Sushil Finance

List of Stock Brokers Reviews:

Sushil Finance is an old full-service stockbroking house in India with its operations starting way back in 1982. Based out of Mumbai, Sushil Finance has a client base of just over a Lakh in India along with a presence in 225 cities of India.

Being a full-service stockbroker, it has a franchise network of more than 450 across 21 states of the country. The broker is primarily known to handle client’s investments with their expertise in mid and small-cap stocks, primarily with the help of their research team.

Let’s learn more about this broker at length so that you are clear whether to go ahead with Sushil Finance or not.

Sushil Finance Review

The financial group is led by Sushil Shah has seen a lot of additions to the overall financial kit they serve today.

It started with very limited investment options for its clients but over a period of time, the group has been successful in adding a lot of financial products in order to cater those to their clients.

Sushil Finance has running memberships with NSE, BSE, MSEI, thus, allowing its clients to use the following financial products and services:

- Equity

- Derivative Trading

- Currency Trading

- Mutual Funds

- IPO

- NRI Demat Account

- Institutional Equities

- Depository Services

Sushil Narendra Shah, Chairman – Sushil Finance

Sushil Finance has an active client base of 60,376 by Financial Year 2019-20.

Sushil Finance Trading Platforms

Sushil finance provides trading platforms across devices i.e. Desktop, web and mobile and clients can use the trading platform(s) based on their preferences. To get an access to use the app, you must have Sushil Demat Account. Here are the details:

Sushil Finance PowerTrade

Power Trade is an executable file that can be downloaded and installed on the client’s desktop or laptop. Mostly suitable for heavy traders, power trade comes with the following features:

- The market watch feature allows you to monitor specific stocks across sectors

- Shortcut keys for quick order placement and personalization

- Conditional Tickers help you in performing a quick analysis

- After Market order (AMO) placement feature allows you to place orders on your trades even after the stock market is closed.

- Portfolio creation and management

- EOD and intra-day charting with indicators

However, the application provides a pretty mediocre trading experience to go along with bulky configuration. Thus, if you are a beginner level trader, you are going to have a tough time understanding the way this software works.

Although, experienced and intermediate traders who have used terminal applications such as NEST Trader or ODIN Diet might find this application relatively easier to use.

Sushil Finance Swift Trade

If you are someone who prefers to trade directly through the browser, then Sushil Finance Swift Trade web application might work for you.

This light-weight application does not require any download and can be accessed directly by a link.

Some of the top features this application offers are as follows:

- Reasonable application speed even at internet connection with lower bandwidth

- Direct information on research, tips and reports for traders to access

- The market-watch feature can be personalized based on user preferences

- Integration with more than 40 banks for direct online funds transfer

- You can place after market orders as well using this application

This web trading solution works well for those set of traders who prefer to trade using their laptop, mobile or computer while using minimal internet bandwidth and want to access a wide range of features.

Sushil Finance Savashare

Savashare is an HTML5 web-based trading platform where clients can directly login and start trading. There is no limitation on the kind of device used as this is a responsive trading platform.

A lightweight application, Savashare web comes loaded with the following features:

- Integrated back office for reports

- Market watch

- Trading history with complete details on transactions made

- After and Premarket order placements

- Displays top gainers and losers along with most active securities

Savashare Mobile App

When it comes to the Savashare Mobile App, there is a lot that can still be improved. As per our research, the mobile app of Sushil finance lacks in a lot of aspects.

But first, let’s talk about its features:

- Market watch that can be customized as per the user’s preferences

- Funds transfer across 40+ prominent banks of the country

- Buy/Sell order placements with utmost ease in a few clicks.

- Reports, tips and recommendations available

- Charting feature with multiple chart types at both intraday as well as historical levels.

- Market depth feature can be accessed to view the top 5 bids and offers.

- Easy fund transfers from and to your trading account.

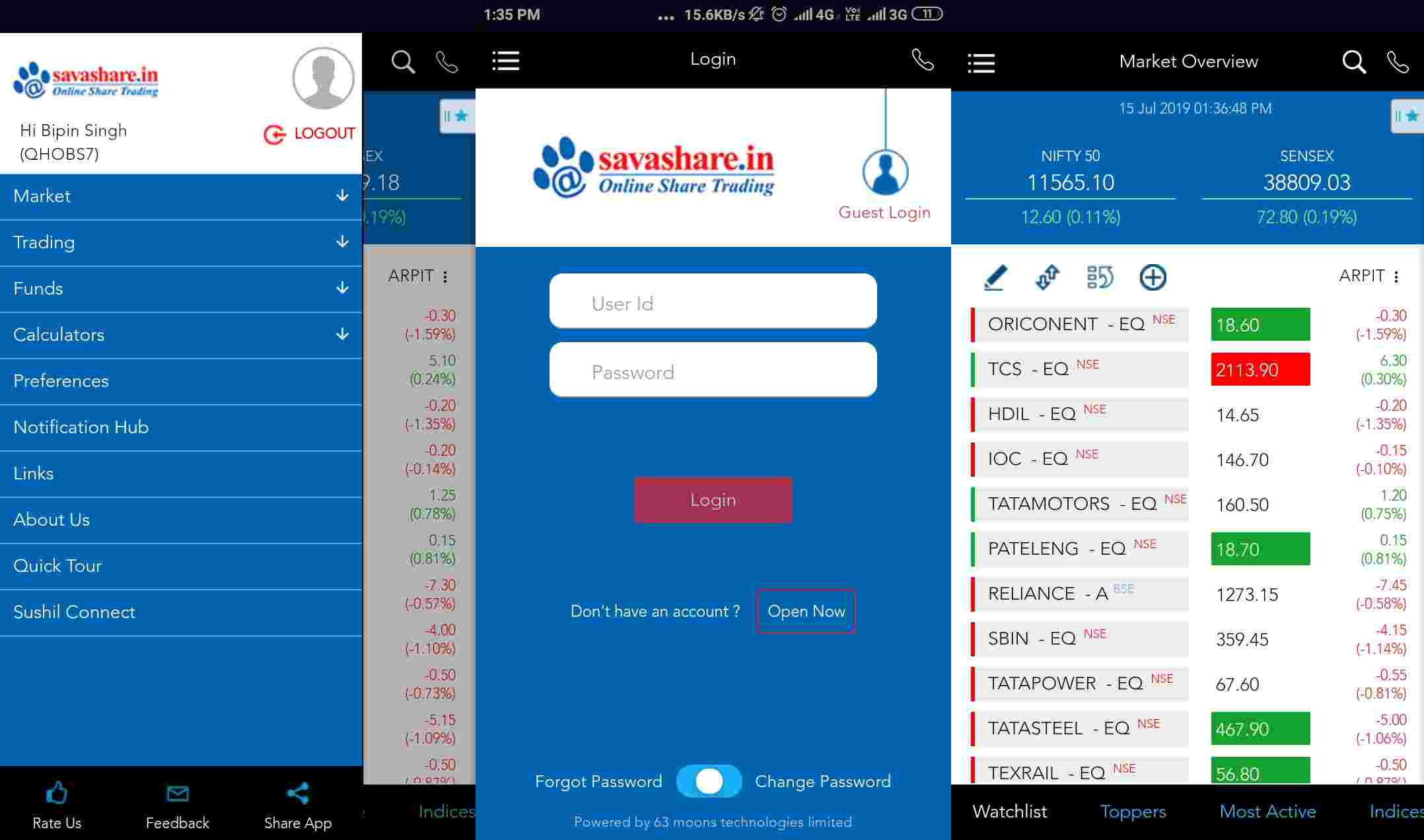

This is how the mobile app – Savashare looks like:

Here are some of the stats of this mobile app from the Google Play Store:

| Number of Installs | 1000+ |

| Mobile App Size | 12 MB |

| Negative Ratings Percentage | 27% |

| Overall Review |  |

As you can observe from the stats, the mobile app has seen limited visibility and traction with a count of around 5000+ downloads which can definitely be improved. Overall rating of 3.7 out of 5 is another area of improvement for this stockbroker.

Some of the concerns raised by the users of this mobile app are:

- Average user experience and design, for instance, a lot of users have complained about the text font, making it very difficult to read whatever is written.

- A limited number of features.

- Slow update frequency

Thus, if you are a beginner level trader, then you may give this app a try. However, the app is certainly not recommended to intermediate and advanced level traders.

Sushil Connect Mobile App

Another mobile trading app offered by Sushil Finance is Sushil Connect Mobile App. This full-service stockbroker definitely has a wide range of trading platforms.

Nonetheless, if we talk specifically about this mobile trading app, some of the top features that can be accessed are as follows:

- The app allows a guest login where you can access some of the basic features without registering with the broker as a client. This guest login comes with a 7-day Free Research trial as well.

- A quick look at the trading ledgers, family portfolio which helps you to view your daily gains.

- Market depth feature allows you to take trading decisions based on the market movements.

- Alerts and notifications help you to stay afloat with the movements of the stocks you are looking to invest in.

- You may get a notional idea on your profits or losses by using the Mark to Market Summary feature.

- Custom research calls based on your investment strategy.

- Price alert feature keeps you notified about the movements in stocks under your radar.

- Fund transfers are made easy as you can use the ‘Pay Online’ feature.

This is how the app looks like:

Some of the concerns raised by the users of this app are:

- The app design is pretty basic as compared to some of the best mobile trading apps in India.

- The app provides a limited number of features to access. For instance, there is no logout feature available in the app.

Here are some of the latest stats from the Google Play Store:

| Number of Installs | 50,000+ |

| Mobile App Size | 11 MB |

| Negative Ratings Percentage | 12% |

| Overall Review |  |

| Update Frequency | 5-6 Months |

Sushil Finance Customer Service

The full-service stockbroker provides you with the following channels of communication:

- Phone

- Web-form

- Offline branches

The approach towards solving customer concerns in a quick time is missing. Yes, the queries are resolved but the turnaround time can be certainly improved. Similarly, the skill-set of the executives can be improved in terms of the knowledge about the products and services provided by the broker.

Sushil Finance Research

As mentioned above, the stockbroker has been around for a while within the full-service space. Thus, it has been able to build a reputation for providing reasonable quality tips and research to its clients.

Some of the research the broker provides is as follows:

- Equity

- Intraday tips

- Market Momentum

- Investment reports

- Future and Option Strategies

- Weekly Monitor

- General Reports

- Commodities

- Intraday tips

- Market Momentum

- Weekly Monitor

- Currencies

- General Reports

- Mutual Fund

- Advisory

- Market Update

The only concern is the range of reports. Thus, if you are a beginner level trader or a long-term investor, then the reports and the corresponding quality works well. For people who are looking to make quick short-term profits on a regular basis might find the whole research structure limited in quality.

Sushil Finance Charges

Talking about the pricing, Sushil finance charges you are a percentage of the overall trade value as its brokerage. Here are the overall charges explained:

Sushil Finance Account Opening Charges

The account-related charges are more or less free with pretty low opening and maintenance charges. These charges can be levied off if you start with a high initial deposit amount.

Here are the details on the account opening and maintenance charges of Sushil Finance:

| Demat Account opening charges | ₹0 |

| Trading Account opening charges | ₹0 |

| Demat Account Annual Maintenance Charges | Free for 1st Year, ₹300 from second |

| Trading Account Annual Maintenance Charges | ₹0 |

Sushil Finance Brokerage

Here is the complete information on the brokerage charged by Sushil Finance:

| Equity Delivery | 0.30% to 0.25% |

| Equity Intraday | 0.03% to 0.02% |

| Equity Futures | 0.03% to 0.02% |

| Equity Options | ₹50 Per Lot |

| Currency Futures | 0.03% to 0.02% |

| Currency Options | ₹50 Per Lot |

| Commodity | NA |

Since Sushil Finance is a full-service stockbroker, it is going to charge a specific percentage of your trade value as brokerage. Having said that, Sushil Finance is definitely open to negotiating on the brokerage charges and can lower these charges based on the client’s trading turnover.

For example, if you are trading worth ₹1 Lakh in the delivery segment and the broker charges 0.1% as the brokerage in that segment – then you would end up paying ₹100 as the brokerage for that particular trade itself.

Such rates are pretty high, especially after the advent of discount stockbrokers.

You can also use this complete Sushil Finance Brokerage Calculator for a detailed understanding of overall charges and your profit/loss.

Sushil Finance Margin

These are the exposure values provided by Sushil Finance across different segments:

| SEGMENT | MARGINS |

| Equity (Intraday) | 2 to 5 times, depending on your growth |

| Equity Delivery | 2 to 3 times |

| Equity Futures | No Margin |

| Equity Options | No Margin |

| Currency Futures | No Margin |

| Currency Options | No Margin |

Looking at the table above, it can be concluded that Sushil finance provides one of the lowest margins in the industry, be it any trading segment.

In fact in derivates trading, the broker has nothing to offer in margin trading. Thus, be wary of this limitation before you open your trading account with this broker.

Sushil Finance Disadvantages

Here are some of the concerns of using the services of this full-service stockbroker:

- Very Low exposure or leverage provided

- Not much innovation in trading platforms with delayed mobile app updates

Sushil Finance Advantages:

You will get the following benefits if you are a client of this stockbroker:

- A wide array of trading and investment products

- FREE call and trade facility

- Reasonable brokerage charges being a full-service stockbroker

- Old stock broking house, so it’s a trustable brand

- Huge offline presence

Conclusion

Sushil Finance is one of those stockbrokers that provides a little bit of everything but does not have a differentiating factor where it does big or something extra as compared to the other stockbrokers.

In such a competitive industry, you have to a champion in any of the aspects, be it brokerage, margin, service, technology, offline presence, research and so on.

Thus, it can be seen as one of the mediocre stockbrokers in India.

If you are a beginner and just want to test out things in trading, you may choose Sushil Finance but it is not recommended for serious investors and traders.

Interested in opening an Account with a Promising stockbroker? Enter Your details here to get a callback!

Next Steps:

Post this call You need to provide few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

More on Sushil Finance:

Feel free to learn more about this full-service broker through the following reference links: