account?

Provide your details in the form below and we will set up a callback for You:

Next Steps:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Here are the membership details of the stockbroker with different entities of the stock market:

| Entity | Membership ID |

| BSE | INB/INF 010876036 |

| NSE | INB/INF/INE 230876034 |

| SEBI | INZ000105336 |

| NSDL | IN-DP-NSDL-98-99 |

| CDSL | IN-DP-CDSL-256-2004 |

| MCX | 10305 |

| NCDEX | 00087 |

| Registered Address | Marwadi Financial Plaza, Nana Mava Main Road, Off 150 Feet Ring ROad, Rajkot-360001, Gujarat(India) |

You can compare Marwadi Shares Vs other stockbrokers other:

More on Marwadi Shares:

If you are looking to know more about Marwadi Shares, here are a few reference links for you:

| Marwadi Group Review |

| Marwadi Group Transaction Charges |

Marwadi Shares Brokerage Calculator  |

Marwadi Shares Comparisons  |