Zerodha Options

More on Online Share Trading

Zerodha is a Bengaluru-based discount broker. In order to do Zerodha options trading, one is required to have a trading and demat account with it. They offer services related to equity, commodities, and currency options trading.

Remember, option trading has its own complexities and challenges. However, the discount broker here i.e. Zerodha tries well with its array of services so that the overall trading experience of its client(s) stays optimal.

Now, let us try to understand the details around brokerages and other charges incurred while doing Zerodha options trading with the help of the following table:

Zerodha Options Charges

| Zerodha Option Brokerage Charges | ||

| Option Brokerage Charges | Flat Rs. 20 per executed order | |

What do these charges imply?

Well, here is a quick explanation:

- Brokerage is levied by the stockbroker. In this case, it is Zerodha brokerage charges are ₹20 per executed trade.

- STT or Securities and Transaction tax is levied by the stock exchange on which the order has been placed (NSE, BSE etc)

- Transaction charges are also levied by the exchange.

- SEBI Charges go to the regulator itself.

- GST or Good & Service Tax is levied by the Central government of India

- Stamp charges are levied by the state government

In case you choose to place trade using basket order in Zerodha, then you need to pay respective brokerage on the basis of number of trades executed.

Zerodha Option Calculator

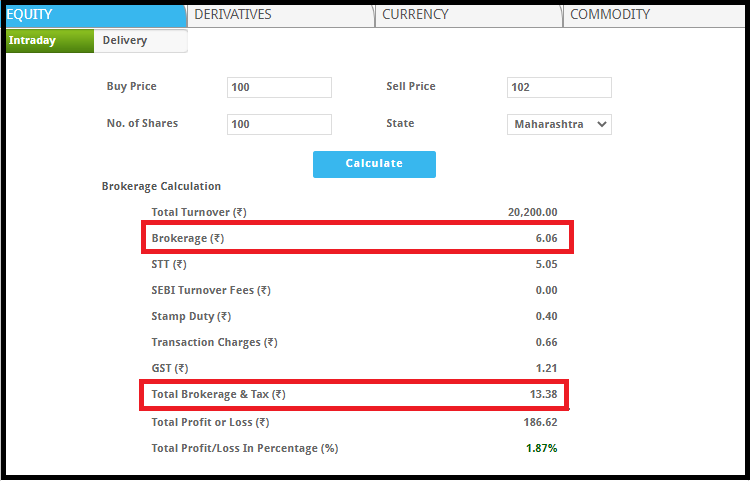

Option trading charges are generally calculated in lots. But being a discount broker Zerodha imposes the flat fees of ₹20 to trade in equity options while for the commodity and currency segment one needs to pay the brokerage of 0.03% or ₹20 whichever is lower.

Apart from this, there are taxes and other fees, that often make it difficult for traders to calculate the net brokerage.

To help you with this here is the brokerage calculator. Just enter few details like buy and sell price, lot size, etc and click on calculate.

You will get the breakup and total brokerage charges information on the screen.

Zerodha Options Margin

Now, let us discuss the margin requirements one needs to be aware of while you trade options on the Zerodha platform.

Buying Of Options – While buying calls or puts, a trader’s trading account must have the required premium in it. There is no additional leverage provided by Zerodha on buying equity and currency options.

Zerodha options can be bought through NRML and MIS product types but it is recommended to use NRML type as MIS positions are automatically squared off at 3:20 pm.

Read CNC and MIS to understand the usage and applicability.

The premium of options required to be there in a trading account is the sum of two numbers :

- The intrinsic value of the option – It is the current value of the option. In simpler terms, it can be seen as the payoff amount a trader will have if he/she decides to exercise the option right now. For example – a ₹90 call option on a stock with the current market price of Rs. 100 simply implies a positive payoff of ₹10.

- Time value of the option – It is the potential increase in the option value over a period of time.

One should be careful while placing market orders in case of illiquid contracts where the difference between the last traded price and ask price is large.

In these cases, the trade will be executed at market price even if the funds in the account are not sufficient. A trader should immediately deposit the required funds in the trading account then.

The Zerodha margin calculator has a comprehensive and exhaustive list of all stocks along with the MIS and CO / BO margin/leverage. It can be accessed online.

Zerodha Selling of Options – Margin requirements for shorting or selling options depend on many factors like expiry, volatility, etc. Writing or selling options can be done using either NRML or MIS product types.

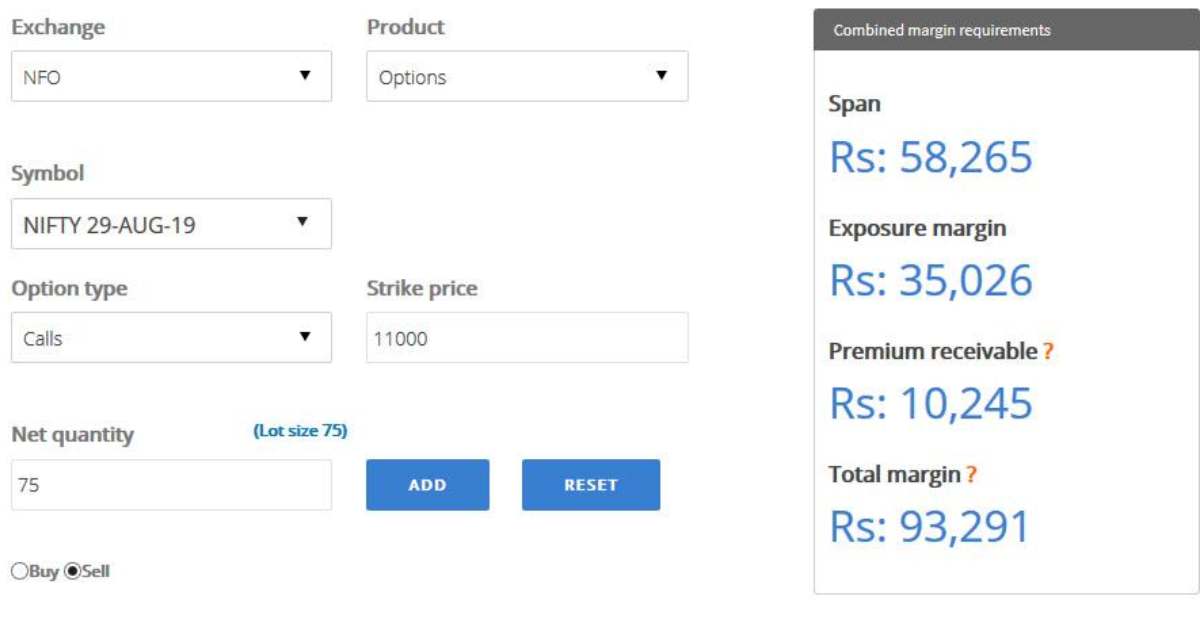

The comprehensive Zerodha margin calculator will give the details of the span, exposure margin, premium receivable and total Zerodha Options Selling Margin. Let us understand this with the help of an example.

Say, a trader wants to sell NIFTY options at a strike price of ₹11,000 and expiry of August. The margin and premium will be calculated as shown in the picture below:

One should be careful while placing doing Zerodha options trading as the order may get rejected due to many reasons like Insufficient margin in the trading account, Incorrect usage of Order type, etc.

So, whenever an order is rejected, one can check the reason by clicking on the “Rejected” status button in the order book.

In order to get the margin amount from one’s existing shares, one can pledge those shares. For this purpose, a Power of attorney (POA) is needed. A POA is a legal document that is used for giving legal authority to another person to operate one’s account according to the instructions provided in it.

POA is used to debit shares from one’s Zerodha demat account when he/she wants to sell shares or pledge them in order to get margin for Zerodha options trading.

Once the sell order gets executed, you can get details of the amount blocked as the Used margin in Zerodha under Funds category.

How to do Option Trading with Zerodha?

Now, let us discuss three of the most common options strategies in place.

Covered Call

This strategy includes buying stocks and writing call options simultaneously on those shares. This strategy is used when a trader wants to hold a stock for short term and has a neutral opinion about the direction of the price movement of the stock.

The covered call strategy is advantageous in the way that it generates an income in the form of a call premium. It also hedges risk from the decline of the stock price.

Married Put Strategy

This strategy acts as an insurance policy when one is holding some stocks. It involves buying stocks and simultaneous buying of put options for those stocks. This strategy protects an investor from a decline in price movement.

Although is the price of the stock does not fall, then, the premium paid by the trader would be lost.

Long Straddle

This strategy involves simultaneous buying of a call option as well as put option of the same stock at the same strike price and the same expiry date. This strategy is played by those who anticipate large movements in stock prices but cannot be sure of the direction in which stocks prices would move.

Loss is limited in this strategy to the premiums paid for buying of call option and put options whereas the profits can be unlimited.

Zerodha Options Orders

1. Market order – This order is placed to be executed at exactly the market price at that instant.

2.Limit Order – This order is placed to be executed at a specified price or better.

3.Bracket Order and Cover Orders

This should be noted that bracket orders and cover orders can be used in Zerodha options trading for some options and NOT for the following –

- Stocks listed only on the Bombay Stock Exchange

- Bank Nifty Options

- Stock Options

- Currency Options

- MCX

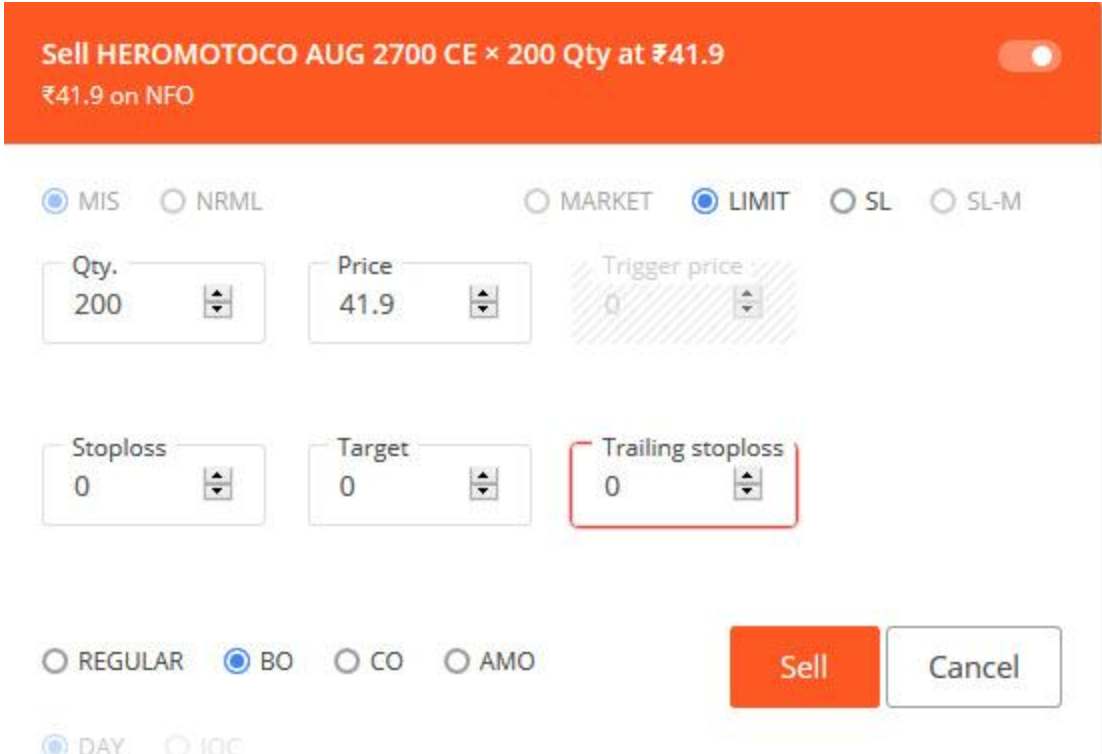

Bracket orders are used for limiting one’s losses through 2 opposite-side orders. One can enter a new position with a target or exit through the trade and a stop-loss order.

When the main order is executed, 2 more orders of target and stop-loss are placed automatically by the system. Therefore, if one order out of them gets executed, the other gets canceled automatically. A trailing stop loss option is also available in this category.

Example – Let us see an image of a bracket order being placed for selling Heromoto Corp. August options at 2700 strike price.

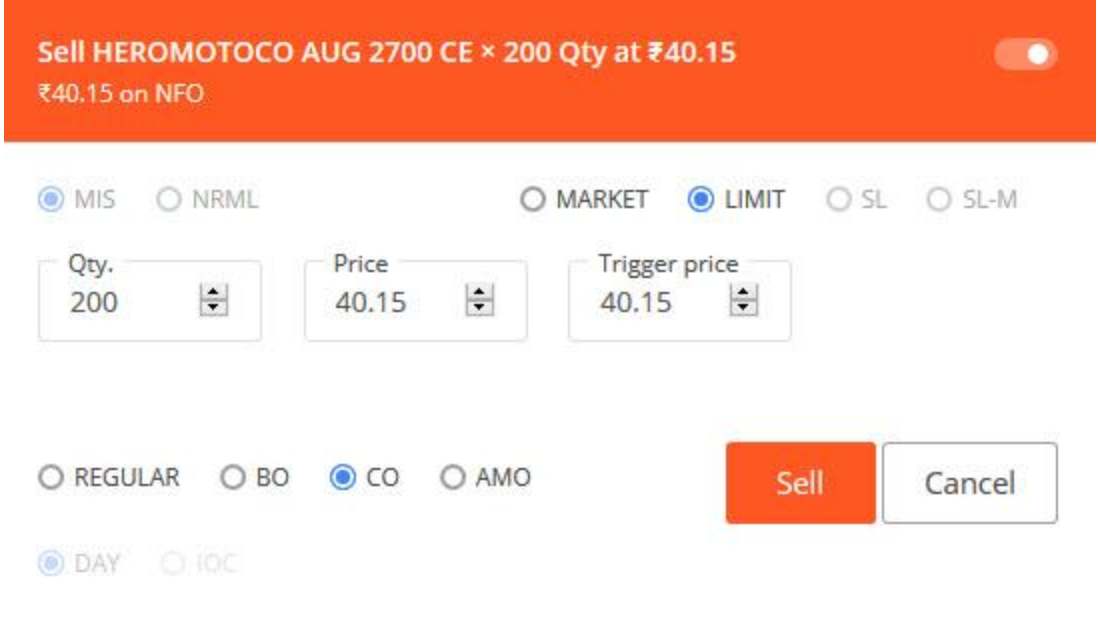

4. Cover Orders:

These orders are necessarily accompanied by stop-loss orders. In these, buying or selling of options can be done through market and limit orders both. Since a stop loss is always mentioned, it reduces the risk and thus requires less margin.

Zerodha allows cover orders for National Stock Exchange / (Equity, Futures and options, Currency) and MCX.

Also Read: Zerodha Currency Trading

Example – A cover order for selling Heromoto Corp August expiry options at strike price 2700 looks like this while Zerodha options trading:

Bracket and cover orders for equity and futures and options are automatically squared off at around 3:20 pm.

All MIS orders need to be squared off before 3:20 pm as they are meant for intraday purposes only. Also, aftermarket orders can be placed for options trading from 3:45 pm till 9:10 am on NSE and BSE.

Zerodha Options Trading

Trading Platforms That Can be Used For Options Trading

Zerodha Kite

It is a web-based platform for trading. Some of the best features are as follows –

- Advanced charting with 6 chart types and more than 100 indicators

- Support bracket and cover orders

- Supports up to 10 regional languages

- Ability to integrate with other investment apps

Zerodha Pi

It is an installable trading platform. Some of its features are as follows –

- Single platform for trading, charting and analysis purposes

- Advanced charting with 10 chart types and more than 80 indicators

- Ability to code complex strategies and backtest them.

- Historical data available

Zerodha Kite mobile

It is a mobile app for trading and its features are the same as that of Kite that can be used on any internet-enabled device.

Here are some of the stats of this app from the Google Play Store:

| Number of Installs | 1,000,000+ |

| Mobile App Size | 6.5 MB |

| Negative Ratings Percentage | 18% |

| Overall Review |  |

| Update Frequency | 8-10 Weeks |

Sensibull Zerodha

Zerodha options trading can also be done through Sensibull. Sensibull is the first options trading platform in India. It is one of the best-paid options trading platforms in the world and provides –

- Options trading strategies and their comparison side by side

- Backtested results of some of the best options strategies

- Data on the volatility of stocks is the key reason for many options strategies.

- Single click execution of strategies

- Enhanced option chains

- Black Scholes Analyser

Conclusion

Options trading is an art and becomes easier to do if done through a good platform. One should be aware of the buy and Zerodha sell charges along with the margin requirements involved in options trading.

Also, good knowledge about the different kinds of orders that can be placed for Zerodha options trading. their advantages over other kinds of orders and square off timings.

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps ahead.

Just fill in a few basic details below to get started: