Zerodha Trading Charges

More on Zerodha

When an individual opens a Zerodha demat account, they certainly take the decision after having a look at all the Zerodha trading charges. Are you looking for them? You have reached your destination!

Before we dive into the details, we must list the various charges associated with the topic. They are:

- Trading Account Charges

- Brokerage Charges

- Online Trading Charges

- DP Charges

- Trading Platform Charges

- Zerodha Demat Account Charges

- Muhurat Trading Charges

So, let’s take a look at all of these trading charges in Zerodha one by one. We will start with the trading account charges.

Zerodha Trading Account Charges

Zerodha offers its clients the facility to open 2-in-1 accounts or 3-in-1 accounts. So, the account charges are combined into an amount and charged as one.

The basic charges related to a trading account are – opening charges and account maintenance charges (AMC). Both of these Zerodha trading charges are talked about under the succeeding content.

Zerodha Trading Account Opening Charges

The account opening fee for both Demat and the trading account in Zerodha is one. The amount is dependent on the type of account you wish to open. For Instance, if you open an individual account, you have to pay ₹200, but if you want to have a corporate account, it costs ₹500.

The charges for all the types of accounts have been tabulated below:

| Zerodha Trading Account Opening Charges | ||||

| Type of Account | Equity (Equity, F&O, & Currency) | Equity and Commodity | ||

| Online Account | ₹200 | ₹300 | ||

| Offline Account | ₹400 | ₹600 | ||

| NRI Account (Offline Only) | ₹500 | N. A. | ||

| Partnership, LLP, HUF, or Corporate Accounts (Offline Only) | ₹500 | ₹800 | ||

However, there are no AMC charges for trading accounts in Zerodha.

Zerodha Trading Brokerage Charges

A trader or investor has to pay a fixed amount as a brokerage fee on every executed order. The percentage or amount varies from broker to broker and even is different for all trading segments. It is the charge that mainly eats up your profit to the highest degree.

This makes traders and investors very cautious of what broker they associate with.

Since Zerodha is the first discount broker in India, it introduced the concept of low brokerage in the Indian stock broking industry. Brokerage is one of many aspects that have helped the broker reach the popularity that it has today.

So, without further ado, let’s start the discussion of Zerodha trading charges for every trading segment facilitated.

Zerodha Delivery Charges

Many people are involved in delivery trading as they wish to meet their financial goals in the long run. So, they plan, analyze, and execute orders accordingly.

Zerodha equity charges for delivery are completely zero. However, the clients need to make sure that they understand the basic differences between intraday vs delivery trades as well.

Else, later beginner traders end up getting confused while adding charges to their trading accounts.

The Zerodha trading charges for delivery have been tabulated below:

| Zerodha Delivery Trading Charges | ||

| Delivery Trading Charges | Zero | |

Zerodha Intraday Charges

Day trading sees a higher number of trades as compared to delivery trading. Due to this, the day traders prefer a broker that charges the least brokerage charges.

This feature was exclusive to the discount brokers of India for a long time. Now, almost all categories of brokers have switched to similar brokerage plans.

Zerodha charges an intraday trader 0.03% or ₹20 per executed trade, whichever is lower. So, no matter how big the transaction amount is, you will not pay more than ₹20 as brokerage.

The Zerodha trading charges related to intraday trading have been compiled below:

| Zerodha Intraday Trading Charges | ||

| Intraday Trading Charges | 0.03% or ₹20 per executed order, whichever is lower | |

Zerodha Options Charges

With the reduction in margin percentage by SEBI, there has been a huge shift in the trading pattern of the retail traders. They are switching from day trading to options trading as the margin in this segment is comparatively better.

The brokerage charges in options vary according to the trading segment. For equity options, you pay flat ₹20 on every executed order whereas, for commodity options, you are charged 0.03% or ₹20 per executed order, whichever is lower.

Zerodha trading charges for this trading instrument are as follows:

| Zerodha Options Trading Charges | ||

| Equity Options Charges | ₹20 per trade | |

| Commodity Options Charges | 0.03% or ₹20 per executed order, whichever is lower | |

| Currency Option Charges | 0.03% or ₹20 per executed order, whichever is lower | |

Zerodha Futures Charges

Similar to all other trading segments, futures are used for trading in the share market. The brokerage charges are the same for all trading segments, equity, and commodity. You have to pay 0.03% or ₹20 per executed order, whichever is lower.

The Zerodha trading charges for this trading instrument are compiled below:

| Zerodha Futures Trading Charges | ||

| Equity Futures Charges | 0.03% or ₹20 per executed order, whichever is lower | |

| Commodity Futures Charges | ||

| Currency Futures Charges | ||

Zerodha Commodity Trading Charges

Since Zerodha is registered with MCX and NCDEX hence it allows you to trade in different agri and non-agri commodities.

Now as you all know that you can trade commodities either in Futures or Options, hence it is important to know the Zerodha commodity brokerage for each.

Here are the details:

| Zerodha Commodity Trading Charges | ||

| Commodity Futures Charges | 0.03% or ₹20 per executed order, whichever is lower | |

| Commodity Options Charges | ||

Zerodha Currency Trading Charges

The last one in the list of trading segments facilitated by the broker is currency trading.

When you trade-in currency, you have the choice between futures and options. Brokerage charges for both of them are the same, i.e., 0.03% or ₹20 per executed order, whichever is lower.

The Zerodha trading charges levied on Futures trading have been tabulated below:

| Zerodha Currency Trading Charges | ||

| Currency Futures | 0.03% or ₹20 per executed order, whichever is lower | |

| Currency Options | ||

BTST Charges in Zerodha

Now there are other charges as well which are imposed when you do BTST trade in Zerodha kite. Here again, Zerodha does not impose any fees from traders executing the order under this trading type.

| Zerodha BTST Charges | ||

| BTST Charges | 0 | |

So, let’s talk about them as well. This was all about the brokerage charges levied by the broker on the trader or investor in various trading segments. We all know there are many other charges that are levied on every trade and are mostly the same for all the trading segments.

Zerodha Iceberg Order Charges

To reduce the impact cost of orders, you can now place an order using Zerodha iceberg order. In this, a single order is divided into multi-legs. Since the order for each leg is executed separately hence the brokerage is charged per leg as per the trading segment.

For example, if you place an intraday trade where you divide your order into 5 legs with a trade value of ₹20,000, ₹22000, ₹25000, ₹28000, ₹30000 then the brokerage for each would be:

- 0.03%*20,000= ₹6.00

- 0.03%*22000=₹6.60

- 0.03%*25000=₹7.50

- 0.03%*28000=₹8.40

- 0.03%*30000=₹9.00

Total Brokerage= ₹37.50.

Want to trade at the minimum brokerage charges, then open a demat account now. Fill in the basic details in the form below:

STT Charges In Zerodha

STT stands for Securities Transaction Tax. It is also known as Commodities Transaction Tax or CTT. It varies for different trading segments. There Zerodha trading charges have been tabulated below for all the segments facilitated by the broker:

| Zerodha STT Charges | ||

| Equity Delivery | 0.1% on buy & sell | |

| Equity Intraday | 0.025% on the sell side | |

| Equity Futures | 0.01% on sell side | |

| Equity Options | 0.05% on the sell side (on premium) | |

| Commodity Futures | 0.01% on sell side (Non-Agri) | |

| Commodity Options | 0.05% on the sell side | |

| Currency Futures | No STT | |

| Currency Options | No STT | |

Transaction Charges In Zerodha

Every executed trade in Zerodha attracts a transaction charge. They are different for different trading segments. It is one of the Zerodha trading charges, and they have been tabulated below:

| Zerodha Transaction Charges | ||

| Segment | Transaction Charge | |

| Equity Delivery | NSE: 0.00325% BSE: 0.003% | |

| Equity Intraday | NSE: 0.00325% BSE: 0.003% | |

| Equity Futures | NSE: Exchange txn charge: 0.0019% | |

| Equity Options | NSE: Exchange txn charge: 0.05% (on premium) | |

| Currency Futures | NSE: Exchange txn charge: 0.0009% BSE: Exchange txn charge: 0.00022% | |

| Currency Options | NSE: Exchange txn charge: 0.035% BSE: Exchange txn charge: 0.001% | |

| Commodity Futures | Group A Exchange txn charge: 0.0026% * Far-month contracts: 0.0013% Group B: Exchange txn charge: CASTOR SEED - 0.0005% KAPAS - 0.0005% PEPPER - 0.00005% RBDPMOLEIN - 0.001% | |

| Commodity Options | Exchange txn charge: 0 | |

GST Charges In Zerodha

The GST charge for any trade in the stock market is fixed by the government. This is decided according to the latest taxing regime and slab chose by the government. It is uniform for all the trading segments and thus the only one of the Zerodha trading charges that are very easy to remember.

The current GST charges are 18% on (Brokerage + Transaction charges).

SEBI Charges In Zerodha

Zerodha charge on every transaction in the share market is also received by SEBI, the regulatory body of the market. It is the same for all of the trading segments except one – Commodity Futures Trading.

Here’s a look at these Zerodha trading charges in brief:

| SEBI Charges in Zerodha | ||

| Equity Delivery | ₹10 per crore | |

| Equity Intraday | ||

| Equity Futures | ||

| Equity Options | ||

| Currency Futures | ||

| Currency Options ' | ||

| Commodity Options | ||

| Commodity Futures | Agri: ₹1 per crore | |

| Non-Agri: ₹10 per crore | ||

Stamp Duty Charges In Zerodha

The state government levies this charge. It was different for every state, but recently, they have been uniformized for all.

These Zerodha trading charges for various trading segments facilitated by the broker are as follows:

| Stamp Duty Charges in Zerodha | ||

| Equity Delivery | 0.015% or ₹1,500 per crore on the buy-side | |

| Equity Intraday | 0.003% or ₹300 per crore on the buy-side | |

| Equity Futures | 0.002% or ₹200 per crore on the buy-side | |

| Equity Options | 0.003% or ₹300 per crore on the buy-side | |

| Commodity Futures | 0.002% or ₹200 per crore on the buy-side | |

| Commodity Options | 0.003% or ₹300 per crore on the buy-side | |

| Currency Futures | 0.0001% or ₹10 per crore on the buy-side | |

| Currency Options | 0.0001% or ₹10 per crore on the buy-side | |

This was all about the extra charges you pay on every trade. Now, let’s talk about the Zerodha trading charges you have to pay if you use the platforms that are third-party integrations or other value-added services.

Zerodha Online Trading Charges

Every broker offers some distinguishing services that add to its customer experience and improves the quality of trading. Zerodha is no different in this aspect.

These are some of the value-added services provided by Zerodha:

- Zerodha Streak

- Zerodha Smallcase

- Zerodha Sentinel

- Zerodha Sensibull

- Zerodha Screener

- Zerodha Kite Connect

- Zerodha StockReports+

Let’s discuss the Zerodha charges for all of these charges in detail.

Zerodha Streak Charges

Zerodha provides its clients with multiple third-party integration software. Streak is one of them. It is an algo trading and strategy platform. You can create, backtest, and deploy your strategies for trading in the stock market.

It is very helpful for people who want to place multiple trades at the same time and for those who want to eliminate the interference of human emotions.

But, to avail of this amazing software, you have to pay Zerodha trading charges. They have been tabulated below:

| Zerodha Streak Charges | ||

| Billing Frequency - Monthly | Basic Plan: ₹500 | |

| Premium Plan: ₹900 | ||

| Ultimate Plan: ₹1400 | ||

Zerodha Smallcase Charges

This software is used for thematic investing. Now, for those of you who don’t know what that is, here is the definition. It is a method of investing where the investor identifies significant investment opportunities without extensive research on every single stock.

For instance, in the current scenario, you feel that the companies producing electric vehicles will flourish and grow in the coming years. You choose this investment theme and invest in these companies without analyzing them individually.

This is also a third-party integration from the broker. The Zerodha trading charges for Smallcase are as follows:

| Zerodha Smallcase Charges | ||

| Billing Frequency - Per Transaction | ₹100 | |

Zerodha Sentinel Charges

Sentinel is one of the online services provided by the in-house team of Zerodha. It is trigger alert software that helps you keep an eye on your favorite stocks and trigger an alert when they reach the target price range set by you.

This service can be availed by anyone as it is not restricted to only those who have a Zerodha demat account.

The charges for Sentinel services are free for the Free Trigger Pack. But there are multiple trigger packs on the website that are charged. These charges vary according to the time duration you select.

The charges are deducted at the end of this duration, and if the prices are updated, the charges during renewal are clearly mentioned accordingly. If you choose the Auto-renew option (available to Kite users only), Zerodha is not mandated to inform you about the updated prices.

The prices are decided by the broker, who has sole discretion in this regard.

Zerodha Sensibull Charges

Sensibull is another popular third-party integration offered by Zerodha. It is an options trading platform that helps with various strategies, research, and signals. This is opted only by the traders willing to trade in options (equity, commodity, currency).

The Zerodha trading charges for Sensibull are as follows:

| Zerodha Sensibull Charges | ||

| Billing Frequency: Monthly | Free Plan: ₹0 | |

| Lite Plan: ₹800 | ||

| Pro Plan: ₹1,300 | ||

Zerodha Screener Charges

As the name suggests, it helps you in screening stocks for analysis and investment or trading. It provides you financial data of listed companies in India. Here are some of the features you get:

- An overview of all the listed companies in minutes.

- Facilitates 10 to 15 queries of financial data at the same time.

- Permits to track announcements and other regulatory filings with just one click.

This value-added service is available for free (some features) and in a premium version. Its Zerodha trading charges for the premium account are as follows:

| Zerodha Screener Charges | ||

| Billing Frequency | Amount | |

| Monthly | ₹100 | |

| Quarterly | ₹285 | |

| Bi-annually | ₹540 | |

| Annually | ₹960 | |

Zerodha Kite Connect Charges

Kite Connect API is a method that helps in developing and building trading platforms with super simple HTTP or JSON APIs. You can develop your apps and showcase them to their client base.

To use this, you have to pay a charge which depends on the type of data being used – just connect, or you want to include historical data too. So, the Zerodha trading charges are as follows:

| Zerodha Kite Connect Charges | ||

| Billing Frequency - Monthly | Connect: ₹2,000 | |

| Historical: ₹2,000 | ||

Zerodha StockReports+ Charges

Generally, discount brokers don’t provide their clients with reports or analyses in any form. Zerodha is no exception. But, recently, they have started giving stock reports and are called – StockReports+.

If you avail of this service, you have to pay a certain fee for this. These Zerodha trading charges are as follows:

| Zerodha Stockreports+ Charges | ||

| Billing Frequency | Charges | |

| Monthly | ₹150 | |

| Bi-annually | ₹810 | |

| Annually | ₹1,440 | |

These are all the Zerodha trading charges for online trading. Let’s move on to the next one – DP charges.

DP Charges in Zerodha

When you trade in the stock market, there are a variety of charges levied on your trades. One such charge is DP charges. The Depository (CDSL) and the Depository Participant (Zerodha) together decide this charge.

They are levied only when the security is debited from your demat account. This means that intraday traders don’t pay DP charges.

Irrespective of the quantity, they are charged per scrip. The Zerodha trading charges as DP are ₹13.5 + GST per scrip. It is automatically debited from your trading account the day the securities are sold.

| Zerodha DP Charges | ||

| DP Charges | ₹13.5+GST | |

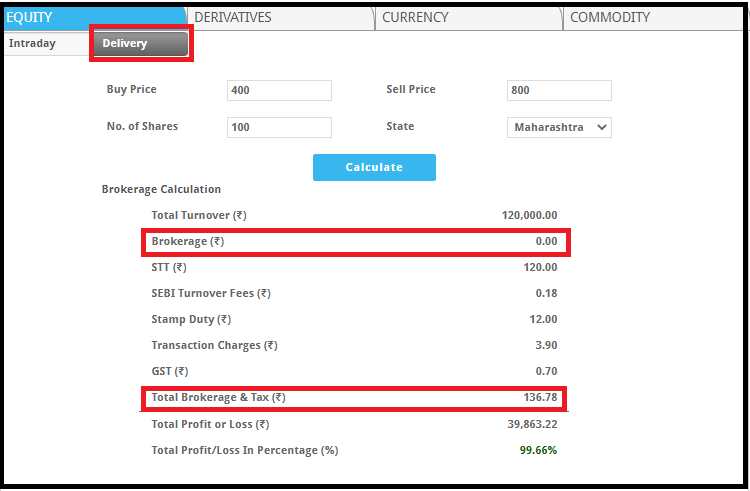

Zerodha Trading Charges Calculator

Many traders want to calculate these trading charges at one click or as quickly as possible. This is humanly impossible. Therefore, you must use a calculator. Now, this calculator is available on the stockbroker’s website or can be accessed from our website too.

So by just entering the share price and evaluating the total turnover fees, you can find what brokerage is levied upon you and what profit or loss you can make from a particular trade.

Conclusion

There are a variety of charges levied for trading with a broker in the share market. These may be different in the case of different brokers as one might levy a charge, and the other might choose not to.

For better reference you can check out the details of Zerodha vs Groww stocks charges.

From trading account to brokerage and value-added service charges, Zerodha trading charges are discussed above. All the aspects in this regard are covered, and we hope that your query about the same has been resolved.

In case of any other doubts, feel free to reach out to us.

Happy trading!

Wish to start trading, open a demat account for FREE. Fill in the basic details below:

More on Zerodha