Upstox

List of Stock Brokers Reviews:

Upstox (earlier known as RKSV) is one of the leading discount brokers in India. With more than 200,000 clients across the country, Upstox does a turnover of INR 7000 crore daily.

This stockbroking firm was launched in the retail trading segment in January 2012 by 3 founders namely Raghu Kumar, Ravi Kumar and Shrinivas Viswanath.

Upstox Review

Upstox is known for designing and developing its own trading platforms for its clients. With a team of 20+ developers, the broker maintains its trading platforms as well.

As far as customer education is concerned, Upstox offers “Trade Academy“, through which it organizes seminars across multiple locations in India.

However, in the recent past, it seems the focus towards this initiative has declined and a much lesser number of such seminars are being held. Further, the ones that are being held are primarily in the metro cities of the country.

Today, Upstox is a member of NSE, BSE, MCX and MCX – SX. Thus opening the Upstox Trading account gives you access to invest in different trading segments including:

- Equity

- Futures Trading

- Options Trading

- Currency Trading

- Commodity Trading

- Upstox NRI Trading Account

“Upstox has an active client base of 28 Lakh+ at the National Stock Exchange as per the latest records.”

Based out of Mumbai, Upstox has a presence in New Delhi and Bangalore as well. The firm has been backed up by some of the prominent names such as Ratan Tata, Kalaari Capital and GVK Davis.

(L-R) Shrinivas Viswanath, Ravi Kumar, Raghu Kumar – Co-Founders, Upstox

“Upstox has a very sleekly designed office based out of Lower Parel in Mumbai. It gives you a very fresh and dynamic feel where employees can reach out to everyone else with the utmost ease.”

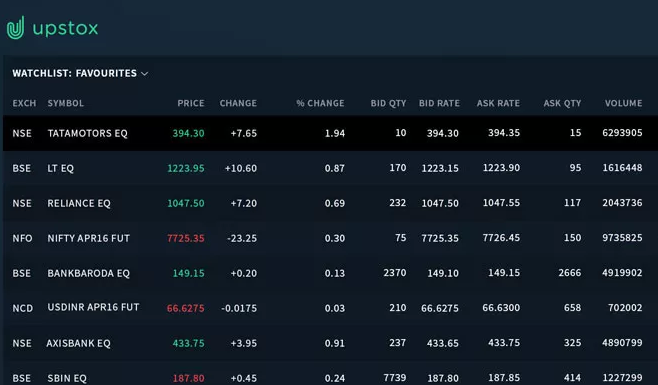

Upstox App

Upstox offers some of the most high-tech trading platforms in the Industry.

Most of the trading platforms of the discount stock broker are developed in-house which is certainly a unique selling proposition among the discount stock brokers in India. They offer trading platforms across devices with advanced features.

Find further details below:

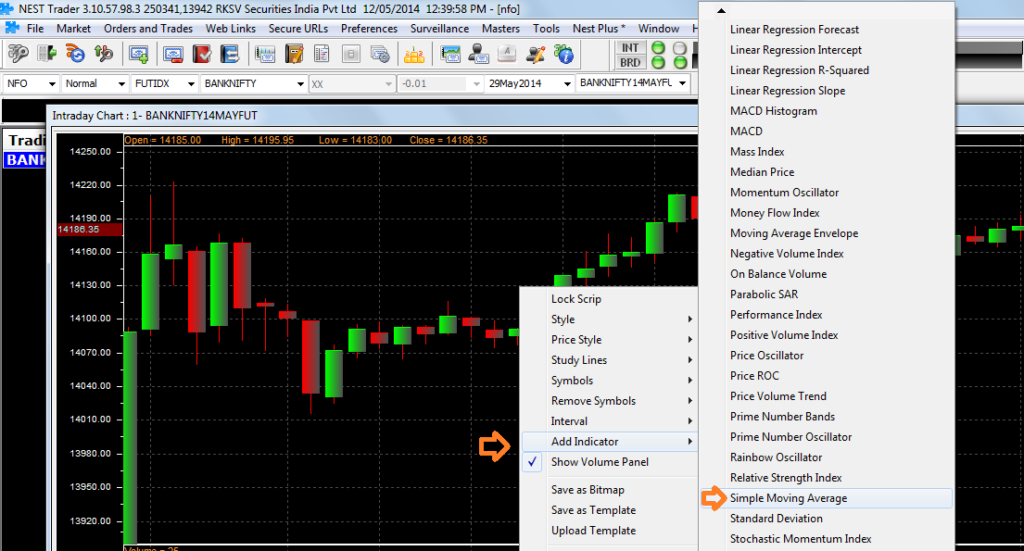

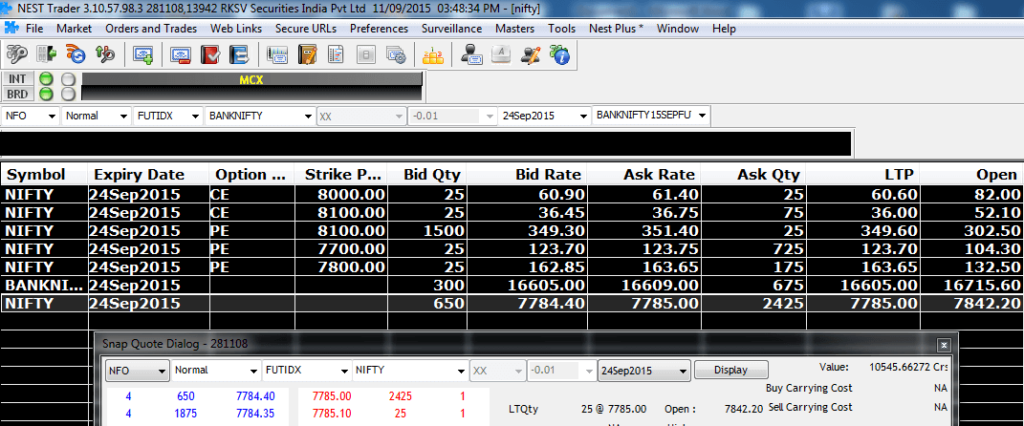

NEST Trading Platform

Upstox NEST is available in the desktop version. It is an executable file that can be installed on a desktop or a laptop. It offers advanced trading tools for high-frequency traders and investors.

Some of the features are listed below:

- It provides high-speed trading with very low delays during transactions.

- The interface can be customized or personalized as per the client’s preferences

- Users have the provision of streaming data on multiple interfaces at the same time

- Advanced charting features for users to perform technical analysis

Here are some of the screenshots of the NEST trading platform for desktop:

The only concern with such an application is that the discount broker himself (Upstox in this case) does not have much control when it comes to the maintenance of the software.

So if you are a client of this broker and you have some feedback regarding the application, there are very low chances of that getting incorporated.

Mostly, the feedback will be transferred to the NSE development team (or financial technologies) and the decision of incorporating the feedback stays at their will.

“Upstox also started Trade Academy where they focus on hold offline seminars and webinars for users to understand the basics and fundamentals of trading or investment.”

Upstox Pro Web

Upstox Pro web is a Trading platform for the web that can be accessed from any browser. Users can use this application from anywhere without downloading or installing any software.

Clients can just open a browser and visit a specific URL to access the application and start trading. This application can also be accessed through mobile phones or tabs.

Here are some of the top features of this trading platform:

- A light application can be accessed through any browser or device

- High functional charts with over 100 indicators and charts allow users to observe the market and stock trends.

“Provision of Bracket order not available within the application. Overall, it provides a decent user experience with different data points for analysis.”

- The ordering window is displayed on the screens so that users can place orders instantaneously

- Features such as Workspaces can be customized as per user preferences.

- Keyboard shortcuts provided to enter orders quickly

This web trading platform is now upgraded to Upstox Pro 3.0 web to offer a better user experience.

This is how the Web trading application looks like:

“There is some usability concern with this application though. Thus, beginner clients will have some hard time understanding the way application works, at least initially.”

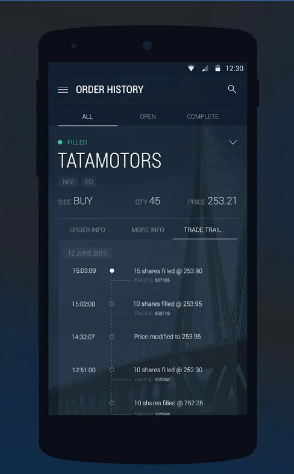

Upstox Pro Mobile App

Upstox is one of the most sophisticated mobile apps for trading. With the Upstox login credential, you can access your app.

Some of the features of the mobile app include:

- Live-streaming of Prices from NSE F&O, NSE Cash, BSE Cash, NSE Currency and BSE Currency

- Line charts, candlesticks with chartings indicators and drawing tools for users to comprehend data easily and take actions quickly

“You can access the mobile app of Upstox with demo user id and password. Get in touch with Us for you to provide you with the credentials.”

- Types of Order Complexity in Upstox such as OCO order, Cover Orders & Bracket Orders

- Easy money transfer with more than 40 banks available within the app

This is how the mobile app looks like:

Here are some of the stats from Google Play Store about this mobile app:

| Number of Installs | 100,000 - 500,000 |

| Mobile App Size | 21 MB |

| Negative Ratings Percentage | 12.3% |

| Overall Review |  |

| Update Frequency | 2-3 weeks |

The discount broker is going to launch a ‘Tamil’ language-based mobile app version very soon in the market. This will be first of its kind of mobile trading app and it comes from the fact that their client base has seen a reasonable movement from Tamil Nadu.

A couple of concerns about this mobile app include:

- Connectivity issues observed in smaller tier cities or with users having low internet connection bandwidth.

- Concerns about the loading of the charts in case you are looking to perform technical or fundamental analysis using the mobile app.

Upstox Demat Account

Demat account is the way to hold your shares in a digital format. In all, it opens a gateway to buy and sell shares in a seamless manner.

Interested in opening a Demat Account.

Enter Your Details here to get a call back now.

Make sure you have all the essential documents like Aadhaar Card, PAN Card, Income proof, Bank Statement, etc to open the account without any hassle.

Here is the list of documents:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

Make sure you signed Upstox POA to gain a seamless trading experience.

For more information, you can check this detailed review of the documents required for the Demat account.

Upstox comes forward with a better offer by providing Upstox 3 in 1 account. This helps customers to reap the benefit of Demat, Trading and Banking services at one place.

In case you do not use your demat account for months, then the broker offers a seamless way to close it. This will help you in saving your AMC charges. Learn how to close Upstox Account and proceed without any hassle.

Upstox Mutual Fund

Upstox has come up with good news for traders by offering a free Mutual fund platform. Traders can now buy mutual funds for free and reap the best benefit.

Here are some of the benefits of Upstox mutual fund:

Built-in Diversification: Offering multiple securities, it comes up with less risk than stocks., thus preventing you from facing large losses.

Professionally Managed: Upstox fund manager are experienced and work proficiently to pick the best stocks for you that plays a vital role in achieving goals.

Paperless Process: Other than this if you have a Demat account with Upstox then you can seamlessly invest in the mutual fund.

Upstox Refer and Earn

Upstox provides a referral program where you can earn by referring its services to your friends or family.

All you have to do is to refer the demat account and once the referral opens the demat account with Upstox you get to reap the benefit of free trade of up to ₹1000 for 30 days.

Isn’t it amazing?

Reap the benefit of free trade for 30 days now by referring the Upstox services to your known ones and start trading now.

Other than this there are many more advantages that can help you to make money by opening an account with the broker. To experience it yourself open an account now.

Upstox Customer Care

Upstox offers the following communication channels for its clients to get in touch with the stockbroker:

- Phone

- Social Media

- Web-form

- Chat-bot

The discount broker certainly can look forward to increasing the number of communication channels such as Web Chat, Toll-free numbers, even automated bots so that users and clients can have a better number of options to get service on the move.

However, as of now, the communication quality is fine but primarily the focus of the executives stays a little “salty” in nature.

Thus, clients of the discount broker who are regular traders and are looking for quick assistance might find the overall quality below average.

Upstox Charges

Till 15th May 2017, the discount stock broker had the provision of free account and annual maintenance charges. However, after that, they have started charging for the opening as well as maintenance of accounts and you can refer to Upstox DP Charges for further details.

Here are the complete details:

| Trading Account Opening Charges | ₹150 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Opening Charges | ₹0 |

| Demat Account Annual Maintenance Charges | ₹150 |

Use this Upstox Brokerage Calculator for complete charges and your profit

“With Upstox, You can open the account using your Aadhar Card as well. With this, the overall Upstox account opening process takes a few hours.”

Upstox Brokerage

Upstox offers pretty competitive brokerage charges in the league of discount brokers. The brokerage is fixed ₹20 at Cash (Equities), Futures, Options, Currency Futures and Options, and MCX Futures.

For instance, even if your order has 15 lots of options, you still pay ₹20 for that particular order. At the same time, equity delivery trades are not charged at all.

“You will be required to pay ₹20 per executed order for using Call and Trade facility”

Apart from this there are different taxes that often makes it difficult for traders to find the net brokerage. So if too are looking for a way of how to calculate brokerage in Upstox, then use the Upstox brokerage calculator to make your calculation simpler and easier.

Upstox Transaction Charges

Apart from Brokerage and Upstox AMC charges, the client needs to pay transaction charges as well. For Upstox, here are the details:

| Segments | Brokerage Charges | Transaction Charges |

| Equity Intraday | Rs. 20 per executed order or 0.05% (whichever is lower) | NSE: 0.00345% per trade on buy & sell. BSE: charges vary as per the scrip group |

| Equity Delivery | Zero brokerage | NSE: 0.00345% per trade on buy & sell. BSE: charges vary as per the scrip group |

| Equity Futures | Rs. 20 per executed order or 0.05% (whichever is lower) | NSE: Exchange turnover charge: 0.0020% Clearing charge: 0.0002% |

| Equity Options | Flat Rs. 20 per executed order. | NSE: Exchange turnover charge: 0.053% Clearing charge: 0.005% |

| Currency Futures | Rs. 20 per executed order or 0.05% (whichever is lower). | NSE: Exchange turnover charge: 0.0009% Clearing charge: 0.0004% BSE: Exchange turnover charge: 0.00022% Clearing charge: 0.0004% |

| Currency Options | Flat Rs. 20 per executed order. | NSE: Exchange turnover charge: 0.04% Clearing charge: 0.025% BSE: Exchange turnover charge: 0.001% Clearing charge: 0.025% |

| Commodity Futures | Rs. 20 per executed order or 0.05% (whichever is lower). | Non-Agri: Exchange turnover charge: 0.0026% Clearing charge: 0.0005% |

| Commodity Options | Flat Rs. 20 per executed order. | Exchange turnover charge: 0 Clearing charge: 0.002% on buy + sell [Rs. 200/crore] |

As per industry standards, the transaction charges levied by the discount stock broker are pretty nominal.

“Digital Contract notes are sent via Email. If you want a physical copy of the contract note, then that can be ordered at an additional charge of 25 Rs per contract + Courier charges.”

Apart from the above-mentioned charges, there are other payments you are supposed to make.

These include Securities transaction charges, Service taxes, Stamp duty, SEBI charges. Make sure you understand all the costs, get those emailed or documented from the broker before you go ahead and open your account with the broker.

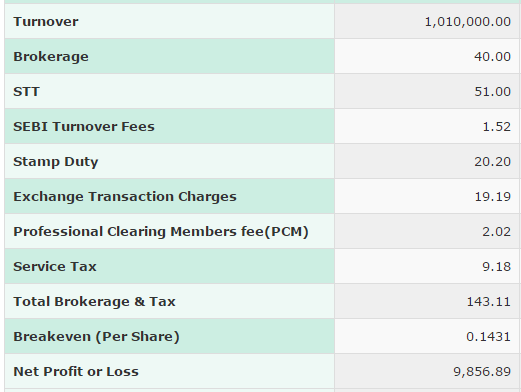

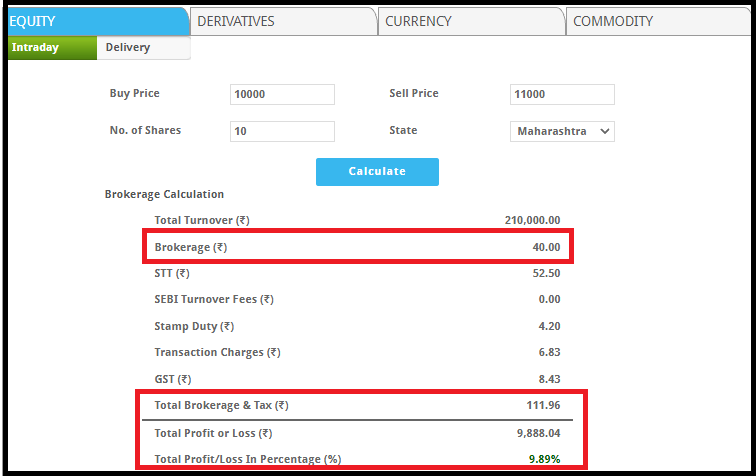

Just to give you an idea, of the overall payment you are required to make a transaction.

Let’s say, for bought 1000 shares of Infosys for ₹500 each. After a week or so, you decided to sell off all the shares for ₹510. For these two transactions of buy and sell, this is how the calculation will be done and the last row talks about your takeaway profit.

Upstox Charges Calculator

As shown in the table above that along with the brokerage, there are few taxes and other fees associated with trading. Now, these charges increased the overall cost and make it difficult for any trader or investor to analyze the total trading fees.

To simplify the calculation, there is a brokerage calculator Upstox where by entering the buy, sell, and quantity of trade you can easily find the total fees along with the profit of the trade.

Upstox Margin Calculator

Here are the details on the margins provided by Upstox:

| Equity | Upto 20 times Intraday |

| Equity Futures | Upto 4 times for Intraday |

| Equity Options | Upto 4 times for Intraday |

| Currency Futures | Upto 4 times for Intraday |

| Currency Options | Upto 4 times for Intraday |

| Commodity | Upto 3 times for Intraday |

For users that are looking for high exposure values, they can avail of some of these new packs introduced by Upstox wherein a specific subscription needs to be paid at a monthly level. By subscribing to this service, clients can get much high leverage values as shown:

Upstox Priority Pack – Equities, Future and Options Segments

Here are the details:

Upstox Priority Pack – Intraday:

Here are the details on the Upstox Intraday Margin:

| Segment | Leverage |

| Equity | Upto 20 times |

| Index Futures | Upto 6 times |

| Stock Futures | Upto 4 times |

| NSE Options Buy | Not Available |

| Index Options Sell | Upto 6 times |

| Stock Options Sell | Upto 4 times |

| NSE Currency | Upto 4 times |

Upstox Priority Pack – Cover Order Leverage:

| Segment | Leverage |

| Equity | Upto 25 times |

| Index Futures | Upto 7 times |

| Stock Futures | Upto 6 times |

| NSE Options Buy | Upto 2 times |

| Index Options Sell | Upto 5 times |

| Stock Options Sell | Upto 5 times |

| NSE Currency | Upto 5 times |

Upstox Priority Pack – Commodities:

| Segment | Leverage | |

| Intraday Leverage | ||

| MCX Futures | Upto 3 times | |

| Stock Futures | Upto 6 times | |

| MCX Futures | Upto 4 times | |

Upstox Disadvantages

There are certainly some concerns observed while using the service of this discount stockbroker:

- No provision to invest in IPOs, FPOs

- The call and trade feature requires an additional ₹20 per trade

- Good Till Cancelled orders are not available in Equity Segment

- Most of the time, the Upstox app does not work properly which leads to heavy losses of traders.

Upstox Advantages

Similarly, here are some of the pros of using the trading account services of the discount stockbroker:

- Upstox provides its own Demat account opening services unlike most of the other stockbroking firms.

- High tech and advanced trading platforms enable customers ease and flexibility to trade online

- A flat rate of ₹20 per executed order across trading segments provides transparency

- Upstox Funds transfer with 40 prominent banks in India is allowed.

- Offers provision to the Upstox Mutual Fund

- It offers a seamless way to monitor your trade with Keystone Upstox.

Conclusion:

“Upstox is a good choice for traders who are looking for a stockbroker that offers cheap brokerage with decent trading platforms. However, such offerings are provided by quite a few discount stock brokers these days such as 5Paisa or Zerodha.

Thus, Upstox needs to push its tempo up and bring in more value propositions in this highly fragmented stockbroking space in India.

One thing, that they can look forward to is developing their own in-house trading terminal software and increase their trading and investment product offerings for clients. Furthermore, their customer service can be improved by a few notches.”

Upstox Membership Information

Here is the information on Upstox’s membership with different indices and exchanges:

| Entity | Membership ID |

| BSE Capital Markets | INB011394237 |

| BSE F&O | INF011394237 |

| NSE Capital Markets | INB231394231 |

| NSE F&O | INF231394231 |

| NSDL | IN-DP-NSDL-11496819 |

| CDSL | IN-DP-CDSL- 00282534 |

| MCX | 46510 |

| Registered Address | Sunshine Tower, 30th Floor, Senapati Bapat Marg, Dadar (W), Mumbai 400013 |

The details can be checked from the corresponding websites.

Upstox Referral Program

The broker has a referral program where existing clients can refer their friends and family. If they become clients of the broker, the referrer gets 10% of the brokerage generated from the accounts opened into his/her own account, for the lifetime.

Having said that, most of the stockbrokers have such a program with a 10%-20% brokerage sharing set up.

Upstox FAQs

Here are some of the most frequently asked questions about Upstox:

- Is Upstox a reliable stockbroker? Is Upstox trustable for long-term investments?

Although the discount broker is primarily positioned as a “start-up” in the discount broking space, it certainly has the backing of some of the renowned names from different industries of India and outside. Names such as Ratan Tata have invested in this discount broker.

However, basing the complete reliability just on that particular factor may also be extreme. Since not all the investments done by renowned investors work out successfully. Nonetheless, the focus of the team looks promising for now.

- Does Upstox provide any inbuilt Algo trading strategies?

No, the discount stockbroker does not provide an algorithm-based trading strategy. Among discount broking space, 5Paisa and Flyers are a couple of names that help you with trading strategies.

- How can I apply for an IPO through Upstox?

There is no direct way for you to invest in IPOs through Upstox. However, there is an indirect way where you fill in the IPO form and put in your Depository Participant (DP) details in your bank account. By doing that, if you are allocated IPO shares, those will be transferred to your Upstox Demat account.

Having said that, it is certainly a cumbersome way and is not recommended for beginners.

- Is Upstox suitable for beginners?

As long as you can perform your analysis and research on your own. A discount stock broker like this will provide a trading platform and average customer service, for the rest of the process you will be on your own.

However, if you are thinking of performing your analysis on your own, then it certainly makes sense to go ahead with this discount stockbroker. By doing that, you can certainly save a lot of profit to yourself, instead of getting it eaten up by a full-service stockbroker.

- Does Upstox have terminal-based software?

Yes, they do but it is not their own in-house trading platform like the rest ones (Pro Mobile and Pro Web). The discount stock broker offers NEST to its clients which is an NSE-based trading platform. Make sure to check with the broker whether it charges its clients for using the platform.

- Is Upstox the cheapest stock broker in India?

It is a cheap stock broker, certainly not the cheapest. There are other discount stockbrokers such as SAS Online, Pro stocks, 5Paisa that offer brokerage in the range of ₹9 to ₹15 as compared to ₹20 charged by Upstox.

- How can I close my Upstox account?

If you are looking to close your account with a discount stockbroker, you need to follow some basic steps. To know the complete procedure of closing your Demat account, click here.

- How do I file a complaint against Upstox?

If you have had a bad experience with the broker, it is better to reach out to the management through channels such as Twitter. However, if you still do not get a satisfactory response, you can register yourself at SCORES, a portal by SEBI and then register your complaint against the broker with all the requisite details, documentation, recordings, etc.

The more proof you have better would be your standing in the case against the broker.

Also, check out the comparisons of Upstox with other stockbrokers here:

More on Upstox:

If you are looking to know more about Upstox, here are a few reference links for you:

The ratings given here seems to be OK, but the fact is their service quality has degraded over the period of last 4 years (They, now are called as “Upstox”, They have introduced their own DP account, make their customer to transfer their trading clients to new RKSV DP account. Lots of misguidance, lack of understanding to customers’ requirements, their customer service. My wife has Upstox account and when she bought shares in August, disappeared and she couldn’t trade. RKSV said they had intimated as they are stopping DP services, but the question is how the delievery of stock could happen at all in absence of linked DP? if it was already linked then why they are saying that they stopped services using IL&FS DP service. How can they force any of their customer to do so, isn’t it a kind of black mail?

I have a loss of about a month now and I am not able to trade the bought shares with IL&FS, in any case they should have blocked the services totally or should have kept running fully.

Really the worst support, service I have ever seen in my life.

No one really bothers about the customer and their issues including founders.

Hello to all, the contents present at this web site are

in fact awesome for people knowledge, well, keep up the nice work fellows.

Fraud Company. Never open account. I have been using it for 2 years. Hell lot of issues with their software. You will end up with writing mail and chatting with support. SEBI should ban this broker. Better go with some other broker like Zerodha, 5paisa etc.

They are nothing but cheats. They have taken my money and have flown away. They are nothing but scoundrels. they have caused immense stress to me. Never have any sort of relationship with them. They have taken my money without providing any sort of a service. they are a bunch of cheaters. Stop promoting them

Really the worst support, service I have ever seen in my life….

No one really bothers about the customer and their issues including founders.