Zerodha Iceberg Order

Zerodha is one of the leading stockbrokers in the industry and has never kept any stone unturned to introduce the most innovative and effective plans for its clients. To second this thought, the broker has now introduced Zerodha iceberg order. But what exactly is this and how can an individual benefit from it?

Let us first understand the meaning of iceberg order and why did Zerodha introduce it?

Iceberg Order

Imagine doing exhaustive work all in one go, contrary to splitting the same work into different timelines and then achieving it? Iceberg order does the same. An iceberg order divides the large orders into smaller ones, often referred to as legs. Now the catch here is that the next order is sent to the exchange only after the successful execution of the preceding one.

You specify a price and the number of legs in an iceberg order. So, every time the market will reach this specified price, a leg will get executed. Suppose you placed an iceberg order for 5 legs at ₹100 for 1000 shares. So the order will get executed at ₹100 5 times in a cluster of 200 shares each.

Now, this order type is very famous among institutional investors, but it is for the first time that a broker has introduced it to retail traders as well.

Although there are major reasons to use an iceberg order the major one is to reduce the impact cost. Now coming to the next question, what is impact cost?

Let us understand this with the help of an example.

Suppose you placed an order for 1000 shares for ₹200 each. But till the time the actual share was executed, the price reached ₹200.50. Now instead of paying ₹2,00,000, you will have to pay ₹2,00,500. So this ₹500 extra is your impact cost.

Hence impact cost is the difference between the price that the order was supposed to be traded and the amount that it was actually traded at. With iceberg orders, this impact cost is reduced as there are multiple orders at a similar price.

Now that we know what an Iceberg order is, let us now talk about Zerodha and all its features it has for the users.

What is an Iceberg Order in Zerodha?

Among the various orders present in Zerodha, the recently introduced one is the iceberg order. As we discussed earlier, the iceberg order helps the individual place multiple smaller orders in place of a large one, Zerodha gives the user the option to do that. Although, there are some things that one must remember before placing an iceberg order on Zerodha.

- Currently, the facility is only available for KITE web. It might be accessible on KITE mobile app later.

- The minimum order limit is ₹1,00,000 in the case of equity shares. In the case of derivatives, the minimum limit is 5 lots.

- When you place an iceberg order, each leg is treated as a different order. This means that you will be charged the brokerage according to every leg. For example, the charges for intraday are ₹20/executed order and you placed 5 legs, then the brokerage on on side of the trade will be ₹100.

- Now when you place an iceberg order, you specify a price. This price can be modified at any time, and the remaining legs will be executed according to the new price. Suppose you placed an order for 5 legs and executed 3 legs at ₹100. But for the 4th leg, you modified the price to ₹110. So the 4th and 5th leg will get executed at ₹110.

- You can place upto 10 legs in a single iceberg order.

- If you cancel any leg of the order, the rest of the legs of the order will also get canceled automatically.

Now let us have a look at how you can place an iceberg order at Zerodha.

How to Place Iceberg Order in Zerodha?

As mentioned earlier that currently, the iceberg order is only available on the KITE web. So you will have to access the order using the same trading platform.

- Log in using your client ID, password, and PIN.

- Now on the search bar, look for the scrip that you want to trade-in.

- Click on buy/sell.

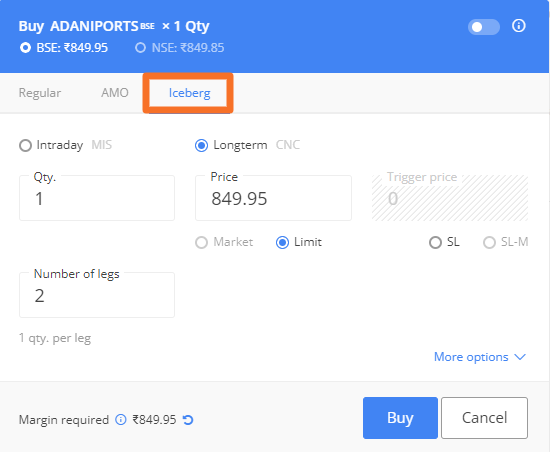

- A new window will open. Now you will see the option of ‘iceberg’. Select the same.

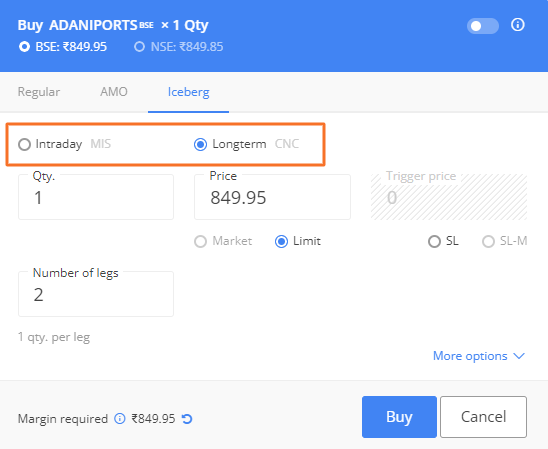

- You can place an iceberg order for intraday and delivery trading both. Select one from either of the options.

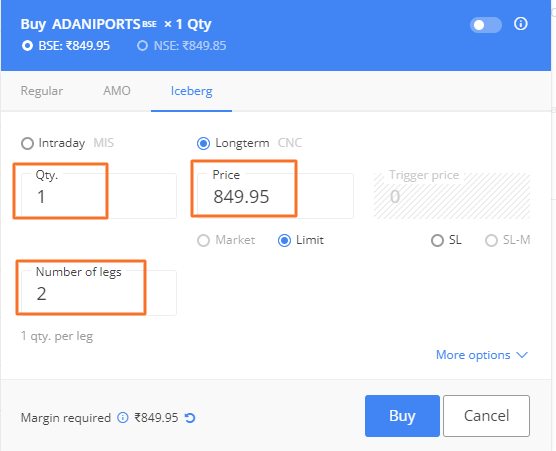

- Now enter the quantity, price, and the number of legs. (Make sure that the number of quantity is more than the number of legs)

- You can also select the validity of the order.

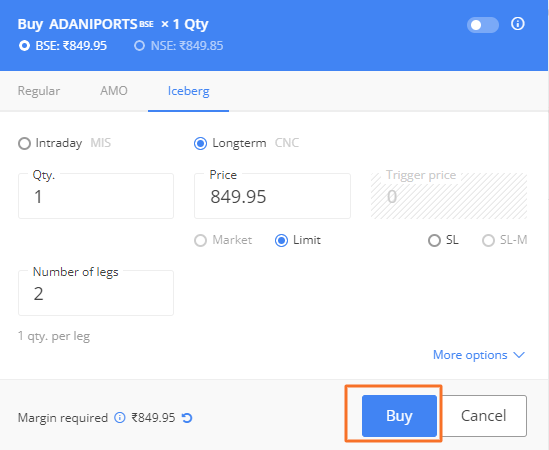

- After this, you just have to click on buy/sell and the iceberg order will get placed successfully.

So, in just these simple steps you can easily place an iceberg order in Zerodha.

Zerodha Iceberg Order Charges

As discussed above, the iceberg is a multi-legged order where you can break your single order into multiple legs. Now as per the Zerodha charges for each segment you need to pay fees on each leg separately which increases the overall trading cost.

For example, if you place an intraday trade using an iceberg order and break your order in 4 legs with the trading value of ₹20,000, ₹30,000, ₹22000, ₹25000 than the brokerage as per the Zerodha intraday brokerage would be as follow:

- 0.03%*20000= ₹6

- 0.03%*30000= ₹9

- 0.03%*32000=₹9.60

- 0.03%*35000=₹10.50

Total Brokerage= ₹31.10

If you had placed a single order with a turnover value of ₹1,17,000 then the brokerage would be ₹20/-. But what if your order gets cancelled.

Does Zerodha charges for cancelled order?

Here if there is no exception of the trade, then no fees or additional charges are deducted by the broker.

Zerodha Iceberg Order Advantages

With the introduction of iceberg orders by Zerodha, there have been a lot of questions regarding its importance and advantages. Let us, therefore, have a look at how you can benefit by placing an iceberg order in Zerodha.

- Helps reduce impact cost– The major advantage of iceberg order is that it helps you save the impact cost. For example, you placed an order for 100 shares at ₹100 each. But at the time of execution, the price went to ₹100.20. So now you have to pay ₹10,020, instead of ₹10,000. So, here ₹20 is your impact cost. With iceberg orders, you can be totally free of this cost.

- Great for volume trades- Iceberg orders work best for traders who want to trade in good volume but do not want to move from a fixed price no matter how much volatile the market is. With the price already defined in the beginning, the orders will execute only after reaching that certain price point.

- More trading – With the help of an iceberg order, you can now buy upto 200 lots or even more of NIFTY instead of just 36 lots. This has been a blessing in disguise for traders who wish to trade in larger quantities.

- Validity – The traders can now not only choose day validity but also minutes validity. This allows the traders to work better with the continuously volatile market.

- Chance for retail traders- Zerodha has given the retail traders a chance just like the institutional investors to place large orders by breaking them into smaller units.

These are all the benefits that a user can ideally avail of by using the Zerodha iceberg order.

Zerodha Iceberg Disadvantages

Apart from the various advantages of the iceberg order, there are some disadvantages as well.

- More brokerage – Every leg of the order is treated as a different order, which means that you have to pay brokerage on every leg.

For example- Suppose the brokerage for every executed trade is ₹20. Now if you place an order for 1000 shares in one go, then you have to pay a brokerage of ₹20 on one side. But if you place an iceberg order and place 5 legs, then you have to pay ₹100 brokerages on one side. - Only available for large orders– Even if a trader wants to invest or trade a small amount, it is not possible as the minimum limit is ₹1,00,000.

Conclusion

Zerodha is a leading player in the industry and with the introduction of iceberg orders, they have taken it up a notch. Iceberg orders help a trader place larger orders in smaller units thus making it the best option for retail traders. With its availability on the KITE web, iceberg orders make sure that there is no impact cost or any extra losses for the investor.

If you also want to avail the benefits of the same, open a demat account now! Fill in your details below and our team will assist you in the entire process.