Stoxkart

List of Stock Brokers Reviews:

The intent behind penning this article is to provide Stoxkart Review to our valuable readers.

Stoxkart, a part of SMC Group, is a Delhi-based financial brokerage firm growing fast in India. It was launched in 2019, and it offers various trading platforms for trading at extremely competitive prices.

It also shares its market expertise with its clients to benefit them financially.

The broker is registered with SEBI (Securities and Exchange Board of India), NSE (National Stock Exchange), BSE (Bombay Stock Exchange), MCX (Multi Commodity).

Use Up/Down Arrow keys to increase or decrease volume.

Also Read: Stoxkart Bracket Order

This article discusses various aspects of Stoxkart, including company offerings, trading platforms, pricing, brokerage, margin, customer service, and its benefits and disadvantages.

STOXKART REVIEW

As mentioned above, Stoxkart is a discount broking arm of SMC Global, which has an active client base of 1,24,453. This client base places the broker among the top stockbrokers in India in the client base aspect.

The brand, Stoxkart, still has a long way to cover in terms of positioning itself as a promising stockbroker. This journey will require providing value to the client irrespective of the brokerage plans or offers it looks to provide.

To begin with, let’s understand the quality of its trading platforms.

STOXKART TRADING PLATFORMS

Stoxkart offers different platforms to its clients to meet their specific needs from a trading platform. These platforms play a very significant role in the Stoxkart review. We will discuss all these applications with their respective features and risks associated.

You can decide which platform works best for your requirements.

STOXKART PRO

This application is another mobile trading app from this discount broker that adds a lot of value to the Stoxkart review.

The only reason for more than one mobile trading app, in this case, is simple. Stoxkart pro was launched, keeping in mind the limitations of Stoxkart classic, i.e., it is suitable for beginner traders. Thus, the need for another app for expert-level traders was felt.

Well, let’s see whether their attempt has worked in their favor or not.

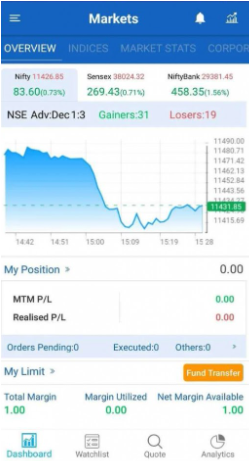

Here are some of its features:

- A specific number of data points for a detailed market understanding.

- Facility to trade in multiple financial segments.

- Informative dashboard.

- A real-time feed from different indices is provided.

- Multiple chart patterns available and cutting edge charting tools.

- Market and historical data available.

- ‘Live Squak’ powers live news.

- Option to trade in equity, stocks, currency, commodity, and derivatives.

- One-touch order placement.

- Provision to trade across different trading segments, including Equity, Derivatives, Currency, Commodity, etc.

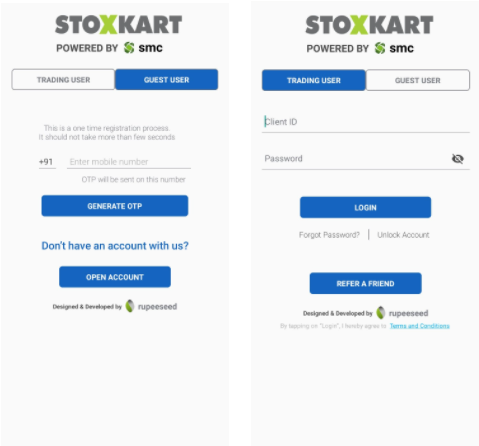

Here is how the Stoxkart App looks like:

At the same time, few concerns have been raised by app users. These concerns affect the Stoxkart review hugely. They are listed below:

- A relatively heavy-app in terms of internet-data usage.

- Not responsive to a few mobile devices.

- Very slow in high traffic time.

- The loading speed is low in many instances.

Here are some of the stats of this app from the Google Play store:

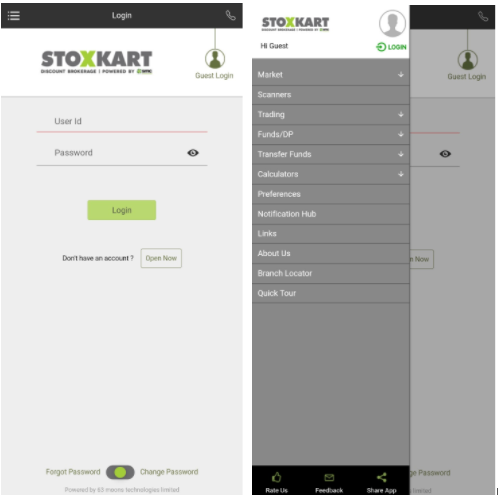

STOXKART CLASSIC

Stoxkart Classic is the mobile trading app from the house of this discount broker. It can be downloaded on Android as well as apple devices.

Its main features have been described below

- Research-Based Recommendations from various analysts.

- Thematic investments.

- Real-time streaming quotes.

- Historical charts are available.

- Facility to trade on multiple exchanges.

- Helpful customer care facility.

- Equity, Derivative, Commodity, and currency investments that can be done online.

- Easy navigation to essential options.

- Option to create multiple market watch list.

These fantastic features add many points to the Stoxkart review.

This how the app looks like:

Some of the risks described by the users of this mobile app are:

- The app comes with a fundamental design and user experience. This point is a big turn-off for the users in this competitive mobile trading space.

- A minimal number of features are provided, limiting intermediate or expert traders to avoid this app for trading.

- Consistent OTP related issues observed.

Here are some of the stats of this mobile trading app from the Google Play Store:

STOXKART INVEST

Stoxkart Invest is the latest addition to the list of platforms offered by the broker. It was launched in February 2020 and is a worthy mention in the Stoxkart review.

So, Stoxkart invest is a dedicated platform for managing and tracking mutual fund portfolios. The main features of this platform are:

- The fact sheet is available for all schemes.

- Seamless transaction at every step – purchase, redemption, SIP, switch.

- Quick and straightforward to use.

- User-friendly interface.

This screenshot is how the login page of the app looks:

Here are some of the stats of this mobile trading app from the Google Play Store:

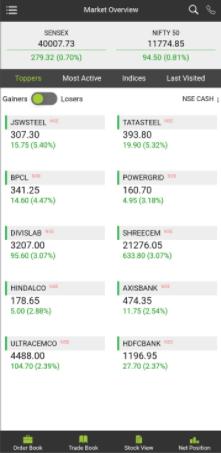

BROWSER TRADING PLATFORM

This lightweight browser trading platform works best for those who need to do frequent trading. The main features have been discussed below :

- Real-time market updates.

- Advanced charts.

- Regular notifications and alerts.

- Shortcut keys for quick trading purposes.

- Detailed scrip overview.

- Mutual funds investments that can be done online.

- Micro and macro data analysis.

- Single hand navigation options for essential tabs.

- Quick landing option.

- Opportunity to choose a theme.

- Continuous market watch.

This application is a custom version of Net-net lite and has been designed accordingly for Stoxkart clients. It is a lightweight application and can be used across different browsers where you do not need to download or install any software.

The platform suits beginner to intermediate level traders since it will not offer high-end features that expert-level traders might need. The better these platforms perform, the better the Stoxkart review is.

Here’s a sneak peek into this platform’s looks:

DESKTOP TRADING APPLICATION

This platform is quite user-friendly and can be accessed on desktops as well as laptops easily. The main features of this app are discussed below –

- Real-time streaming quotes.

- Advance chart facility.

- Market screeners & advanced analytics.

- Shortcut keys for quick trading purposes.

- Portfolio Tracker.

- Mutual funds investments that can be done online.

- Research and advisory support.

- Thematic investments are enabled.

You are required to download and install this application for your trades. Furthermore, this application is platform-dependent and can only be used on a computer, laptop, or desktop.

The overall user-experience of this application is relatively average and has room for improvement. Still, it can be seen as a better trading application than the rest of this broker’s offerings.

STOXKART BACK OFFICE

Access to the back-office of the broker increases customer experience and satisfaction. This point contributes a lot to the Stoxkart review. Backoffice provides information like:

- Transaction reports.

- Access to easy fund transfer.

- Customer support, and much more.

This screenshot is a peek a boo into the looks of Stoxkart back office:

STOXMF

Besides providing trading platforms for investing directly in the stock market, Facility for investing in mutual funds facility is available in Stoxkart Online. This facility for a new stockbroker adds a lot of value to the Stoxkart review.

Therefore, paperless transactions for investment in mutual funds can be done from the same trading platform.

One can also get recommendations based on one’s financial goals.

Some of the most expert investors also recommend investing your capital in different financial segments, and mutual funds are undoubtedly profitable investment products.

This offering by Stoxkart is undoubtedly an interesting one, and you are advised to check it out if it goes with your investment needs.

STOXKART LOGIN

The majority of the login credentials for Stoxkart trading platforms require you to enter the client ID provided to you, and you set the password. But, in a few cases, they ask for a user ID.

This user ID is provided to you when you register for the application or platform.

Keeping your passwords safe and confidential is mandatory in times like these. Be cautious while you log in from an unknown device or get the information about an unfamiliar login activity.

Click here for more information about Stoxkart Login.

STOXKART MARGIN

Stoxkart review would be incomplete without the mention of its margin facility. Stoxkart margin facility is extended in two forms – Free and Premium.

Below is a table of their margin funding in various segments.:

Brokerage charges across all segments are ₹15 per order for normal users and ₹30 per order for premium users.

Also, you can trade in derivatives by availing the facility of Stoxkart Futures Margin and for commodity trading you can refer to Stoxkart Commodity Margin.

STOXKART CHARGES

One can open a Stoxkart Demat Account online or offline with Stoxkart. One just needs some necessary documents like PAN card, Aadhar card, bank statements of the last three months, etc.

The charges levied on the trader or investor have a significant contribution to the Stoxkart review.

- Stoxkart Account opening charges for equity, commodity, and currency trading at Stoxkart – ₹300 + GST and ₹200+GST

- Annual Maintenance charges or AMC for the account – ₹300

- Mutual Fund Investments are made for ₹0 fees.

- Stamp duty charges are also levied as per government regulations.

Also, they claim that there are no hidden charges other than these.

STOXKART BROKERAGE

One can trade in equity, futures and options, commodities, and currencies on the NSE, BSE, and MCX. Without discussing the brokerage charges, Stoxkart review would be incomplete.

Since Stoxkart is a discount broker, it charges a flat rate brokerage charge. In other words, irrespective of the trading turnover of your order, the brokerage charged is going to be a fixed amount.

Otherwise, India’s full-service stockbrokers charge a percentage-based brokerage, which goes high as your order value increases, thereby cutting into your profit.

For delivery based trades – Stoxkart provides the facility of zero brokerage on delivery trades.

Simultaneously, for intraday equity trading, ₹15 is charged for every intraday, derivatives, commodity, and currency transaction irrespective of the trade’s size but only if one earns a profit. This part is one of the best things about this broker.

One can also call and place orders at ₹20 per order.

Let us look at the detailed charges and other transaction costs involved with trading from Stoxkart.

CHARGES FOR EQUITY SEGMENT

If you are into delivery trading, where you buy today and sell tomorrow, or later, then these are the charges levied on your trades:

Intraday Trading:

For buying and selling within the same trading session, here are the charges applicable:

Equity Options Trading:

Derivatives trading in options, you will be required to pay the following on your trades:

Furthermore, futures trading draw the following payments at different levels:

Equity Futures Trading:

CHARGES FOR CURRENCY SEGMENT

The currency trading requires you to pay the following charges (for futures):

Similarly, for currency options, here are the pricing details:

Commodity Futures require you to pay the following charges:

CHARGES FOR COMMODITIES SEGMENT

Similarly, commodity options have the following charges mapped with it:

Before entering any transaction, one must get a detailed view of all the charges and margin requirements that are going to be involved in the particular trades. These charges play an essential role in Stoxkart review.

For more information, you can check this detailed Stoxkart Brokerage Calculator for reference.

STOXKART CUSTOMER CARE

The discount broker offers the following communication channels to serve its clients, and these add to improve the Stoxkart review. The channels available are:

- Web-form

- Stoxkart customer care number

- Multiple Email ID

With limited communication channels and overall average customer service, Stoxkart can certainly improve a lot when it comes to its resolutions’ turnaround time.

Furthermore, the support executive team can be trained better in market understanding and the broker’s different offerings.

STOXKART BENEFITS

Before we conclude this Stoxkart review, let us discuss various advantages of the stockbroker.

- Brokerages – The brokerage charges charged by Stoxkart are one of the lowest in the industry. And an attractive feature about it is that brokerage is to be paid only when the trader earns a profit.

- Research-Based Advice – Another essential feature of Stoxkart is that stock recommendations are given by different analysts based on their research. Robo advisory is available with the Stoxkart Pro app.

- Real-Time Support – Stoxkart has an experienced and reliable team of professionals who can solve any account related queries and place trades for their clients.

- Exposure on Intraday – Stoxkart offers a considerable margin per trade, making it one of the competitive stockbrokers when it comes to margin trading. This value is applicable across every intraday equity, currency, and commodity transaction.

- Easy Account Opening Process – It is straightforward and convenient to open an account with Stoxkart.

- Real-Time Support Team – A dedicated team of experienced individuals is always there to help a client with an account or trade-related query.

STOXKART RISKS

Simultaneously, a quick look at some of the risks or concerns associated with opening an account with Stoxkart is necessary for the Stoxkart review. The disadvantages are:

- Relatively New in Market – Stoxkart is a relatively new broking platform compared to other well-established and reliable players.

- Call and Trade facility is not Free – If any person needs to make multiple trades offline for any reason, he/she would be required to pay Rs. 20 per order, which can become a large amount with many transactions.

- No IPO Facility – One cannot participate in an Initial public offering through Stoxkart.

CONCLUSION

Overall, Stoxkart is a good option for opening a trading account as its features and platforms are quite user-friendly as well as pocket-friendly.

The brokerage and other charges are low, and Stoxkart account opening and maintaining are effortless.

One can also get stocks related advice through Stoxkart, which can prove very beneficial to the traders who are new to the world of stocks.

One should know one’s expectations from his /her broker before deciding to open a trading account with Stoxkart.

One should also be familiar with all the platform’s charges and features for trading purposes. All the pros and cons should be thoroughly reviewed before making a decision.

This information was all about the Stoxkart review. In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps ahead.

Want to open a Demat Account? Please refer to the below form

Know more about Stoxkart

Hi,

Brokerage is free for entrada trading but for all product types?? Or only in bo/co order