SBI Securities

List of Stock Brokers Reviews:

SBI Securities or SBICap Securities is the broking arm of the SBI (State Bank of India) Group. The bank based full-service stockbroker was established in the year 2006 and is regarded as one of the most trusted brands within the stockbroking space in the country.

SBI Securities is a SEBI registered stockbroker and depository participant of central securities depositories – NSDL and CDSL.

Having an account with the stockbroker allows a resident as well as a foreign trader to reap the benefits of having access to a multitude of investment options, including securities and other financial instruments.

Here in this article, we review SBI Securities taking into various aspects such as trading platforms offered, various account related charges, customer support, research facilities, as well as the pros and cons of opting for an account with the full-service stockbroker.

Use Up/Down Arrow keys to increase or decrease volume.

SBI Securities Review

SBI Securities is headquartered in Mumbai and has a physical presence in at least 119 locations of the country through its partner network.

The stockbroker is affiliated to both the national level stock exchanges – NSE, BSE.

Being a bank based stockbroker, the broker provides an SBI 3 in 1 demat account to its clients where they do not need to transfer funds between trading and bank accounts manually.

The 3 in 1 account includes a banking account along with a Demat and a Trading account which further enhances the ease in transferring money from a savings account to your trading account to make purchases of stocks.

SBI Securities is known to provide a wide range of trading and investment products for its clients. The extensive list includes the following investment segments:

- Equity

- Derivative Trading

- Currency Trading

- IPO

- Mutual Funds

- NRI Demat Account

- SBI Demat Account

- Home Loans

- NCDs

- NFOs

- ETFs

- Loan against Securities

“SBI Securities has an active client base of over 2.8 Lakhs for the financial year 2020-21.”

Mr. Arun Mehta, Chairman – SBI Securities

SBI Securities Trading Platform

SBI Securities trading platform is accessible through web, desktop, and mobile devices. Traders who have a Trading Account in SBI can make use of the platforms to place trades and transact anywhere, anytime.

This facility of offering trading platforms isn’t offered by many of the mainstream stockbrokers in India, however, SBI Securities takes care of that front.

There is still a lot that can be done when it comes to enhancing the performance, user experience and exhaustibility of these trading softwares.

Let’s discuss these applications one by one and see whether those are any good for you:

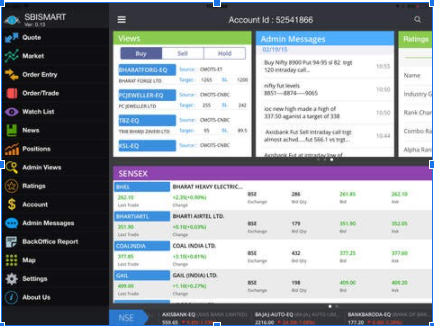

SBISMART Xpress

SBISmart Xpress is the terminal-based trading software from SBI Securities that needs to be downloaded and installed on your computer or laptop.

This is useful for heavy traders looking for high performance and quick order execution. Some of the features of SBI Smart Express are:

- Historical Data – Vast amounts of historical data to help traders in carrying out both fundamental as well as technical analysis.

- Live Stream of Market Data – Users get access to live stock market news, track real-time movement of stocks on Sensex, Nifty.

- Charting Tools – Advanced charting tools provided with technical indicators to help traders analyze stocks.

- On-screen Alerts – Get screen alerts for selected stocks for trading.

- Superfast Order Execution – Trade orders get executed swiftly. The trading terminal is provided with shortcut keys which enhances the ease and speed in placing bids. Modify, Square off, or cancel pending orders in a matter of seconds.

- Multiple Watchlist – With SBISmart Xpress, traders have the luxury of keeping track of several stocks by adding them to a watchlist. Further, traders can keep several watchlists as per their trading needs.

- Research Reports – Trading research calls and research reports available within the trading platform

This is how this SBISmart Xpress looks like:

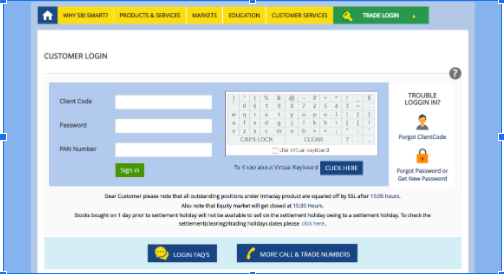

SBI SMART Website

SBI Smart Website is a browser-based trading platform that can be accessed directly through a web link without any downloads or installations.

The user simply needs to browse the link – www.sbismart.com and fill in the valid account credentials and can start trading after logging into the website.

It is a web-based trading platform that can be accessed using any device such as Desktop, Laptop, Mobile, or Tablet. Here are some of the features of the SBI Smart Website:

- 360 Degree Portfolio – Traders can access all their investment portfolios on a single dashboard which ensures ease in accessing and keeping track of the investments.

- Actionable Watchlist – Traders can monitor multiple stocks at the same time by creating a watchlist.

- Multi-Asset Order Window – This feature facilitates a trader in navigating and switching between various asset classes to place quick trade orders.

- Lightweight Trading Platform – This platform needn’t be downloaded and installed on any device. Instead, the trader can simply access the light SMISmart website

- Fund Transfer Feature – The availability of the fund transfer feature ensures an added bit of comfort to the trading experience.

- Provision for Technical and Fundamental Analysis – Traders can carry out a technical and fundamental analysis of stocks to make better investing decisions.

Here is the login screen for the platform

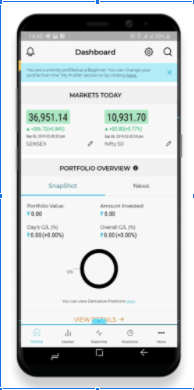

SBI Smart Money

SBI Smart Money is the mobile trading application offered by SBI Securities. The app is available for both Android and iOS-based smartphones and can be downloaded for free from Google Play and App Store respectively.

The SBIsmart money app is packed with some mouth-watering features which enhance the trading experience for a trader. Apart from that the app does well in terms of design and ensuring a top-class user experience.

Here are the features offered by SBISmart Money in detail

- Profile-based Dashboard – Traders can set up and customize their dashboards as per their requirements. The dashboard is the one-click access to market watch, various indices, and research tips, ideas.

- Actionable Watchlist – Get live quotes, performance data charts, and place orders through the watchlist available in the SBI smart money app

- Advanced Charting Tools – The trading platform offers 70 types of charts packed with intraday and historical data to help traders carry out thorough research on stocks. Plus, there is a provision to place trades through charts.

- 360 Degree Portfolio – This feature provides traders with a multidimensional view of their portfolios. Also, the platform ensures an advanced heat map analysis.

- Research Ideas – The app provides research ideas, tips as per the profile and need of the trader, be it stocks for long term investment or short term intraday trading tips.

- News & Analytics – Through this feature, traders are ensured real-time updates of stock market activity, and stock price fluctuations will help them identify investment opportunities at the right time.

- Thematic Investment Basket and Model Portfolio – Traders can opt for a sample portfolio containing a combination of stocks. Also, SBI Smart money gives traders the freedom to choose an investment theme as per their preference.

- Screeners – Through this feature, a trader can create and set market screeners, stock filters as well as determine the resistance and support levels.

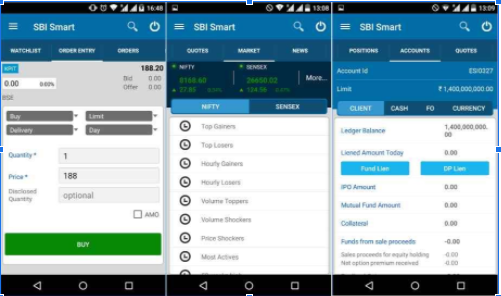

This is how the SBISmart money app looks like:

| Number of Installs | 100,000+ |

| Mobile App Size - Android | 50M |

| Mobile App Size - iOS | 200.1 MB |

| Overall Review - iOS | 2.2 Stars |

| Android Version | 5.0 and up |

| iOS Version | iOS 10.0 or later |

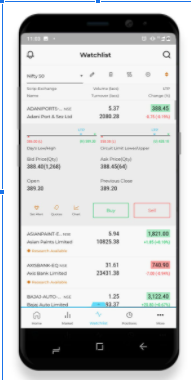

SBISmart Mobile App

SBISmart Mobile app is an average mobile trading application in terms of performance and user experience. It is well designed and has a decent number of features but when it comes to using the application, users might face some hard time in terms of the usability of the app.

Here are some of the features of the SBI smart mobile trading app:

- Access to Live Quotes – This feature ensures that a trader has easy and consistent access to live quotes and messages

- Market Watch – A trader can create a market watch to keep track of multiple stocks through a single window. Traders can add as many as 30 stocks to a watchlist based on their preferences and trading needs.

- Check Order Status – Check order status and positions on stocks

- Live market tracking – This feature helps a trader in monitoring stock movements on both national-level stock exchanges – BSE and NSE.

Following are some of the screenshots of the SBI Smart mobile app:

SBISmart mobile app is one of the worst-rated mobile apps on Google Play store. Some of the major concerns with this application include:

- Consistent slowness in the app has been observed irrespective of your internet connection bandwidth

- Delay in the stock market feed

- The log-in process can be cumbersome at times

- Average quality user-experience

Here are a few of the app stats for reference:

| Number of Installs | 500,000+ |

| Mobile App Size - Android | 3 MB |

| Mobile App Size - iOS | 14 MB |

| Negative Ratings Percentage | 48% |

| Overall Review - Android | 2.8 out of 5 |

| Overall Review - iOS | 1.5 out of 5 |

| Update Frequency | 10-12 Months |

| Android Version | 4.4 or Up |

| iOS Version | 8.2 or Later |

SBICAP Securities Charges

When it comes to charges related to an account with a stockbroker, users need to consider account opening, maintenance charges, transaction charges, taxes, duties, and so on.

However, SBI Securities charges are among the best on offer in the stockbroking industry.

Here we are going to take a look at the complete SBICAP Securities charges

SBI Securities Account Opening Charges

To open SBI demat account, you have to pay certain charges. Although SBI Securities does not charge any trading account opening or maintenance fees, there are charges related to the Demat account.

Here are SBI Securities account opening charges in full detail

| Demat Account opening charges | ₹850 |

| Trading Account opening charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹350 |

| Trading Account Annual Maintenance Charges | ₹0 |

SBI Securities Brokerage Charges

Having an account with SBI Securities allows a trader the opportunity to trade across various segments, except the Commodity segment.

Here is the complete list of SBI Securities Brokerage Charges

| Equity Delivery | 0.5% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | ₹100 per lot |

| Currency Futures | 0.03% |

| Currency Options | ₹30 per lot |

Use this SBI Securities Brokerage Calculator for complete charges and your profit.

SBI Securities Transaction Charges

The complete list of SBI Securities Transaction Charges is as follows

| Equity (Cash & Delivery) | 0.00386% |

| Equity Futures | 0.002206% |

| Equity Options | 0.05515% |

| Currency Futures | 0.002206% |

| Currency Options | 0.05515% |

SBI Securities Margin

If you are a trader that would like to participate in carrying out trade but lack the required funds to purchase stocks then you can give SBI Securities Margin a try.

SBI Securities provides pretty low and mediocre values across the segments.

Here are the complete details

| SBI Securities Margin | ||

| Equity Intraday | Upto 15 times | |

| Equity Delivery | Upto 4 times | |

| Equity Futures | Upto 10 - 12 times | |

| Equity Options | Upto 10 - 12 times | |

| Currency Futures | Upto 4 times | |

| Currency Options | Upto 4 times | |

| Commodities | Upto 4 times | |

As mentioned above, if you are someone who is looking for high-value margin trading, then SBI Securities might not be able to satisfy you with its margin policies and limits.

For more information, check this detailed SBISmart Margin Calculator.

SBI Smart Customer Care

SBI Smart Customer Care can be contacted from 8.30am to 6.30pm on weekdays (Mon – Fri) through the following communication channels, as shown:

- SBICAP Securities customer care number – 022-68545555

- Email – helpdesk@sbicapsec.com

- Web-form

- NRI-Calling

- Physical Branches

When it comes to basic administration and account-related activities, SBI Securities customer care is pretty good and comes with a quick turnaround time. In fact, answers to a lot of your queries are provided on their website itself.

However, dealing with the support team in case of concerns with your trade or trading software – it is a different story altogether – a horror one actually.

Most of the time, technical support does not really have much of an understanding of their trading applications and related concerns.

In cases they somehow do, the turnaround time does not seem to have any related SLA to it.

In other words, the support team can sometimes take too long a time to solve your query, and most of the time you might be kept waiting to get your query resolved.

Thus, keep your expectations low when it comes to SBI Securities customer support.

SBI Securities Research

Since it is a full-service stockbroker, you will get access to research reports and tips on a regular basis. Some of the research products SBI Securities provides to its client base include:

- Fundamental Reports – Fundamental reports are provided with detailed research on specific stocks and companies coming from different sectors. You will be given a recommendation on Buy or Sell or Accumulate or Hold based on the market situation and corresponding impact on the stock discussed.

- Derivatives Reports – SBI Securities derivative reports provide traders all the data required for investing in futures and options. The reports are included with market trends, market news that will prove helpful for a trader to develop trading strategies to make the most of stock market fluctuations.

- Technical Reports – SBI Securities technical reports help a trader in predicting the price movement of a particular stock. The reports are created by experts after taking into account various technical factors such as charts, support and resistance levels, trends & patterns.

In addition, SBI Securities offers a multitude of Analysis Tools such as

- Decisive Screeners – Screeners are useful for a quick glimpse of the market momentum and which specific stocks you should be monitoring for quick profit and exit. These insights are provided across Equity and Derivatives segments.

- Heat Maps – Heat Maps help in figuring out the specific stock’s trend by the usage of specific colour codes. This saves a lot of time for users who are looking to make a quick buck through intra-day trades.

- Detailed Quote – Traders can get a complete look at a particular scrip through this feature. A detailed quote on any scrip usually comprises of the following – quote on stocks, company profile, charts, Fibonacci, risk-return, shareholding pattern,

- Bubble Map – provide you with a relative study of different stocks in one go with an idea of their specific movements in the stock market. Furthermore, different colour codes are used to give an even quicker idea of the movement type.

One thing that is of major importance when it comes to research is – Accuracy. And this is the area where the technical tips of this full-service stockbroker falter pretty badly.

The concern is not only with the performance but with the regularity and the timing of these tips. Either you get these tips too late in order to make a quick profit or you get them once in a while.

Thus, SBI Securities certainly need to pull up its socks when it comes to Research.

SBI Securities Advantages

At the same time, you get the following benefits while trading through SBI Securities:

- Vast Investment Options – Having an account with SBI Securities offers the traders the opportunity to invest in a wide range of investment products

- Trust Factor – SBI Securities is the stockbroking arm of a hugely trustable brand, SBI Group.

- Physical Presence – SBI Securities enjoys a decent physical presence across India. The stockbroker carries out through multiple locations.

- Detailed Quote – SBI Securities detailed quote facility provides a trader with all the data such as – quotes on stocks, company profile, charts, risk-return, shareholding pattern, etc. which is required to make a better investment decision.

- Heat, Financial & Bubble Maps – SBI Securities provide traders with various maps such as Heat Maps, Financial Maps, and Bubble Maps that aid in analyzing stock markets.

SBI Securities Disadvantages

Here are some of the concerns of using the services of this bank-based full-service stockbroker:

- Low Focus on Technology – SBI Securities Trading platforms need improvement in terms of performance and user experience. The stockbroker needs to update their trading platform on technological grounds, especially when you compare them with other stockbrokers.

- High Account Opening and Maintenance Charges – Account opening and maintenance charges levied by SBI Securities are high as per industry standards.

- HIgh Brokerage Charges – The stockbroker levies high brokerage charges when compared against discount brokers.

- Trading Call and Research Facility – Average accuracy of trading calls and research

Looking to open an account or want to have a word with the executive?

Provide your details here and we will set up the callback for You!

Next Steps:

Post this call You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

SBI SECURITIES MEMBERSHIP INFO

Here are some of the important details regarding the membership of SBI securities with different regulatory bodies in the stockbroking industry in India:

| Entity | Membership ID |

| SEBI | INZ000200032 |

| DP Reg. | IN-DP-314-2017 |

| RA | INH000000602 |

| PMS | INP000004912 |

| IRDA | CA0103 |

| CIN | U65999MH2005PLC155485 |

| Registered Address | SBICAP SECURITIES LTD., A&B WING, MARATHON FUTUREX 12TH FLOOR, N.M.JOSHI MARG LOWER PAREL, MUMBAI - 400 013 |

SBI SECURITIES FAQS

Here are some of the most frequently asked questions about SBI Securities:

- How is SBI Securities for opening a Demat Account?

SBI Securities, being a bank-based stockbroker, provides you with a sense of ‘trust’ when you are looking for potential stockbrokers to open a demat account with. However, you need to see what you are looking for and what your requirements are.

This full-service stockbroker is good in offline coverage, okayish in trading platforms, and pretty low as far as brokerage, margin, and service are concerned. Make sure you make your choice accordingly.

2. How to transfer shares from Zerodha to SBI Securities?

Transfer of shares from one demat account to another is a pretty straightforward process these days. With SBI Free Demat Account, you just need to log in to the ‘SCORES’ portal that allows you to register as a trader, and then you can create your profile.

Your details will be validated and then you can transfer shares from one account to another online. This process generally takes 2-3 business days to complete.

Otherwise, you can transfer your shares from Zerodha to SBI Securities, simply by visiting Zerodha’s office, filling in the DIS slip, returning it to the Zerodha executive, taking the acknowledgement, and then the share transfer is taken care of by your current broker (In this case, it’s Zerodha).

3. How do I subscribe to an IPO through SBI Securities?

If you are a client of this full-service broker and want to apply for an IPO, you can use the IPO ASBA Process for the subscription.

First of all, you need to log in to your SBI bank account, click on the ‘Profile’ tab, find ‘Manage IPO Applicant’, and click on that option.

Once you have registered yourself as an IPO Applicant, then you can go ahead and apply for an IPO that is open for subscription.

Applying is done through the ‘eServices’ tab where you find the ‘IPO (Equity)’ option. You need to select your ‘Category’ of the investor, select bid price, quantity, etc, and submit.

4. How is the SBI Securities mobile trading app?

The mobile trading app from SBI Securities is called – SBI Smart. The app is one of the weakest links among the propositions of this stockbroker.

SBI Smart mobile app is rated as bad as 2.8 out of 5 with more than 50% ratings as ‘poor’. Having said that, the app has seen more than half a million downloads to date with an update frequency of 4-6 weeks.

5. What are the brokerage charges of SBI Securities?

SBI Securities, like other bank demat accounts, charges pretty high when it comes to brokerage charges. The equity delivery is charged at 0.5% of the trade value.

Then for intraday trades, the brokerage is as high as 0.05%. Options trading for equity come at ₹100 per lot and for currency options, the brokerage is placed at ₹30 per lot.

So if you ask yourself – Which is the best bank for demat account, with all these propositions, is SEBI Securities the answer for you, or not? If it is, you may choose to open your demat account with this stockbroker, else there are other options too.

Conclusion

SBI Securities or SBICAP Securities is a bank based full-service broker and is the stockbroking firm of the highly trusted SBI Group. Established in 2006, SBI Securities provides a 3-in-1 demat account to its clients.

The stockbroker allows traders to trade on NSE, BSE through its online trading platforms. In addition, the stockbroker also has a physical presence in at least 119 locations of the country

The trading platforms offered by SBI Securities are decent in terms of efficiency, design, and user-friendliness, however, it does need a lot of work when it comes to enhancing performance, user experience.

SBI Securities account-related charges are among the best on offer in the stockbroking industry. It doesn’t charge any trading account opening and maintenance fees. Even the brokerages are evenly priced.

However, when compared with discount brokers, the charges can come across as costly.

Interested in opening a Demat Account? Please refer to the below form

More on SBI Securities

For more information on SBI Securities, you may choose to check any of the below-displayed links:

It’s awesome for me to have a website, which is useful for my experience.

thanks admin

Thanks for sharing post!!! I appreciate this. We also provides best Commodity tips at Dollar Advisory.

Sbi have started a ssl smart value plan.. In 3 in 1 account .. Should I opt for..am a small investor..

I do not even know how I ended up here, but I thought this post was

good. I do not know who you are but certainly you’re going to a famous blogger if you aren’t already

😉 Cheers!