Trustline

List of Stock Brokers Reviews:

Trustline was incorporated in 1989 and has been a successful financial player ever since. The full-service stockbroker offers financial products and services to meet the clients’ requirements.

Trustline Review

Trustline offers services including equity, currency and commodity trading, both online and offline. The company has robust technology, experienced staff and a user-friendly platform to facilitate strategic trading. It gives one of the best brokerage rates, with personal attention to the clients by the experienced and skilled research and customer relations staff.

Trustline deals in both the cash and derivative segment of BSE and NSE, and is also a depository participant of CDSL and NSDL. The services are also spread across portfolio management services, mutual funds, IPOs, real estate, gold, insurance, and research-based services.

The broker has recently come up with a discount broking initiative as well with iTradeOnline. With this ‘experiment‘, the broker is trying to test the waters in case it may want to convert completely into a discount broker.

Trustline Active Clients

As of 2019, Trustline had 12,844 active clients. The clients of Trustline include corporates, institutions and retail investors and the services are highly customized to meet the needs of the clients.

From the numbers’ perspective, Trustline falls among the smaller stockbrokers in India.

Also Read: Top Stockbrokers in Terms of Active Clients

Trustline Products & Services

Trustline is the one-stop solution for all financial needs. The services offered by the broker include financial market services which provide comprehensive trading facilities on all major exchanges for its clients.

The company also provides wealth management services related to mutual funds, bonds, loans and portfolio and wealth management.

The products of the stockbroker include real estate wherein the company brings the best deals on commercial and residential properties in India. It also offers a wide variety of insurance products to meet the specific requirements of the customers and offers to trade in bullions as well.

Trustline Research

Trustline has an in-house research team, which performs research on the markets and provides reports and trading tips to its clients. The purpose of the reports is not to influence the investment decisions of its clients, but to keep them informed and updated.

The information in the reports is the personal view of the analyst about what he feels about the market, based on extensive research.

The research is provided by the broker through Market Charcha. It includes reports on equity & derivative, currency and commodity. The reports include Nifty Trends, Bank Nifty Trends, stocks to watch, and stock trends. They also include forex trends, major forex news, and a lot of other relevant and significant information.

Trustline Trading Platforms

The full-service stock broker offers a variety of trading platforms (as listed below). Each of these applications has its own sets of pros and cons. Thus, users are advised to have a detailed demo of these applications before finalizing the broker for the demat account.

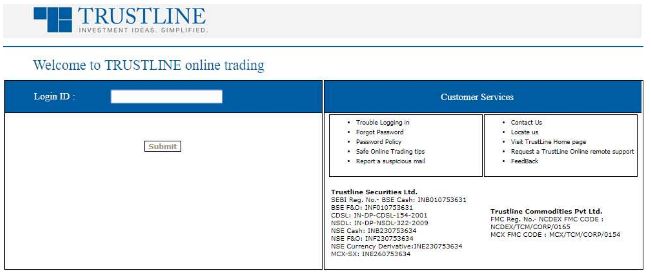

T5- Web-based Platform

The web-based trading platform of Trustline is called T5. It provides a reasonable user experience and can be used on all portable devices. The platform can be used for online trading by selecting the exchange, instrument and stock of the traders’ choice.

It provides the ability to buy orders and sell orders.

The platform is also equipped with tools like intraday charts, including OHLC charts, area charts, line charts. The users have access to their order books, trade books, position books, RMS limits and holdings.

Trust Power- Application-based Terminal

It is an application-based terminal that is used by active traders. It provides an online fund transfer facility, with high speed and great analytical features like graphs and customized formula in a market watch.

Unlike the web-application explained above, this terminal software requires you to download and install the trading software onto your computer, laptop or desktop.

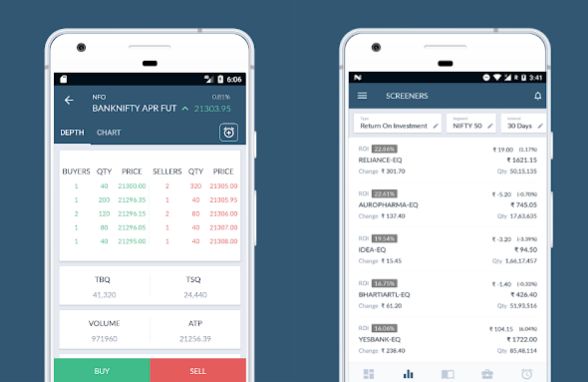

iTrade Mobile – Application

It is the front-end mobile application of Trustline. The application is quite comprehensive and easy to use. It includes a watchlist to keep a track of stocks, and many tools like charts, news, alerts and scrips all in one place.

The application can also be used to place orders or cancel orders and can be used to check the order history, order validity, and order alterations. In terms of the portfolio, the application provides access to day/net positions, cover/exit positions, holdings, and cash summary.

The trader can have real-time access to the market data of individual contracts and market indices, and support for multiple exchanges and segments.

The various types of orders that can be placed using the app include normal buy/sell orders, cover orders, after-market orders, SL orders and SLM orders.

Trustline Customer Care

Trustline provides excellent customer care services. The clients can get in touch with the company through a centralized help desk, or call and trade desk or through emails and at the physical branches. The clients can also WhatsApp or message Help and get a response within 20 minutes. For emails, customer support will reply within 30 minutes.

The clients get personal attention through the skilled and experienced customer care staff and the clients are also assigned with specific relationship managers.

Trustline Pricing

When it comes to pricing, you must be totally aware of all kinds of payments you need to do at different points in time to your broker. Otherwise, some of these charges may come up as hidden charges later – thus, affecting your overall profits.

- There is no account opening fee for the demat accounts.

- The account maintenance charges can either be Rs 300 per year or Rs 1000 for a lifetime free AMC.

- The other demat charges include Rs 50 per script for dematerialization, Rs 100 per security for rematerialization and the transaction charges are 0.03% of the value of the securities, with a minimum of Rs 20 per transaction.

Trustline Brokerage

Here are the brokerage charges levied by Trustline across different segments.

- The brokerage charged by the company is 0.02% for intraday and 0.2% for delivery trading.

- For futures trading, depending on your negotiation skills, the brokerage can be Rs 50 to Rs 90 per lot.

- The brokerage can be further reduced, depending on the volume and quality of trades by the client.

Check this Trustline Brokerage Calculator for more information on brokerage, taxes, GST, Stamp duty etc.

Trustline Margin

Here is a quick look at the margin offered by this stockbroker across segments:

- There is no fixed limit to the exposure that the company provides.

- It can be as high as the client wants, depending on the credibility and trading volumes of the client. At the same time, it has been observed that you may get exposure in the range of 2-3 times for delivery and 8-10 times for your intraday trades.

Trustline Advantages

Here are some of the benefits of opening your demat account with Trustline:

- The customer service provided by the company is reasonable.

- High offline presence.

- The technology of Trustline is robust and inbuilt. This provides safe, smooth and seamless access to the records and orders, and the ability to transact with the clients.

- The brokerage charges are quite competitive, with high leverage.

Trustline Disadvantages

Here are some of the concerns of Trustline you must be aware of:

- Although offline presence is good, however, the density of branches is limited to northern India.

- Low Brand Equity.

Trustline Membership Information

Here is the membership information of Trustline with various regulatory bodies of the Indian Stockbroking space:

In case you are looking to get started with stock market investments or trading in general, let us assist you in the steps ahead:

Trustline Branches

This full-service stockbroker has Pan India presence, with about 400 offices in all major cities of the country.

Trustline has multiple branches in Noida and New Delhi. The branches are also present in Vaishali, Ghaziabad, Faridabad, Gurgaon, Dadri, Ballabhgarh, Modinagar, Meerut, Palwal and Bulandshahar.

The regional offices are located in Mumbai, Kolkata and Chandigarh.

More on Trustline

If you wish to learn more about this stockbroker, here are a few references for you: