PhillipCapital

List of Stock Brokers Reviews:

PhillipCapital India part of the Singapore group – PhillipCapital, has its Indian headquarters in Mumbai. It is a full-service stockbroker providing trading services at both Institutional as well as Retail segments.

Although PhillipCapital as a financial house, was incorporated back in the year 1985 they started their Indian operations around 2010.

In this short and quick review, we will try to touch different value propositions provided by the broker to its clients. Hopefully, you will be able to decide whether it is suitable for you or not.

PhillipCapital Review

It is accredited by BSE, NSE and MCX-SX. The trading and investment segments it provides to its clients include:

- Equity

- Commodity Trading

- Derivatives Trading

- Mutual Funds

- IPO

- Margin Trading

- Insurance

- NRI Demat Account

- Portfolio Management Services

PhillipCapital is a relatively small sized stockbroker in terms of active clients, offline presence, partners and other related values provided.

Let’s have a quick look in this detailed review.

As per the latest numbers for the financial year 2019-20, PhillipCapital has an active client base of 13,611 making the broker one of the smallest in the Indian Stockbroking space.

Vineet Bhatnagar, CEO PhillipCapital

PhillipCapital Trading Platforms

Most of the trading platforms provided by the stockbroker are out-sourced in nature. This takes away all the responsibility and your feedback or suggestions about the trading platform(s) cannot be implemented by the broker directly.

Here is a look at the trading applications provided to you by the stockbroker here:

ODIN Diet

This is a third-party terminal based trading software that this full-service stockbroker has taken the license of. The trading software is pretty exhaustive in terms of the number of features and is suitable for intermediate to advanced level traders.

ODIN Diet is known for:

- Real-time market data across exchanges

- Personalized User Interface

- Pivot watch

- Unlimited scrips allowed in Market watch

- Advanced tick watch

One of the major concerns of this application is that the maintenance stays out of the control of the stockbroker. Thus, in case you have an issue with any feature or general usage of the platform, PhillipCapital team will not be able to assist you directly.

NSE Now

This is a web-based trading software which is also third-party in nature. Nonetheless, it is a reasonable solution for your trading requirements and can be accessed from any specific device you may like to choose.

Furthermore, it is responsive in nature so adaptability with different screens such as laptop/computer/mobile/tablet is of no concern either.

Here are some of the features of NSE Now:

- Can be accessed from any laptop/desktop

- Easily accessible across devices including laptop, mobile, desktop or tab

- Lightweight application with charting tools and technical indicators

- Algo-trading is allowed

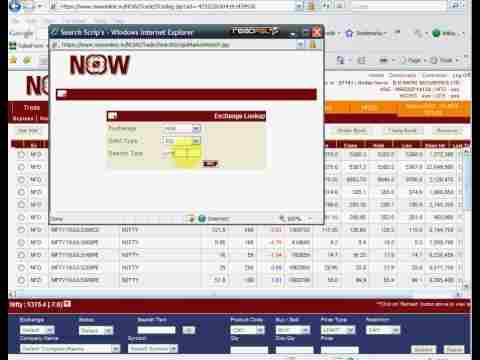

This is how the web application of NSE Now looks like:

Phillip Pro Trader

Phillip Pro Trader is the mobile app from this full-service stockbroker. It is a lightweight application, however, it gets updated very rarely. The last update on the mobile app was done in June 2016, while generally stock brokers these days provide mobile updates once or twice each month.

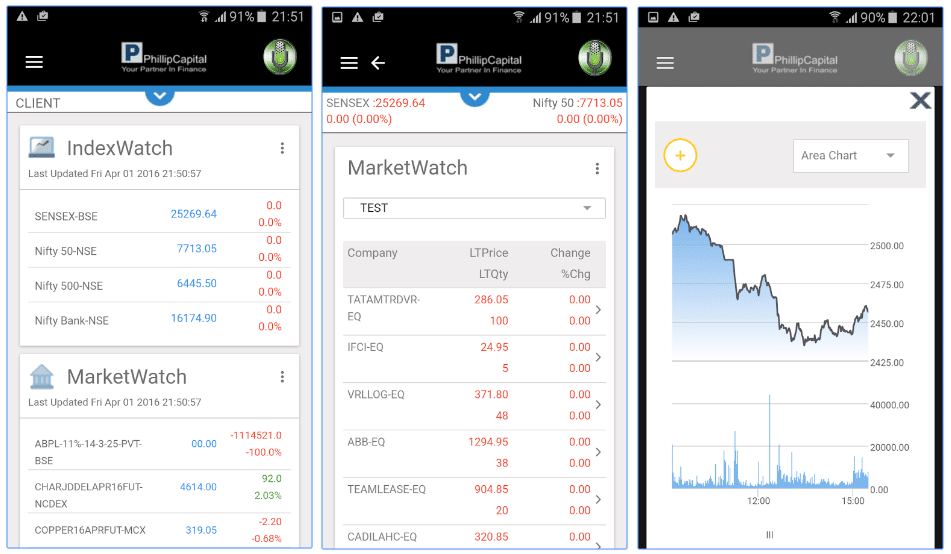

Here are some of the screenshots of the mobile app:

Few of the concerns raised by the users of this mobile app from PhillipCapital are as follows:

- Basic implementation of the market-watch feature

- A limited number of features

- User interface pretty average

Some of the stats about this mobile app from the Google Play Store are mentioned here:

| Number of Installs | 1,000+ |

| Mobile App Size | 21 MB |

| Negative Ratings Percentage | 42.9% |

| Overall Review |  |

PhillipCapital Customer Care

You can get in touch with this stockbroker through the following communication channels as listed below:

- Phone

- Toll-free Number

- Offline Branches

- Web-chat

Although it may see the broker has a balance of offline and online communication channels but when it comes to delivering, PhillipCapital falls miserably.

For instance, there is no personalized communication made, the web-chat is nothing but a tool to acquire business leads and no quick assistance or support is provided, the service executives have limited understanding of the stock market, in general, implying they are not provided with any training whatsoever.

All the feedback above has been tested by the team and there are requisite proofs to back the claims made.

PhillipCapital Pricing

Here are the details on different types of charges levied by the broker to its clients:

PhillipCapital Account Opening Charges

The stockbroker charges the following amount for account opening and annual maintenance charges:

| Trading Account Opening Charges (One Time) | ₹0 |

| Trading Annual maintenance charges (AMC) | ₹400 |

| Demat Account Opening Charges (One Time) | ₹700 |

| Demat Account Annual Maintenance Charges (AMC) | ₹0 |

Depending on the initial margin you provide to the broker, the account opening fees and maintenance charges can be levied off as well.

PhillipCapital Brokerage

As far as brokerage charges are concerned, this full-service stockbroker charges brokerage based on the initial deposit provided by the client:

| Equity Delivery | 0.4% to 0.15% |

| Equity Intraday | 0.04 to 0.015% |

| Equity Futures | 0.01% |

| Equity Options | ₹25 per lot |

| Currency Futures | 0.01% |

| Currency Options | ₹25 per lot |

| Commodity | 0.01% |

The range provided above is based on the initial margin you provide to the broker. Higher the margin, lower is the brokerage charge you end up paying to PhillipCapital.

Use this PhillipCapital Brokerage Calculator for the calculation of complete charges and your profit.

PhillipCapital Transaction Charges

Following are the transaction charges levied by PhillipCapital:

| Segment | Transaction Fee |

| Equity Delivery | NSE: 0.00325% | BSE: 0.00325% |

| Equity Intraday | NSE: 0.00325% | BSE: 0.00325% |

| Equity Futures | NSE: 0.0019% |

| Equity Options | 0.051% on premium |

| Currency Futures | NSE: 0.0019% |

| Currency Options | 0.051% on premium |

| Commodity | 0.0025% |

PhillipCapital Margin

PhillipCapital provides the following exposure across segments as shown:

| Equity | Upto 8 times for Intraday, 0 for Delivery |

| Equity Futures | Upto 4 times for Intraday |

| Equity Options | Buying no Leverage, Shorting upto 4 times Intraday |

| Currency Futures | Upto 4 times for Intraday |

| Currency Options | Buying no Leverage, Shorting upto 4 times Intraday |

| Commodities | Upto 4 times for Intraday |

Looking at the overall broker size, the margin provided is around average. Thus, entry-level traders may find this stockbroker suitable for themselves. However, an intermediate or expert level trade might not find these values useful.

PhillipCapital Disadvantages

Here are some of the concerns of using this stockbroker for your trading:

- Low-Quality Customer service

- Low performing mobile trading app

- Not much of innovation across trading platforms

PhillipCapital Advantages

At the same time, it provides the following merits as well:

- A good amount of trading and investment products

- Decent margin provided across segments

Interested to open an account?

Enter Your details below and we will connect you with an exclusive calling team

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

More on Phillip Capital:

In case you wish to know more about Phillip Capital, here are a few reference links for you:

| Phillip Capital Review |

| Phillip Capital Hindi Review |

| Phillip Capital Brokerage Calculator |

| Phillip Capital Transaction Charges |

| Phillip Capital Associate |