Prudent Broking

List of Stock Brokers Reviews:

Prudent Broking Group was founded in 2000 as a full-service stockbroker and offers professional services in the area of personal and corporate investment. The company has created a position for itself over a period of time with a steadily increasing quality client base.

Let’s have a quick look at what it has to offer and at what cost! Does it make sense for you to open your Demat account with this broker? Let’s find out!

Prudent Broking Review

The broking house has developed an in-house capability of tracking and analyzing different funds on various parameters before conveying the same to the clients.

Prudent Corporate Advisory Services Ltd. is the flagship company of the group offering specialized services in Personal and Corporate Investment Planning through Mutual Funds, Debt and Third-Party products.

Other group companies include Prudent Insurance Services Pvt. Ltd, which taps the growth potential of the Insurance sector in the country. Incorporated in 2008, the company offers various options of life and general insurance-based products through the strategic tie-ups with the best insurance companies in India.

There is also Prudent Properties to help investors in creating an asset class and enabling them to buy their preferred realty whether home or office.

Talking about Prudent Broking Services Pvt. Ltd, it was incorporated in 2004. It is a stockbroking and Depository Participant service providing company. The company is a member of BSE (Bombay Stock Exchange) & NSE (National Stock Exchange) and is working to expand in various parts of the country through its sub-brokers and franchise offices.

As per the latest records from NSE, Prudent Broking has an active client base of 17,575.

Segments they deal in:

Prudent Broking actively offers services in

- Equity

- Commodity Trading

- Insurance

- Advisory Services

- IPO

Prudent Broking Trading Platforms

Let’s look at some of the trading platforms offered by this full-service stockbroker.

ODIN Diet

ODIN Diet is a terminal based trading platform that you can download from the website of Prudent Broking. Once you have opened your demat account with this broker, they will be providing you with a unique user id and password combination. Post installation, you can log in to this application with these credential details.

This, third-party software, is developed by designed by 63 Moons or Financial Technologies. Prudent Broking sources this application to its clients, post account activation.

Some of the features offered in this software are:

- Real-time market feed across different exchanges (NSE, BSE etc)

- Alerts & notifications

- Research & Support tools such as Charts, Indicators, Resistance watch etc.

- Payment gateway integration for funds transfer

At the same time, there are a few concerns related to this trading software, such as:

- Sub-optimal user experience

- Relatively bulky application

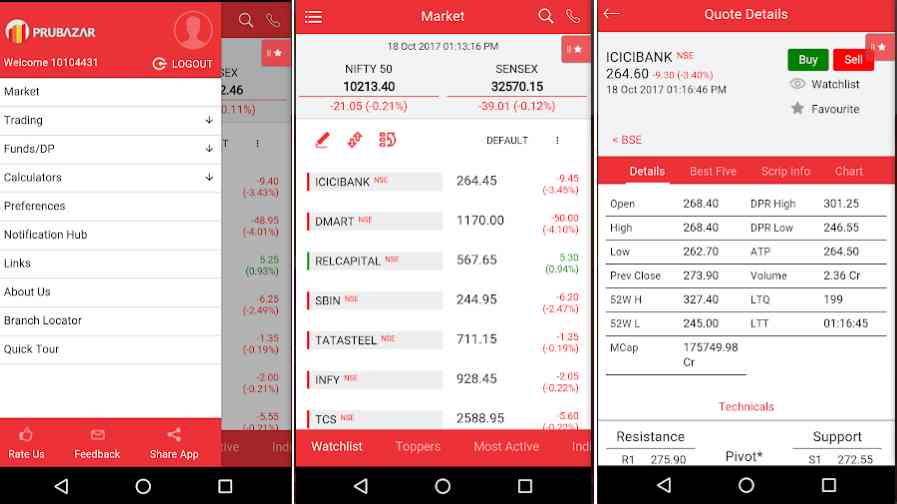

Prudent Broking Mobile App

Prudent Broking offers an in-house trading application in the form of its iOS & Android Mobile apps named ‘PruBazar’. Some of the features that you can access in this trading application include:

- Market Watch

- Order placement/execution

- Portfolio Management Services

- Technical/Fundamental Analysis

At the same time, some of the concerns raised by the clients of this full-service stockbroker regarding this mobile app are:

- The app cannot work in a stable mode when running in the background

- Login related concerns

- Connectivity issues

Here is how the mobile app from Prudent Broking is rated:

Prudent Broking Online Trading Account- TradeNow

The Prudent Broking Online trading account gives personalised services to help with the execution of buying and selling orders for both equity and debt securities. The platform is flawless and fast and has HTML5 features. It can be used to trade on the exchange of the trader’s choice.

The trader can also trade in futures & options on NSE using the Prudent Broking online trading account. On registration, the client will receive a Unique Client Code, which is to be used for placing orders. The platform also offers secure modes of transaction.

Prudent Broking Customer Care

Prudent Broking Services has various avenues for clients to get in touch with customer care.

The clients can connect through

- Phone calls,

- Emails,

- Online chat and

- Offline branches.

The customer service is not up to the mark and the clients feel a lack of transparency.

Prudent Broking Research

Prudent Broking has a credible team of researchers to pick the value and multi-bagger stocks for both long, as well as, short-term. Something that makes Prudent Broking stand in the elite list of service providers is that it suggests the stock to the investors throughout the market hour and beyond that.

Before the stock market starts, the firm releases a Morning Report followed by other reports under its ‘PruIntelligence’ segment. Some of the quality reports from the firm are as follows:

Morning Mantra – In this report, an investor gets an insight into the world market, as well as, the Indian market. The report elaborates on the significant developments that took place in the past day and are capable of swinging the market in either direction.

The report also includes the Pivot levels of the stocks, Key stats of the Index, Option activity, Open Interest scenario among other data points, which are important for any trader to get hold of before starting the day and punching the first trade.

Evening Edition – Once the market is closed, an evening report is published expounding on how the market fared and the sentiments throughout the session that shaped it. Along with the gainers and losers, the report talks about indices performance.

Other than these reports, the firm releases reports such as:

- Derivative Diary

- Prudent Weekly Wisdom

- Prudent Weekly Technical Insight

- Prudent Weekly Derivative Insight

- Samvat Reports

- Special Reports

Overall, it can be said that Prudent Broking puts in place almost every bit of information that an investor would want after getting their Demat accounts opened in the firm and start trading.

Prudent Broking Charges

There are different charges associated with your account and share market trades when you invest in the share market. As far as Prudent Broking is concerned, here are the different charges levied:

Prudent Broking Account Opening Charges

Here are the details on the different account opening costs:

Prudent Broking Brokerage

As far as the brokerage charges are concerned, Prudent Broking is a full-service stockbroker and thus, charges you a percentage of your trading turnover. For instance, if you trade in the delivery segment – then you could be charged 0.3% of let’s say ₹1 Lakh (your trading capital). In order words, you will be charged ₹300 for that particular trade.

Similarly, depending on your trading capital and negotiated brokerage in the segment – corresponding brokerage and other taxes will be levied.

Here are the details of Prudent Broking brokerage charges across different segments:

Check this Prudent Broking Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

Prudent Broking Margin

Furthermore, when it comes to exposure or leverage – we always advise traders (especially beginners) to understand the risks and implications first and only then use margin in your trades.

In the case of Prudent Broking, the following are the values offered across the segments:

As you can see in the table above, not much exposure is offered across any of the trading segments. Thus, be sure to understand the limitations of this broker before going ahead with opening an account.

Prudent Broking Advantages:

Here are some of the top benefits of using the services of Prudent Broking:

Wide Range Of Services – the company offers a varied range of services to their clients right from the broking services, insurance sector and realty sectors.

The client gets a range of services under one roof, and therefore, does not need to look anywhere else for any sort of financial services and real estate solutions.

Customer Care Service – the company has set in place back office support, as well as, attentive customer care service to assist the clients in the trade, as well as, any queries related to the trade, products and so on.

On their website, Prudent has given the address of head office along with phone number and email ID.

Well Researched Reports – Through their string of reports, the company makes sure that the clients are well informed and aware of all the development happening around even before starting to trade.

Trading platforms – Prudent Broking offers their clients all the available options for trading. A client can easily download the set up for ODIN Diet and ODIN Terminal from their website. They also have a smartphone app for trading.

Prudent Broking Disadvantages:

At the same time, here are a few issues related to this full-service stockbroker:

No Fee Breakup – a potential client always wants to know about the brokerage and other costs that they would need to pay while trading. However, Prudent Broking is not transparent about this particular aspect and can pitch in any specific number.

No Live Chat – Prudent Broking is yet to start the live chat sessions with the clients.

The service is considered utmost important for the organizations, who offer financial products and services, as the clients are not always well versed with these products. Also, its website lacks the customer care options, when it comes to encouraging potential investors, i.e., there is no request a call, or something similar.

Overall, it can be said that Prudent Broking appears to be a responsible broking house that has witnessed and survived the highs and lows of the stock market in the last two decades.

However, the absence of brokerage structure, limited focus on trading platforms, exposure could certainly divert potential customers to the rivals.

Our recommendation of Prudent Broking is around average and we will suggest you open the account with this broker only if you have limited options to choose from.

In case you are looking to get started with trading in the share market and want us to suggest you a broker that matches with your requirements and preferences.

Just fill in some basic details in the form below and a callback will be arranged for you:

Prudent Broking Services Branches

Prudent Broking Services has 11 branches in Gujarat in Ahmedabad, Vadodara, Bhavnagar, Jamnagar, Junagarh, Nadiad, Palanpur, Patan, Rajkot and Surat, one branch in Bihar in Patna, one in Delhi on Tolstoy Marg, two in Jharkhand in Jamshedpur and Ranchi and one branch in Madhya Pradesh in Indore.

The company also has three branches in Maharashtra in Mumbai, Nashik and Pune, three in Odisha in Bhubaneswar, Cuttack and Rourkela, one in Rajasthan in Jaipur, one in Uttar Pradesh in Lucknow and one in West Bengal in Kolkata.

More on Prudent Broking

If you wish to learn more about Prudent Broking, here are a few references for you: