Zerodha Futures

More on Online Share Trading

Zerodha is one of the biggest and best discount brokers for Futures trading in India. Trading in Futures is buying and selling of stocks at a future date at an agreed price.

If you are a client or want to be a client of Zerodha, then you will be glad to know that Zerodha has provisions for its clients for futures trading.

However, this form of trading has its own sets of rules, challenges and that is why experienced traders use specific strategies to make consistent profits.

Trade-in Zerodha Futures is possible only if you have Zerodha Free Demat Account.

Let us discuss Zerodha futures trading, its related aspects including the different charges and involved.

Zerodha Futures Margin

When a trader enters a new position in the futures market, a margin is blocked in the trading account which is called Initial Margin. It needs to be maintained with both the buyer and seller of the futures contract.

This initial margin is made up of SPAN margin and exposure margin and its value is a certain percentage of the contract value.

Therefore, the margin keeps on changing daily with the futures price. Due to the daily change in the initial margin, a trader makes either profit or loss as of the closing price of each day.

This profit or loss gets adjusted in the account and the process is called Marking to market or M2M.

Span margin is the minimum amount that needs to be blocked before entering a Zerodha futures contract as per the mandate of the stock exchange. If this amount is not available in a trader’s account at the time of opening of the position, the exchange imposes a penalty for this.

Span margin must be maintained in the trading account as long as the Zerodha futures trading position is open.

Exposure Margin is the amount over and above span margin that is used for settling mark to market. Its value is in the range of 4% – 5% of the contract value.

The details of the margin blocked for any Zerodha futures trade can be accessed through the Zerodha margin calculator.

Example – If A wants to buy an August expiry futures contract of ACC, the details of span and exposure margin can be seen in the image posted below

NOTE – If at any time during a Zerodha futures trade, cash balance of the trading account falls below the span margin after settling for the mark to market loss, a margin call is made to the client to deposit the required funds.

Also, if the account does not have an initial margin required to initiate a trade, the order may get rejected. The reason for rejection can be found out by clicking on the rejected status button on the orders page.

Orders can be rejected due to many other reasons also like incorrect order type or a particular scrip not available for trading in futures.

Once the order gets executed, the amount blocked for futures trading can be seen as used margin in Zerodha under Funds category.

Another important thing to remember about Zerodha futures trading is that in order to get collateral margin from the existing holding of stocks, one can pledge those stocks for any amount of time.

For this purpose, a power of attorney or POA needs to be signed. This enables debit of shares from one’s demat account to pledge them and get margin in return. If one does not want to use this facility of pledging shares, then, it is not necessary to sign a POA.

Zerodha Futures Brokerage

For each trade you place in Zerodha futures, you are required to pay a corresponding brokerage charge to go along with some taxes as shown below:

Other than these, a stamp duty charge is also to be paid and the value of this charge depends on the state of residence of the clients.

You can calculate Zerodha brokerage charges digitally where you can get the detail of all the taxes included in the trade.

Zerodha Brokerage Calculator

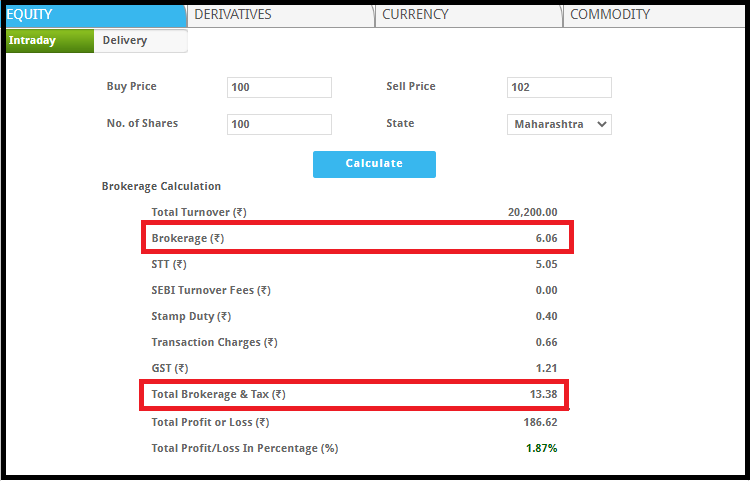

Now comes how to calculate the overall brokerage. Well this can be made simpler using the brokerage calculator.

So, now the overall calculation is made simpler by just entering the buy and sell price and further by adding the number of shares.

Click on calculate and you will get the breakout of charges and total brokerage you end up paying to the broker.

Zerodha Futures Orders

MIS order type is for intraday trading in futures and all such orders need to be squared off before the end of the day.

1. Limit order – This order is placed at a specified price or better.

2. Market order – This order is placed at the exact price at that instant.

3.SL order (Stop Loss order) – This order is used for placing a stop loss at a limit price. It requires a trigger price after which, the stop loss is sent to the exchange. For more information, check this quick review on Trigger Price in Zerodha.

4. SL – M (Stop loss at Market Price) – This order is used for placing a stop loss at market price. It requires a trigger price after which the stop loss is sent to the exchange.

5. BO (Bracket order) – A bracket order is placed with the target price and a stop loss. This order is used for limiting one’s losses by two opposite-side orders. Let us examine how a bracket order looks like on the Zerodha trading platform.

Example – If one wants to buy an October expiry futures contract for Heromoto Corp at ₹2,681.25, the bracket order will look like the image posted below –

6. CO (Cover order) – This is a kind of order that has to be compulsorily placed with a stop-loss order. Buying and selling of futures can be done at both limit and market order.

Example – If one wants to sell an October expiry futures contract for Heromoto Corp at ₹2,664.3.25, the cover order will look like the image posted below:

Zerodha Futures Timing

All MIS / BO/ CO orders of Zerodha futures contracts need to be squared off before 3:20 pm, failing which the system may automatically square off these orders.

If by any chance, the order is not squared off, it might get converted into a CNC order which can be squared off on the next trading day.

You can place CNC and MIS order using Zerodha Kite app. To understand these terms, you can read CNC and MIS to clarify your doubts.

After Market Orders: Also, aftermarket orders are also allowed for futures trading that can be given anytime between 3:45 pm and 9:10 am for NSE and BSE for futures and options trading.

Zerodha Futures Strategies

Now, let us discuss two of the most basic and common future strategies that one can use in order to fetch good returns from the stock market.

Long Futures Strategy

This strategy is used by traders when they are bullish and do not have an opinion about the volatility changes. The payoff of this strategy looks like the image posted below –

Short Futures Strategy

This strategy is similar to the long futures strategy with the difference of direction of movement of the price of the stock. It should be applied when a trader is confident about the bearishness of a particular stock or index but not about the volatility changes.

The payoff diagram of this strategy looks like the image posted above.

Zerodha Futures Trading Platforms

The discount broker avails multiple trading platforms to its clients in order to perform Zerodha futures trading. Here are the details for your reference:

Trading in futures has become quite easy with this web-based platform. You can now easily buy futures in Zerodha Kite

Its user interface is quite good and comes with many features that make Zerodha futures trading a smooth experience.

Its universal search for instruments can search for more than 90000 stocks and Futures and options contracts without any latency. Keyboard shortcuts have been designed to give a seamless experience.

A charting interface that can be customized is one of the best features of this platform. It comes with hundreds of indicators and studies.

It is an installable trading platform that can be enabled for any client of theirs. It works best on desktops and laptops.

It has the feature of advanced charting with 10 types of charts and more than 80 built-in indicators. Strategies for trading can be made and backtested here. A large amount of historical data is also available in Pi.

You may also choose to use the Zerodha Kite Mobile app in case you prefer trading through your mobile phone.

Conclusion

Zerodha futures trading becomes easy to be done with knowledge about the charges and margin requirements which are easily available on their margin and brokerages calculators.

One does not need to enter an actual trade in order to know about the exact margin requirements.

An important thing to remember while trading futures is to adopt a strict stop-loss policy as the mark to market losses in futures trading have the potential to wipe out the complete capital of the traders.

Be smart, be well informed, and enjoy trading!

If you are looking to get started with stock market trading, let us assist you in taking the next steps forward. Fill in the below-shown form to get started:

More on Zerodha

If you want to learn more about this discount broker, here are a few references for you: