Standard Chartered Securities

List of Stock Brokers Reviews:

Standard Chartered Securities is a part of the Standard Chartered Group. It is a wholly-owned subsidiary of Standard Chartered Bank (Mauritius) Limited. It is a leading broking company that aims to provide simplified investment solutions to its clients.

Standard Chartered Securities Review

In India, Standard Chartered Securities works as a bank-based full-service stockbroker.

The company provides equity and derivative trading services, along with depository services, mutual funds and fixed income instruments. It also deals in the distribution of financial products including IPOs, bonds and debentures.

It also provides non-discretionary portfolio management services to its valued customers to enhance their wealth.

Standard Chartered Securities is a registered member of BSE and NSE. It is also registered as a Depository Participant with CDSL and NSDL.

The aim of the company is to help the investors in achieving their financial goals by providing them with high-quality investment services in a simple and cost-effective manner.

Standard Chartered Securities Active Clients

Standard Chartered Securities reported 5,401 active clients as of 2020-21.

The clients of Standard Chartered Securities include retail customers, including high net-worth individuals and non-resident Indians.

The number of active clients in case Standard Chartered Securities is really low (as compared to the overall Industry benchmarks).

Also Read: Top Stock Brokers with Active Clients

Standard Chartered Securities Products & Services

Standard Chartered Securities provides a platform to place online trades for any stocks listed on BSE and NSE. It offers both delivery trading and intraday trading in the equity segment and the order types allow the clients to take either time-based or price-based decisions.

Leverage products of the company include Intraday, Margin Plus, and Margin against shares.

Standard Chartered Securities also offers derivatives trading to help the traders hedge their investments and gain from the movement of Index or the stocks. The derivatives trading is offered on the Futures and Options segment.

Standard Chartered Securities also provides an opportunity for currency derivatives trading to diversify the portfolio. These are the foreign exchange contracts traded online.

The company is also a member of the CDSL and NSDL and provides depository services. This helps the clients in dematerialisation and rematerialisation of shares, pledging of shares, freeze or unfreeze and other depository services.

The other services of Standard Chartered Securities comprise of corporate fixed deposits and distribution of IPOs, bonds and debentures.

Standard Chartered Securities Trading Platforms

Standard Chartered Securities offers three types of web-trading platforms, with varying levels of advancement.

Easy Trade

Easy Trade is a web-based application that allows users to access their accounts from anywhere, at any time. It facilitates the users to trade on BSE, NSE, FONSE and CDNSE. The users can also place orders for mutual funds, IPOs, debentures and bonds using the trading platform.

The Easy Trade platform has an option to create a customised market watch and to view reports like historical trades, contract notes, ledgers and other back-office reports. The portfolio tracker also allows tracking the portfolio online.

The payment transfers and withdrawals can also be done instantly and there is also an option to block stock for trading and for collateral margin.

Advance Trade

Advance Trade is a more advanced version of the web-based trading platform. In addition to the features of Easy Trade, it provides streaming quotes with auto price updates in the customised market watch. The platform also features an advanced tool named Market Trendz.

It can be used for various studies, resistance and support level of a scrip, moving average and block deal information.

Super Trade

Super Trade is a highly advanced trading platform. In addition to the excellent features of the other web platforms, it can be customised to the needs of the traders. The platform monitors market movement and streams intraday, daily and weekly charts.

It also allows the traders to set scrip wise alerts.

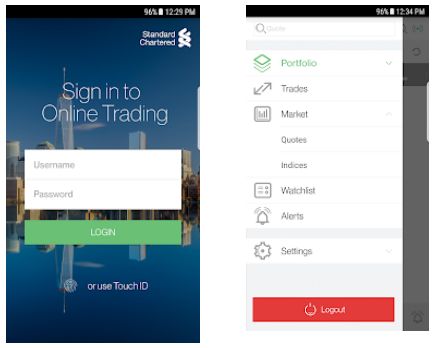

Mobile Application – SC Trading

The mobile application of Standard Chartered Securities, SC Trading, is a simple user-friendly app. It can be used to access the account from anywhere anytime. The mobile app can be used to trade in equity, derivative and currency markets.

The users can create a customised market watch and receive live updates on scrips and indices directly on their mobile phones. The app also facilitates placing after-market orders and intersegment fund transfer.

Some of the features offered in the mobile trading app are:

- Market Watch for quick monitoring of specific stocks and asset classes.

- Order Book, Trade Book & Net Position provisions.

- Order modification and cancellation allowed

- Allocation/De-allocation of shares allowed across segments

At the same time, few concerns have been raised as well by the clients of Standard Chartered Securities:

- The user interface has a decent room for improvement

- A limited number of features provided

- App performance may be a concern for a few users

From the industry perspective, this is one of the mediocre mobile trading apps in the industry, be it in terms of features, user experience or usability.

Here are the stats of this mobile app from Google Play Store:

| Number of Installs | 10,000+ |

| Mobile App Size | 7.5 MB |

| Negative Ratings Percentage | 44.44% |

| Overall Review |  |

| Update Frequency | 5-6 months |

Standard Chartered Securities Research

Standard Chartered Securities has a skilled and experienced research and analytics team. The team does extensive research and provides reports.

The analysis also forms the basis of the tips and recommendations that the Standard Chartered Securities brokers provide to their clients for trading or for portfolio management.

The reports include:

- Morning reports – Daily Reports

- Pre-market dossier – Daily Reports

- Market wrap – Daily Reports

- India weekly reports – Weekly Reports

- Live calls – 3-4 Daily Calls

- Report on BSE200 stocks – Quarterly Reports

- Trade ideas – Monthly Reports

- India top picks – bi-weekly reports

- India private wealth research – No set frequency

The stockbroker provides a mix of long-term investment and short-term trade calls for different types of traders.

As far as the quality of the research is concerned, Standard Chartered does better than an average level job. Nonetheless, it is advised you perform a quick check on the tips provided by the broker before investing your money into the stock market.

Standard Chartered Securities Customer Care

Standard Chartered Securities provides exemplary customer care services to its clients.

The customers can contact the company through a toll-free number, email or by visiting the branch. There is a 24*7 IVR which can be used to place trading and Demat account queries even after the office timings.

It can also be used to check the application status and to check the ledger balance and buying power. There is also a dedicated helpline number for NRIs. Customers have dedicated relationship managers and portfolio managers.

You can get in touch with the customer support of this full-service stockbroker between 8.30 am to 5.30 pm during the weekdays. There is no support provided by the broker over the weekends and public holidays.

The quality of customer support is definitely good.

Standard Chartered Securities Pricing

In case you are looking to take the services of this stockbroker for your trading needs, here are the pricing details you must be aware of:

- The account opening fee for Easy Trade is Free.

- For Advance Trade, the account opening fee is Free, with maintenance charges of ₹500 per quarter.

- The account opening fee for Super Trade is Free, with maintenance charges of ₹1500 per quarter.

- For depository services, dematerialisation is charged at ₹3 per certificate and rematerialisation is charged at ₹50 per certificate.

- Pledge creation and closure are charged at 0.04% of the transaction value, with a minimum of ₹50 per transaction.

Standard Chartered Securities Brokerage

Furthermore, brokerage charges are regularly applied on your trades and below are the charges levied by Standard Chartered Securities across segments:

- The brokerage for intraday trading is 0.05% and for delivery trading, it is 0.5%.

- The brokerage for futures transactions is 0.05% and 1% on the premium for options transactions.

- For currency derivatives transactions, the brokerage is 0.05% on each leg.

Here is a quick summary of all sorts of charges levied by the broker at different levels from its clients:

| Demat Account Opening Charges | Free |

| Demat Account Maintenance Charges | ₹999 |

| Trading Account Opening Charges | ₹0 |

| Trading Account Maintenance Charges | ₹0 |

| Duplicate Statement Charges | ₹25 for monthly statement per account |

| Pledge Creation and Closure | 0.04% of the transaction value subject to a minimum of ₹50 per transaction |

| Equity Delivery | 0.50% or ₹25 Per Contract, whichever is higher |

| Equity Intraday | 0.05% or ₹25 Per Contract, whichever is higher |

| Equity Futures | 0.05% |

| Equity Options | 1% of the premium amount with a minimum brokerage of ₹100 per contract |

| Currency Futures | 0.05% on Each Leg |

| Currency Options | 0.05% on Each Leg |

Check out this Standard Chartered Securities Brokerage Calculator for more information on brokerage and other related charges.

Standard Chartered Securities Advantages

Here are some of the positives of this bank-based full-service stockbroker you must know:

- The company has strong brand equity.

- The research and analytics team is highly skilled and proficient to guide investment decisions.

- The technology is advanced, with seamless fast and secure transactions.

- The company is dedicated to providing excellent customer care to its clients.

Standard Chartered Securities Disadvantages

And here is the dark side of the coin as well:

- The brokerage charges are slightly higher, compared to the other brokers.

- The number of physical branches is less.

- Commodity Trading not allowed

Standard Chartered Securities Membership Information

Following details show the different memberships this stockbroker has taken up with various regulatory bodies in India:

| Entity | Membership ID |

| BSE | INB011333334 |

| NSE | INB231333338 |

| SEBI | INH000000966 |

| NSDL | IN-DP-NSDL-36-97 |

| CDSL | IN-DP-CDSL-531-2010 |

| PMS | INP000003542 |

| Registered Address | Standard Chartered Securities (India) Limited 2nd Floor, 23-25 M.G. Road Fort, Mumbai-400001 Maharashtra, India |

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking your next steps ahead:

Standard Chartered Securities Branches

Standard Chartered Securities has a large network with pan India presence in 8 locations through 9 branches. The branches are located at Mumbai, Pune, Ahmedabad, Bengaluru, Hyderabad, New Delhi, Chennai and Kolkata.

You can read this review in Hindi as well.

More on Standard Chartered Securities

If you wish to learn more about this stockbroker, here are a few references for you:

Standard Chartered Securities Review  |

Standard Chartered Securities Brokerage Calculator  |

Standard Chartered Securities Comparisons  |