Used Margin in Zerodha

Margin

Zerodha the number one discount broker of India, offers a trading platform Zerodha Kite and many want to grab the information on what is used margin in the Zerodha Kite.

Margin is a widely used term in stock trading. If it were to be explained in simple words, Margin or leverage is the money that a trader borrows from a broker to execute the trade.

When the total value of investments held by a trader is deducted by the loan amount, the margin on a particular stock/share is obtained.

Before getting into details here is exactly what does Margin means?

On Kite or any trading platform, for that matter “buying on margin” means purchasing securities with the money borrowed by a stockbroker. The “margin used” is the amount that a trader has already used for his/her open position or in case of a pending order, it is the amount that has been blocked.

Thus, Margin In Zerodha Kite allows its clients to trade even with limited funds. This margin is also called exposure or leverage and varies across different segments like equity, futures & options, etc.

Note that margin is provided only on Intraday Trading i.e trades classified as “MIS”. For all delivery trades i.e. trades classifies as “NRML” or “CNC” you need to have the total amount of funds required in your Zerodha account as no margin is provided on them.

You must also remember that if you do not have enough funds in your account (to even fulfill the margin amount for a particular order), the “MIS” position will be converted to “CNC/NRML”.

Also Read: What is CNC & MIS in Zerodha

Let’s understand the concept of used margins in Zerodha’s Kite platform.

Zerodha Kite Margin Used

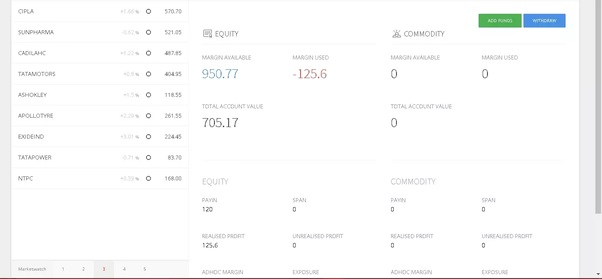

To understand “margin used in Zerodha Kite”, it is important to know the other two terms related to it. In margin trading, there are three important elements

- Total Account Value

- Margin Available

- Margin Used

Your Total Account Value is the “actual cash” that you had in your account yesterday and carried it forward today (the current trade day). In simple words, it is the total amount available in your Zerodha Account.

The Margin Available is the total amount of margin that you can use for that particular trade day. This is the amount you can use for trading.

Margin Used denotes the amount/margin that you have already used in your trade. It is the amount with which you may have purchased any stock like – equity, commodity, etc.

For example, if your account value is 1,000 and you placed an order for 200 to purchase stocks, then your margin used is 200 and the margin available is 800.

Now the “margin used” is categorized into two types – “positive” and “negative”.

If your margin used is positive, you have incurred a loss and you need to pay that particular amount to your broker (Zerodha in this case).

If your Zerodha margin used is negative, you have earned a profit and you shall receive that amount from your broker.

The margin used in Zerodha Kite thus means the net funds’ trader has already utilized in placing an intraday, F&O, or delivery orders. It also refers to the amount blocked for open/pending orders that are yet to be executed.

When a trader sells his shares, opens F&O positions, or earns profits on intraday trades, his Zerodha margin used will be negative. Also, the “margin used” is credited to “margin available” as and when the trader squares off his/her position.

For example, assume that you purchase 5 shares of XYZ at ₹200 per share and sold them at ₹210 per share. The total profit earned on 5 shares of XYZ is ₹10 X 5 i.e. ₹50. This profit, therefore, is seen as – ₹50 in “margin used”.

Similarly, if you had incurred a loss of ₹50, it would be considered as + ₹50 “margin used”.

A picture showing a “negative margin used” that ultimately denotes profit.

Zerodha Kite Margin Calculator

As already mentioned, the margin used in Zerodha kite or on the firm’s platform, in general, varies based on segments and the type of stock.

While Kite is among the firm’s most extensively used trading platform, there are other advanced platforms as well namely – Kite Connect, Kite Mobile App, Zerodha Console, Zerodha Pi, Zerodha Coin, the Coin Mobile App, and Zerodha Sentinel.

Coming back to Zerodha Margin Calculator, discussed below are the margin/leverage/exposure across various segments.

Refer the table below to know the margin across different segments in Zerodha:

Zerodha Kite Margin Calculator Trade Segment Margin/Leverage Provided By Zerodha Equity Delivery No margin provided (on NRML/CNC) Equity Intraday Between 5x and 16x (depending on the stock) Equity Futures (Intraday) 45% of NRLM margin Equity Options (Intraday) 45% of NRLM margin Currency Futures (Intraday) 50% of NRLM margin Currency Options (Intraday) NA Commodity Futures (Intraday) 50% of NRLM margin Commodity Options (Intraday) NA

Bracket orders (BO) and cover orders (CO) provide higher leverage due to the “stop-loss” added to them. All BO and CO orders under the equity F&O segment require a margin of 2.45% of the contract value. Additionally, the margin requirement for index futures and options is 35% of the NRML margin.

If you are still confused learn how to use Zerodha Margin Calculator and experience flawless trading.

Note that BO and CO orders can not be placed for “stock options”, “currency options”, “commodity options”, and BSE stocks. Also “MIS” i.e, intraday trade is not allowed in currency options.

Zerodha Kite Margin Used Charges

The margin used in Zerodha Kite across various segments is activated by default when you open a trading or a Zerodha Demat account. Your trades irrespective of the margin – either on a high or lower- are provided with you at no extra cost.

Therefore, there are no charges on Margin Used in Zerodha Kite. Also, this applies to intraday trades only because no leverage is provided on delivery trades.

Conclusion

To sum up the definition of “used margin” in Zerodha or any other stockbroker, it is the margin that has been locked and can not be used to open any new positions. In other words, the margin used in Zerodha is the amount/money a trader must deposit in order to keep his respective trade open.

We hope that you are now clear about the concept od margin used in Zerodha while trading. Make sure to educate yourself well about the requirements and restrictions of margin trading before getting into the actual process.

Happy investing!

Want to open the Demat Account

More on Zerodha