TradingBells

List of Stock Brokers Reviews:

TradingBells is an Indore based discount broking firm that has the backing of the prominent full-service stockbroker – Swastika Investmart Ltd. It recently was funded by Swastika Investmart in a ₹2 Crore seed round in December 2016.

TradingBells Review

Founded as recent as 2016 by the duo of an IIT Engineer, Parth Nyati and a chartered accountant turned Investment banker, Amit Gupta – TradingBells already has a presence in 16 states and 80 cities of the country.

TradingBells is not listed as an individual entity at the National Stock exchange and still works under Swastika Investmart listing. As of now, the broker has a registered office in Mumbai and their corporate actions happen through their office in Indore.

Tradingbells is one of those stockbrokers that provide free demat and trading accounts along with Zero AMC Charges.

“The Parent broker of TradingBells has a total of 27,023 active clients for the current year 2019-20.”

With its membership of NSE, BSE, MCX, MCX – SX and NCDEX, TradingBells allows its client to trade across:

- Equity

- Derivative Trading

- Currency Trading

- Commodity Trading

- Depository Services

- NRI Demat Account

Parth Nyati, Amit Gupta – Founders (TradingBells)

TradingBells Trading Platforms

TradingBells using its collaboration with Swastika Investmart Ltd., allows its own clients to trade using Swastika’s trading platforms and NSE based trading applications. Thus, Trading Bell’s clients can trade using:

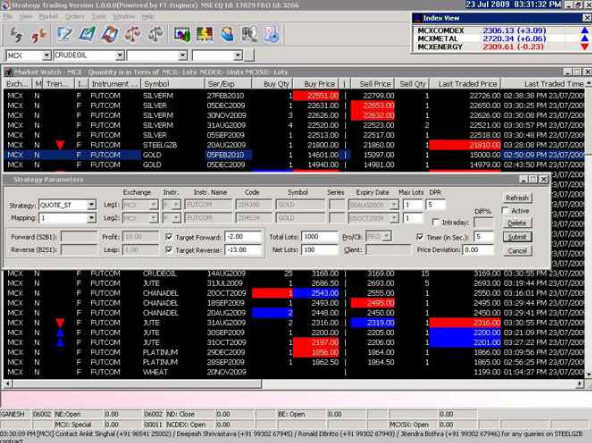

ODIN Diet

ODIN is the traditional online share trading platform that users can download and install on their laptop or desktop. It is developed by Financial technologies or FinTech and is used by numerous stockbrokers across the country.

ODIN comes with built-in intelligence that searches apt opportunities in the market as per the yield and other user-defined criteria.

The software allows you to trade in multiple segments including Equity, commodity, currency etc. Although the application is exhaustive when it comes to the number of features at the same time, it’s pretty bulky in size.

Thus, as a user, you are required to keep a decent configuration of your laptop or desktop to have a consistent and smooth trading experience.

This is how the software looks like:

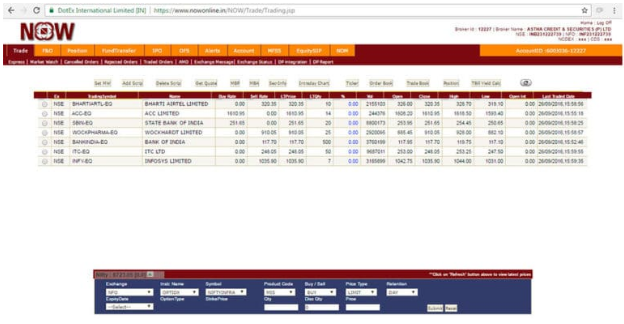

NSE Now

NSE Now is a web-based trading application developed by NSE. It is a widely used browser-based application that users can directly login through their laptops or desktops without any installs or downloads.

Again this is an out-sourced trading application and the broker has no control over the application in case any client provides any feedback or input in order to improve the trading experience.

This is a lightweight application and provides multiple generic trading features to go along with reasonable performance and speedy order execution.

This is how the application looks like:

NETNETLITE

This is a browser-based trading application of Swastika Investmart which is also opened up for clients of TradingBells. To access this application, you do not need to download or install any software. It just requires you to browse to the website of Swastika Investmart, put in login details to get started.

However, the application is pretty basic in terms of number and quality of features within the application. Although it is just fine for beginner traders or investors but is certainly not suitable for medium to heavy level traders.

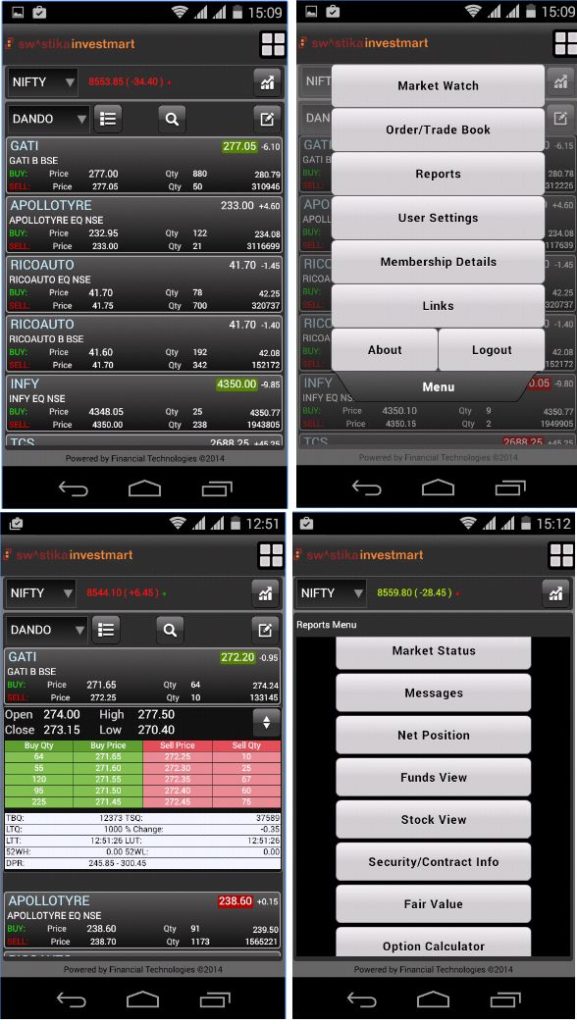

TradingBells Mobile Trade

Mobile Trade is a mobile trading app from Swastika Investmart Ltd. With its partnership with the full-service broker, TradingBells allows its clients to access the mobile app to carry on trading. Some of the features of this mobile app are:

- Allows to trade in Equity, Currency, Commodity and Derivative segments

- Personalization of market watch as per user preferences allowed

- Aftermarket orders placement allowed

- Intraday charts, research reports available for clients

Here is the Google play store information on Swastika Mobile App:

| Number of Installs | 5000 - 10000 |

| Mobile App Size | 48.1 MB |

| Negative Ratings Percentage | 22.1% |

| Overall Review |  |

NSE NOW Mobile App

NSE Now mobile app is available across Android, iOS, Windows and Blackberry platforms. With close to 1 Million downloads, it is one of the most used trading mobile application in India.

You need to know that this application is neither developed nor maintained by any stockbroker, including TradingBells. The tech team of NSE takes care of all the updates and bug fixing.

Some of the features of the application include:

- A wide range of features

- Multiple types of charts and indicators

- Okayish user experience

Here are the stats for this mobile application:

| Number of Installs | 1,000,000 - 5,000,000 |

| Mobile App Size | 37.4 MB |

| Negative Ratings Percentage | 13.9% |

| Overall Review |  |

| Update Frequency Cycle | 1 year |

TradingBells Customer Care

The discount stock broker provides the following communication channels to its clients for any assistance:

- Webform assistance

- Phone

- Offline branches of Swastika Investmart

The discount stockbroker, although new, is trying hard to make sure the voice of the client gets heard and addressed in the most reasonable manner. However, like what happens in other startups, Tradingbells is also struggling to keep pace with the user expectations and this, in a way, dilutes the overall experience needed by clients for smooth performance.

Nonetheless, discount brokers are known to provide minimal customer service to their clients. The major part of their operations goes towards account management and administrative tasks.

TradingBells Charges

Discount brokers pose pretty low charges across different dimensions of payments including account opening, maintenance, brokerage charges, transaction charges etc. Here we discuss different charges levied by Tradingbells:

TradingBells Account Opening Charges

Demat and Trading account by Tradingbells is free of cost as shown below:

| Demat Account opening charges | ₹0 |

| Trading Account opening charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹0 |

| Trading Account Annual Maintenance Charges | ₹0 |

Thus, you don’t need to make any payment whatsoever as far as opening and maintaining your account with this discount stockbroker.

TradingBells Brokerage

Since this is a discount stockbroker, you will be charged a flat rate per executed order as far as the brokerage is concerned.

Here are the brokerage charges across asset classes charged by Tradingbells:

| Equity Delivery | ₹0 |

| Equity Intraday | 0.01% or ₹20 per executed order whichever is lower |

| Equity Futures | 0.01% or ₹20 per executed order whichever is lower |

| Equity Options | Flat ₹20 per executed order |

| Currency Futures | 0.01% or ₹20 per executed order whichever is lower |

| Currency Options | Flat ₹20 per executed order |

| Commodity | 0.01% or ₹20 per executed order whichever is lower |

These brokerage charges are exactly similar to the charges poised by discount stockbrokers such as Zerodha.

Use this TradingBells Brokerage Calculator for complete charges and your profit.

TradingBells Transaction Charges

Apart from account opening charges, AMC and brokerage charges, the client needs to pay transaction charges as below:

| Equity (Cash & Delivery) | NSE: 0.00325% | BSE: 0.00275% |

| Equity Futures | NSE: 0.0021% | BSE: 0.0007% |

| Equity Options | NSE: 0.060% | BSE: 0.030% |

| Currency Futures | NSE: 0.00135% |

| Currency Options | NSE: 0.044% |

| Commodities: MCX | Non-Agri: 0.0031% | Agri: 0.004% (NCDEX) |

The broker charges higher transaction charges as compared to the permissible percentages set by regulatory authorities. This has become more or less a trend among stockbrokers where they attract clients by promising low brokerage charges but compensate (to an extent) to other charges such as transaction/turnover charges.

Users are advised to have a detailed discussion with the executive on all kinds of charges, get the finalized prices sent through an email from the official id of the stockbroker, before actually opening the account with the broker. This will help you in avoiding any potential fraud or addition of hidden charges to your account.

TradingBells Margin

TradingBells provide the following margins to its clients:

| Equity | Upto 22 times Intraday |

| Equity Futures | Upto 7 times for Intraday |

| Equity Options | Buying no leverage |

| Currency Futures | Upto 7 times for Intraday |

| Currency Options | Upto 3 times for Intraday |

| Commodity | Upto 3 times for Intraday |

As far as exposure is concerned, the discount broker provides average level exposure values across all the segments. Thus, if you do not have high exposure expectations, then Tradingbells will definitely suit your requirements.

TradingBells Disadvantages

Here are some of the concerns about using the services of this discount stockbroker:

- Investment across asset classes such as IPOs and Mutual funds not possible

- A relatively new name in the industry, thus, the trust factor is still not there.

- No focus on in-house trading platforms

- Customer service can be improved, especially around the turn around time aspect

- Investment in IPOs not possible.

“The broker has received 3 complaints in total with 0.01% of complaint percentage (industry average is 0.01%) this year. Thus certainly, the broker needs to keep making sure its acquired clients stay satisfied with its services.”

TradingBells Advantages

At the same time, you will get the following benefits in case you open your trading account with TradingBells:

- Fixed brokerage plans allow clients to trade without any fear of transaction amount.

- Free delivery based trades

- High leverage allowed across segments especially Equity.

- Even though TradingBells is a discount broker, it still has a presence in around 80 cities of the country.

Conclusion

“TradingBells is one of those stockbrokers that is still finding its space among discount stock brokers in India. It has taken the brokerage model from mature discount stockbrokers such as Zerodha and NSE/BSE based trading platforms.

In other aspects such as Exposure and customer service, it still has a long way to go before it creates a sense of value among the potential client base.

Thus, as of now, the discount stock broker needs to create its own positioning with initiatives and innovations in different cadres of stockbroking to create a brand of itself in this crowd of stockbrokers.”

Interested to open an account?

Enter Your details here and we will arrange a FREE Call back.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

TradingBells Membership Information:

The discount stock broker, Tradingbells is under the license of Swastika Investmart. Here is the membership information of Swastika Investmart with different exchanges and intermediate parties:

| Entity | Membership ID |

| BSE | INB/F 011129732 |

| NSE | INB/F/E 231129736 |

| MSEI | INE 261129736 |

| NSDL | IN-DP-115-2015 |

| MCX | INZ000072532 |

| Registered Address | 305 Madhabun Buliding,Cochin Street, S.B.S Road , Fort, Mumbai, Maharashtra-400001 |

The details can be verified from the corresponding websites of the exchanges.

TradingBells FAQs:

Here are some of the frequently asked questions about this discount stockbroker from the trading community:

Is TradingBells a trustworthy stockbroker? Is it reliable?

TradingBells has been launched recently as a discount stock broker in December 2016. However, its parent company Swastika Investmart has been around for more than 2 decades and enjoys a decent brand name in the stockbroking fraternity.

It’s up to the discretion of the users that they can trust the parent brand as it is or wait for the discount stock broker to get mature and create a rapport of its own in the industry by providing valued services to its existing clients.

What are the brokerage charges of TradingBells?

The brokerage charges are placed similarly to that of most of the other discount stockbrokers such as Zerodha, Upstox etc. For delivery, brokerage charges are zero while for other segments it is capped maximum at INR 20 per executed order. It can be less than that if your trade value is small.

For more details, please refer to the Brokerage section above.

How much do I need to pay for opening an account with TradingBells? What are the annual maintenance charges (AMC)?

With TradingBells, the account opening and maintenance is free of cost and you are not required to pay anything as far as your account is concerned.

How to transfer shares from TradingBells to Zerodha?

You can transfer shares from TradingBells to any other stockbroker in either offline or online manner. With the offline process, you need to fill in your DIS slips and submit those to TradingBells. Otherwise, you can register yourself at EASIEST, an online portal by CDSL and can do fund transfer online by yourself.

To know complete details, you can refer to this article on How to transfer shares from One Demat account to another?

More on TradingBells:

Looking to know more about TradingBells? Here are a few reference articles for you:

TradingBells Review  |

TradingBells Hindi Review  |

TradingBells Brokerage Calculator  |

TradingBells Comparisons  |

| TradingBells Transaction Charges |

There is a one time charge of 300 during account opening after that they provide life time free amc

my review for the company is good

it was very easy to do online trading with the tradingbells app, and the charges are very low compared to others. compter support are also good…

I have experienced a very bad services from trading bell.A lot of difference between kathani and karani. The broker charged me a month services and after availing the services he is not picking the phones on time.I put on 28000 in my trading account but in one day they gave me a loss of 25000.Now saying sir add some fund .Always try to get funds but will never tried for your benefits. They always looks after their benefits.Never believe them because they are the ugly picture of society.Believe me you will regret on your decisions if you will open an account in the trading bell.

Same with me . Very bad research team & Bad employee communication . They focus only their profits not investors profits

Be careful this is a very worst type of trading provider .If you want to trade find another option like zerodha.sharekhan .upstox.I felt very bad after joining.Only high net worth individual is being focussed .