Yes Securities

List of Stock Brokers Reviews:

Yes Securities or Yes Invest is the trading arm of Yes Bank. It was incorporated as a bank based full-service stockbroker on 14th March 2013 and is based out of Mumbai, India. Registered with SEBI, Yes Securities has its membership running with BSE (Bombay Stock Exchange) as well as NSE (National Stock Exchange).

Being a bank based stockbroker, it provides you with 3 in 1 demat account.

Are you looking to open your demat account with it?

Check out this detailed review listing out all the different value propositions it has to offer before you make your decision.

Yes Securities Review

“With 3 in 1 Demat Account, you don’t need to transfer your funds between Trading Account and Bank account (& vice versa) manually. The whole process is done automatically.”

If you are a client of this full-service stockbroker, you are allowed to invest or trade in the following products:

- Equity

- Currency Trading

- Derivative Trading

- Mutual Funds

- IPO (Initial Public Offerings)

- ETFs

- Yes Bank PMS

You will also be entitled to fundamental as well as technical research through their expert team. These tips are communicated via multiple channels such as SMS, Email and through trading platforms.

“Yes Securities has an active client base of 11,462 till Financial Year 2019-20.”

With a presence in around 35 cities, 29 states and 7 UTs of India, Yes securities has a total network of 52 offices for offline assistance.

Thus, certainly from presence point of view, the broker has a lot of work upon and especially when you look at much mature full-service stockbrokers such as Motilal Oswal, Sharekhan, Angel Broking – Yes securities has to increase its footprint in the offline space to give any noticeable competition to such players.

Kapil Bali – Yes Securities CEO

Yes Securities Trading Platforms

When it comes to trading platforms, this full-service stockbroker falls flat in providing much value to its clients. It provides a couple of average performance trading platforms and we will discuss these in detail one by one. Let’s start with the mobile app.

Yes Securities Mobile App

The mobile app from Yes Securities is pretty basic in the kind of features it provides. Some of the offerings include:

- Market Watch

- Basic Charting

- Alerts and Notifications

- Order Execution across multiple indices

At the same time, there are certainly quite a few concerns with this mobile app, such as:

- Low-Quality User interface

- No updates for the last 1.5 years or so

- No Funds transfer feature

- Slow performance and order execution speed

- Limited number of features

This is how the application looks like:

These are the stats from the Google Play Store for this mobile app:

| Number of Installs | 5,000 to 10,000 |

| Mobile App Size | 23 MB |

| Negative Ratings Percentage | 33.5% |

| Overall Review |  |

| Update Frequency | 1.5 Years |

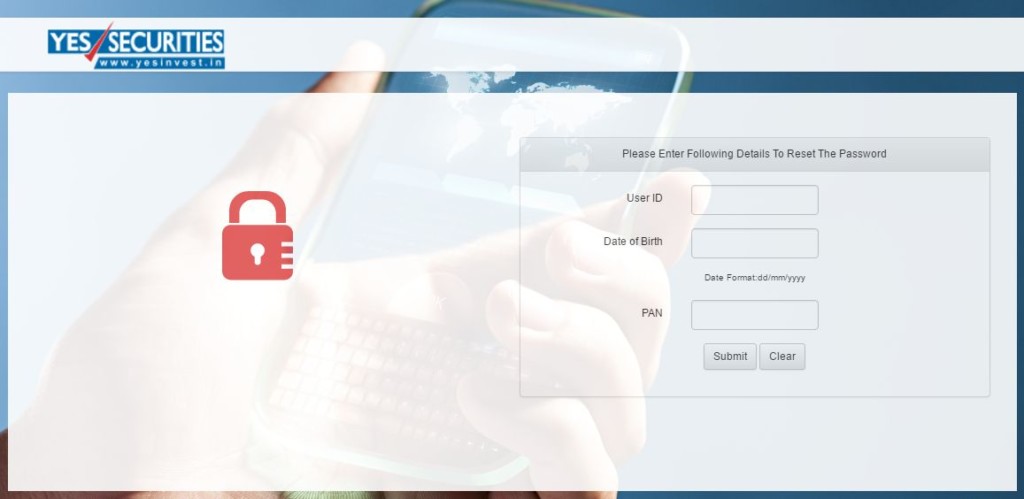

Yes Securities Web

Further, the full-service stockbroker provides a web-based trading application to its clients. This browser-based application does not require any download or install onto your device. You need to browse the link page of the application, put in your valid credentials and start trading.

“The trading platforms of Yes Securities don’t do much justice to the brand name of this finance group.”

The application is responsive in nature, implying that you can use it across any particular device (be it a computer, desktop, laptop or mobile) using any browser (such as Internet Explorer, Google Chrome, Mozilla or Safari). So from the compatibility point of view, not many concerns there.

This is how the application looks like:

The design of this application clean and thus, it is easy to use application. However, as in the case of their mobile app, this web-based application lacks a lot of important features that are primarily required by heavy traders.

Yes Securities Research

This bank-based full-service stockbroker provides research to its clients through the following offerings:

Equity Fundamentals

These reports provide fundamental research on stocks listed on the share market with info on the position, recommendation, target price along with expected percentage returns.

The concerning part of this report type is that its update frequency is very long. Thus, investors looking to invest regularly might not find it useful.

Equity Technicals

As per the names suggests, you are provided with technical calls with a short-term horizon period. Thus, traders looking to make some quick money may use these tips before placing their trades.

IPO Reviews

Based on the timelines of different IPOs getting launched in the stock market, the research team of Yes Securities provides analysis of these IPOs. These reports, apart from providing a detailed analysis of the company to be listed, provide info on the recommendation on the IPO subscription and the corresponding return expectations.

The overall cohort of research provided by this full-service stockbroker is very limited and traders looking for currency and derivative research might find it not helpful.

Yes Securities Customer Care

This bank based stockbroker provides the following communication channels to its clients for using their customer service options:

- Email Support

- Toll-Free Phone Number

- Offline Branches

Even though you might have high expectations when it comes to customer service from a full-service stockbroker, and especially a bank based one, the ground reality is pretty different. Along with a limited number of communication methods, the quality of the service is not that great either.

While talking to some of the clients of the broker, it was realized that the broker majorly focuses on making sure its clients are trading on the stock market. Other than that, issue resolutions take their own time which is not great news for the clients of the broker.

Yes Securities Funds Transfer

Like mentioned above, the funds’ transfer process in case of Yes Securities is a cakewalk. Your bank account is linked directly to your trading account and all the funds’ transfers happen automatically. You are required to set up a few conditions (varies from user to user) and based on that, the funds’ transfers take place.

The story with Payouts is same as well. This is one of the biggest advantages of opening an account with a bank based stockbroker where you are provided with a 3 in 1 Demat account. However, with the advent of so many online wallets and payment gateways, fund transfer has now become much simpler than it ever was.

Yes Securities Pricing

Being a full-service stockbroker, Yes Securities charges you a percentage based commission which in turn depends on your trade value. That would mean, if you trade for ₹1,00,000 and your brokerage rate is 0.4%, in that case, you will be charged ₹400 as brokerage charges. This is pretty expensive honestly. With the introduction of discount brokers, brokerage charges have gone down to the range of ₹10 0r ₹20 per executed order.

Nonetheless, let’s talk about pricing in case of Yes Securities. Here are the account opening and maintenance charges:

| Trading Account Opening Charges (One Time) | ₹0 |

| Trading Annual maintenance charges (AMC) | ₹0 |

| Demat Account Opening Charges (One Time) | ₹0 |

| Demat Account Annual Maintenance Charges (AMC) | ₹500 |

Yes Securities Brokerage Charges

Furthermore, let’s talk about the brokerage charges which you are going to pay consistently to the broker. Like mentioned above, these charges are percentage based and depend on your trade value. Here are the brokerage percentages for different segments offered by Yes Securities:

| Equity Delivery | 0.45% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | ₹75 per lot |

| Currency Futures | 0.05% |

| Currency Options | ₹75 per lot |

There is a minimum brokerage rate of ₹25 in case of Yes Securities, irrespective of your trade value. This implies, in any case whatsoever, you will be required to pay this much brokerage amount to the broker.

Use this Yes Securities Brokerage Calculator for complete charges and your profit.

“Clients are charged ₹25 for using Call and Trade facility at per executed order level.”

Yes Securities Transaction Charges

Apart from the account opening, maintenance and brokerage charges, you are supposed to pay some other type of charges as well. These charges include stamp duty, taxes and transaction charges. We will talk about the transaction charges here.

| Equity (Cash & Delivery) | 0.00325% |

| Equity Futures | 0.0020% |

| Equity Options | 0.053%(on Premium) |

| Currency Futures | 0.00125% |

| Currency Options | 0.0435%(on Premium) |

| Commodities: MCX | 0.0030% |

| DP Transaction charge | ₹15 /Debit Transaction |

| Dial & Trade | ₹20 per executed order |

Yes Securities Margin

Then, if you are looking to use exposure or leverage from this full-service stockbroker, these are the values you are exploiting across different segments as shown:

| Equity | Upto 5 times Intraday |

| Equity Futures | Upto 3 times for Intraday |

| Equity Options | Buying no Leverage, shorting upto 3 times for Intraday |

| Currency Futures | Upto 2 times for Intraday |

| Currency Options | Buying no Leverage, shorting upto 2 times for Intraday |

| Commodity | Upto 2 times for Intraday |

A Special Notice to Beginners

“Don’t use leverage if you don’t understand how it works. It certainly is lucrative but is also pretty risky. Thus, before you use it, have a detailed understanding of the concept and keep a high-risk appetite.”

Yes Securities Disadvantages

There are few concerns about opening a trading account with Yes Securities, such as:

- High Brokerage charges with a low room of negotiation

- Average performing trading platforms

- Okayish Customer Service with a limited number of communication channels

- Commodity trading not possible

“Yes Securities has received 5 complaints in this financial year from its clients. This is around 0.05% of its total client base. The industry standard is around 0.01%.”

Yes Securities Advantages

Here are some of the benefits of using the services of Yes Securities:

- Provides a 3 in 1 Demat Account, no concerns with fund transfers

- Recognized brand, thus gives a decent trust factor

- No account opening fees, neither for demat nor for the trading account.

Conclusion

“Well, Yes Securities is certainly a new but prominent name in the stockbroking space, primarily because of the brand equity gained by Yes Bank. The broker certainly provides a 3 in 1 demat account, which certainly cuts out some of the manual and time taking funds transfer process.

However, there are quite a few areas that the broker needs to focus its attention on. Aspects such as its Pricing, Trading Platforms, Customer service are to be looked onto as far as quality is concerned. It’s not useful for beginners since they will end up paying high brokerage with low-quality customer service and trading platforms.”

Yes Securities Account Opening

In case you are interested to start trading and open a demat or trading account, let us assist you in taking the next steps forward. Just fill in some basic details to get started:

Next Steps:

Post this call, You need to provide a few documents to start your account opening process. The documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, cancelled cheque

- Passport sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review on documents required for demat account.

Yes Securities Membership Information

Here are the details on the different membership details of the full-service stock broker:

| Entity | Membership ID |

| BSE | INB/F 011491439 |

| NSE | INB/F/E/231491433 |

| Registered Address | YES SECURITIES (INDIA) LIMITED, Unit No. 602 A, 6th Floor, Tower 1 & 2, Indiabulls Finance Centre, Senapati Bapat Marg, Elphinstone (West), Mumbai - 400013 |

The details can be verified from the corresponding entity websites.

Yes Securities FAQs:

Here are some of the most frequently asked questions about Yes Securities you must be aware of before opening an account with this broker:

What are the brokerage charges at Yes Securities?

Pretty expensive like other bank based stockbrokers. You are charged 0.45% of your trade value for Delivery trades and 0.05% of your trade value for intraday trading. Other brokerage charges are mentioned above in the ‘brokerage table’.

What is the Quality of Research and Tips provided by Yes Securities?

Being a full-service stockbroker, it provides you with research reports, recommendations, tips and calls on a regular basis. The quality, however, is just average for both technical and fundamental research. If you are a client of this broker, You are advised to perform your own analysis to be completely sure of the tip accuracy.

Is Account Opening free at Yes Securities?

Yes, you are not required to pay any account opening fees for your trading and demat accounts. There is an AMC (Annual Maintenance Charges) of ₹500 that you are required to pay every year.

Is it safe to open an account with Yes Securities?

Yes, this full-service stockbroker is a wholly owned subsidiary of Yes Bank, a prominent bank in India and certainly can be trusted for your trades.

How is Yes Securities App?

The full-service stockbroker has mediocre quality trading platforms, be it the mobile app or the web-based browser application. More information mentioned above under the ‘Trading Platforms’ section.

What if I want to close my Yes Securities demat account? Is it easy?

Yes, in order to close your account, you just need to download this Yes Securities Account Closure Form, fill it up and submit it to a branch close to your location. You may also choose to dispatch this form to the registered office of this stockbroker.

Once all the formalities are completed and you have paid off any outstanding balance, your demat account will be closed in 3-4 business days.

More on Yes Securities:

If you wish to know more about Yes Securities, here are a few reference links for you: