Ventura Securities

List of Stock Brokers Reviews:

Ventura Securities began its operations in the year 1994 as a full-service stockbroker and today, this stockbroking company has accreditation with NSE, BSE, MCX, MCX-SX, & NCDEX. With a presence in more than 525 locations across India, Ventura Securities is known for its decent performing trading platforms.

The broker is primarily known for its wide offline presence and high-performance based terminal software.

Nonetheless, let’s figure out whether this broker is suitable for you or not.

Ventura Securities Review

With their services, you can invest and trade across the following segments:

- Equity

- Currency Trading

- Commodity Trading

- Mutual Funds

- IPO

- Depository Services

- NRI Demat Account

- Insurance

“Ventura Securities has an active client base of 75,092 until 2019-20 for this financial year.”

The full-service stockbroker has dedicated research and advisory team at both fundamental and technical levels. Quality of research is supposedly better than average and can be trusted to an extent.

Ventura is a Depository Participant (DP) itself and allows its clients to open a demat account directly with it. Such a provision is limited to handful stockbrokers only and Ventura is certainly one of those. In this case, they are a member of NSDL (National Securities Depository Limited).

(L-R) Sajid Malik, Hemant Majethia, Juzer Gabajiwala (Co-founders & Directors)

Ventura Securities Trading Platforms

Clients get access to all kinds of trading applications across devices, be it desktop, web or mobile. Here are the details:

Ventura Pointer

Ventura Pointer is a trading software that can be installed on a desktop or laptop. It is compatible with all major versions of Windows operations systems including XP, Vista, 7,8 and 10. Some of the key features of Ventura Pointer are:

- Setting-up market watch

- Quick order placing across equity, F&O

- Market depth and share price chart windows with a customized interface available

- Share price charting with scrip fundamental data available

- Scrip analysis available for 7-days intraday charts

Some of the screenshots of Ventura Pointer are shown below:

P.S. Be sure to have a detailed discussion with the executive of Ventura since they levy a charge of ₹3500 as Pointer usage charges. This payment is applicable in case you are not able to generate brokage of the same amount within the first month of account opening.

We’d suggest you have a detailed discussion around this point before you finalize opening the account with the broker.

Otherwise, you may get this “hidden” charge added to your total payment for the first year. Nonetheless, if you are able to generate a brokerage of that amount, then you can callback the support of Ventura and ask them to reverse the charges. Post verification, the amount deducted will be refunded back to your account.

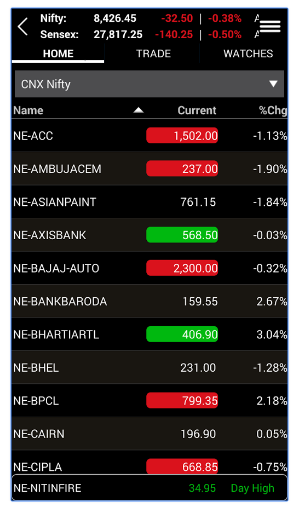

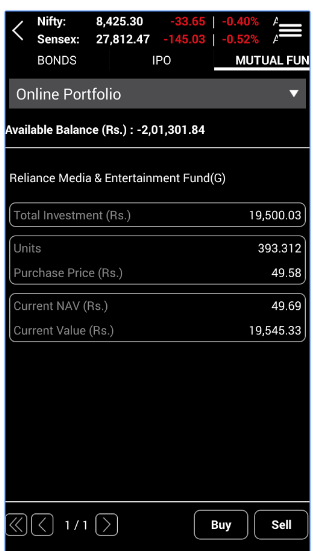

Ventura Wealth

Ventura Wealth is a mobile trading application provided to its clients from the house of Ventura securities. It allows users to trade on BSE & NSE i.e. buy and sell Equity, Commodity, Currency, Derivatives, Mutual funds using their mobile phones with an internet connection. Some of the features the mobile app carries are:

- Live Charts with market updates

- Automated market watch based on your preferences

- Multiple order types for execution

- Presence of tips and recommendations within the app

- Provision to invest in mutual funds available

This is how the app looks like:

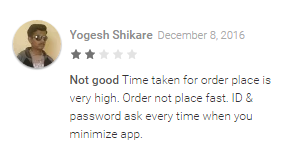

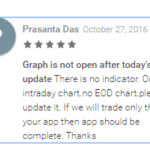

However, the app has received mixed reviews at the android play store with around 28% negative ratings. Here are some of the reviews for reference:

Thus, the mobile app can certainly be improved, a lot! Some of the feedback points mentioned by this app users are as follows:

- The app hangs at certain moments especially on mobile phones with a relatively slower processor.

- The app user interface and design are pretty mediocre and can be improved.

- The login process is a bit complicated.

With so much competition out there in the industry when it comes to technology, this app from Ventura Securities has a lot that can be improved for better trading experience.

Here are the stats around the mobile app from Google Play Store:

| Number of Installs | 100,000 - 500,000 |

| Mobile App Size | 5.3 MB |

| Negative Ratings Percentage | 28.6% |

| Overall Review |  |

| Update Frequency | 12-14 Weeks |

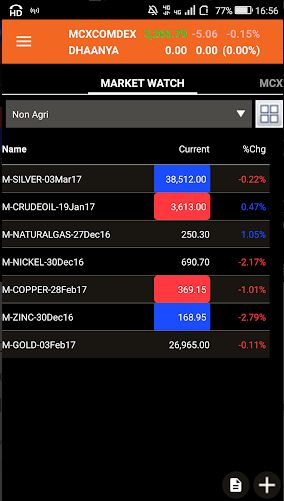

Ventura Commodities

For traders who specifically prefer Commodity trading, Ventura Securities has taken the pain to design and develop a specialized app named Ventura Commodities.

This app allows its users to check margin status across commodities, place trades, edit or cancel orders, set watchlists and so on.

This is how the app looks like:

Some of the concerns around this app are:

- Historical charts for analysis not available. Overall charts experience for analysis not so great either.

- Concerns raised against app’s user interface and experience

Here are the stats of this app from the Google play store:

| Number of Installs | 50,000+ |

| Mobile App Size | 5.4 MB |

| Negative Ratings Percentage | 21.4% |

| Overall Review |  |

| Update Frequency | 4-6 Weeks |

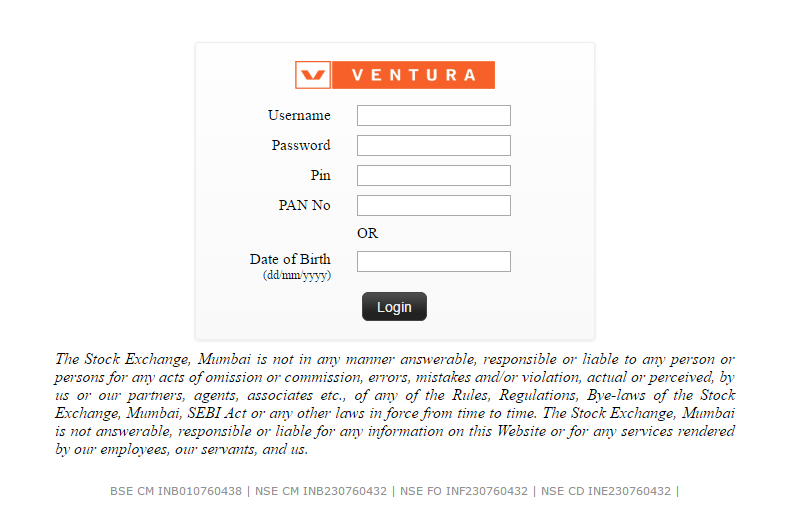

Ventura Web

Ventura also has a web-based trading application that can be accessed directly by their website. The user needs to have a valid username and password to log in and perform trading. It is a lightweight application and is responsive in nature, thus, can be accessed from any device.

This is how it looks:

However, when it comes to features, you will get limited access. Thus, if you are looking for an exhaustive application, Ventura Pointer is much better a trading platform for you.

Ventura Securities Research

Being a full-service stockbroker, Ventura provides its clients with regular research reports, recommendations, trading calls and tips across multiple trading products. Users may choose to perform their own analysis to back the information provided by Ventura, but more or less, their accuracy is better than the industry average.

Although this is not much of an issue for long-term investors definitely a grave concern for short-term intraday traders who are seeking quick tips round the clock when the market is open.

Here is a quick look at the different Ventura Securities Research products:

- Stock Ideas

- Quarterly Analysis

- Daily Pointer

- Market Technicals

- Currency Derivatives Tips

- Value Picks

- Event Calendar

- Mutual Funds Pointer

- Commodities Pointer

As per the claims of the broker, most of these reports are updated on a regular basis and some of these are downloadable in nature, especially the fundamental reports.

A lot of data points such as top gainers, losers of the day, are publicly available on their website but specific information is made available to the client base through email, SMS and trading platforms. In the recent past, some of the clients have raised concerns about the regularity of the reports and tips provided by the broker.

Ventura Securities Customer Care

Ventura Securities offers the following communication channels to its clients:

- Offline branches

- Phone

- Fax

The broker offers limited formats of communication and furthermore, provides an average quality of service as well. There is a good room for improvement in all areas including the turnaround time i.e. time they take to solve your concern, the quality of the final resolution provided and the professionalism of the support executives.

This will require training over a period of time with close attention towards improving the overall experience for the clients.

In a nutshell, Ventura provides one of the poorest customer services in the whole stock broking Industry in India.

Ventura Securities Pricing

When it comes to full-service stockbrokers, there are multiple types of charges in place and as a wary customer, you must know what all charges you are paying for. Here we have tried to cover most of these payments levied by the broker, but we suggest you have a detailed one to one discussion with the executive of the broker and make sure to get everything documented (in an email) post discussion.

Ventura Securities Account Opening Charges

Ventura Securities provides you with a 2-in-1 account for both Demat and trading. To open and maintain trading, here are the charges one needs to bear:

| Trading Account Opening Charges | ₹150 |

| Trading Account Annual Maintenance Charges | ₹0 |

| Demat Account Opening Charges | ₹300 |

| Demat Account Annual Maintenance Charges | ₹400 |

Ventura Securities Brokerage

Although brokerage charges really depend on the plan you opt for, here is a generic range of charges for brokerage:

| Equity Delivery | 0.20% |

| Intraday Delivery | 0.03% |

| Equity Futures | 0.03% |

| Equity Options | ₹50 per lot |

| Currency Futures | ₹20 per lot |

| Currency Options | ₹20 per lot |

| Commodity | NA |

The brokerage levied on you really depends on the initial deposit you provide to the broker in case of Ventura. For instance, with a low initial deposit of ₹1000, your brokerage for delivery will stand at o.45% of your trade value while with the deposit of ₹72,000, it falls to as low as 0.1%.

Furthermore, you can negotiate with the broker as well, and see which deposit value and what brokerage percentage suit your pockets.

Here is a detailed review on Ventura Securities Brokerage Charges for your reference. You can also use this Ventura Securities Brokerage Calculator for a complete understanding of charges and your profit.

Ventura Margin

Ventura provides the following margins for different trading segments:

| Equity | Upto 5 times for Intraday, & 2 times for Delivery |

| Equity Futures | Upto 3 times Intraday |

| Equity Options | No Leverage |

| Currency Futures | Upto 2 times Intraday |

| Currency Options | No Leverage |

| Commodity | Upto 3 times Intraday |

Ventura Securities Disadvantages:

Here are some concerns that you must be aware of before opening your account with Ventura:

- A minimum of ₹3500 fixed charge is levied in case you do not generate that much of brokerage in a month.

- Minimal innovation in online trading softwares

- Since Ventura is not into banking services like HDFC securities or ICICI Direct, it is not able to provide 3-in-1 account facility which is much easier to use for transactions

- One of the lowest quality customer service among the stockbrokers of India.

“Ventura has seen 4 complaints this financial year until 2019 which converts to 0.01% of its overall client base. This goes hand in hand with the industry average of 0.01%.”

Ventura Securities Advantages:

At the same time, you get the following benefits if you use the trading services of this full-service stockbroker:

- Has a decent offline presence across most parts of the country

- Multiple investments and trading products are available for clients financial plans.

- Since it is a DP itself, Ventura can provide free AMC demat account to its clients.

- Equity and mutual funds investment options available for Non-resident Indians (NRIs)

- Online funds transfer across major banks of the country available

Conclusion

Ventura Securities is one of those stockbrokers that are trying very hard to make a name for themselves in the Industry. Yes, they have been in the industry for a while, however, their focus seems to be divided into multiple aspects. By doing this, they have unnecessarily complicated many things.

For instance, charging for the trading platform and expecting clients to generate a minimum of ₹3500 brokerage in a year takes away the interest of beginners and small traders.

In a sense, they want serious traders ONLY who can bring continuous revenue to their business. Having said that, if they expect seriousness from their client base, their customer service must be one of the best too. On the contrary, they provide one of the weakest service and support. Again, it’s pretty complicated when it comes to Ventura Securities.

Looking to open an account? Enter Your details here to get a FREE call back.

Next Steps:

You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on Documents required for demat account.

Ventura Securities Membership Information

Here are the details on the different membership details of the discount stockbroker:

| Entity | Membership ID |

| BSE (Capital Markets) | INB010760438 |

| BSE F&Os | INF010760438 |

| NSE (Capital Markets) | INB230760432 |

| NSE F&Os | INF230760432 |

| MCX-SX | INB260760435 |

| NCDEX | 00059 |

| Registered Address | Ventura Securities Limited, I-Think Techno Campus, “B” Wing, 8th Floor, Pokhran Road No. 2, Off. Eastern Express Highway, Thane (West) – 400 607. Maharashtra. |

The details can be verified from the corresponding entity websites.

In case you are looking to partner this broker, you can check out this detailed review on Ventura Securities Franchise before taking a decision.

Ventura Securities FAQs:

Here are some of the most frequently asked questions about this full-service stockbroker. It makes total sense to have a quick look at these questions and the corresponding answers:

Can I trust Ventura Securities for my trading?

The broker has been around in the full-service stockbroking space since 1994. It has tried to improvise in multiple facets, be it trading platforms, service, pricing etc over its span of existence. With this much experience in the industry and the maturity it has shown over a period of time, the broker can certainly be trusted as a reliable stockbroker.

Does Ventura Securities charge for using its trading platforms?

Although it provides different trading platforms across devices including web, desktop, and mobile, it charges ₹3500 as “Platform access charges” for using its desktop-based solution – Ventura Pointer. Having said that, if you are able to generate a brokerage of ₹3500 in your first year of account opening, you can call the support of the broker and ask them to reverse the charges levied.

Nonetheless, the mobile app and the web-based software are free to use.

How is the research of Ventura Securities?

The full-service stockbroker provides decent research across its offerings, be it equity, commodity, currency etc. Furthermore, whether you are a short-term trader or a long-term investor, the research you will get will be of optimal quality. Their tips and recommendations are available to their clients through SMS, Email as well as through their trading platforms for free.

What is the quality of customer service provided by Ventura Securities?

This is one area where the broker needs to work exhaustively. Be it the quantum of communication channels or the quality of service, Ventura securities has a lot to improve. With limited communication channels and below average customer service, clients of the broker cannot keep huge expectations. In a sense, it clearly is the weakest link among the value provided by the broker.

What are the account opening charges of Ventura Securities?

The account opening charges at Ventura are ₹450 for Demat and Trading account both. You are also required to pay ₹3500 that is refundable on a conditional basis. In case, you are able to generate brokerage of that amount, you can call the support team and get the amount reversed to your account.

Does Ventura Securities offer a mobile app for trading? How is the quality of the mobile app?

Yes, they do provide a mobile trading app to their clients. However, it is nowhere close to the quality of the desktop-based trading software. The mobile app has quite a few problems including login issues, app getting hang at times, tough usability etc. The app is rated at an ordinary rating of 3.4 with around 28% of the users providing negative feedback (industry average is around 19%).

Shall I open account with Ventura Securities?

It really depends on your preferences and phase of trading. If you are a beginner or a small investor, then broker such as Ventura definitely will not suit your requirements. They don’t really offer a decently performing mobile app, their terminal software requires you to pay ₹3500, the customer service is not at all close to industry standards.

However, if you are a heavy trader and want assistance in tips and research, then yes, you may opt for the broker.

Ventura Securities Branches

This full-service stockbroker is present in the following locations across different parts of India:

| States/City | |||

| Assam | Guwahati | ||

| Bihar | Patna | ||

| Delhi/NCR | New Delhi | ||

| Gujarat | Ahmedabad | Surat | Vadodara |

| Karnataka | Bangalore | ||

| Kerala | Kochi | ||

| Madhya Pradesh | Indore | Jabalpur | |

| Maharashtra | Ahmednagar | Mumbai | Nagpur |

| Pune | |||

| Orissa | Bhubaneshwar | ||

| Punjab | Chandigarh | ||

| Rajasthan | Jaipur | ||

| Tamil Nadu | Chennai | Coimbatore | Tirupur |

| Trichy | |||

| Telengana | Hyderabad | Secunderabad | Warangal |

| Uttar Pradesh | Allahabad | Ghaziabad | Kanpur |

More on Ventura Securities:

If you want to know more about Ventura Securities, here are a few reference links for you:

Also, check out the detailed comparison of Ventura Securities Vs Other Stock Brokers: